Effect of individual CEOs’ characteristics on firms’ performance: Evidence from China

Опубликована Июль 31, 2022

Последнее обновление статьи Авг. 22, 2022

Abstract

This paper investigates the effect of individual chief executive officers’ (CEOs’) characteristics on corporate performance. CEOs across 50 Chinese firms over time were selected and it was discovered that CEOs’ specific factors play a significant role in their firms’ performance. CEOs’ demographic characteristics include their legal background, dual position (that is, as both CEO and chairman of the same firm), shareholding ratio, gender, and tenure. The findings show that CEOs with a legal background have a positive influence on return on assets. Robustness tests support the validity of the main results. Our findings are consistent with the human capital theory and provide support for human-capital explanations in which CEOs’ legal expertise enhances their performance and corporate governance.

Ключевые слова

Return on assets (ROA), Corporate performance, human capital theory., legal expertise

INTRODUCTION

As firm leaders and promoters of companies’ strategic decision-making, top managers play a significant role in corporate production, operation, and performance. Specifically, the individual characteristics of top managers will affect their strategic decisions, which in turn affect the company’s behavior. As an important representative of top managers and the core leaders of a company, CEOs have an indispensable impact on corporate governance. Usually, the CEO, as one of a company’s board members, has the ultimate power to execute business management decisions in a company, including the financial expenses, and business direction and scope. CEOs have a huge impact on companies’ operation. Prior research has generally focused on the influence of chief financial officers (CFOs), top managers, and specific factors such as the legal environment on corporate financial reporting disclosures. However, the question arises as to what specific impact CEOs have on corporate performance. Prior studies examine the impact of CEOs’ characteristics including age, gender, education on firms’ performance (Setiawan and Gestanti, 2022; Naseem et al., 2020; Gupta and Mahakud, 2020). Researchers also indicated that CEO’s education negatively and significantly affects financing policy, but positively and significantly affects investing policy and performance (Setiawan and Gestanti, 2022). Withreference to human capital theory (Becker, 2009), prior study found that CFA charter holders issue forecasts that are timelier than those of non-charter holders (De Franco and Zhou, 2009), and their results provide support for a human-capital explanation in which charter holders improve their productivity and performance in the financial market. However, research on the impact of CEOs’ legal background on firms’ performance is limited, particularly in the context of research in China (Belal et al., 2021; Bogdan et al., 2022). Due to the gap in literature, this provides an opportunity to explore the relationship between CEOs’ legal background and corporate performance in China. It has been argued that even though CEOs and CFOs take responsibility for different aspects of companies, they might change companies’ direction together, since CEOs may have excessive power over a company and influence CFOs’ decision-making. Prior study also found that well experienced CEOs contribute to higher performance (Gupta and Mahakud, 2020). To improve the accuracy and reliability of the paper, the Shanghai Stock Exchange (SSE) Cyclical Industry 50 Index is used to construct the sample.

This index reflects the trend of SSE-traded stocks, which have distinguishing industrial characteristics. Due to the lag in financial statistics disclosure of SSE Cyclical Industry 50 listed companies as well as the update of financial statistics of the databases consulted in our region, CEOs from 50 Chinese listed companies over the period 2010–2017 are tracked which provides a dataset for this study. The timeframe of this study is consistent with prior studies with a period of less than 10 years (Liu and Jiang, 2020; Setiawan and Gestanti, 2022; Gupta and Mahakud, 2020; Belal et al., 2021; Bogdan et al., 2022). The firm-specific fixed effects and year-specific fixed effects are added into the base model, along with the effect of CEOs’ demographic characteristics to control for the effect of firm-level characteristics and time effects on corporate performance. The effects of five personal characteristics of CEOs—legal background, dual position (that is, as both CEO and chairman in the same company), shareholding ratio, gender, and tenure—on corporate performance are explored, and control for the firm-specific fixed effect and year-specific fixed effect on the firms’ return on assets (ROA). Based on the above results, only one out of five characteristics, CEOs’ legal background has a significant impact on individual CEOs’ decision making, and thereby on corporate performance. CEOs with a legal background can effectively avoid subjecting their firms to legal risks, and improve the quality of financial reports, which enables better decision-making and improves corporate performance.

These findings for the Chinese context support Krishnan et al. (2011)’s research in the US and those conducted in Romania (Bogdan et al., 2022) and Malaysia (Belal et al., 2021). At present, there is limited research on the relationship between CEOs’ characteristics and Chinese listed firms’ performance. This paper provides a basis for Chinese listed firms to effectively appoint CEOs, which will help to improve China’s CEO appointment system overall, thus consolidating and accelerating the development of Chinese listed firms. Furthermore, this paper supports findings for the US (Krishnan et al., 2011) that legal expertise can help to promote financial reporting quality, thereby improving corporate governance (Belal et al., 2021). Although China and the US differ culturally, the effects of CEOs’ legal background on corporate performance in these two countries are found to align.

LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

Human capital theory

Human capital was defined by Adam Smith as the skills, dexterity (physical, intellectual, and psychological), and judgment of an individual (Smith, 1937). Human capital is acquired through both formal schooling and experience. The concept of human capital entered mainstream academic inquiry in the early 1960s through the work of Becker (2009). In the past decades, it has fueled considerable and sustained debate among researchers. According to human capital theory, education is one of the many investment alternatives that individuals can choose to obtain future benefits. Indeed, the key assumption of the theory is that ‘‘education raises earnings and productivity mainly by providing knowledge, skills and a way of analyzing problems’’ (Becker, 2009). According to Becker (2009), education, vocational training, and skills are forms of capital because they raise earnings and provide individuals with higher returns for their efforts. The literature on human capital often distinguishes between ‘‘specific’’ and ‘‘general’’ human capital (Becker, 2009), where specific human capital refers to skills or knowledge that are useful to a single employer or industry and general human capital (such as literacy) is useful to all employers. Becker (2009) explained that individuals with highly specific skills are less likely to quit their jobs and are more highly paid. Human capital theory thus offers a uniform and generally applicable analytical framework for studying a range of economic and social issues, from the returns on education and on-the-job training to wage differentials and wage profiles over time. For example, earnings and experience levels were highly correlated with teachers' education levels, as suggested by human capital theory (Ismail and Awang, 2017). With reference to the human capital theory, De Franco and Zhou (2009) also find that CFA charterholders issue forecasts that are timelier than those of non-charterholders. In addition, prior literature indicates that human capital theory is supported in state-owned enterprises in China by providing implications for enhancing productivity (Kong and Kong, 2017). However, scant research has applied the theory to firms’ performance, and especially research on the impact of CEOs’ legal background on firms’ performance is limited which provides a literature gap for conducting this study in China. Based on the literature review below and five main demographic characteristics of CEOs-legal background, dual position, shareholding ratio, gender, and tenure-are included to examine the influence on the corporate performance.

Legal background

Legal executives are those who disclose decisions and behaviors, and supervise financial reporting. In 2002, the legal responsibilities of top managers in the US were clearly defined by the Sarbanes–Oxley Act; this included detailed statements on the professional responsibilities of legal personnel in companies. The American Bar Association also holds that corporate lawyers occupy an important position in corporate supervision, and should be one of the four major management mechanisms of listed companies (Wang, 2013). In particular, since the Enron scandal, many US companies have begun to establish an internal legal department or internal legal counsel position. Although these are not explicit provisions of US law, the measures have been recognized by the stock market, and have become one of the primary methods by which to prevent corporate legal risks, and improve the quality of financial reports and corporate performance. Legal counsel can influence corporate decision-making (Fisher, 2017). Top managers with legal expertise are sensitive to transactions involving legal risks, and are keenly aware of the potential risks in financial reporting; they thus use their power to influence management teams’ behavior so as to influence relevant strategies and decisions, thereby reducing loss due to legal risks and improving firm ROA. Research finds that AC chairs with legal expertise are positively and significantly associated with real earnings management and improved corporate governance (Belal, Shaker and Abdulwahid, 2021). Prior research also finds that professional qualification of CEOs in finance stream enhances firms’ performance (Gupta and Mahakud, 2020). However, in the Chinese legal system, the executive team is not required to include legal members; indeed, increasing the number of legal executives is one of the requirements of enterprises’ resource management model, which indicates that the importance of legal executives in corporate governance has not received sufficient attention to date. Since research on the impact of legal background on firms’ performance is limited and based on prior literature, the first hypothesis is developed as follows:

H1: CEOs with a legal background have a positive influence on their firm’s performance (ROA).

Dual position

Prior research shows that CEO duality has a negative impact on firms’ performance (Wijethilake and Ekanayak, 2020) and that a CEO with a dual role is more inclined toward debt financing (Naseem et al., 2020). The power intensity of CEOs can be reflected in two main respects: one is whether the CEO holds a dual role in the same company, such as CEO and chairman, while the other is the shareholding ratio of the CEO. Principal–agent theory holds that the position and power of the chairman and general managers within the same company should be separated, which can reduce the huge agency costs caused by managers’ moral hazard and adverse selection. If the general manager has a dual position as chairman in the same company he or she will have both ownership and management rights, and thus excessive power; in other words, the general manager will have greater control over the company and cannot be dismissed easily, thus affecting the independence of the company and adversely impacting corporate performance. The necessity to separate CEO and chairman is based on analysis of the relationship between the structure of listed companies’ board of directors, and corporate performance from the potential costs and benefits perspective. Prior research also finds that there is a negative relationship between CEOs’ duality and corporate social responsibility disclosure which reduces corporate governance and renders CEOs less liable to their stakeholders (Voinea et al., 2022). Wijethilake and Ekanayake (2020) also find that CEOs’ duality exerts a negative effect on firms’ performance when the CEO is equipped with additional informal power. Based on prior literature, the second hypothesis is developed as follows:

H2: CEOs holding a dual role have a negative influence on firms’ performance (ROA).

Shareholding ratio

Since information asymmetry exists between senior executives and shareholders due to the differing levels of information disclosure, top managers have the information advantage, and shareholders are in an informationally inferior position. Top managers are likely to conduct selective information disclosure based on their personal interests and shareholders’ interests. This means that top managers will fully disclose good news and cover up bad news to effectively meet both top managers’ and shareholders’ interests, and encourage top managers to work hard for both their personal interests and those of shareholders, thereby improving corporate performance. Many companies have adopted equity incentives, such as executive ownership. Mei and Wei (2014) conducted an empirical analysis of a sample of listed companies in the growth enterprise market (GEM) between 2010 and 2011, finding that when the executives’ shareholding ratio is less than 20% or higher than 50%, the alignment effect is greater than the entrenchment effect. As executives’ shareholding ratio increases they have greater control over their company, such that external forces decrease. This allows executives to pursue their personal interests to a greater extent and reduces corporate performance. When the shareholding ratio is between 20 and 50%, the entrenchment effect is greater than the alignment effect. Prior literature also demonstrates evidence of a significant negative influence of managerial shareholding and CEO's tenure on the debt ratio of listed firms in sub-Sahara Africa (Ehikioya et al., 2021). The result of the study suggests that the outside directors and board size positively influence the debt ratio of listed firms in sub-Sahara African countries. Given the results of this study, it is imperative for stakeholders in the region to continually improve the ownership and board structures of the firm to avoid the negative effect of debt on performance and the value of shareholders' wealth. Top managers with high shareholding ratios may change their companies’ business strategies in order to avoid risks that may harm their personal interests. The new business strategies will be more aligned with CEOs’ personal interests than those of their companies and other shareholders, thereby negatively influencing the companies’ values and performance. Based on prior literature, the third hypothesis is developed as follows:

H3: CEOs that own shares in their company have an influence on firms’ performance (ROA)

Gender

In recent years, some European countries have begun to implement a quota system for female directors, and legally guarantee the executive team’s gender diversity. For example, in Sweden, laws stipulate that female executives should comprise not less than 25% of the total. In Norway, female directors should comprise more than 40%; otherwise the company will be forced to withdrawal risks. Thus, Western countries have noticed the importance of having female executives in corporate management. Among Chinese companies, female executives are not only highly involved in economic activities, but also play a guiding role in the corporate development. For example, Yan Xiaoyan, used to serve as the president of Bank of Beijing, Dong Mingzhu currently serves as the chairman and president of Gree Electric, and Zhu Min currently serves as the chairman and general manager of World Bank. Compared to men, women are risk-averse and tend to take a relatively conservative approach to decision-making in their work in order to act securely. Setiawan and Gestanti (2022) found that female CEOs have a significant positive effect on firm performance and financing policy. Similar finding is also found for female CEOs that exert significant effects on firms’ financial decisions and performance (Naseem et al., 2020). Jalbert et al. (2013) also found that female CEOs have better capabilities compared to men to increase companies’ sales growth, asset returns, and market value. Female CEOs also improve their companies’ decision quality and competitiveness. Prior study also finds that firms led by female CEOs exhibit a greater probability of being innovators and highlights that female CEOs outperform their male counterparts in innovation activities (Prabowo and Setiawan, 2021). Their results support the argument that because of gender-based discrimination that they receive, female CEOs are greatly motivated to exhibit greater innovation performance (Prabowo and Setiawan, 2021). Based on prior literature, the fourth hypothesis is suggested:

H4: Female CEOs have a positive influence on firms’ performance (ROA).

Tenure

As CEOs’ tenure increases they become more familiar with their enterprises, and have a stronger ability to avoid institutional restraints within and outside of their enterprises. This makes it easier to obtain core resources and pursue their own interests. On the other hand, CEOs with long tenure will accumulate more working experience in their companies, which deepens their recognition of resources and enhances their ability to identify the outside environment. Tanikawa and Jung (2019) have investigated whether the interactive effect of CEO–top management team (TMT) relations on firms’ performance differs when past firms’ performance is either poor or strong. Using a sample of 115 Japanese firms, results show that the interactive effect of CEO power and TMT tenure diversity on firms’ performance is positive in a situation of poor past firms’ performance. However, in a situation of strong past firms’ performance, the opposite result is found. These findings imply that CEO power might play a significant role in enhancing the effectiveness of TMT diversity on firms’ performance when past firms’ performance is poor. Nebert et al. (2018) also found that board structure and CEO tenure jointly have a significant effect on performance which uncovered the importance of CEO tenure on firms’ performance. It is suggested to formulate managerial policy and practice that can promote better governance practices and improve firms’ performance. Based on prior literature, the fifth hypothesis is as follows:

H5: CEOs’ tenure has an influence on firms’ performance (ROA).

RESEARCH DESIGN

This part presents the research design for the tests of H1–H5, setting the ROA as the measure. To test the effect of individual CEOs’ characteristics on corporate performance, the model of Bamber et al. (2010) is followed and developed as follows:

Yit=α+βXit+λ+τi+γt+ε1 (1)

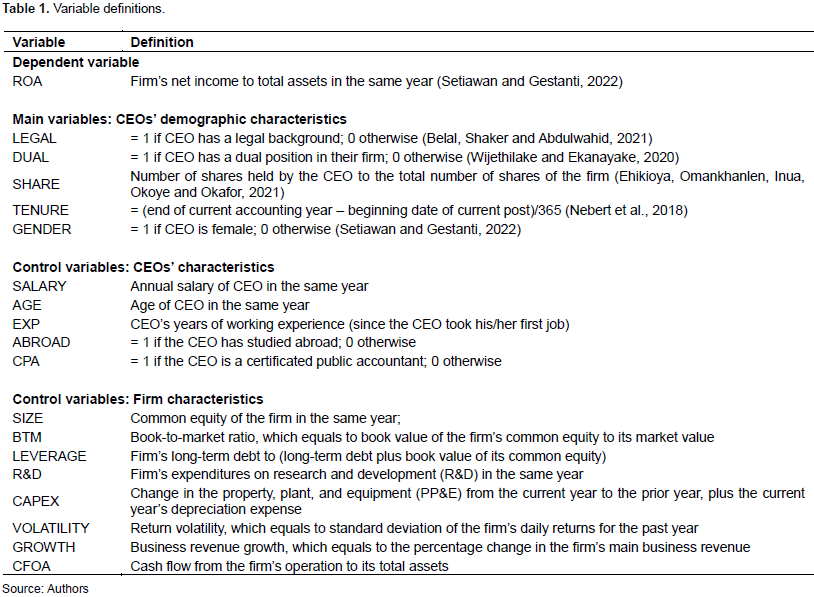

In this model, the unit is the firm-year; Yit is the ROA of firm i in year t, which means corporate performance; the vector X is the comprehensive set of CEOs’ information and firms’ characteristics, which are the control variables in this model, as summarized in Table 1; λ are the main variables in the model, from which coefficients are estimated for indicator variables corresponding to each CEO. Thus, λ represents the fixed effect of CEOs on corporate performance. A summary of λ is shown in Table 1, including the individual CEOs’ demographic characteristics. Finally, τi is the firm-specific fixed effect on ROA, and γt is the year-specific fixed effect on ROA.

To test CEOs’ fixed effect on corporate performance, the following model is used:

λ=α0+γ1Legal+γ2Dual+γ3Share+γ4Tenure+γ5Gender+ε2 (2)

Where λ is the CEOs’ fixed effect on corporate performance estimated in Model 1; Legal represents the presence of CEO’s legal background; Dual indicates that CEOs have a dual position in their firm; and Share indicates CEOs’ shareholding ratio in their firm. Tenure and Gender indicate CEOs’ tenure in their firm and the CEOs’ gender, respectively.

Sample construction

The sample was taken from the SSE Cyclical Industry 50 Index from 2010 to 2017. This index consists of the 50 largest and most liquid A-share stocks listed on the Shanghai Stock Exchange, and is regarded as the blue-chip index of the exchange. The index aims to reflect the overall performance of the most influential Shanghai stocks, and a complete picture of high-quality large companies, using scientific and objective methods. Hence, it was deemed suitable for devising the sample in this paper. Data were taken from these 50 firms’ annual reports, and the CSMAR, RESSET, and Wind databases. Data acquisition and processing mainly preceded using Excel and STATA 15.0. Multivariate Regression Analysis was used to examine the relationship between the dependent variable (return on assets) and the independent variables. Since the mid-term listed companies cannot ensure the long-term nature of their data, four companies with only a mid-term listing were excluded. In addition, one company was listed after 2017 and five had incomplete data; these were also excluded. This left 40 listed companies, which formed the final sample for the study.

RESULTS

First, this section outlines the descriptive statistics of the variables to identify basic information on the sample of 40 firms from the SSE Cyclical Industry 50 Index 2011–2017. The specific statistical results are shown in Table 2. Second, a correlation analysis of the variables is conducted, the results of which are shown in Table 3, and a multivariate regression analysis to further test the effect of individual CEOs’ demographic characteristics on corporate performance. Third, additional tests are run to verify the robustness and reliability of the variables and results with two additional main variables: CEOs’ professional technical background and political background. The regression results are shown in Tables 4 to 6. Finally, the findings are discussed and implications outlined.

Descriptive statistics of the dependent variable

ROA is selected as the financial measure of corporate performance: the mean ROA of the sample firms is 5.22, the standard deviation is 6.122, and the maximum and minimum are 35.065 and -1.569, respectively. The standard deviation shows that the firms have a high degree of dispersion of ROA; firms with low ROA can learn from firms with high ROA, and pay attention to their innovations.

Descriptive statistics of the main variables

According to the above results, the mean and standard deviation of legal background are 0.043 and 0.203, respectively, which means that almost none of the CEOs have a legal background. The mean of dual position is 0.1, showing that only 10% have a dual position in their firm. The shareholding ratio of CEOs varies significantly, with many CEOs not owning equity in their firms. This shows that the equity incentive plan has not yet become a trend among Chinese listed companies. The longest tenure of the CEOs is 14.093 years, while the shortest is 0.03 years, and the average is 4.01 years. This shows that these listed firms do not change CEOs very often generally; but there are great differences among different companies. The percentage of female CEOs among these companies also varies, as the mean of gender is 0.007. This indicates that only 0.7% are female CEOs.

Descriptive statistics of control variables

There are marked differences between the CEOs’ salaries, showing that different companies have different salary systems. Companies with good salary systems have higher possibilities to attract talent, and if top managers change jobs frequently, companies need to consider whether they have reasonable salary systems in place. The average age of the CEOs is 52.489 years old. The oldest CEO is 68, while the youngest is 38. Thus, the overall age of the CEOs is old. If companies have some younger top managers in their teams, it would help to provide more diversified information on the companies’ strategic decisions. The longest duration of experience is 43 years, while the shortest is three years; the mean is 28.454, which shows that the majority of the CEOs are experienced. However, only a few CEOs have CPA certification and experience of studying abroad. It can be useful to firms for their CEOs to have professional financial knowledge to help formulate financial strategies. In addition, CEOs with a broader horizon will have more efficient leadership and management methods, which can improve corporate performance. The standard deviations of firm size and CAPEX are very high, showing that they have a very high degree of dispersion, and the largest and smallest companies have a huge difference in their common equity and PP&E. Furthermore, the growth in business revenue among these companies differs, with a maximum of 117.719 and a minimum of -53.286. Companies with higher business revenue growth rates have better prospects in the market, while those with negative growth rates may face problems such as unsatisfactory products or services, products with high prices but low quality, shrinking market share, etc.

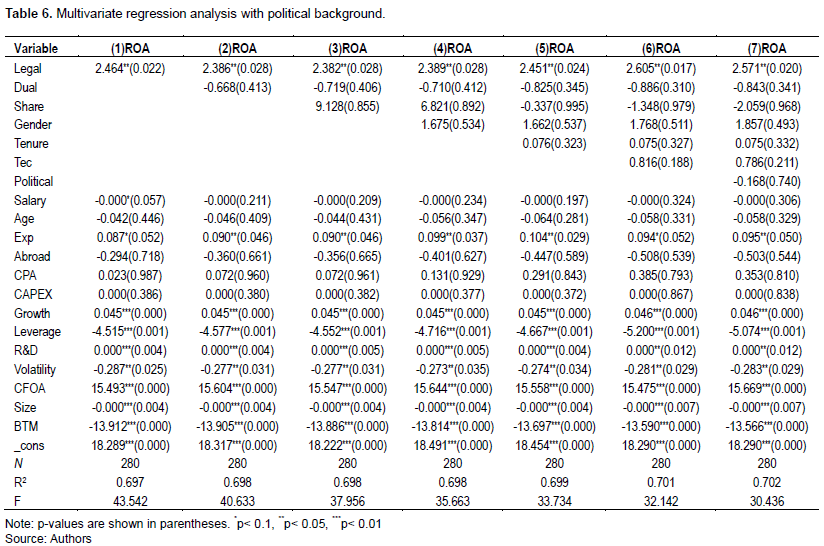

Correlation analysis of variables

After identifying the descriptive statistics, a Pearson correlation analysis of the variables was conducted. The results are shown in Table 3. According to the results, among the main variables, CEOs’ legal background has a negative correlation with corporate performance. This result is opposite to the expectation posited in H1, and further regression analysis is needed. CEOs’ dual position and corporate performance are positively correlated, and CEOs’ shareholding ratio and corporate performance have a significant positive correlation at the 1% level. The results of the preliminary verification are opposite to the expectations of H2 and are consistent with H3, so, again, further regression analysis is required. CEOs’ gender and corporate performance are negatively correlated, which goes against H4. However, tenure and corporate performance have a significant positive correlation at the 5% level, consistent with H5. According to the results for the control variables, the companies’ R&D and return volatility have positive correlations with corporate performance, and both the companies’ business revenue growth and CFOA have significant positive correlations with corporate performance at the 1% level. On the contrary, CEOs’ age and experience of studying abroad, and companies’ leverage, size, and book-to-market ratio are significantly and negatively correlated with corporate performance at the 1% level. Companies’ CAPEX has a significant negative correlation with corporate performance at the 5% level. CEOs’ CPA qualification has a significant negative correlation with corporate performance at the 10% level. CEOs’ salary and working experience have a negative correlation with corporate performance.

Main results

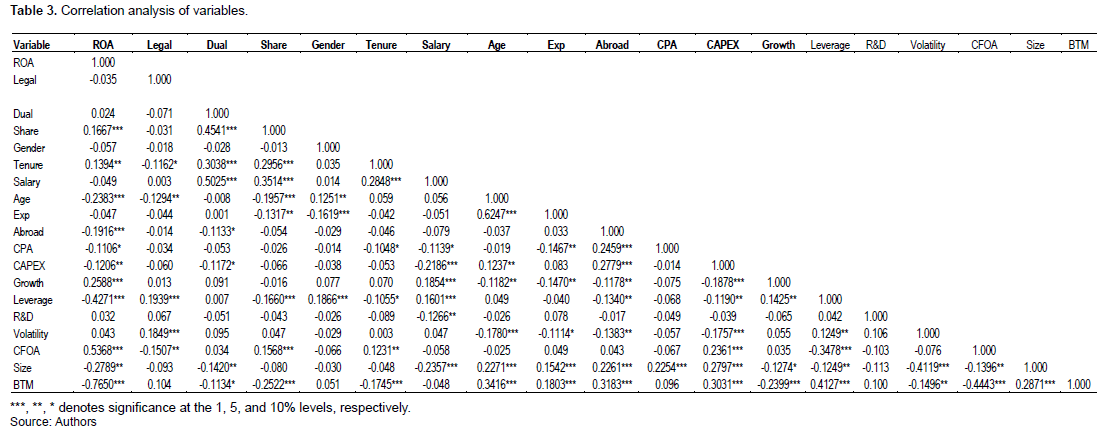

To further test the above hypotheses, multivariate regression analyses were conducted to include all variables in the paper. This used the following procedure. First, the main variable legal background was put together with all the control variables into Models (1) and (2). The results are shown in Table 4, column 1. Second, the main variables legal background and dual position with all the control variables were put into Models (1) and (2). The results are shown in Table 4, column 2. Third, three main variables—legal background, dual position, and shareholding ratio—together with all control variables were put into Models (1) and (2). The results are shown in Table 4, column 3. Then four main variables—legal background, dual position, shareholding ratio, and gender—with all control variables were put into Models (1) and (2). The results are shown in Table 4, column 4. Finally, the five main variables legal background, dual position, shareholding ratio, gender, and tenure together with all control variables were put into Models (1) and (2).

The results are shown in Table 4, column 5. From Table 4 we can see that in regression (1), the R-square value is 0.697. The R-square value in regressions (2), (3), and (4) is 0.698, and in regression (5) it is 0.699. The R-square rises from 0.697 to 0.699 from regression (1) to regression (5), indicating that the regression equations have good degree of fit, especially the regression equation that includes all main variables, which has a better degree of fit compared to regression equations with one to four main variables. Thus, these five main variables, including CEOs’ legal background, dual position, shareholding ratio, tenure, and gender, explain the dependent variable well, and the regression equation can be used to analyze individual CEOs’ characteristics and corporate performance. Specific analyses of the effect of the five main variables on corporate performance are shown below.

The effect of CEOs’ legal background on corporate performance

From Table 4, we can see that CEOs’ legal background and corporate performance have a significant positive relationship at the 5% level, indicating that companies perform better if their CEOs have a legal background. CEOs with a legal background are more familiar with the national legal system. When business decisions may cause legal problems, CEOs can use their knowledge to analyze the current situation and potential results, helping the company to control its legal risks, and make better decisions to maximize profits. Compared with hiring lawyers from outside, top managers can participate in corporate operation and management activities, and better monitor the overall business behavior of their companies. Thus, hiring CEOs with a legal background is a better choice compared to hiring outside lawyers. In this paper, we recognize CEOs who graduated from law or used to work in law as having legal background. Among these sample CEOs with legal background, all of their prior legal positions were in mainland China and compliance with Chinese legal systems, and the CEOs also graduated from law in mainland China, which can enhance the relationship between CEOs’ legal background and these Chinese listed firms’ performance. The above analysis shows that CEOs’ legal background has a significant positive influence on corporate performance. Thus, H1 is supported.

The effect of CEOs’ dual position on corporate performance

Table 4 indicates that CEOs’ dual position has an insignificant relationship with corporate performance. When a CEO holds the position of chairman in the same company, he/she will be under heavier pressure from both inside and outside the company, including from political and public opinion perspectives. They will then be likely to earn hidden income, such as job consumption, using their positions. When CEOs have a dual position in the same company, they will have greater power over the control of company management and decision making. It is possible that some other top managers will follow CEOs’ strategies and decisions because of CEOs’ power. In this case, the supervision effectiveness of external investors over CEOs will decrease, and internal controls will be unable to effectively counterbalance CEOs, such that the CEOs’ decision will represent their companies’ decisions to some extent. Since CEOs may pursue their self-interests at the expense of the companies, this can negatively influence corporate performance. However, the main results in Table 4 show that dual position and firms’ performance have an insignificant relationship, so H2 is rejected.

The effect of CEOs’ shareholding ratio on corporate performance

In Table 4, the coefficient of shareholding ratio is negative but not significant, indicating that CEOs’ shareholding ratio has an insignificant negative relationship with corporate performance. CEOs with a larger shareholding ratio are more capable of competing with other shareholders and the board of directors in making business decisions. The higher the shareholding ratio of CEOs is, the greater their control over their companies. Since CEOs hold more company information than do other shareholders who are not part of the companies’ management team, it is possible that CEOs with a large shareholding ratio will transfer the companies’ property using their information advantage and power, thereby reducing the companies’ value and damaging other shareholders’ profits. However, the main results in Table 4 show that CEOs’ shareholding ratio and firms’ performance have an insignificant relationship; thus, H3 is rejected.

The effect of CEOs’ gender on corporate performance

Table 4 shows that CEOs’ gender has an insignificant positive relationship with ROA. Usually, female CEOs have more emotional intelligence, can reduce internal conflict within companies more effectively, and improve the management team’s cohesion, thus enhancing firms’ development in the future. Furthermore, females are more considerate than males, and notice details that males do not. Thus, female CEOs can make more accurate business strategies compared to male CEOs, improve the creativity of their companies, and broaden the companies’ development path. However, in Table 4, the results in this regard are insignificant, though positive as expected; one possible reason for this is that only a few of the sample companies have female CEOs. Since the results show that CEOs’ gender and corporate performance have an insignificant relationship, H4 is rejected.

The effect of CEOs’ tenure on corporate performance

The results in Table 4 show that CEOs’ tenure and firms’ ROA have an insignificant positive relationship. For CEOs with long-term tenure and who are close to retirement, in order to maintain corporate performance and consolidate their personal reputation during their last working period, so as to maximize their retirement pension, they will try to avoid making risky business decisions that might have a negative impact on corporate performance, such as high-risk strategic revolution. In addition, CEOs who have longer tenure like to show their rich experience and prove that they can handle unexpected situations, and ensure the maximization of profits for both their companies and shareholders; thus, they tend to choose operational strategies and business models that have been validated. However, the main results in Table 4 show that CEOs’ tenure and firms’ performance have an insignificant relationship; thus, H5 is rejected.

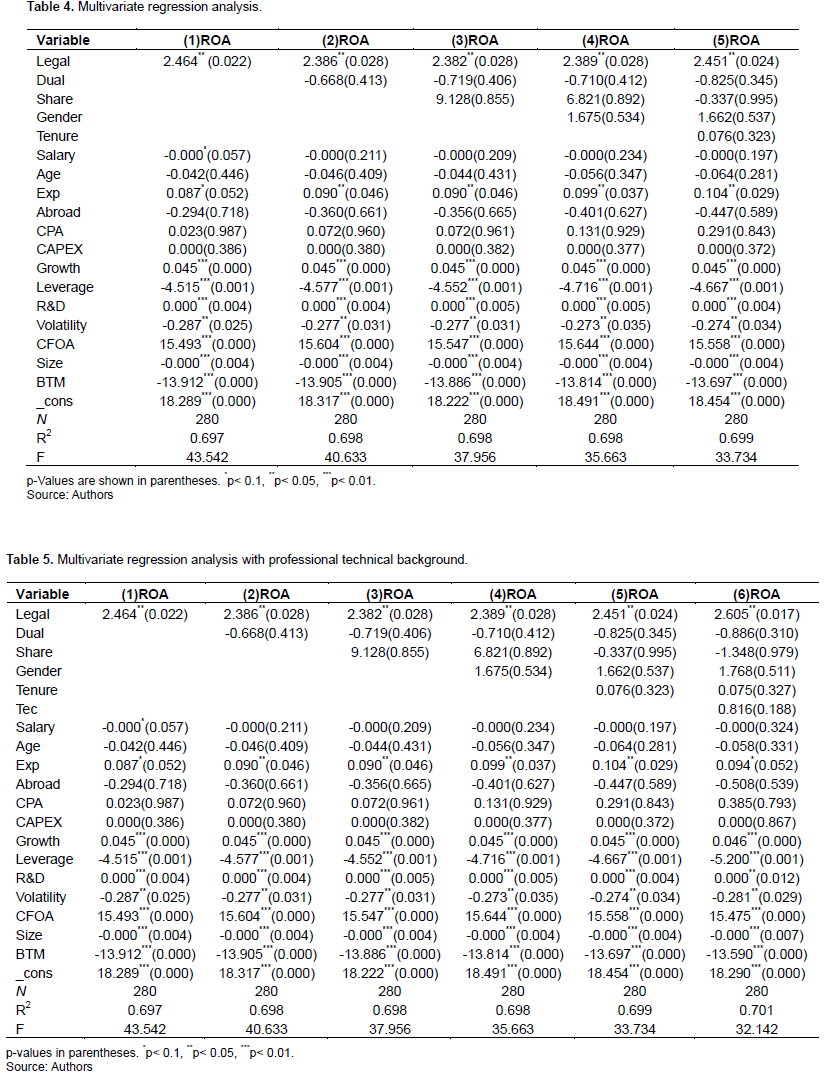

Additional testing

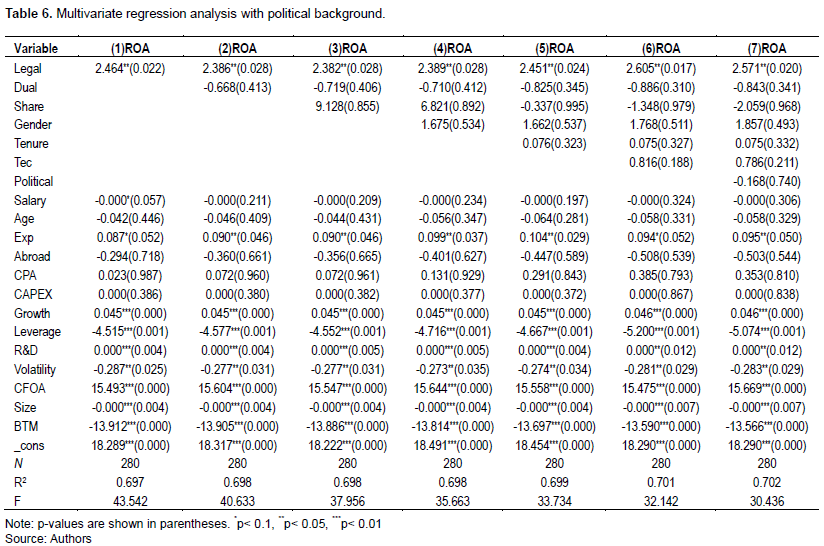

To further test the robustness of the analytical method and the validity of the main variables, including legal background, dual position, shareholding ratio, gender, and tenure, two additional CEO demographic characteristics-professional technical background and political background are added as main variables to the multivariate regression analysis to assess whether the regression results of the five main variables remain the same. Research has also shown that companies with top managers with a more professional technical background have better corporate performance. Ibrahim et al. (2020) found that board professional qualifications have a significant influence on firms’ performance in family CEO firms. Furthermore, senior executives with titles such as senior engineers have better performance when devising innovation strategies, which help companies obtain better corporate performance. Therefore, CEOs’ professional technical background has a positive influence on corporate performance. In addition, research has found that the relationship between senior executives’ political background and the sensitivity of corporate performance is significantly negative. Omonona and Oni (2019) find that political affiliation significantly relates to financial performance and non-financial performance. The study therefore recommends that: the negative interference by the political class should be discouraged or minimized. Thus, CEOs’ political background has a negative influence on corporate performance. This paper recognizes CEOs with professional titles, such as engineer, as having a professional technical background (assigned the value of 1; and 0 otherwise). In addition, CEOs are considered to have a political background if they had held or currently hold positions as government officials, or if companies hire the National People’s Congress (NPC) delegates or the Chinese People’s Political Consultative Conference (CPPCC) members to work as CEOs (assigned the value of 1; and 0 otherwise). The results of these regression analyses are shown in Tables 5 and 6. Table 5 shows that CEOs’ professional technical background and corporate performance have an insignificant positive relationship. In Table 5, column 5, the regression results of the five main variables—legal background, dual position, shareholding ratio, gender, and tenure—are the same as in Table 5 column 4, with the same effective directions and significance level. The R-square value rises from 0.699 to 0.701, indicating the strong explanatory ability of the five original main variables. Table 6 shows that CEOs’ political background and corporate performance have an insignificant negative relationship. Column 6 shows that the regression results of the other six main variables, including legal background, dual position, shareholding ratio, gender, tenure, and professional technical background, are the same as those in Table 6, column 5, with the same effective directions and significance levels. Furthermore, the R-square value in regression (7) is 0.702, which is larger than that in regression (6) at 0.701. The regression results shown in Table 6 confirm the robustness of the regression results in Table 4 with the original five main variables. As confirmed by the above two regression analyses, the original regression results in this paper are reliable and stable, and the analyses with professional technical background and political background added further support the conclusions drawn previously.

DISCUSSION

Limitations

The first limitation of this paper pertains to the time period during which data were collected. Sample data spanned the lag in financial statistics disclosure of SSE Cyclical Industry 50 listed companies and in updating of financial statistics in the databases consulted in our region. Future research can be explored to conduct another study to extend the dataset from 2018 to 2022 when the data are made available. The second limitation is that the sample size of CEOs with legal background is not large enough. Though 280 samples were included in the final sample to do the data analyses, the mean of CEOs with legal background is 0.043, showing that only 4.3% of the sample CEOs have legal background. However, our study samples are larger than those of prior studies which include 73 (Bogdan et al., 2022) and 179 samples (Naseem et al., 2020), respectively. Although the paper explores the effects of five individual characteristics of CEOs on corporate performance, several aspects could be explored in future study such as the optimal shareholding ratio of CEOs in balancing CEOs’ power and shareholders’ interests, and the optimal tenure of CEOs in the same companies to maximize companies’ profits.

Implications

The results in this paper show that CEOs with a legal background can help companies notice legal risks in advance and avoid them in time, thus helping senior executives to make better decisions and devise better business strategies, and thereby improving corporate performance. Our results are consistent with the human capital theory and provide support for human-capital explanations in which CEOs’ legal expertise enhance their professional judgment and performance (De Franco and Zhou, 2009). This China’s study further provides evidence consistent with “credentialism,” a variant of signaling theory in which a professional’s education level provides a signal about the professional’s quality to his or her clients and enhances corporate governance (De Franco and Zhou, 2009; Belal et al., 2021). Based on the results of this paper, several implications for companies, government, and future researchers can be discussed. First, there is much extant research on the relationship between background characteristics of top management teams of China’s listed companies and these firms’ corporate performance. However, research on the effect of CEOs’ background characteristics on corporate performance is lacking. Future study can examine variables including the optimal tenure of CEOs in the same company to maximize companies’ profits; the optimal shareholding ratio of CEOs; the optimal proportion of female senior executives in the management team to increase companies’ return on assets; and the optimal years of working experience of CEOs in improving corporate performance. Though only one out of five variables was found to be significant in this paper, further research can be performed to confirm the validity of the results. Second, the results of this paper confirm prior research conducted in the US (Krishnan et al., 2011), Romania (Bogdan et al., 2022) and Malaysia (Belal et al., 2021). Though China has cultural differences from other countries, our results suggest that the legal background of senior executives has a positive influence on financial performance and corporate governance in this China study. For example, the management methods differ in the US versus the China. Companies in the US tend to encourage employees to participate in management activities, thus improving their motivation. In China, companies’ management style tends to be highly supervised and arbitrary, and employees need to strictly follow the rules. In addition, the US and China differ in their interpersonal values: those in the US are relatively simple, and incentive methods such as rewards are usually based on employees’ performance. In China, because of the presence of strong hierarchy and human sentiment idea, performance management often deviates based on emotional factors, which can affect employees’ motivation. Despite these cultural differences, the present study findings show that cultural differences do not make a difference with regard to the positive effect of CEOs’ legal background on corporate performance across the countries. Firms should pay attention to the proportion of top managers with a legal background, and utilize such CEOs’ legal knowledge to improve firms’ overall legal awareness and the risk awareness of other employees. In addition, organizing legal lectures and curricula may be useful for companies’ development. In particular, encouraging CEOs and other top managers to attend such programs would greatly improve firms’ personnel allocation structure, and make personnel adjustment decisions and companies’ operation and management decisions more effective, thereby improving firms’ efficiency and performance. Third, the results contribute to the literature by finding that the variables dual position and shareholding ratios are insignificant, indicating that for China’s listed companies, CEOs’ dual position and corporate performance do not have a negative relationship. There is no relationship between CEOs’ shareholding ratio and corporate performance, though the corporate governance concept suggests that senior executives’ dual position and shareholding ratio influence corporate performance. Based on the corporate governance concept, companies should improve the corporate governance structure, and enhance their internal controls and external supervision, thus strengthening the supervision and restriction of CEOs. They should also seek to optimize the power allocated to CEOs, and curb opportunistic behaviors of CEOs who abuse their official position to pursue personal interests, so as to maintain the companies’ interests. This can be achieved via the following two ways. The first is to establish a modern system to separate the CEO and chairman. There are three groups in companies’ internal governance mechanisms, including shareholders, the board of directors, and senior executives. Ensuring a reasonable allocation of power between these three groups is helpful to limit the power of senior executives, and improve the effectiveness of internal control. Among them, the board of directors’ main governance function is supervision and decision-making, especially supervising senior executives on behalf of shareholders, and taking responsibility for the appointment of CEOs. Establishing such a system of separation between CEO and chairman can help to enhance the consistency of interests between the board of directors and shareholders, strengthen the supervision function of the board of directors, improve the CEO appointment system, and reduce the possibility of CEOs damaging shareholders’ interests in the pursuit of their own, thereby improving the corporate performance. The second approach would be to establish a diversified equity structure, increase the shareholding ratio of institutional investors, and limit the shareholding ratio of CEOs, so as to enhance the supervision and management function of external investors, and weaken the power of CEOs. Fourth, results show that the variable CEOs’ gender is insignificant, indicating that among China’s listed companies, CEOs’ gender does not have a positive influence on corporate performance, though the corporate governance concept states that senior executives’ gender influences corporate performance, and companies should cultivate female CEOs. It has been found previously that companies should put aside gender discrimination, and give female employees equal working and developing opportunities. Nowadays, women’s position in social economic development is becoming increasingly significant. In managing and developing companies, the flexible management function of female CEOs is becoming more and more obvious, and their female characteristics also meet the needs of social development in the future. Finally, the government should establish laws and regulations to help listed companies improve their operation mechanisms so as to better supervise and limit senior executives’ behaviors, and prevent them from pursuing personal interests at the expense of the companies.

CONCLUSION

This paper used 40 companies from the SSE Cyclical Industry 50 Index, 2010–2017, to research the effect of five individual CEO demographic characteristics on corporate performance, including CEOs’ legal background, dual position, shareholding ratio, gender, and tenure. Two additional demographic characteristics of CEOs—technical background and political background—were then added to further test the relationship between CEOs’ original five characteristics and corporate performance. The results show that CEOs with a legal background have a positive influence on corporate performance (ROA) at a 5% significance level. This indicates that CEOs with a legal background are more familiar with current national legal systems, and can notice potential legal risk quickly. This helps companies to make good business decisions, and promote firms’ performance. The additional testing supports the validity of the main variables and confirms findings of prior research conducted in the US (Krishnan et al., 2011), Romanian (Bogdan et al., 2022) and Malaysia (Belal et al., 2021). Our results are consistent with the human capital theory and provide support for human-capital explanations in which CEOs’ legal expertise enhance their performance and corporate governance (De Franco and Zhou, 2009; Belal et al., 2021).

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

Becker GS (2009). Human capital: A theoretical and empirical analysis, with special reference to education. University of Chicago press. | |

Belal G, Shaker D, Abdulwahid A (2021). Committee Chair's Legal Expertise and Real Activities Manipulation: Empirical Evidence from Malaysian Energy and Utilities Sectors. International Journal of Energy Economics and Policy 11(1):65-73. | |

Bogdan M, Dumitrescu D, Micu C, Lobda A (2022). The Impact of Board Diversity, CEO Characteristics, and Board Committees on Financial Performance in the Case of Romanian Companies. Journal of Risk and Financial Management 15(1):1-17. | |

De Franco G, Zhou Y (2009). The performance of analysts with a CFA® designation: The role of human?capital and signaling theories. The Accounting Review 84(2):383-404. | |

Ehikioya B, Omankhanlen A, Inua O, Okoye L, Okafor T (2021). An empirical investigation of the impact of ownership and board structure on capital structure of listed companies in Sub Sahara Afraican countries. Academy of Strategic Management Journal 20(1):1-12. | |

Fisher B (2017). The importance of legal counsel. Forced Migration Review 54(2):28-29. | |

Gupta N, Mahakud J (2020). CEO characteristics and bank performance: evidence from India. Managerial Auditing Journal 35(8):1057-1093. | |

Ibrahim H, Abdul Z, Jabeen G (2020). Board Education, Growth and Performance of Family CEO Listed Firms in Malaysia. International Journal of Banking and Finance 15(2):25-46. | |

Ismail R, Awang M (2017). Quality of Malaysian teachers based on education and training: A benefit and earnings returns analysis using human capital theory. Quality Assurance in Education 25(3):303-316. | |

Jalbert T, Jalbert M, Furumo K (2013). The relationship between CEO gender, financial performance, and financial management. Journal of Business and Economics Research 11(1):25-34. | |

Kong G, Kong D (2017). Corporate governance, human capital, and productivity: evidence from Chinese non-listed firms. Applied Economics 49(27):2655-2668. | |

Krishnan J, Wen Y, Zhao W (2011). Legal expertise on corporate audit committees and financial reporting quality. The Accounting Review 86(6):2099-2130. | |

Liu C, Jiang H (2020). Impact of CEO characteristics on firm performance: evidence from China listed firms. Applied Economics Letters 27(14):1-5. | |

Mei S, Wei Q (2014). Executive ownership: Convergence of interest effects or entrenchment effects--An empirical analysis of listed companies on GEM. Science Research Management 35(07):116-123. | |

Naseem M, Lin J, Ramiz R, Muhammad A, Ali R (2020). Does capital structure mediate the link between CEO characteristics and firm performance? Management Decision 58(1):164-181. | |

Nebert M, Kaijage E, Aduda J, Iraya C (2018). The Effect of Board Structure and CEO Tenure on Performance of Financial Institutions in Kenya. Journal of Finance and Investment Analysis 7(1):59-76. | |

Omonona S, Oni O (2019). The relationship between political affiliation and performance of mobile telecommunication organisations in South Africa. Journal of Management Information and Decision Sciences 22(3):284-295. | |

Prabowo R, Setiawan D (2021). Female CEOs and corporate innovation. International Journal of Social Economics 48(5):709-723. | |

Setiawan R, Gestanti L (2022). CEO characteristics, firm policy and firm performance. International Journal of Business and Society 23(1):371-389. | |

Smith A (1937). Wealth of nations. Random House publisher. | |

Tanikawa T, Jung Y (2019). CEO Power and Top Management Team Tenure Diversity: Implications for Firm Performance. Journal of Leadership and Organizational Studies 26(2):256-272. | |

Voinea C, Rauf F, Khwaja N, Fratostiteanu C (2022). The Impact of CEO Duality and Financial Performance on CSR Disclosure: Empirical Evidence from State-Owned Enterprises in China. Journal of Risk and Financial Management 15(1):1-17. | |

Wijethilake C, Ekanayake A (2020). CEO duality and firm performance: the moderating roles of CEO informal power and board involvements. Social Responsibility Journal 16(8):1453-1474. | |