Firms’ corporate social responsibility behavior to stakeholders and its effect on financial performance indices: A case study of Ctrip

Опубликована Июль 31, 2022

Последнее обновление статьи Авг. 22, 2022

Abstract

In recent years, some domestic and foreign scholars have studied the relationship between corporate social responsibility and corporate performance. Some of these studies show that there is a positive relationship; others found a negative correlation while others found no correlation between them. It is of great significance for internet enterprises to undertake corporate social responsibility when private sector operators provide public services. Through case analysis, this study selects Ctrip, a Chinese multinational online travel company with many incidents of social responsibility in recent years, to explore the impact of corporate social responsibility on corporate financial performance by reading its corporate citizenship report from 2014 to 2020 and selecting major social responsibility events for detailed study. This study has done a specific analysis of its social responsibility performance for different stakeholders such as shareholders, consumers, government, society and the environment, and employees. The case study shows that there is an impact of social responsibility performance on the stock price, revenue, or operating income for different stakeholders. Improving corporate performance using social responsibility is suggested in this study.

Ключевые слова

Corporate social responsibility, corporate citizenship report, financial performance.

INTRODUCTION

Although the world economy has developed rapidly, some environmental, social, and governance related vicious incidents in recent years have aroused widespread concern about corporate social responsibility. Corporate social responsibility includes the responsibility for shareholders, consumers, employees, the government, and the corporate’s social environment. In terms of the environment, for example, Bhopal poisonous gas leakage in 1984, the Indo-U.S. joint company set up factories next to slums and did not properly keep chemical raw materials. As a result, pesticide leakage directly caused 25,000 deaths and indirectly caused 550,000 deaths, and more than 200,000 people were permanently disabled. In terms of employees, more than a dozen assembly line workers jumped off the building within two years in a manufacturing enterprise, Foxconn. On the consumer side, security incidents have occurred one after another in online car-hailing. In 2008, there was a dairy product contamination incident in China.

With the occurrence of such incidents, the governmentand citizens have tended to demand greater corporate social responsibility, China and other countries have issued laws requiring enterprises to attach importance to fulfilling corporate social responsibility. In 2006, China introduced a revised Company Law requiring company to assume social responsibility. In the same year, State Grid Corporation of China, a Chinese state-owned electric utility corporation, issued the first social responsibility report for domestic-funded enterprises. In 2017, General Secretary of Chinese Communist Party Xi Jinping pointed out the changes in the main social contradictions in the report of the 19th National Congress of the Communist Party of China, as well as the great emphasis on ecological environment construction. The report redefines the development direction of social responsibility for enterprises, including: paying attention to the happiness of all people and the common progress of society, committing them to meeting the needs of the people, solving social problems, fulfilling the responsibilities corresponding to their capabilities and achieving sustainable development.

It is a well-known fact that increasing operating profit is the goal pursued by enterprises and fulfilling corporate social responsibilities will definitely make enterprises incur additional costs. The contradiction between the two has caused many researchers at home and abroad to examine the relationship between the fulfillment of corporate social responsibility and the improvement of corporate financial performance. Some researchers have found a positive correlation between them. For example, Preston and O'bannon (1997), based on a sample of 67 companies, using the reputation rating index in Fortune as the evaluation index of corporate social responsibility, and return on investment, return on net assets and return on total assets as financial Performance indicators, concluded that the two have a positive correlation. However, some scholars have also concluded that the two are negatively correlated. For example, Vance (1975) finds that if the financial performance indicator is set as short-term profit, a negative correlation exists between the two even if the sample is expanded. There are also a small number of researchers who have concluded that the two are not related. For example, Brammer and Millington (2008) found that the level of a company’s stock price and financial performance only reflect the effectiveness of the company’s business strategy but have no relationship with whether the company performs social responsibility or not. This study indicated that fulfilling social responsibilities will not enable the company to gain excess return.

Although there have been many studies on the relationship between the two, most of them use empirical research methods. This report starts with specific incidents encountered by enterprises and adopts a case study method. From the five aspects of governments, consumers, shareholders, employees and social environment, different events are selected for specific empirical study, which is more convincing, easier to understand, and can provide a more intuitive reference for companies performing social responsibilities. A Chinese multinational online travel company in the Internet industry, Ctrip, is selected as research object. It is currently the largest online travel agency (OTA) in China and one of the largest travel service providers in the world.The Internet industry is a popular industry in China after more than 20 years’ rapid development and has become the industry most closely related to our daily lives. In recent years, the number of Internet companies has increased rapidly, and they have played a key role in promoting economic development and improving people's living standards. The Internet industry is different from traditional industry models due to its instantaneousness, ubiquitousness, and virtuality, so companies should take more social responsibility. However, given the short history and imperfectness in all aspects of corporate social responsibility, many Internet companies in China have a weak awareness of social responsibility. Internet security incidents often occur in China, such as personal information disclosure, and employing cyber actors. Not only has it affected the healthy development of the Internet industry, but also has even caused certain losses in consumers' rights and interests. Therefore, this study selects Ctrip, which has experienced more corporate social responsibility incidents in the Internet industry in recent years, to conduct a case study. A specific study of a series of incidents reveals that there is a positive relationship between corporate social responsibility performance and financial performance. Then the report puts forward feasible suggestions to enable enterprises to better balance the relationship between financial performance and social responsibility fulfillment. This study provides relevant references for Chinese enterprises to fulfill their corporate social responsibilities.

The rest of the paper is organized as follows. Section 2 provides the related prior literature reviews. Section 3 introduces the research methodology adopted in this study and the data collection method. Section 4 discusses the case study of Ctrip. Section 5 concludes the case study and gives some recommendations drawn through the empirical study.

LITERATURE REVIEW

Corporate social responsibility

The effects that corporate operations have on the society have informed changes in society’s expectations of corporate behavior. The concept of corporate social responsibility has been continuously expanded and improved in the practice and theoretical research of scholars in China and abroad. The concept of corporate social responsibility first appeared in the 1930s, when British economist Oliver Sheldon first proposed it in 1924.

He believes that it is wrong for companies to blindly pursue economic benefits. In order to meet the social needs of the company, the company should be responsible for its stakeholders and incorporate ethical standards in the daily production and operation process. Bowen (1953) proposed that corporate strategy should be formulated in accordance with social needs. The social responsibility of corporate executives is to make decisions based on social values and require companies to take the initiative to assume social responsibilities. In 1971, the U.S. Economic Development Commission issued the "Corporate Social Responsibility" protocol, so CSR began to receive widespread attention. Carroll (1979) put forward the first unified concept of CSR, that is, the social responsibility of a company is the society's expectations of the company's economy, law, morality, and charity over a period of time. Carroll (1991) believes that these expectations could be regarded as social responsibilities according to the four aspects of economy, ethics, law, and charity, and arranged the importance of these four responsibilities in a pyramid structure. Economic responsibility is the most basic one; from the bottom to the top are economics, law, ethics, and charity. This "Corporate Social Responsibility Pyramid Theory" is currently widely recognized by academia. Liu (1999) believes that the goal of an enterprise should not be limited to pursuing more economic interests, but should also focus on the fulfillment of social responsibilities, and fully consider other social interests in addition to shareholders’ rights. In 2000, the establishment of the United Nations Global Compact (UNGC) provided new content for understanding corporate social responsibility, including five aspects: human rights, labor rights, environment, anti-corruption and sustainable development. The Social Responsibility Guidelines for Listed Companies of the Shenzhen Stock Exchange stipulates that listed companies should take responsibility for the overall development of the country and society, the natural environment and resources, shareholders, creditors, employees, customers, suppliers, public relations and public welfare undertakings and other stakeholders. Shen (2005) believes that corporate social responsibility should mean that enterprises pay attention to social welfare while improving their own economic benefits. Carroll (2015) gives an overview of the evolution of CSR and points out that the participation and management of stakeholders, industrial ethics, corporate citizenship, corporate sustainability, and shared value creation have all been incorporated into CSR.

To sum up, although domestic and foreign scholars have different understandings of corporate social responsibility, they all believe that enterprises should take the initiative to assume social responsibility and pay attention to the rights and interests of all stakeholders.

Financial performance

It is the financial goal of the enterprise to maximize shareholder value. In the process of achieving the goal, a reasonable financial performance evaluation system must be established. The so-called financial performance is the result obtained by the business operation. According to the division of time, financial performance can be divided into broad sense and narrow sense. The broad sense of financial performance is accessed in a long period of time, not only focusing on the recent profits of the company, but also focusing on whether the company has achieved its goals after a long period of time, for example total profit, return on assets. The narrow financial performance reveals the company's recent financial results, such as Tobin's Q value. Friedman (1983) points out that increasing the net profit is the ultimate goal of an enterprise. The better the company's operating conditions are, the higher the net profit is.

Financial performance indicators can be divided into two categories: market indicators and accounting indicators. Cochran and Wood (1984) propose that shareholders are the main stakeholders of an enterprise and maximizing shareholders’ value is the way to improve corporates’ performance. Stock price per share and earnings per share are market indicators for evaluating financial performance. Qing (2010) proposes that enterprise performance is mainly aimed at the comprehensive evaluation index of enterprise solvency, operating ability, profitability, and ability to resist risks.

To sum up, the evaluation of financial performance should be combined with multiple angles and indicators for a comprehensive analysis.

The impact of CSR on financial performance

There are three views about the impact of fulfilling corporate social responsibility on financial performance: the positive, negative and neutral views.

Fulfilling corporate social responsibility has a positive impact on financial performance

This view believes that active performance of corporate social responsibility can promote corporate image, enhance corporate competitiveness, effectively reduce costs, increase profits, and increase financial performance.

Cornell and Shapiro (1987) believe that companies that actively perform corporate social responsibility have a good corporate image and can attract investors to invest, thereby improve financial performance. Moskowitzt (1972) selects some companies that actively fulfill their social responsibilities as the research objects. The study finds that the stock prices of these selected companies have increased rapidly. It is inferred from this that investors priorized companies with better corporate images during the investment process. Preston and O'bannon (1997) selects 67 companies, choose the reputation rating index in "Fortune" as the evaluation index of corporate social responsibility, and take return on investment, return on net assets and return on total assets as financial performance indicators; they conclude that there is a positive correlation between the reputation rating and all the financial performance measures. Simpson and Kohers (2002) adopt empirical approach to analyze the fulfillment of social responsibilities of 385 banks selected in the financial industry, and their financial performance. This study shows that there is a positive correlation between the two. Also, Tsoutsoura (2004) selects 422 companies listed in 1996-2002 as a sample, using Kinder Lydenberg and Domini & Co (KLD) Index to measure their corporate social responsibility, ROA and ROE, and financial performance; they found a positive correlation. Chen and Wang (2005) show that a company's focus on fulfilling social responsibilities will enable the company to gain a better reputation, have a better image in the eyes of the public and help improve its financial performance. Zhang et al. (2012) find that corporate social responsibility has a positive relationship with the EBIT margin of total assets, which suggests that companies should not only consider maximizing shareholder wealth, but also actively assume social responsibilities for consumers, governments, and employees in order to achieve corporate viability. Only in this way can enterprises realize sustainable development and improve their performance for a long time. Mishra and Suar (2013) find that companies that pay more attention to environmental protection have better financial performance. Zou et al. (2019) analyze many cases and believe that the fulfillment of corporate social responsibility should take into account factors such as consumers’ needs, employees’ welfare, environmental protection, and compliance with the law, so as to comprehensively improve corporate financial performance.

CSR has a negative impact on financial performance

Fulfilling corporate social responsibility is thought to increase cost thus reducing corporate performance. CSR and corporate financial performance would then show a negative correlation.

In their study of the relationship between corporate social responsibility and financial performance, Preston and O’bannon (1997) conduct an in-depth study on Vance’s research. The financial performance indicator was set as short-term profit. This study finds negative relationship between corporate social responsibility and financial performance.

Companies that fulfill their social responsibility have higher operating cost and lower profit. Hillman et al. (2001) document that compared with companies that do not assume social responsibility, companies that actively invest in social responsibility are at a disadvantage in terms of market competitiveness. Li (2006) uses the data of companies listed on the Shanghai Stock Exchange as a sample and finds that companies with low corporate value are those that actively perform social responsibilities.

It is pointed out that in order to improve the financial performance of enterprises, costs should be cut in all aspects, and fulfilling of social responsibilities will incur additional expenses. Companies that actively fulfill their social responsibilities have higher investment, lower profit, and worse financial performance.

CSR has no impact on financial performance

It is also believed that there is no correlation between the corporate social responsibility and financial performance. Aupperle et al. (1985) believe that the financial performance of enterprises will not be affected by the performance of social responsibilities. Elsayed and Paton (2005) collect British corporate data for analysis, using corporate environmental behaviors to evaluate the performance of social responsibilities, and taking profitability as a measure of financial performance. They did not find a correlation between the two. Chen and Ma (2005) collect the data of companies listed in the Chinese stock markets, establish an indicator system of corporate social responsibility for various stakeholders, and explore the relationship between the performance of social responsibilities and the companies' stock price. They find no significant correlation between the two. Brammer and Millington (2008) believe that the stock price and financial performance of a company only reflect the effectiveness of the company's business strategy, and have no obvious relationship with whether the company fulfills its social responsibilities or not. Actively fulfilling social responsibilities cannot make a company obtain excessive returns.

RESEARCH METHODOLOGY AND DATA

This study adopts the case study approach, which is particularly useful when there is a need to obtain an in-depth appreciation of an issue or phenomenon of interest. It is an established research design used extensively in a wide variety of disciplines in social sciences. Yin (2009) illustrates that the case studies can be used to explain, describe, or explore events or phenomena in the everyday contexts in which they occur; understand and explain causal links and pathways resulting from the development of incidents. Rather than seeking to test a set of specific hypotheses, case study approach captures information on more explanatory 'how', 'what' and 'why' questions. This study selects Ctrip, a Chinese multinational online travel company, as the case to study. The case is selected not because it is representative of other cases, but because of its uniqueness, which is of genuine interest to the researchers.

This corporation involved some incidents of social responsibility in recent years, 2014-2020. The impact of these social responsibility incidents was explored on the financial performance indices. The social responsibility incidents were identified by reading the corporation’s corporate citizenship report. The daily closing prices of Ctrip were collected from Sina Finance. The financial figures like revenues and operating incomes were collected from the corporation’s financial statements.

Case analysis – Ctrip

Basic introduction of Ctrip

Founded by James Liang et al. in June 1999, Ctrip is headquartered in Shanghai, China, and has established branches in 16 cities in China. As a leading comprehensive travel service company in China, Ctrip has successfully combined the Internet industry and traditional tourism. Ctrip provides more than 60 million members with a full range of travel services including hotel reservations, air ticket reservations, travel vacations, business travel management, gourmet reservations and travel consultation. Relying on stable business development and excellent profitability, Ctrip became listed on NASDAQ in December 2003. The stock price increased on the day of listing and set a record for NASDAQ’s opening day in three years. In 2010, Ctrip strategically invested in Taiwan ez Travel and Hong Kong Wing on Travel, completing the layout of Greater China. In 2015, Ctrip acquired Qunar.com, eLong.com. Today Ctrip is China's largest online travel platform. In 2018, Ctrip was selected into the Fortune Future 50 list in 2018, ranking fourth. Ctrip's philosophy is "integrity and law-abiding operations, fulfilling social responsibilities, and providing consumers with more high-quality public welfare services". Ctrip was choosen in the case analysis because of its philosophy.

Analysis of Ctrip's major social responsibility events

This section mainly analyzes some social responsibility activities of Ctrip from 2015 to 2020. The responsibility targets are the stakeholders such as consumers, shareholders, social environment, government, and employees. There are some positive events and some negative events. The impact of corporate social responsibility on corporate performance is mainly studied.

RESULTS AND DISCUSSION

Consumer-related events

Bundled sales

On December 5, 2015, New Weekly deputy editor Jiang Fangzhou publicly complained about Ctrip on Weibo. It is understood that she booked a flight from Beijing to Tokyo through Ctrip and paid a total of 3,016 yuan. Unexpectedly, she booked a connecting ticket, which added a voyage that she did not even know about. The total face value of this coupon was 1,645 yuan, which prevents her from being reimbursed. After that, Jiang Fangzhou contacted Ctrip customer service many times, but the customer service passed the responsibility to customers and suppliers. Jiang Fangzhou was angry to announce the matter on Weibo, and soon received replies from many netizens. In a few days, there have been more than 3,000 comments, most of which are dissatisfied with Ctrip's work such as booking air tickets and hotels. Faced with repeated complaints, Ctrip has not resolved them well, which not only lost a large number of users, but also established a bad image of defrauding customers. This does harm to Ctrip's brand image. In 2016 Ctrip faced merger and acquisition; the rise in stock price cannot clearly reflect the impact of social responsibility since the Internet industry was booming. After the merger, Ctrip did not actively make corrections to improve user experience.

On the evening of October 9, 2017, the well-known actor Han Xue angrily scolded Ctrip and posted on Weibo that he often used Ctrip to book air tickets. With more than 99% of Ctrip users on her trip, it is still sometimes difficult to avoid Ctrip's hidden options under booking information. The screenshot of the order details displayed by Han Xue shows that in addition to the due air ticket costs and airport construction fees, an additional 38-yuan hotel coupon has been added. Ctrip was asked to provide an explanation for multiple bundling events, but only made an apology for it.

There is a provision in the China’s Consumer Rights Protection Law: Consumers have the right to independently choose goods or services. Consumers have the right to independently choose the operators who provide goods or services, independently choose the types of goods or service methods, and independently decide to purchase or not to purchase any kind of goods, and to accept or not to accept any kind of service.

According to this provision, Ctrip uses coupons as the default purchase options when providing ticket options, which obviously violates the right of consumers to independently choose goods or services. Consumers have the right to complain about this bundled consumption behavior.

Before the public figure Han Xue raised objections, in fact, many Ctrip consumers experienced similar incidents, and consumers were very dissatisfied. It is precisely because of the greater social impact brought by Han Xue as a public figure that Ctrip made corrections.

Figure 1 presents the graph of stock price movement before and after the incident. Before the incident, October 2017, Ctrip's share price remained above $50 for most of the time, with a peak of more than $60. After the bundling incident, the stock price remained basically down, a sharp decline on October 19; the stock price fell below $50, and continued to decline. The incident caused strong consumers’ dissatisfaction, the company's reputation fell, investors complained about the company and investment was weakened.

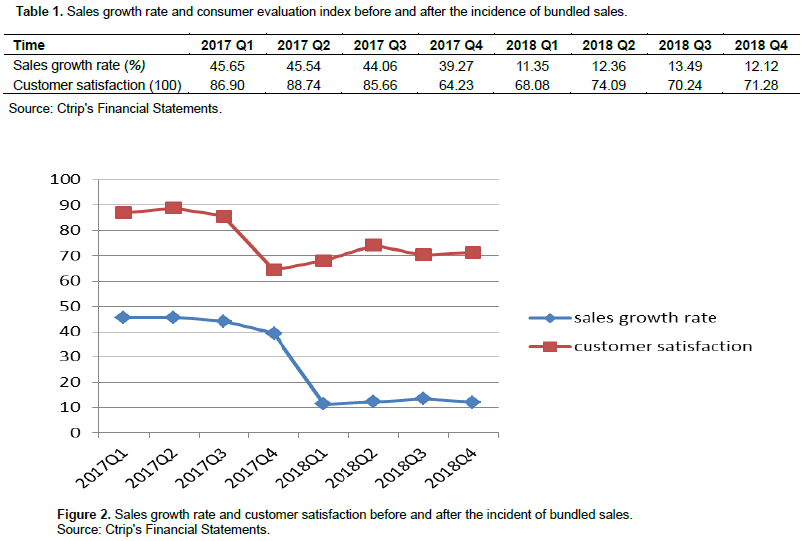

When selecting the evaluation index that shows the performance of a company's social responsibilities to consumers can be selected as user satisfaction, which mainly refers to the degree of satisfaction of the company's consumers with products and services. The customer satisfaction scores in this article are derived from the full score of 100 points in the questionnaire of China Tourism Academy on tourist satisfaction.

For the selection of evaluation indicators for corporate financial performance, at the consumer level, it is more appropriate to select sales growth rate as an indicator. Byobserving the change trend of a company’s sales growth rate with the customer’s satisfaction, the impact of fulfilling corporate social responsibility on financial performance can be obtained.

Table 1 summarizes the consumer evaluation index and the sales growth rate before and after the incident of bundled sales. Before Han Xue exposed the bundling sales event, Ctrip's customer satisfaction has been maintained at more than 80 points, and the sales growth rate of each quarter has been maintained at about 40%, which is a relatively rapid growth; the development trend of the company’s financial performance is good. However, after the incident was exposed, in the fourth quarter of 2017, customers’ satisfaction dropped significantly down to 21.43%, and sales growth rate also dropped to about 10%. It shows that this negative incident has lost the trust of consumers due to Ctrip's failure to fulfill its corporate social responsibility for consumers, and customers have become dissatisfied. Unwilling to spend money on Ctrip's products, the company's financial performance is reduced. It shows that fulfilling corporate social responsibility has a positive impact on financial performance. Figure 2 displays sales growth rate and customers’ satisfaction before and after the incident of bundled sales.

Information leakage incident

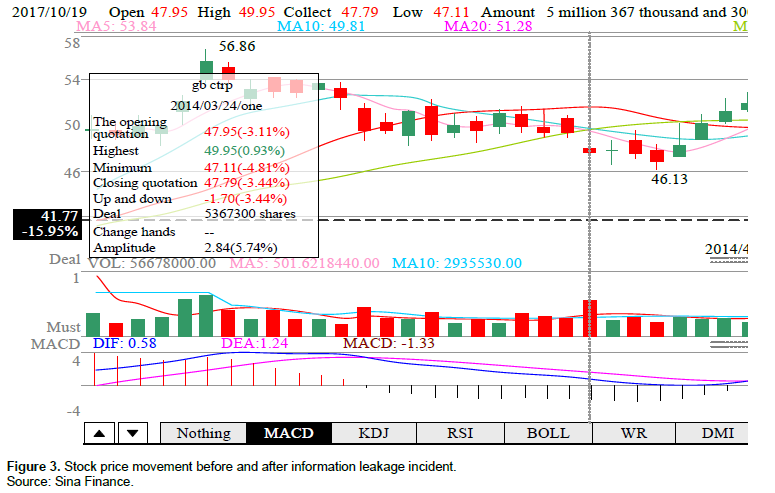

On March 22, 2014, the exposure of Ctrip's payment loopholes led to the disclosure of credit card information. It was pointed out that Ctrip's secure payment log can be traversed and downloaded, resulting in the disclosure of a large number of users' bank card information (including the cardholder’s name ID, bank card number, card CVV code, and 6-digit card Bin). After the exposure, Ctrip said that it has notified the manufacturer of the details and is waiting for the manufacturer to deal with it. Ctrip stated that it has not discovered any leakage of customers’ information and losses due to website security. The company will continue to repair network security. If a user suffers property damage due to the loophole, Ctrip will provide compensation for the loss. But even so, in an era when the Internet is so developed, consumers attach great importance to information security, and Ctrip has undoubtedly lost the trust of consumers in this information leakage incident. In terms of stock price changes, it is also obvious that the stock price has a clear downward trend after the incident.

Figure 3 presents the graph of stock price movement before and after the information leakage incident. After the information leakage incident, the stock price has a sharp decline on March 24, and continued to decline in the coming two trading days. The information leakage incident has made Ctrip's consumers feel insecure, and the security loopholes generated by Ctrip also reflect the company's lack of attention in fulfilling its social responsibility to consumers. The decline in stock prices can also reflect the positive correlation between the fulfillment of corporate social responsibility and corporate performance.

Using big data to harm the interests of loyal users

Not long ago in 2017, the news about “the more expensive the mobile phone, the more expensive the taxi price” once became one of the topics of heated discussion among netizens. In the recent national Two Sessions (the National People’s Congress and the Chinese People's Political Consultative Conference), some representatives proposed to legislate "resist data abuse" and put an end to such marketing methods of Internet companies. While netizens are still complaining about the Internet companies’ big data killing, Ctrip also pointed out that when booking hotels by a mobile phone, the more expensive the mobile phone is, the more expensive the room is.

Recently, Mr. Zhang from Hebei Province accidentally discovered when he booked a hotel on Ctrip.com that the price displayed by an expensive mobile phone for the same room would be higher than that of a cheaper mobile phone. Some reporters use three mobile phones for verification. One was an ordinary phone with a price of 1,000 yuan, the other was a mid-range phone with a price of more than 3,000 yuan, and the other was an even more expensive Apple phone. According to the same hotel, room type, check-in time and other same conditions, the price shown in the ordinary mobile phone is 1158 yuan, and the average member price shown in the mid-range mobile phone is 1258 yuan. Ctrip gold members should enjoy a more favorable price according to conditions, but the result price shown in Apple phone is the same as the price shown in mid-range phones, also 1258 yuan.

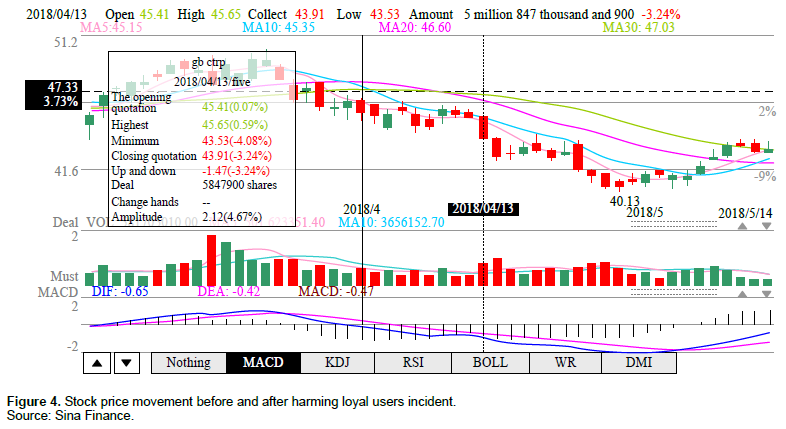

It should be noted that this is not the first time Ctrip has been exposed for big data killing. Big data killing in Ctrip often occurs. In April 2018, a consumer accidentally discovered that her Ctrip spending points were nearly 60,000 higher than her husband's, but when she used Ctrip to book a hotel, the booking price was more expensive than her husband's. So many media reported it. Articles such as “Consumers are ‘killed’ by technology companies' big data” have also aroused public opinion on the Internet. Ctrip became a hot topic of discussion, and its stock price continued to decline during that period.

Figure 4 presents the graph of stock price movement before and after harming loyal users’ incident. The stock price of Ctrip had a significant decline of 3.24% on 13 April 2018 and continued to decline in 10 of the following 12 trading days. It can be seen that big data killing events will cause companies to lose the trust of users, and it is also a manifestation of companies not fulfilling their social responsibilities for consumers. Through the downward trend of stock prices, it can also be seen that failure to fulfill corporate social responsibility will have a negative impact on corporate performance.

Employee-related events

On November 8, 2017, Ctrip’s “child abuse” incident was exposed. Ctrip employees angrily exposed videos of Ctrip Parent-Child Park employees’ abuse. In the video, some children were pushed to the ground, some were tied to chairs, and others were forcibly fed with mustard. The video quickly spread on various social media. On November 9, Shanghai Changning Public Security Bureau announced that it had detained 3 of the 4 staff in accordance with the law.

Ctrip's establishment of the parent-child park back then was a manifestation of caring for employees' lives and fulfilling their social responsibilities. Shi Qi, vice president of Ctrip, said that Ctrip has more than 10,000 employees at its headquarters in Shanghai, and many mothers are worried about how to better balance the time between work and childcare after the maternity leave is over or during winter and summer vacations. Now the completion of the parent-child park will be a real benefit for Ctrip's mothers. However, the occurrence of child abuse incidents has turned a good thing into a bad thing. Ctrip has lost more than just customers and revenue. In this round of negative incidents, Ctrip lost more of the trust of its employees and the people. And trust needs to be established for a long time, so this incident has a greater impact on Ctrip.

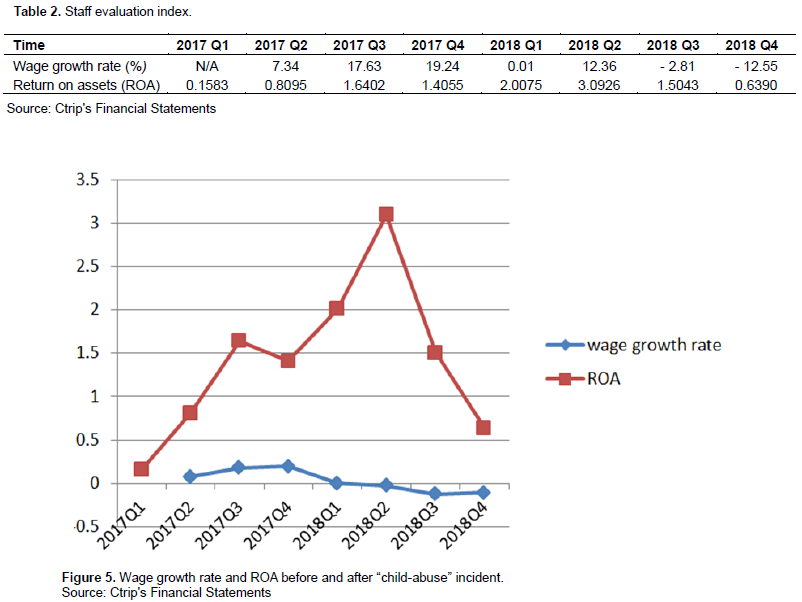

Analyzing the changes in the stock price before and after the incident, the stock price did not change significantly, possibly because the child abuse incident did not have a direct impact on shareholders and consumers. However, due to the significant impact on corporate employees, from the perspective of revenue, Ctrip has suffered a huge impact. In terms of net revenue, Ctrip has 7.9 billion in the third quarter of 2017, and 6.4 billion in the fourth quarter, a decrease in 19.0%; during the same periods of time one year before (2016), the net revenue decreased from 5.61 billion to 5.1 billion yuan, a decrease in 9.0%. The “child abuse” incident aroused public outrage and group boycott of using this online platform in the coming several months since November 2017. The decline in revenue in the fourth quarter of 2017 was not only due to the off-peak season, but the impact of “child abuse” incidents also affected corporate performance. The fulfillment of corporate social responsibilities in terms of employees will also have an impact on corporate performance, and it is positively correlated. The salary growth rate was selected as the evaluation index that evaluates the company's fulfillment of social responsibilities to employees. In 2017, the child abuse incident at the Ctrip Parent-Child Park occurred, and Ctrip failed to fulfill its corporate social responsibility to its employees. Judging from the increased wage rate in the third and fourth quarters of 2017, Ctrip tried to make up for this incident by raising wages. The salary growth rate reached about 20%. Although it is an afterthought, it has alleviated the lack of social responsibility for employees to a certain extent.

By comparing the change in return on assets (ROA) ratio of the company with wage growth rate, the impact of fulfilling corporate social responsibility on financial performance can be derived. ROA increased in the third and fourth quarters of 2017 and the first and second quarters of 2018. Corporate performance is temporarily stable. However, starting from the second quarter of 2018, for three consecutive quarters, the wages of employees did not increase but declined, and the rate of decrease reached 10%. The reason should be that Ctrip believes that the child abuse crisis has passed for a long time, and there is no need to increase wages to stabilize employees. However, from the perspective of corporate performance, ROA has shown a clear downward trend since the third quarter of 2018. This also shows that the child abuse incident shows that Ctrip has not fulfilled its social responsibility to its employees and has lost the trust of its employees. Trust cannot be established temporarily, and it will have a lasting impact. When the trust of employees is lost, some employees' loyalty to the company will decrease, and they may no longer work hard as before. This will definitely have an impact on corporate performance and reduce corporate performance. Table 2 and Figure 5 summarize the salary growth rate and ROA before and after the “child-abuse” incident. The fulfillment of corporate social responsibilities in terms of employees will also have an impact on corporate performance, and it is a positive correlation.

Government-related events

Tourism revival V plan

Ctrip launched a tourism recovery data platform called “travel observer” on March 5, 2020, which was opened free of charge to local governments. Ctrip's "travel observer" data platform is Ctrip comprehensive global public health and safety events platform before and after the recovery of tourism, 2019-2020 tourism industry growth scale, pandemic development judgment, platform users search, browse, order, collection, and other factors. The 2020 industry recovery forecast model was established in the “travel observer” platform to help local government have a projection of tourism industry after the pandemic and a plan called Ctrip’s V plan was also implemented.

According to the analysis of the industry recovery forecast model, after the pandemic, people's enthusiasm for travel will start to pick up from "tour around". Among them, consumers in first-tier cities such as Beijing, Shanghai and Guangzhou are looking forward to traveling around; Tianjin, Qinhuangdao, Zhangjiakou, Baoding, Jinan around Beijing, Huzhou, Huangshan, Lishui, Suzhou and Hangzhou around Shanghai, and Macau, Huizhou, and Zhuhai around Guangzhou. Zhanjiang, Guilin and other places are among the top five in the "Surrounding Destination Wish Index" list. In addition, the "Wish Index" of Chengdu and Guizhou, Chongqing, Ganzi Prefecture, Lijiang and Shangri-La has gradually increased. The "Wish Index" of the three dimensions of "Parent-Child", "Ancient City" and "Food" is showing a strong momentum. Thanks to the data analysis of the Ctrip Travel Renaissance V Plan, the government can better predict the direction of the tourism industry after the epidemic, which is more conducive for the development of the tourism industry after the epidemic.

According to the results presented by the model, with the gradual control of the pandemic and the easing of the industry, after the industry has gone through a trough, it will start to rise steadily with the control of the epidemic and increase with the arrival of traditional tourism nodes such as May Day Golden Week and summer vacation. The trend throughout the year appears to be obvious V-shape. To stimulate tourism consumption, Ctrip has joined hundreds of destinations around the world to launch a one-billion-yuan recovery fund through smart investment and refined subsidies.

As the leader of China's tourism industry, Ctrip's positive attitude in response to the pandemic has undoubtedly made great contributions to the government's promotion of the economic recovery of the tourism industry after the pandemic. The effect of Ctrip's implementation of corporate social responsibility on the government side is affirmed.

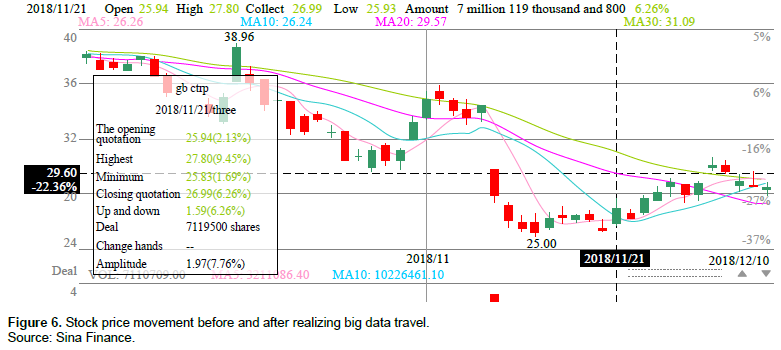

Cooperating with the National Development and Reform Commission to realize big data travel

On November 21, 2018, Ctrip signed a strategic cooperation agreement with the Comprehensive Transportation Research Institute of the National Development and Reform Commission. The two parties collected traffic and travel big data to provide services for building a smart and efficient modern integrated transportation system, and planning the major transportation infrastructure. According to a China Travel News report on 26 October, 2017, Ctrip as the world's leading online travel company has more than 300 million users generating 50TB of big data every day, which accumulate a wealth of big data resources. The National Development and Reform Commission stated that big data applications are still insufficient in the field of transportation, and there are still problems such as fragmentation and lack of standardization in the “Notice on the Special Project of Innovation Capacity Establishment in the Field of Big Data” published on 26 August 2016. Ctrip has a comprehensive and full chain of massive travel data resources, which can provide data support for building smart transportation and smart travel. The cooperation between the two parties decided on 21 November 2018 was conducive to the implementation of the national comprehensive transportation development strategy and the development of the transportation economy. It is an outstanding performance of Ctrip in fulfilling its corporate social responsibility for the government. In the following trading days in December 2018, the stock price had a clear upward trend.

Figure 6 presents the graph of stock price movement before and after realizing the big data travel. The fulfillment of corporate social responsibilities for the government enhances the corporate image in the hearts of citizens, attracts more investors, and has a positive impact on corporate performance.

Events related to the social environment

Launching the travel charity platform

In October 2019, Ctrip Group held its 20th anniversary ceremony in Shanghai, and its "STAR" social responsibility strategy was first released at the conference, which includes the protection of travel safety, precise tourism and poverty alleviation, and responsible travel. The first domestic travel charity platform started by Ctrip Group was launched simultaneously.

According to the data released by the Ministry of Civil Affairs, as of 2018, there were more than 6.97 million rural left-behind children under the age of 16, whose parents both went to cities to work, rarely had the opportunity to reunite with their parents. In fact, many groups are eager to travel but have no chance. Ctrip's public welfare platform was launched to improve this situation.

Ctrip's charity platform is positioned as a new funding model of "Internet + charity + travel", through the integration of upstream and downstream partners in the tourism ecological chain and Ctrip users' point-of-care donation channels. Ctrip created the first public welfare platform in China that realizes the travel dreams of disadvantaged groups. According to the plan, Ctrip's charity platform will fund 50 travel charity projects in the first year and provide 10 million for charity fund. In addition to supporting travel dreams, the charity platform will also add two new directions in the future: travel environmental protection and tourism poverty alleviation, with an aggression to become the world’s largest and most influential travel charity platform. In recent years, Ctrip has relied on its strong online marketing capabilities and the resource advantages of large members, big data, large platforms, large products, and large traffic to help poverty class in inland provinces to get out of poverty in an all-round way. According to an article published in “China SME” issue number 304, Ctrip has opened stores in more than 450 county-level cities and 16 impoverished counties, creating more employment opportunities for local young people. Ctrip has been working hard on the road of public welfare.

Figure 7 presents the graph of stock price movement before and after launching the travel charity platform. From the fluctuations of stock price, it may be seen that Ctrip’s stock price has a clear upward trend after launching its travel charity platform on 29 October 2019 until mid-November 2019. It also shows that citizens recognize Ctrip’s public welfare behavior. This charity act is an obvious manifestation of Ctrip’s fulfillment of corporate social responsibility. The significant increase in stock prices is also an indication that fulfilling corporate social responsibility has a positive impact on corporate performance. Figure 8 shows the key highlights in the financial report for the 4th quarter 2020.

Ctrip’s public welfare actions in response to the Covid-19

After the outbreak of the Covid-19, Ctrip was one of the first companies in the domestic tourism industry to introduce a series of comprehensive safeguard measures, including free subscription and supplier support policies. Ctrip reported a total of tens of millions of orders have been unsubscribed, and the amount involved exceeded 31 billion yuan in the quarterly statements for the first quarter of 2020. Ctrip also announced the launch of the “Angel Wings Project” in the corporate’s online platform. The project included several public welfare actions to pay tribute to doctors, provided free public welfare accommodation and cars for medical staff and volunteers, and sent health care exclusive version of super members, diamond membership around the country worth 500 million yuan.

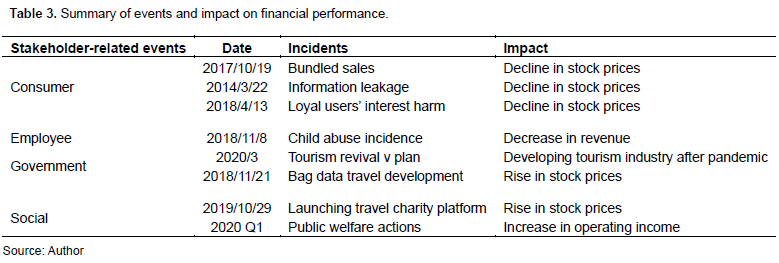

According to an article titled “Wish you were here” in the December 2020 issue of Finance and Development (Behsudi, 2020), the tourism industry contributes 10% of the world’s GDP and is also the industry most affected by the pandemic. As a leading company in China’s tourism industry, Ctrip has given full play to its platform advantages and actively assumed social responsibilities, which has made great contributions to the recovery of the tourism industry. According to the financial report for the fourth quarter of 2020, Ctrip’s net operating income increased by 73% month-on-month, and its growth rate ranked first in the domestic online travel industry. The improvement in financial performance was not only related to the effective control of the epidemic, but also benefited from Ctrip’s spirit of public welfare demonstrated during the epidemic and its attitude of actively assuming social responsibilities was widely recognized by consumers and investors. Therefore, actively fulfilling social responsibilities has a positive impact on financial performance. Table 3 summarizes the stakeholders involved in, the date of and the impact on the financial performance of the incidents analyzed in this section.

CONCLUSIONS

Through a specific analysis of Ctrip's performance of social responsibilities for shareholders, consumers, government, society and the environment, and employees, the study concludes that stock price fluctuations are closely related to firms’ performance of corporate social responsibilities. When a vicious event shows that Ctrip fails to fulfill its social responsibilities, the stock price (financial performance) drops significantly. When Ctrip actively participates in public welfare and cooperates with government decision-making and other positive events, its stock price and financial performance rise. The results indicate that fulfilling corporate social responsibility has a positive impact on financial performance. The findings are consistent with some previous studies (Tsoutsoura, 2004; Chen and Wang, 2005; Zhang et al., 2013; Mishra and Suar, 2013; Zou et al., 2019) that fulfilling the corporate social responsibility may improve corporation image and derive a better financial performance: short-term rise in stock prices, or intermediate-term improvement in accounting figures. The findings of our study are against the findings of one of the previous studies done issues related to corporate social responsibility. The investors and consumers in China concern the image of the corporations’ social responsibilities in their investment portfolio and daily lives. Future studies may be done on a sample of listed firms to explore whether the corporations in China collectively concern the issue of corporate social responsibility.

Recommendations

Enterprises should establish a correct understanding of social responsibility and put it into practice

For enterprises, especially the Internet industry, the current market economy system is still in the process of construction, and the Internet environment still needs to be improved. To win in market competition and achieve sustainable development, companies should abandon the simple principle of profit maximization, and fully understand the potential benefits of fulfilling social responsibilities, incorporate corporate social responsibility into development strategies and form corporate culture.

From the company's internal perspective, the company must attach importance to the health and safety of employees, protect their legitimate rights and interests, and establish a good corporate culture. A company needs to abide by the law, be honest and trustworthy, protect its environment, and be enthusiastic about the public welfare.

The government should strengthen the disclosure and supervision of corporate social responsibility performance

The governments should fully understand the importance of corporate social responsibility performance, invest appropriate human and material resources, establish a scientific and complete evaluation system of social responsibility, and improve disclosure mechanism of the corporate social responsibility, to enable all sectors of society to perform supervision functions. In addition, appropriate reward and punishment mechanisms should be established, and measures such as supplementary publicity and education should be taken to encourage enterprises to increase their emphasis on fulfilling their social responsibilities. Finally, it is necessary to conduct thorough investigations into enterprises regularly to ensure the authenticity and transparency of their social responsibility. Strengthening government supervision also needs setting up a professional supervisory department when necessary. Through a series of more standard and complete laws and regulations, Chinese enterprises are guided to actively fulfill their social responsibilities.

Investors should incorporate corporate social responsibility into investment guidelines

For investors, they should fully implement the rational investment philosophy, and comprehensively assess the performance of all aspects of investment goals, including the performance of social responsibilities, to effectively restrain the enterprises from engaging in behaviors that damage social interests, reduce the occurrence of negative social responsibilities and carry out reasonable supervision. Incorporating corporate social responsibility into the investment guidelines can effectively mobilize the public's supervisory power, help the society establish a sound social responsibility system, activate investors' investment enthusiasm, fully protect their rights and interests, and achieve a win-win situation.

CONFLICT OF INTEREST

The author has not declared any conflict of interests.

REFERENCES

Aupperle KE, Carroll AB, Hatfield JD (1985). An empirical examination of the relationship between corporate social responsibility and profitability. The Academy of Management Journal 28(2):446-463. | |

Behsudi A (2020). Wish you were here. Finance and Development 12:36-39. | |

Bowen HR (1953). Social Responsibilities of the Businessman. University of Iowa Press. | |

Brammer S, Millington A (2008). Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Management Journal 29(12):1325-1343. | |

Carroll AB (1979). A three-dimensional conceptual model of corporate performance. Academy of Management Review 4(4):497-505. | |

Carroll AB (1991). The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Business Horizons 34(4):39-48. | |

Carroll AB (2015). Corporate social responsibility: The centerpiece of competing and complementary frameworks. Organizational Dynamics 44(2):87-96. | |

Chen XD, Wang L (2005). SA8000 dui qiye jing zhengli yingxiang de yanjiu zongshu [Summary of researches on the impact of SA8000 on corporate competitiveness (Doctoral dissertation)]. Kexue Xueyu Kexue Jishu Guanli 8:137-142. | |

Chen YQ, Ma LL (2005). Wo guo shangshi gongsi shehuizeren kuiji xinxi shichang fanying shizhengfenxi [An empirical study on the market response to the social responsibility and accounting information]. Kuaiji Yanjiu 11:76-81. | |

Cochran PL, Wood RA (1984). Corporate social responsibility and financial performance. Academy of Management Journal 27(1):42-56. | |

Cornell B, Shapiro A (1987). Corporate stakeholders and corporate finance. Financial Management 16:5-14. | |

Elsayed K, Paton D (2005). The impact of environmental performance on firm performance: static and dynamic panel data evidence. Structural Change and Economic Dynamics 16(3):395-412. | |

Friedman M (1983). The social responsibility. Ethical Theory and Business 2:81-83. | |

Hillman AJ, Keim GD, Luce RA (2001). Board composition and stakeholder performance: Do stakeholder directors make a difference? Business and Society 40(3):295-314. | |

Li Z (2006). Qiye shehuizeren yu qiye jiazhi de xiangguanxing yanjiu - - laizi hushi shangshigongsi de jingyan zhengju [A study on relation of corporate social responsibility and corporate value: empirical evidence from shanghai securities exchange]. Zhongguo Gongye Jin?ji 2:77-83. | |

Liu JH (1999). Jinrongweiji de falv fangfan [Legal prevention of financial crisis]. Zhongguo Faxue 2:100-110. | |

Mishra S, Suar D (2013). Salience and corporate responsibility towards natural environment and financial performance of Indian manufacturing firms. Journal of Global Responsibility 4(1):44-61. | |

Moskowitz M (1972). Choosing socially responsible stocks. Business and Society Review 1(1):71-75. | |

Preston LE, O'bannon DP (1997). The corporate social-financial performance relationship: a typology and analysis. Business and Society 36(4):419-429. | |

Qing WJ (2010). Qiye caiwu zhanlüe jixiao pingjia zhuti ji jilizhidu tanxi [Subject and incentive system of corporate financial strategy performance evaluation]. Hunan Keji Xueyuan Xuebao 31(9):156-159. | |

Shen HT (2005). Gon?si shehuizeren yu gongsi caiwuyeji guanxi yanjiu [Research on the relationship between corporate social responsibility and corporate financial performance], Doctoral Dissertation. | |

Simpson WG, Kohers T (2002). The link between corporate social and financial performance: evidence from the banking industry. Journal of Business Ethics 35(2):97-109. | |

Tsoutsoura M (2004). Corporate social responsibility and financial performance. Journal of Business Ethics 61(1):29-44. | |

Vance S (1975). Are socially responsible corporations good investment risks? Managerial Review 64:18-24. | |

Yin RK (2009). Case Study Research, Design and Method. London: Sage Publications Limited. | |

Zhang ZG, Jin XC, Li GQ (2013). Qiye shehuizeren yu caiwujixiao zhijian jiaohu kuaqi yingxiang shizheng yanjiu [Empirical study on the cross-period impact of corporate social responsibility and financial performance]. Kuaiji Yanjiu 8:32-39. | |

Zhang ZG, Liang ZG, Yin KG (2012). Liyixiangguanzhe shijiaoxia qiye shehuizeren wenti yanjiu [Research on corporate social responsibility from the perspective of stakeholders]. Zhongguo Ruan Kexue 2:139-146. | |

Zou F, Zhu QQ, Wang J (2019). Jiyu duoanli fenxi de zhongxiao qiye shehuizeren shijian dui jixiao de yingxiang [Impact of social responsibility practice on performance of small and medium-sized enterprises based on multi-case analysis]. Keji Yu Guanli 21(1):96-108. | |