Management of relations with enterprise stakeholders based on value approach

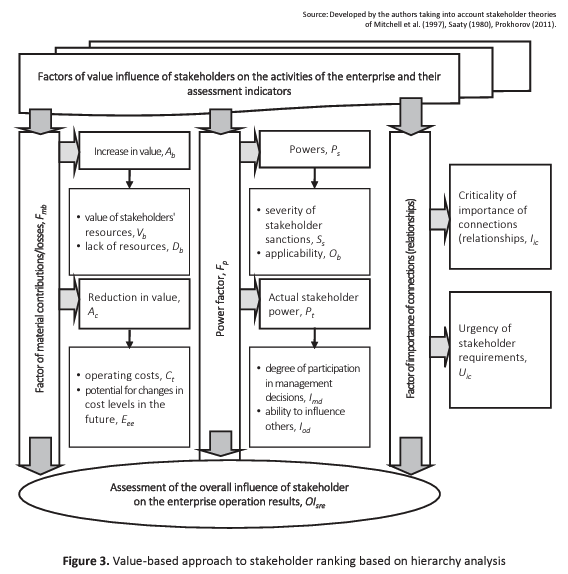

Опубликована Янв. 20, 2021

Последнее обновление статьи Дек. 12, 2022

Abstract

Significant transformations in economic relations and increased competition have posed enterprises with extremely complex tasks in the field of corporate governance. Mainly it concerns the systems of corporate governance, in which the principles of vertical organization are losing relevance, and the effectiveness of management largely depends on the balance of interests of participants (stakeholders) who can actively influence the production and commercial policy of the enterprise to distribute its resources in their favor. T he study aims to develop proposals to ensure the effective interaction of the enterprise with stakeholders, based on establishing an optimal balance of material (value) interests, allowing achieving a reduction of risks that threaten the development of the enterprise. T hus, it was proposed to determine the total value of the commercial results of the enterprise, taking into account the real contribution, which is provided by the relations with one or another stakeholder. A similar approach is implemented to determine the share of the value of the corresponding stakeholder, which is ensured by its relationship with this enterprise. In addition to the value of the enterprise itself, the proposed models explicitly determine the value benefits of stakeholders and disclose a list of the main controlling factors: the volumes of resources supplied and consumed by the parties, their relative values, the structure of resource flows, etc. As an example, using the developed recommendations, the circle of the most influential stakeholders of the Ukrainian enterprise – PJSC KhTP – was studied. This approach allows an industrial enterprise to rank stakeholders by value, to analyze the dynamics of the structure and parameters of material and financial resources flows of the enterprise and its stakeholders

Ключевые слова

Stakeholders, Ukraine, value, relationships, ranking, industrial enterprises

INTRODUCTION

The stakeholder theory of industrial enterprise is utilized as a separate economic research direction and is actively discussed by researchers and scientists for more than a quarter of a century. Simultaneously, a certain part of researchers defends its practical importance (Bourne & Walker, 2008; Kelanti, 2016; Prokhorov, 2011), while others emphasize the theoretical one and consider it a significant contribution to the development of enterprise theory and strategic management (Freeman, 1984, 2010; Noland & Phillips, 2010). Nowadays, for many industrial enterprises, profit is no longer the main goal of their activities. The goals of enterprises are defined much more broadly, and increasingly associated with innovative activities, the prospects for development and increase in business value, the expansion of the existing markets, and take into account not only the commercial interests of the owners but also the needs of a wider range of stakeholders. The success of global corporations depends on how they build their relationships with their stakeholders. The stakeholder model is focused on creating value for stakeholders, expanding the very platform of value creation, and balancing multiple stakeholder interests as a condition for choosing strategic initiatives. Any enterprise can have a significant number of them, all the requirements of which it cannot meet due to the limited resources available. Therefore, the task arises to identify the most significant key stakeholders that can have a major impact on the activities of the enterprise (Mitchell, 2003). For this purpose, it is necessary to use appropriate methods and methodological approaches for ranking stakeholders according to appropriate criteria to determine the most important of them, which have a strategic influence on the level of commercial success of an industrial enterprise.

The importance and relevance of this task require the appropriate research, the development of methodological approaches, and sound recommendations, the use of which will significantly improve the effectiveness of stakeholder relationship management processes.

1. THEORETICAL BASIS

The global economic crisis of 2008-2009 aggravated the discussion about the change of priorities in the management system of industrial enterprise. Several scientists began to suggest that for effective stakeholder management and business development, it is necessary to use not only the widely known shareholder model of the enterprise, the achievement of which is traditionally carried out mainly through the growth of owners’ wealth (Porter & Kramer, 2011; Donaldson & Davis, 1994; Donaldson & Preston, 1995) but also stakeholder model (Svendsen, 1998; Lankoski et al., 2016; Lane & Devin, 2018; Ivashkovskaya, 2019).

The algorithm for using the shareholder financial model of an enterprise is built on the dominance, as a rule, of the material interests of the owners of the company’s own capital. Proponents of this model Mitchell (2003), Ivashkovskaya (2019), Lane and Devin (2018) consider profit maximization for the shareholders of this enterprise the main financial goal of production and commercial activity.

The equity financial model of the enterprise was developed in the contract theory of the firm, first formulated by Coase (1937). Within this theory framework, an enterprise is considered a set of relations between employees, managers, and owners, expressed in the form of agreements (contracts). The theory defines the costs incurred by the owner in the implementation of these contracts - internal (costs of control) and external (transactional), as well as the priority right of owners to meet their needs, as the owners have a high risk of failure and they receive some compensation for this risk on the residual principle. At the same time, control costs are designed to mitigate existing conflicts of interest. Indeed, managers are often interested in the volume of market sales of products and profits generated. At the same time, owners are motivated by future financial flows, employees are motivated by higher wages without additional effort, and owners are focused on more efficient employee performance.

The contract theory of firm has found continuation in the stakeholder theory by its expansion at the expense of more economic agents. R. E. Freeman, the founder of the stakeholder theory, in his work “Strategic Management: A Stakeholder Approach”, which is considered a pioneer in this direction (Freeman, 1984), formulated a new firm model as a set of stakeholders of this firm. Although the main provisions of the stakeholder theory were formulated back in the mid-80s of the XX century, interest in it and its practical implications are currently growing (Moratis & Brandt, 2017; Tkachenko, 2017; Ivashkovskaya, 2019; Velychko, 2020). This theory proclaims the achievement of such organizational excellence, in which the proportionate satisfaction of stakeholders’ interests leads to the maximization of enterprise value, which is a modern strategic goal of the business.

The stakeholder financial model of an industrial enterprise is based on accounting for the interests of all owners of both financial and non-financial capital (Patrusheva, 2009; Lankoski et al., 2016; Kelanti, 2016). The model has arisen and is being improved due to the increasing role of interaction of all stakeholders involved in various forms (active and passive) of participation in the activities of an industrial enterprise to obtain a certain benefit from connections with it. The purpose of the enterprise should be to create value for sustainable development in a broad sense. For this, it is necessary not only to consider the interests of a wide range of stakeholders in words but also create a balance of these interests, exchange resources with them, and transfer them a part of the added value resulting from the enterprise’s operation. The European and domestic experts in the field of management of the industrial enterprises reconsider the purposes of its activity, and offer various mechanisms by creating partial value by participation in incomes of various groups of stakeholders (Porter & Kramer, 2011). There is a new definition in economic research - shared value (partial value for stakeholders) (European Commission, 2011).

Proponents of the stakeholder model propose an integrated model of value management, which is based on a new goal, which is to increase value for enterprise stakeholders and relies on the expansion of the value creation platform and balancing different stakeholder interests as a condition for the successful choice of strategic business initiatives. Hence, according to several researchers (Patrusheva, 2009; Prokhorov, 2011; Tkachenko, 2017), the central task in the development of the stakeholder approach is to solve the problem of assessing stakeholder value.

There are different approaches to solving this question in the economic literature, although most of them are of the same nature. According to Post et al. (2002), the enterprise value includes the market value of all types of assets, including intangible assets (intellectual capital, patents, and licenses), as well as the value of relationship and relationship assets, including relationships between stakeholders and the reputational effects of the enterprise generated by these relationships. This point of view is reinforced by the research conducted by Capasso (2004) who, in addition to tangible and separable intangible assets, considers goodwill as components of the system value of the enterprise, i.e., the market value of intangible assets (image, brand, stable market share), and systemic goodwill, including unique trade relations, customer satisfaction, intellectual and innovative potential of the enterprise.

One possible solution to this problem is offered by Lankoski et al. (2016), which define stakeholder value as a subjective assessment of the value provided by an individual stakeholder (or group of stakeholders), obtained for it due to the production and commercial activities of the enterprise. In this case, the authors of this approach justify their position because stakeholders’ thoughts about the measurement of value depend on their idea of some ideal (desired) for their state of enterprise performance. In this case, the very process of value assessment for stakeholders and, as a result, the formulation of their value judgments can occur intuitively or intentionally and can change over time. Using this approach, the top management of an industrial enterprise should understand and perceive the value of corporate actions for stakeholders and, if possible, influence stakeholders’ assessments with their corporate policies. Based on open cooperation with its stakeholders, a mutually beneficial synergetic effect for all stakeholders can be achieved.

Several researchers, including Patrusheva (2009), Tkachenko (2017), Ivashkovskaya (2019), consistently develop the stakeholder approach to management, focused on increasing the value of the enterprise. The model proposed by these authors at its core contains a strategically oriented system of corporate governance, the important task of which is to create value for stakeholders. The researchers propose to use a system of key indicators of added value for stakeholders, among which it is recommended to include the calculation of a special coefficient - the index of stakeholder contribution to the results of the enterprise. Ivashkovskaya (2019), develops a stakeholder model of corporate governance of an enterprise and emphasizes the need to form a balanced capital architecture and harmonize the interests of strategic financial and non-fl- nancial stakeholders. Simultaneously, it proves that only based on this, it is possible to achieve positive value growth for stakeholders. Within the framework of the stakeholder model of corporate governance, the top management of an industrial enterprise must rely on “new value thinking” and take non-standard actions to ensure long-term value growth for financial and non-financial stakeholders of the company (Ivashkovskaya, 2019).

As for the assessment of stakeholder value, the studies by Patrusheva (2009), Prokhorov (2011), and Tkachenko (2017) indicate two ways of solving this problem: the value assessment of stakeholders’ contribution to the total assets of the enterprise and the value created by the enterprise for its stakeholders. The enterprise and stakeholders are interdependent on each other, and the interdependence can be high or low, depending on the nature and strength of the impact of the enterprise or on the nature and strength of stakeholder influence.

According to Olander and Landin (2008), another key problem of the stakeholder approach is the complexity of the formalized description of stakeholder behavior, each of which has and implements its own interests and policies. The application of different kinds of models helps in the study of stakeholder interaction to develop a collective decision on the management of the organization. So, Kharin and Gareev (2014) offer a model that allows formalizing the process of selection by stakeholders of the main target criterion of company management as a dynamic cooperative game. In a general sense, stakeholders’ gain is the value of the enterprise. However, because of the heterogeneity of stakeholders’ interests, their judgments about value may differ: it is financial value and benefit for some. For others, it is a non-financial value, which is an intellectual, social, or environmental benefit. This approach relies on the overall value of the enterprise, an indicator that can potentially integrate the interests of all stakeholders. According to Kharin and Gareev (2014), this indicator reproduces an expanded interpretation of the concept of “company value”. It measures the utility of an industrial enterprise from the perspective of all stakeholders. It results from the synergistic unity of the entire set of resources and benefits associated with its activities, having both economic and non-economic nature.

The authors of another sufficiently promising model of financial management of stakeholders, Vashakmadze et al. (2013), find its application for mergers and acquisitions. At the same time, this model can be used to assess the synergy effect from the interaction of different groups and individual stakeholders. To identify the factors and catalysts for the growth of enterprise value, these scientists suggest using the Sun Cube model, which allows focusing on the key performance indicators of managing different stakeholder groups. In this approach, as Tkachenko (2017) rightly points out, three groups of stakeholders are distinguished: the first and the second groups are represented by the key stakeholders that have or may have a direct impact on the cash flows of the enterprise, the third group includes the so-called “remote” stakeholders that indirectly influence the functioning of its business activities. The amount of each stakeholder’s contribution to the enterprise is determined based on ranking and is considered a tool for increasing the value of the business, which is the most useful for the stakeholder and does not worsen its position.

2. RESULTS

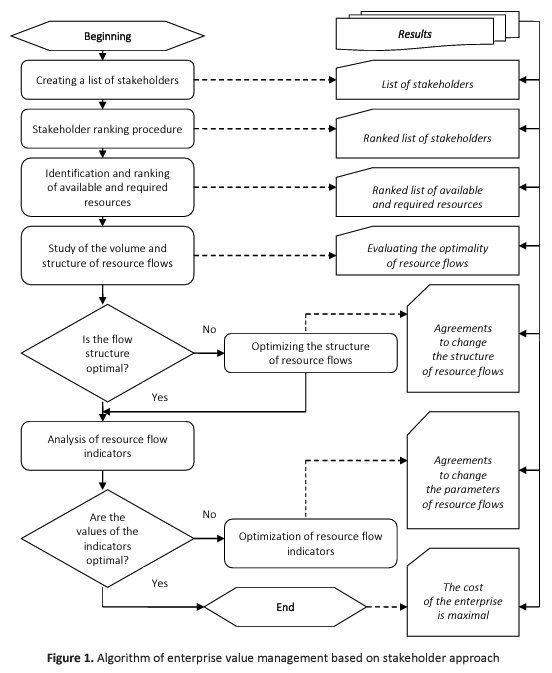

Effective implementation of the task of managing relationships with its stakeholders in an industrial enterprise can only be achieved with several managerial innovations, new practices, processes, and procedures of strategic and operational management, the action of which is aimed at improving the production and commercial activities of the enterprise, including accounting for the network nature of modern business (Prokhorov, 2011). This task can be accomplished using a certain industrial enterprise value management algorithm based on the theory of stakeholder approach, presented in Figure 1.

This algorithm includes several actions of the enterprise to achieve the maximum of its value, which is possible to obtain with the simultaneous satisfaction of the needs of both the enterprise and its stakeholders. The practical use of the algorithm of enterprise value management based on the stakeholder approach (Figure 1) involves the implementation of several interrelated stages, the basis of which is proposed to be the procedure for identifying key stakeholders, on which the success of the production and commercial activities of the enterprise depends to the greatest extent.

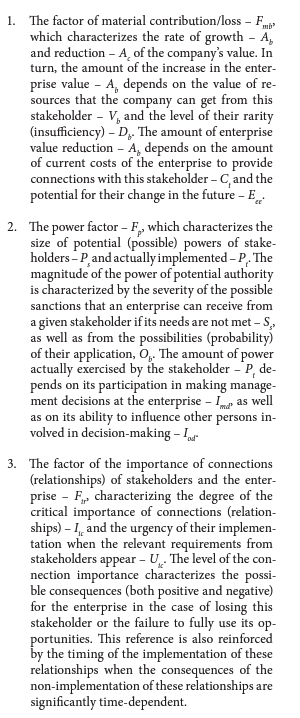

The first stage of this algorithm identifies, specifies, and ranks the stakeholders of the enterprise, determines the suppliers of critical resources, the most influential business participants, and economically attractive partners. As a result, managers come to an understanding of the real environment of the enterprise, which has a direct impact on the value of the business. For example, the influence of shareholders depends on the price of their equity, the influence of creditors - on the price of borrowed capital, the influence of consumers - on sales volume, the influence of suppliers - on the cost of production, the influence of personnel - on labor productivity, the influence of social groups - on the market value of company shares, etc.

Identification and specification of the circle of stakeholders and working with them is an important tool that allows increasing business reputation and capitalization of the enterprise to establish effective and balanced relations with all stakeholders. At the beginning of work at this stage, it is necessary to find out the presence/absence of a stakeholder management system at the enterprise, and if there is stakeholder relations management at the enterprise, then it is necessary to establish what is the purpose of this management and what level of development it is at. Then groups of people capable of influencing the business or a particular enterprise project are identified, and a detailed list of stakeholders for the planning period is compiled. Particular attention is paid to identifying the presence of negative or positive influence of stakeholders on the activities of the enterprise in the operational and strategic sections. Additional information is collected, based on which stakeholders are grouped (using the method of Mitchell (2003) or another stakeholder typology model), and a list of stakeholders is generated.

One of the leading industrial enterprises of Ukraine - Public Joint-Stock Company Kharkiv Tractor Plant - was defined as the object of the study. The circle of the most influential (key) stakeholders of PJSC Kharkiv Tractor Plant was investigated. As a result of the analysis of the primary data obtained at the enterprise, as well as qualifying interviews, a sufficiently reasonable conclusion was made that the following groups of stakeholders are the most significant for this enterprise: consumers, personnel, shareholders, suppliers, top management, authorities (state), credit and financial institutions, social groups. To a greater or lesser extent, each of these stakeholders can influence the indicator of increasing or decreasing the value of the enterprise (Figure 2) and thus provide themselves with the appropriate value rank.

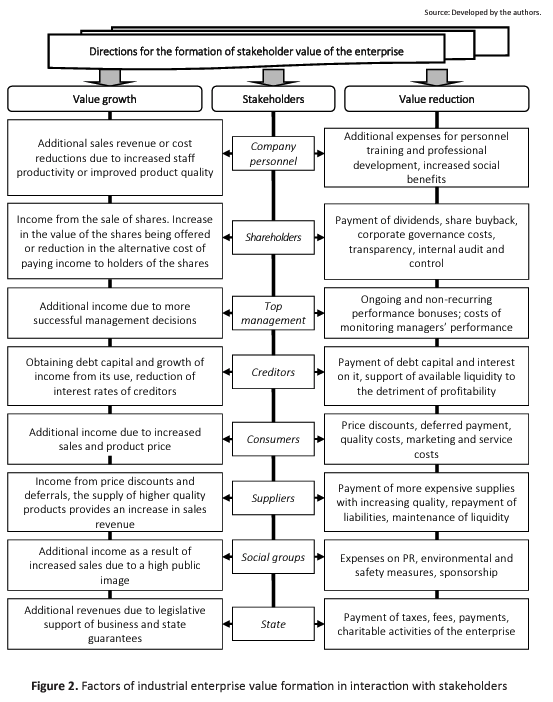

The ranking of stakeholder groups is recommended using the hierarchy analysis method, adapted for multifactor quantitative stakeholder ranking using the analytical hierarchy scheme. Decomposition of the criteria of influence of a particular stakeholder into contribution, power, and importance factors, and then into pairs of criteria connected by matrix logic, provide relative ease and validity of pairwise comparisons and therefore allow calculating the priorities of various business stakeholders.

To realize this task, the three most important factors were identified in the relationship between stakeholders and the enterprise:

The structure of the value approach to the ranking of stakeholders of an industrial enterprise based on the method of hierarchy analysis by the most significant features is presented in Figure 3.

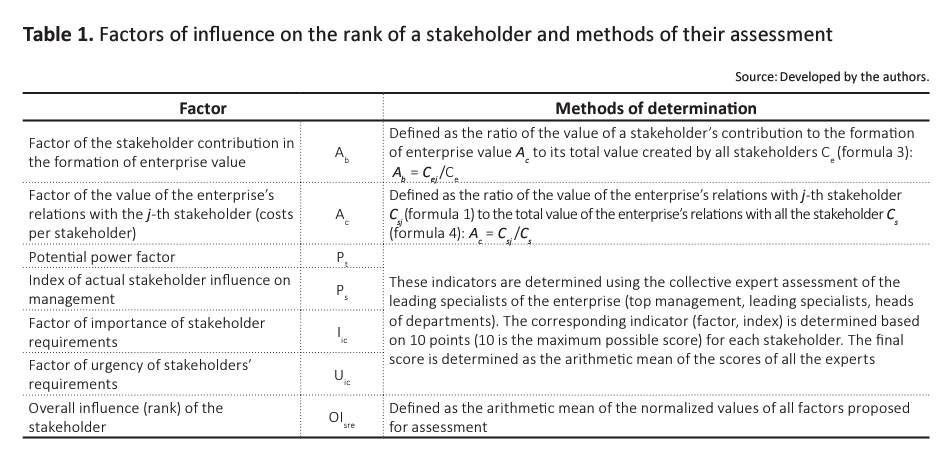

Research and ranking of stakeholder groups for PJSC KhTP with the help of hierarchy analysis (Figure 3) with the help of hierarchy analysis was carried out using an expert-analytical method, according to which part of the necessary indicators selected for stakeholder ranking was obtained by analytical calculations using the results of the enterprise operation, and another part - using the method of expert assessment. Table 1 presents all the factors used to assess the stakeholder ranking and the methodological approach to their determination.

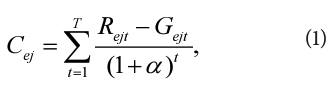

The practice of using the above mechanism of determining the influence factors on the stakeholder rank (Table 1) based on the value approach requires the development of some tools to determine, first, the share of enterprise value provided by relations with one or another j-th stakeholder Cej and, second, the determination of the share j-th stakeholder value provided by its relations with this enterprise Csj.

Based on the proposals of Bigge and Schaltegger (2000), as a universal indicator, which can assess the created values of the enterprise and its stakeholders, it is necessary to use cash flows, which accompany a wide range of relationships of the enterprise with different kinds of stakeholders. Since the nature of relations between stakeholders is re- source-based, it is recommended to determine the amount of cash flows using the supplied resource volume and the indicator of its profitability. Based on this, the value of the enterprise, provided by the connections with one or another stakeholder, will be determined as follows:

where Cej - the share of the enterprise’s value, provided by connections with the j-th stakeholder; Rejt - the value of resources received by the enterprise from the j-th stakeholder; Gejt- the value of resources transferred by the enterprise to thej-th stakeholder; T - time period for which the calculation is made; a - discount rate.

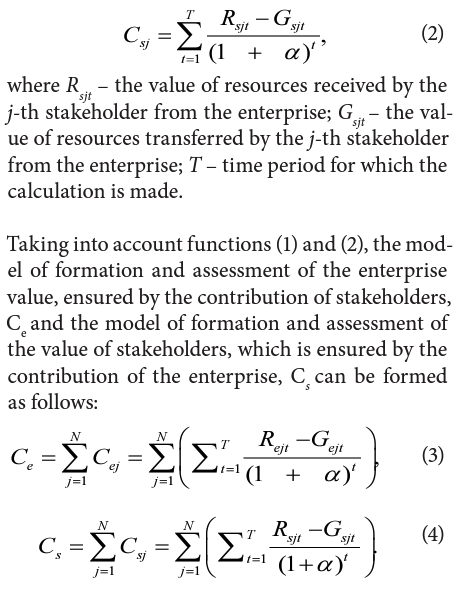

Similarly, one can determine the share of the value of the corresponding stakeholder Csj, which is ensured by its connections with this enterprise: where R - the value of resources received by the j-th stakeholder from the enterprise; 6 - the value of resources transferred by the j-th stakeholder from the enterprise; T - time period for which the calculation is made.

It should be noted that although the models are based on the ideas set forth by Figge and Schaltegger (2000), they, to a certain extent, expand and improve the original provisions and allow to remove important limitations of their concept. First, in addition to the value of the enterprise, they explicitly define the value benefits of the stakeholders. Second, they reveal a list of the main controlling factors: the volume of resources supplied and consumed by the parties, their relative values, the structure of resource flows, etc. Thus, it provides a better opportunity for their application and increases the effectiveness of the management of relations with the stakeholders of the enterprise.

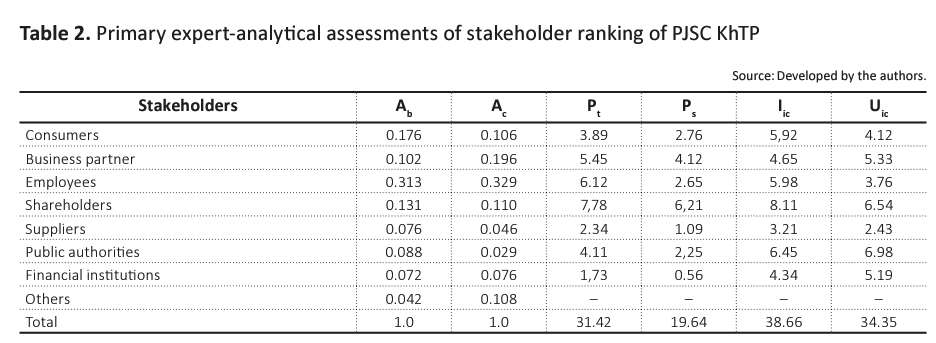

Taking into account the recommendations of Table 1 and formulas (1-4), the initial data for the ranking of stakeholders of the industrial enterprise were obtained. The data are presented in Table 2.

For further calculations, the data presented in Table 2 were normalized in a certain way. The task of indicators normalization is the transition to such a scale of measurements, when “the best” value of the indicator corresponds to the value of 1, and “the worst” - to the value of 0. From the viewpoint of mathematics, this is a task of normalization of variables, and from the viewpoint of statistics - transition from absolute (relative) to normalized values of indicators, which vary from 0 to a certain value and already by its value characterize the degree of approach to the optimal value, which can be interpreted in percentage (“0” corresponds to 0%, “1” - 100%) or in fractions of one.

To determine the stakeholders most relevant to the activities of this enterprise, opinions of 18 experts were taken into account, who were top-managers (Technical Director, Commercial Director, Quality Director, Chief Engineer, Head of Financial and Economic Service), chief specialists (Chief Designer, Chief Technologist, Chief Metallurgist), as well as heads of marketing, sales, and procurement departments. The expert evaluation was carried out using the ranking method, which allows selecting the most significant from the studied set of factors. This method is effectively used when necessary to arrange the objects according to any criterion, but it is unnecessary to carry out its exact measurement.

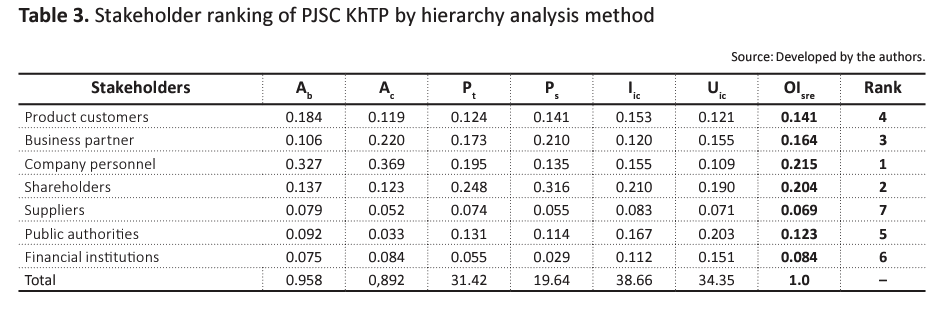

Normalized values of expert-analytical evaluation of stakeholder ranking factors of PJSC KhTP are presented in Table 3. In the same table, the calculations of the total influence (rank) of the stakeholders on the performance of the industrial enterprise OIsre were made. The calculations were made according to the recommendations given in Table 1.

The results of the calculations performed using the hierarchy analysis method adapted for this purpose showed that the most priority stake- holderbi of PJSC KhTP are personnel and shareholders (relative weight - 21.5% and 20.4%). Next in descending order of importance are business partners (16.4%), customers (14.1%), authorities (12.3%), financial institutions (8.4%), and suppliers (6.9%). Thus, the experts concluded that the establishment of favorable relations with shareholders and personnel is the primary management task of this enterprise, the implementation of which can have a significant positive impact on the value of the enterprise. It should be noted that the data obtained are not generalized. They are relevant only for PJSC KhTP and consider its current state. For other companies, the stakeholder ranking results may be far from those obtained for PJSC KhTP. Besides, even for this enterprise, priorities concerning separate stakeholders can change with time. Everything depends on the condition and results of production and commercial activity.

Despite the high degree of influence of the personnel on the results of the enterprise, a study of personnel satisfaction and analysis of other primary data was carried out. Experts found the following structure of needs of the personnel: fair wages (relative weight - 37%), stability and reliability of work (21%), convenience, safety and technical equipment of working places (15%), high level of awareness of the situation (9%), the opportunity to participate in decision-making (7%), the opportunity for professional growth and training (6%), the opportunity for career development (5%). As for the company itself, the structure of its requirements was as follows: high quality of work (31%), high productivity (29%), initiative and independence of work (17%), low level of staff turnover (10%), high discipline (8%), loyalty and support of the leadership (5%).

Analyzing the obtained results, the experts saw a fundamental consistency in the mutual requirements of the enterprise and its workforce. On the one hand, the high quality of work and initiative of the personnel seemed interrelated with the factors of workplace equipment, awareness, and participation in decision-making. On the other hand, fair wages or stability intersected with the factors of labor productivity and loyalty to the organization’s management. As a result, the experts were tasked with finding a feasible combination of these factors that would simultaneously satisfy at least some of the mutual interests.

3. DISCUSSION

The evolution of scientific views on the main goal of production and commercial activity of the industrial enterprise reproduces the presence of certain changes. By the middle of the last century, the main task of the enterprise was the maximization of profit from its production and commercial activity, but in our time, this goal has changed in a certain way. Most enterprises consider positive the volume of profits and the increase in the value of their business, which is ensured by using conceptual provisions of the theory of value-based management (VBM) in the practice of their work. The scientific discussion of scientists in this field (Post et al., 2002; Ivashkovskaya, 2019; Grushina, 2017; Lane & Devin, 2018; Moratis & Brandt, 2017; Velychko, 2020) has revealed fundamental flaws in the traditional approach to value management, among which are, first, the desire to increase the value of the enterprise in real-time, can have negative consequences in the long term; second, a certain disregard for the interests of stakeholders in favor of one’s own profits (Freeman, 2010; Post et al., 2002). As a result, it was proposed to create a more effective enterprise value management concept, which is based on the stakeholder approach (Freeman, 2010). Within the framework of this approach, the enterprise is considered a network of interconnected components, effective interaction of which provides it with mutually beneficial cooperation of the enterprise and its stakeholders. Based on these references, it is proposed to take into account in the management process the needs of the owners of the active business and the needs of its stakeholders who also make a certain contribution to the overall success and claim their share of the end result.

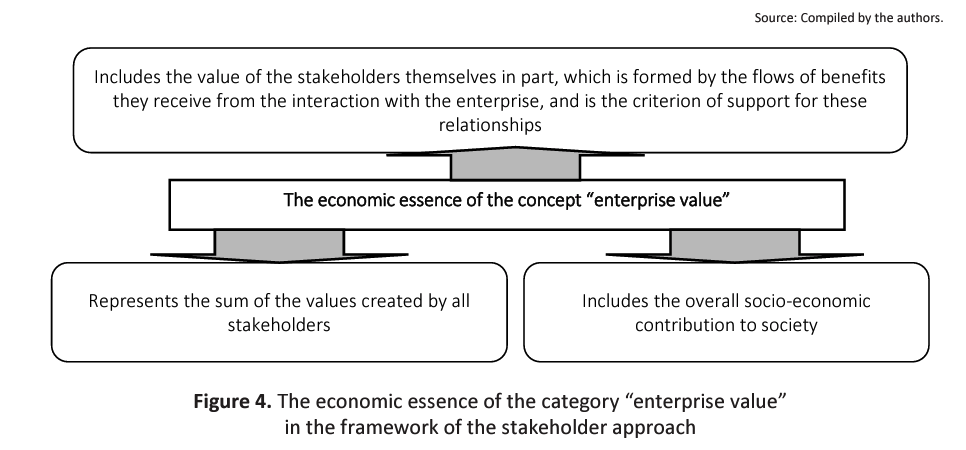

The approval of this proposal requires a more expanded interpretation of the category of “enterprise value”, which is proposed to consider taking into account several interrelated components, the essence of which is presented in Figure 4.

The components of an enterprise value shown in Figure 4 are usually not considered by traditional management tools. Top management of companies currently does not pay due attention to the interests of stakeholders, whose needs and benefits are also determined by the success of this enterprise. The results of modeling of material (resource) relations of an industrial enterprise and its main stakeholders indicate that the real (maximum) increase in the value of the enterprise is impossible without a simultaneous increase in the value of stakeholders associated with the business of this enterprise. This conclusion is also confirmed by the results of Prokhorov’s (2011) research. In many studies, according to the traditional approach to determining the value of the enterprise, the value of most stakeholders is not taken into account at all, as it is considered to be equal to zero (Charreaux & Desbrieres, 2001; Vilanova, 2007). However, the practical realization of the value approach proposals urges the management of an industrial enterprise to consider several important preconditions, the essence of which is as follows. In contrast to the previous thought, Hutsaliuk et al. (2020) propose to use the concept of broad value in an industrial enterprise, according to which the purpose of the enterprise is not so much the welfare of the owners and its increase, as the creation of opportunities for mutually beneflcial cooperation with stakeholders, which leads to sustainable economic development. The adoption of such a concept allows controlling not only the cash flows and financial results of industrial and commercial activities of an industrial enterprise, which are the basis of modern management, but also social priorities, accepted in the macro-environment norms of morality and ethics, compliance principles, peculiarities of the psychology of various stakeholders. These factors can be components of the mechanism of the created value of one or another participant of business processes.

CONCLUSION

The article investigates the formation and use of strategic tools, creating theoretical and methodological foundations to ensure the effective management of the industrial enterprise of its relations with various kinds of stakeholders based on the value approach.

The formation of stakeholder value added is the process of obtaining the financial result of an enterprise (industrial enterprise) based on the comparison of income and expenses, the result of which is a quantitative measurement of the additional financial benefits of the enterprise and its key stakeholders.

The proposed methodical approach to the formation of the overall value considers the value of the industrial enterprise and the value of its stakeholders, which together create the overall contribution of this economic entity to the achievement of society as a whole. Theoretical and methodological provisions of this approach are presented in the form of a general algorithm for managing the value of an industrial enterprise, taking into account the value contribution to the overall success of its stakeholders. This algorithm combines theoretical conclusions and practical recommendations on the sequence of actions of managers of the enterprise, aimed at increasing the overall value based on the coordinated interaction of stakeholders. In the process of research, the method of hierarchy analysis for the needs of stakeholder ranking, the method of identifying resource flows to the enterprise from stakeholders. In the opposite direction, the method of calculating the indicators to analyze the dynamics of the structure and parameters of material and financial resource flows of the enterprise and its stakeholders were improved.

This approach does not contradict traditional management practices but expands the managerial perspective and offers additional criteria and decision-making methods.

Further research can be associated with developing an effective methodology for determining the stakeholder added value, the identification of factors of its formation, the construction of a management system of enterprises by the criterion of stakeholder added value growth.

AUTHOR CONTRIBUTIONS

Conceptualization: Petro Pererva, Tetiana Kobielieva, Nadezhda Tkachova.

Data curation: Maxim Tkachov, Tetiana Diachenko.

Formal analysis: Tetiana Kobielieva, Nadezhda Tkachova.

Funding acquisition: Petro Pererva.

Investigation: Petro Pererva, Tetiana Kobielieva, Maxim Tkachov.

Methodology: Petro Pererva, Maxim Tkachov.

Project administration: Tetiana Diachenko.

Resources: Tetiana Kobielieva, Maxim Tkachov, Tetiana Diachenko.

Software: Nadezhda Tkachova, Maxim Tkachov.

Supervision: Petro Pererva, Tetiana Kobielieva.

Validation: Petro Pererva, Tetiana Kobielieva.

Visualization: Nadezhda Tkachova, Tetiana Diachenko.

Writing - original draft: Petro Pererva, Maxim Tkachov.

Writing - review & editing: Petro Pererva.

REFERENCES

- Bourne, L., & Walker, D. H. T. (2008). Project relationship management and the Stakeholder Circle. International Journal of Managing Projects in Business, 1(1), 125-130.

- Capasso, A. (2004). Stakeholder Theory and Corporate Governance: The Role of Intangible Assets. European Corporate Governance Institute Magazine, 10.

- Charreaux, G., & Desbrieres, P. (2001). Corporate Governance: Stakeholder value versus Shareholder value. Journal of Management and Governance, 5(2), 107-128.

- Coase, R. H. (1937). The nature of the firm. Economica, 4(16), 58-69.

- Donaldson, L., & Davis, J. H. (1994). Boards & Company Performance – Research Challenges the Conventional Wisdom. Corporate Governance: an International Review, 2(3), 151-160.

- Donaldson, T., & Preston, L. (1995). The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Academy of Management Review, 20(1), 65-91.

- European Commission. (2011). A renewed EU Strategy 2011–2014 for Corporate Social Responsibility (Communication from the Commission).

- Figge, F., & Schaltegger, S. (2000). What is Stakeholder Value? Developing a Catchphrase into a Benchmarking Tool. Paris: UNEP.

- Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach. Boston: Pitman Publishing.

- Freeman, R. E. (2010). Strategic Management: A Stakeholder Approach. Cambridge University Press.

- Grushina, S. V. (2017). Collaboration by Design: Stakeholder Engagement in GRI Sustainability Reporting Guidelines. Organization & Environment, 30(4), 366-385.

- Hutsaliuk, O. M., Yaroshevska, O. V., Shmatko, N. M., Kulko-Labyntseva, I. V., & Navolokina, A. S. (2020). Stakeholder approach to selecting enterprise-bank interaction strategies Problems and Perspectives in Management, 18(3), 42-55.

- Ivashkovskaya, I. V. (2019). Financial measurements of corporate strategies. A stakeholder approach. INFRA-M.

- Kelanti, M. (2016). Stakeholder analysis in software-intensive systems development (Doctoral Thesis). University of Oulu, Finland.

- Kharin, A. G., & Gareev, T. R. (2014). Stakeholder approach in the management of organizations: prospects for the application of game-theoretic models. Terra Economicus, 12(4), 105-113.

- Kocziszky, G., Pererva, P. G., Szakaly, D., & Somosi Veres, M. (2012). Technology transfer. Kharkiv-Miskolc: NTU “KhPI”.

- Kosenko, O., Cherepanova, V., Dolyna, I., Matrosova, V., & Kolotiuk, O. (2019). Evaluation of innovative technology market potential on the basis of technology audit. Innovative Marketing, 15(2), 30-41.

- Lane, A. B., & Devin, B. (2018). Operationalizing stakeholder engagement in CSR: A process approach. Corporate Social Responsibility and Environmental Management, 25(3), 267-280.

- Lankoski, L., Smith, N., & Van Wassenhove, L. (2016). Stakeholder Judgments of Value. Business Ethics Quarterly, 26(2), 227-256.

- Mitchell, R. K. (2003). Assessing stakeholder interests in prosperity and cultural well-being (Appendix A). In Masters in our own house (pp. 163-182).

- Mitchell, R. K., Agle, B., & Wood, D. (1997). Toward a Theory of Stakeholder Identification and Salience: Defining the Principle of who and What Really Counts. Academy of Management Review, 22(4).

- Moratis, L., & Brandt, S. (2017). Corporate stakeholder responsiveness? Exploring the state and quality of GRI-based stakeholder engagement disclosures of European firms. Corporate Social Responsibility and Environmental Management, 24(4), 12-325.

- Noland, J., & Phillips, R. (2010). Stakeholder engagement, discourse ethics and strategic management. International Journal of Management Reviews, 12(1), 39-49.

- Olander, S., & Landin, A. (2008). A comparative study of factors affecting the external stakeholder management process. Construction Management and Economics, 26(6), 553-561.

- Patrusheva, E. G. (2009). The Stakeholder Theory of the Corporation: Estimation of Stakeholders Contribution in the Company’s Value Growth. Bulletin of Yaroslavl University. Ser. Humanitarian sciences, 4(10), 112-117. (In Russian).

- Pererva, P. G., Kосziszky, G., Sоmоsi Vеrеs, M., & Kobielieva, T. A. (2019). Compliance prоgrаm (689 p.). Khаrkоv, Miskоlс: NTU “KhPI”. (In Russian).

- Pererva, P., Besprozvannykh, O., Tiutlikova, V., Kovalova, V., Kudina, O., & Dorokhov, O. (2019). Improvement of the Method for Selecting Innovation Projects on the Platform of Innovative Supermarket. TEM Journal, 8(2), 454-461.

- Pererva, P., Hutsan, O., Kobieliev, V., Kosenko, A., & Kuchynskyi, V. (2018). Evaluating elasticity of costs for employee motivation at the industrial enterprises. Problems and Perspectives in Management, 16(1), 124-132.

- Porter, M. E., & Kramer, M. R. (2011). Creating Shared Value: How to Reinvent Capitalism and Unleash a Wave of Innovation and Growth. Harvard Business Review.

- Post, J. E., Preston, L. E., & Sachs, S. (2002). Redefining the Corporation: Stakeholder Management and Organizational Wealth (320 p.). Stanford University Press.

- Prokhorov, K. O. (2011). Management of the company’s value on the basis of coordinated interaction of stakeholders as a management innovation. Yaroslavl: YSU. (In Russian).

- Saaty, T. L. (1980). The Analytic Hierarchy Process: Planning, Priority Setting, Resource Allocation (287 p.). London: McGraw-Hill International Book Company.

- Svendsen, A. (1998). The Stakeholder Strategy: Profiting from Collaborative Business Relationships. San Francisco, CA: Berrett Koehler Publishers.

- Tkachenko, I. N. (2017). Analysis of Concepts of Estimation of Stakeholder Contributions, or to the Question of Stakeholder’s Value. In New trends in the development of corporate governance and business (pp. 93-99). Ural State University of Economics. (In Russian).

- To Trung Thanh, Le Thanh Ha, Hoang Phuong Dung, Doan Ngoc Thang, & Tran Anh Ngoc (2020). Determinants of marketing innovation among SMEs in Vietnam: a resource-based and stakeholder perspective. Innovative Marketing, 16(4), 74-90.

- Vashakmadze, T. T., Martirosyan, E. G., & Sergova, A. A. (2013). Model upravleniya steykkholderami v sdelkakh sliyaniy i pogloshcheniy [Stakeholder management model in mergers and acquisitions transactions]. Corporate finance, 2(26), 81-90. (In Russian).

- Velychko, V. (2020). Theoretical and methodological approaches to the definition of stakeholders of construction companies: characteristics and rationale. In Conference Proceedings Tendenze attuali della moderna ricerca scientifica (pp. 37-38). Stuttart.

- Vilanova, L. (2007). Neither Shareholder nor Stakeholder Management: What Happens When Firms are Run for their Short-term Salient Stakeholder? European Management Journal, 25(2), 146-162.