Transformation stages of the Russian industrial complex in the context of economy digitization

Опубликована Ноя. 8, 2018

Последнее обновление статьи Дек. 12, 2022

Abstract

T he present article presents an approach to evaluating the transformation of the industrial complex in the context of deep penetration of digital technologies into the material sector of the economy. The authors propose a theoretical research platform based on the theory of a new industrial society, substantiate a methodology, which comprises reproduction, institutional and synergetic approaches. The study showed that the transformation of the industrial complex, caused by any factors and implemented in any conditions, is always a discrete process of qualitative changes, resulting in significant structural changes and institutional transformations. The authors proposed a methodology to define the stages of industrial complex transformation in a digital economy. T he authors’ model of the digitization process consists of five stages – primary information and communication digitization; electronic data exchange with external partners; use of specialized software; electronic data exchange with external partners. Within this framework, an empirical analysis was carried out to determine the digitization level of the industrial complex of Russia that implies a sufficiently high degree of primary computerization, the involvement of the industrial enterprises in the “digital” communication with counterparties and the dynamic software development. The study shows that the process of digital transformation of the Russian industry is still in its formative stages

Ключевые слова

Digitization stages, Industry 4.0, new industrialization, industry transformation

INTRODUCTION

Today, the formation of a digital economy is not only a matter of national security, but also groundwork to improve competitiveness. Although the share of the digital economy in the Gross Domestic Product of Russia is currently not as crucial as the traditional material production sectors, its growth rate already exceeds the growth rate of Gross Domestic Product (GDP). At the same time, the technological development of industrial production and structural distortions towards the low-tech and environmentally disadvantaged sectors allows to perceive the predictions of a comprehensive digitization of industry in the nearest future very carefully. At the same time, the prospects for digitalization are estimated as very significant.

According to McKinsey Company, the digitization of the Russian economy will increase the country’s GDP by 4.1-8.9 trillion rubles by 2025, which will account for 19-34% of the total expected GDP growth (Aptekman et al., 2017). According to the Ministry of Industry and Trade of the Russian Federation, the systemic transition to a digital model of development will ensure labor productivity growth in manufacturing by more than 30% by 2024, while the contribution of the sectors based on advanced production technologies in the country’s

GDP will increase by 15% (Press Release of the Meeting of the Presidential Council, 2017). Even if the real figures will be more modest, this trend will allow speaking about a complete consistent digitization of the Russian industry.

The real or the “analog” economy is the economic activity of the company, as well as a combination of relations in the system of production, distribution, exchange, and consumption. Therefore, there is no independent digital economy, only a digital segment of the material economy - a virtual environment complementing the reality. The digital economy is an infrastructural superstructure above the material sector of the economy, designed to increase the efficiency of interaction between the participants of production and sale of industrial products, as well as the relationship of individuals in the process of the economic activity. Accordingly, if the introduction of digital technologies will be implemented without a commensurate development of the material production, the overall economic impact of digitization is not going to make the critical difference: the country will continue to “digitize” the technological underdevelopment.

Therefore, the purpose of this study is to justify the methodological approach to the evaluation of the process of transformation of the industrial complex in the context of deep penetration of digital technologies into the real sector. The digital transformation of such a poly-structural system with a lot of vertical and horizontal connections as the Russian industrial complex is quite a long process involving several successive stages. It is essential to systematize these stages, to substantiate their qualitative and quantitative characteristics, to define patterns and conditions for transition between the stages. Defining the stages of the real sector digital transformation will allow not only assessing the current stage, but also predicting the prospects for industry digitization.

1. THEORETICAL BASIS

Methodological approach and the methodological tools for assessing the level of industry digitization can only be considered on a combined theoretical platform, incorporating four fundamental approaches: neo-industrial, reproduction, transactional and network. Every approach determines its own set of research methods.

The new industrialization is associated with the birth of the Fourth Global Industrial Revolution, which creates an innovative industrial and economic model using hybrid NBIC technologies, among which information technologies are integrating technologies. New industrialization involves the inevitable transition from simple digitization (the Third Industrial Revolution) to innovations based on hybrid convergent technologies (the Fourth Industrial Revolution), which will result in a fully automated digital production with the prospect of integration into a global industrial network of things and services. Therefore, in the recent decade, economists, sociologists, and political scientists have indicated that the idea of post-industrial society was if not utopian (Heilbroner, 1974; Webster, 2006; Kumar, 1978, 1996; Frankel, 1987), then, in any case, premature (Bell & Inozemtsev, 2007; Bodrunov, 2014, 2016; Inozemtsev, 2014). No economy can grow without a material segment, and in this connection, the re-industrialization of the economy becomes the main course of economic development in most countries (Bodrunov, 2014). The industry is changing qualitatively, and it goes beyond the formation of a high-tech sector of the economy and the technological inclusion (involvement) of traditional industries in this development vector (Romanova et al., 2016, 2017). The key indicators and differences of new industrial production will be, first, its modularity as opposed to “monolithic” production capacities in a single enterprise; second, the distribution of production as opposed to the existing hierarchical approach; third, wireless communication between sensors, actuating mechanisms and assembly units.

The reproduction approach was considered in the traditions of the world classical economics (Desai, 2018), each of which proposed their model-theoretic vision of the reproduction processes, their structure, dynamics, and institutional conditions.

At the same time, the authors are more interested in the analysis and theoretical understanding of characteristics of the new paradigm of the theory of reproductive process in the context of digital society development, analyzed in the works by Babaev (2012), Buzgalin and Kolganov (2007), Valtukh (2009), Maevskii (2012), Nizhegorodtsev (2002), Ryazanov (2013), Khubiev (2012) and others. The influence of digitization on the nature of economic dynamics predetermines the transformation of industrial cycles and the increasing role of long waves in modern industrial production processes associated with a change of the role of information in the system of production factors (Shatrevich & Strautmane, 2015).

According to the transactional approach formulated by Coase (2007) and developed by Arrow (1973), Williamson (1979, 2007) and others, it is especially difficult to achieve effective transactions in an emerging transaction space, since the number of interested parties is large, while negotiation with all the interested parties is too expensive (Kuzmin, 2017). The use of digital technologies and the principles of network interaction contributes to a significant reduction in transaction costs. Less effort is needed for digital transactions to collect and process information, select counterparties, prepare transaction decisions, make payments, and provide legal support. Information and communication technologies create new factors of value-added growth, which are associated, on the one hand, with the ability to reduce production costs by increasing the information processing speed and decision-making, and on the other hand, with the growth of product competitiveness resulting from a quicker development period for innovative products.

The network approach is perhaps the primary one in justifying the effects of industry digitization process. The first studies describing the network approach were made by Granovetter (1992, 2006) and White (2002) who published several works on the network organization of the market. By the mid-1990s, the network approach has become a key approach in economic science due to the works by Bert (1995), Powell and Brantley (1992), Grabber and Stark (1997). Today, the specificity of this approach lies in the fact that the main attention is paid not to the agents, but to their relations (Prause & Atari, 2017). The structure and nature of network connections are the key properties of their constituent elements (Bolychev, 2014, Weiber, 2005, Popov, 2016). From a theoretical point of view, the fundamental patterns described in Moore’s law and Metcalf’s law can be distinguished as catalysts for the process of digital technology distribution in industrial markets. Moore’s law describes one of the most powerful economic factors in the modern digital world - the decreasing cost of digital communications (Moore, 1965). Metcalf’s law explains that the development of the Internet leads not only to the expanding communication capabilities of individual users, but also to the growth of its social value. This law reflects the relationship between the number of network users and its value (Dyatlov, 2014). Metcalf’s law states that the value of a network is proportional to the square of the number of network members. It should also be noted that the increasing size of the network results in a growing value of each member. The relationship between the size of the network and its network-wide value for an individual company is transformed into a performance improvement of its operations, a more efficient use of the resources and implementation of a more effective communication policy.

Within the global information economy, there is a variety of information network effects. In fact, these are synergistic network effects, expressed in various forms. Varian (2005) has revealed that the simultaneous effect of Moore’s law, the Internet, computer involvement and new financial instruments has resulted in a period of “rapid innovations”. According to Weiber, in contrast to the traditional economy, the network economy is subject to the law of diminishing marginal profitability. Direct network effects and positive feedback provide the increasing marginal profitability (Weiber, 2003). At the same time, the scale of the processes of integration and networking of developers, producers, sellers and consumers of intellectual information goods and services, along with the processes of value-adding to the network effects, is increasingly growing.

The transformation of the industrial complex, caused by any factors and implemented in any conditions, is always a discrete process of qualitative changes, which leads to significant structural

changes and institutional transformations. The allocation of stages of the industrial complex transformation arose from the need for a gradual assessment of irreversible qualitative changes that form a transition to a fundamentally new state with higher socio-economic indicators of efficiency towards the formation of a future industry model. In this interpretation, the term “transformation” does not include the entire preparation process of this transition, which, as is well known, is divided into different periods of quantitative and qualitative transformations. In this case, the transformation is only the result of previous transformations, the moment of transformation, not the process of system transformation.

2. MATERIALS AND METHODS

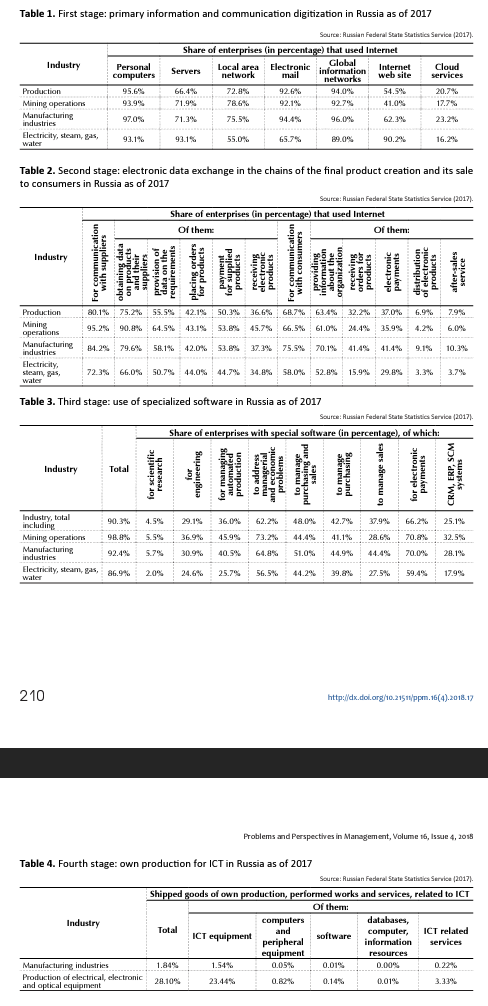

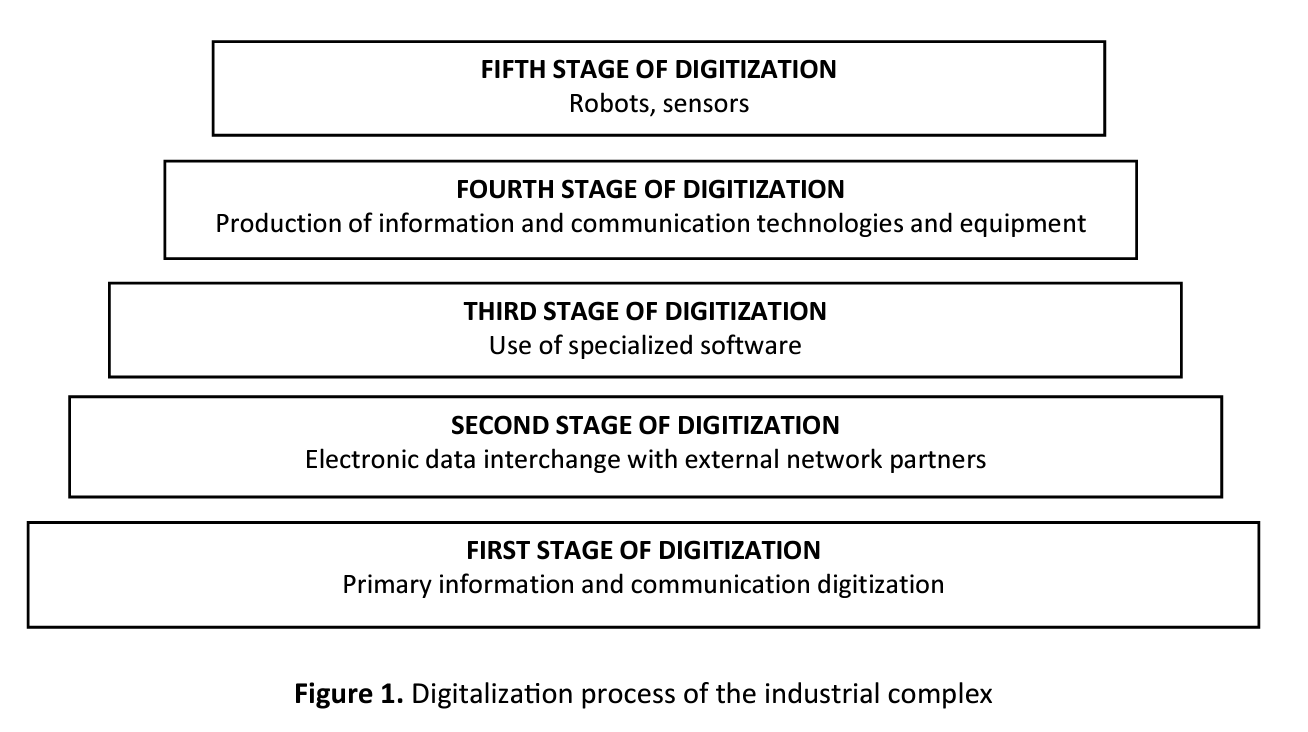

The authors propose to single out the stages of the industrial complex transformation, representing them in the form of a pyramid, each of which having a certain “digitization gene” (Figure 1). A set of indicators to assess each stage is formed considering the global reports and digitization indices - the world’s digital competitiveness rating (IMD World Competitiveness Center, 2017), the composite index of readiness for the global era (Baller et al., 2016) and the composite index of digital evolution (Chakravorti & Chaturvedi, 2017).

The first stage of digitization is primary information and communication digitization. This stage involves computerization in the broad terms, large-scale introduction of electronic computers in different industries. The use of computers in various areas increases the efficiency of accumulation and processing of information, becoming the factor of improving the efficiency of managerial interactions and the reliability of feasibility studies of industrial development projects (Ragulina et al., 2018; Samasonok et al., 2016).

The indicators characterizing this stage include the shares of enterprises using personal computers, servers, local area networks, electronic mail, global information networks, Internet websites, cloud services, allocated technical means for mobile access to the Internet for the general industry and the individual industries.

The second stage of digitization is electronic data interchange (EDI) with external network partners. In conjunction with the Internet, EDI enables electronic transactions in real time and thereby significantly accelerates the processes of interaction between suppliers, contractors, cooperators, and consumers.

The indicators characterizing this stage include the share of enterprises using EDI in exchange formats; the percentage of the purchases (sales) cost of goods per orders transferred (received) by the enterprise via the Internet and other global information networks; percentage of enterprises using the Internet to communicate with counterparties; share of enterprises using the Internet to communicate with consumers.

The third stage of digitization is the use of specialized software. This step is closely related to the widespread introduction of automation, using the self-regulating hardware and mathematical methods in order to liberate humans from the processes of preparation, conversion, transmission and the use of materials, supplies or information, or to reduce the degree of human involvement or the labor intensity of these operations.

The indicators characterizing the third stage of digital industry transformation include the share of industrial enterprises using specialized software for scientific research, design, management of automated production and/or individual processes, CRM, ERP, SCM systems; solutions for organizational, managerial and economic tasks; share of the CNC equipment and the machining centers in the machinery park.

The fourth stage of digitization is the production of information and communication technologies and equipment. This stage brings the industry close to the “digital” status and describes the transition from the simple use of information and communication technologies results to their production, large-scale development of the internal market for electronic components and equipment, development of import substitution software. This is the А-type production. The production of electrical and electronic and optical equipment is the industry responsible for the fourth stage of industry digitization. In this regard, the key indicators characterizing this stage are the share of goods (works, services) of own production related to the ICT in the total shipment volume, both in general and by type.

The fifth stage is the production and use of robots and sensors (industrial Internet). The key message is that enterprises’ production capacity will interact with the produced goods and, during the production process, adapt to the new consumer demands. In such a world, the role of intelligent machines and devices will increase - they will be involved in the production and management of services and goods. They will also network together, independently analyze data and make the decisions. Production machines, assembly lines (conveyors) and the entire factories and plants will be merged into one network (Chernyak, 2012; Ashton, 2009).

3. RESULTS

The results of federal statistical observation in Russia according to the form “Data on the use of information and communication technologies and the production of computers, software and services in these areas”, presented in the context of economic activities (industry characteristics), served as the information base for the study.

Let us consider the stages of transformation of the industrial complex of Russia in the context of digitization in accordance with the method proposed above (the pyramid of digitization process).

Primary information and communication digitalization (the first step of the “pyramid of digitization”)

The Russian economy in general and the industry in particular demonstrate quite a high level of primary computerization (Table 1, see Appendix). More than 90% of industrial enterprises use personal computers, electronic mail, global information networks. Manufacturing enterprises show values close to 100%. At the same time, one cannot claim that the high initial computerization provides high rates of primary informatization. Only 66.4% of industrial enterprises use servers, 54.5% of enterprises have websites on the Internet, and only every fifth company uses cloud technologies.

Electronic data exchange with the external network partners (second stage of the “digitization pyramid”)

Industrial enterprises are sufficiently integrated into the information flows with partners, yet there is an interesting paradox. Industrial enterprises are more intensively involved in “digital” exchange with suppliers rather than with consumers, which once again confirms the fact that industrial enterprises are separated from sales

markets. Slightly more than 80% of enterprises use global networks to communicate with their suppliers, while only 68.7% of the enterprises use the Internet for communication with customers (Table 2, see Appendix).

Most of the “digital” exchange is information exchange on products and needs. Thus, using the global networks, 75.2% of enterprises receive information from suppliers, 63.4% - provide information about products to their customers, and 55.5% - provide information about their needs. At the same time, the share of enterprises placing electronic orders for the supply of raw materials and components via the Internet accounts for only 42.1%, while the share of enterprises receiving orders via the Internet is even less - 32.2%.

Among industries, enterprises of light industry, woodworking, as well as machine-building enterprises producing vehicles and equipment, are the least integrated into electronic data interchange with external suppliers. The percentage of enterprises included in the “digital” exchange with consumers in the machine-building industry (except for the electronics segment) and the timber industry complex is low.

The use of specialized software (the third step of the “digitization pyramid”)

While the first two stages demonstrate a sufficiently high level of enterprises’ readiness for network digital interrelations, the third stage figures are much worse (see Table 3, see Appendix). Despite the fact that the share of industrial enterprises using specialized software is high (90.3%), the content of the used software demonstrates a clear bias towards specialized programs for solving managerial and economic objectives (accounting, legal bases, etc.), while the share of industrial enterprises using software for research (4.5%) and engineering (29.1%) remains catastrophically low.

Only one of four enterprises (25.1%) uses ERP, SCM and CRM systems, specialized software for managing automated production - one of three enterprises (36%), software for managing purchases and sales of goods (works, services) - every second enterprise (48%). Among industries, the expected leaders in the use of specialized software (in addition to accounting programs and legal frameworks) are high-tech enterprises of electrical and chemical industries. Among them, the share of enterprises that have implemented ERP and CRM systems accounts for 35-40%, and the share of enterprises using software for research - 12-18%. The number of enterprises using design software is quite high in the production of electrical and electronic equipment (57%) and in metallurgical production (53.7%). The use of specialized software in the machine-building complex is significantly less in the segment of transport engineering industry, and in general, in the light, food and woodworking industries.

Own production of information and communication equipment (fourth stage of the “digitization pyramid”)

The development level and the volume of own production of the enterprises in the electrical industry is an indicator of the overall technological level of development in any country. In Russia, the industry for production of electrical equipment, electronic and optical equipment accounts for less than 5% of the industrial output, with an insignificant change in its share from 3.3% in 2005 to 4.4% at present (Russian Federal State Statistics Service, n.d.). At the same time, the Russian market of electronics and components is consolidated with a dominant position of foreign manufacturers; its imports account for 73%.

The volume of export of electrical industry goods related to ICT is 28.1%, which in terms of the total industrial production shows a frightening value of 1.8% (Table 4, see Appendix). The main reason for the low growth rate of production of microelectronic components in Russia is the technological lag. Moreover, the manufacturers of microelectronic components are very dependent on government orders in the domestic sales market (substantial amount is occupied by the military and special-purpose products).

Production and use of robots and sensors (industrial Internet) (fifth stage of the “digitization pyramid”)

The potential of robots use is much higher than the current extent of their use. In Russia, there are still very few robots designed for private and com-

mercial mass consumer. According to the National Association of Robotics Market Participants, the average annual sales of industrial robots in Russia accounts for 500-600 units, which is about 0.25% of the global market volume.

In general, the density of robotization in Russia (the use of industrial robots - programmed manipulators for 10 thousand workers) is almost 70 times lower. However, if one considers the segment of industrial robots in the context of the manipulator, they are 10 times “popular” than service robots. This market in Russia is quite mature, it is 20 years old and it grows at an average of 11% per year - better than the steel industry and the automotive industry. However, the existing positive dynamics is insufficient for the “fifth stage” of digitization.

The situation is similar with sensors. Workshop and test equipment is an important material component of the technological level. Increasing demand for sensors and analytical equipment is happening faster than the overall growth of industries. This is due to the fact that aside from creating new production facilities, there is an active modernization of equipment installed 20 or 30 years ago and thus inadequate in the modern requirements. One can now observe a gradual formation of the environment in which the machines begin to understand their surroundings and communicate with each other using the Internet protocol, bypassing the operators, independently solving issues of increasing efficiency or, otherwise, preventing emergency situations.

Thus, the introduction of new management systems and automation equipment in Russia is at the early stage of development. Now the main objective for Russia is not to teach robots to work autonomously, but to help people and machines to interact. One can safely say that the potential for improving efficiency through the introduction of elements of the industrial Internet is high.

CONCLUSION

The study enabled a systematic assessment of the digital transformation of the Russian industry. Firstly, the authors managed to demonstrate that the high values of primary and secondary digitalization indicators point to the “digitalization”, but not the digitation of the industrial complex. The availability of computers, servers, local area networks, the use of global networks, and the commercial use of the Internet indicate a fairly high level of enterprise readiness for network digital relationships. Secondly, the authors revealed that with a high proportion of industrial enterprises using special software, the proportion of enterprises using specialized software for research and development remains catastrophically low. Thirdly, the study showed that the fourth and fifth stages of digitalization are currently represented in an extremely fragmented manner. Production of electrical equipment and electrical engineering accounts for less than 5% in the volume of industrial production with insignificant growth dynamics, while the robotics industry is also in its formative stage. The main causes of low growth rates in the production of microelectronic components and robots in Russia are the technological lag amidst a significant share of imports.

Furthermore, the analysis of digitization processes showed a significant differentiation of various industries, both in terms of primary digitization (personal computer equipment, use of servers, local networks, websites, etc.) and digitization of relationships with suppliers and customers (submitting requests and providing information, electronic payment of orders via the Internet, placing orders for cooperative supplies, after-sales service, etc.).

The article also justifies that the degree of high-tech industries is determined primarily by the level of digitization, automation, and networking. The level of digital economy development directly correlates with the level of material sphere development: development of the digital segment is most appropriate only in a high-tech segment of the industrial complex. Nevertheless, one can safely conclude that the reverse is also true: the more production processes are digitized and virtualized, the greater the development of the analog types of services and production.

ACKNOWLEDGEMENT

This article was prepared with the financial support of the RFBR (Russian Foundation for Basic Research) grant No. 18-010-01156 “Modeling the technological transformation of the industrial complex of Russia in the context of economy digitization”.

REFERENCES

- Aptekman, A., Kalabin, V., Klintsov, V. et al. (2017). Digital Russia: A New Reality: Report by McKinsey Company. Moscow: McKinsey.

- Arrow, K. J. (1973). Information and Economic Behavior. Stockholm: Federation of Swedish Industries.

- Ashton, K. (2009, June). That “Internet of Things” Thing. In the Real World, Things Matter More Than Ideas. RFID Journal, 123-128.

- Babaev, B. D. (Ed.). (2012). Multilevel Social Reproduction: Questions of Theory and Practice: Collection of Scientific Essays. Ivanovo: Ivanovo State University.

- Baller, S., Dutta, S., & Lanvin, B. (Eds.). (2016). The Global Information Technology Report – 2016.

- Bell, D., & Inozemtsev, V. L. (2007). The Age of Disunity: Reflections on the World of the 21st Century. Moscow: Svobodnaya mysl. Tsentr issledovanii postindustrialnogo obshchestva.

- Bodrunov, S. D. (2014). Re-industrialization. Round-Table Talk in the Free Economic Society of Russia. The World of New Economy, 1, 11-17.

- Bodrunov, S. D. (2016). The Coming of New Industrial Society: Reloaded. Moscow: Institute of New Industrial Development named after S.Y. Vitte.

- Bolychev, O. N. (2014). The Concept of the Network in the System of Basic Concepts of Regional Economic and Geographical Research. Baltic Region, 4(22), 79-93.

- Burt, R. S. (1995). Structural Holes: The Social Structure of Competition. Cambridge: Harvard University Press.

- Buzgalin, A. V., & Kolganov, A. I. (2007). Global Capital (2nd ed.). Moscow: Editorial URSS.

- Chakravorti, B., & Chaturvedi, R. S. (2017). The Digital Planet-2017.

- Chernyak, L. (2012). The Internet of Things Platform. Open Systems. DBMS, 7, 98-104.

- Coase, R. (2007). The Firm, the Market and the Law: Collection of Articles. Moscow: Novoe izdatelstvo.

- Desai, M. (2018) Simple and Extended Reproduction. In The New Palgrave Dictionary of Economics. London: Palgrave Macmillan.

- Dyatlov, S. A. (2014). Network Effects and Increasing Returns in the Information and Innovation Economy. Bulletin of Saint Petersburg State University of Economy, 2(86), 7-11.

- Frankel, B. (1987). The Post- Industrial Utopians. Universiy of Wisconsin Press.

- Grabher, G., Stark, D. (1997). Organizing Diversity: Evolutionary Theory, Network Analysis, and the Postsocialist Transformations. In G. Grabher & D. Stark (Eds.), Restructuring Networks: Legacies, Linkages, and Localities in Postsocialism (pp. 1–32). London and New York: Oxford University Press.

- Granovetter, M. (1992). Networks and Organizations: Structure, Form, and Action. Harvard Business School.

- Granovetter, M. (2006). Business Groups and Social Organizations. In N. Smelser & R. Swedberg (Eds.) The Handbook of Economic Sociology (2nd ed.). Princeton: Princeton University Press.

- Heilbroner, R. (1974). An Inquiry into the Human Prospect (2nd ed.). W.W. Norton.

- IMD World Competitiveness Center (2017). The World Digital Competitiveness Rankings – 2017.

- Inozemtsev, V. L. (2014). Postindustrial/Industrial Dichotomy. World of Changes, 1, 144-147.

- Khubiev, K. A. (Ed.). (2012). Modern Nature of Cyclical Reproduction. Moscow: MGU, TEIS.

- Konyukhovskaya, A., Tsyplenkov, V., & Nedelsky, V. (2016). Industrial Robotics in Russia and the World. Moscow: The National Association of the Robotics Market Participants.

- Kumar, K. (1978). Prophecy and Progress: The Sociology of Industrial and Post-Industrial Society. Alein Lane.

- Kumar, K. (1996). From Post- Industrial to Post-Modern Society: New Theories of the Contemporary World. Oxford, UK; Cambridge, USA: Blackwell.

- Kuzmin, E. A. (2017). A Study on the Problems of the Structure of Transaction Costs. Problems and Perspectives in Management, 15(3), 224-233.

- Maevskii, V. I. (2012). On the Switching Reproduction Mode. TERRA ECONOMICUS, X(1), 38-49.

- Moore, G. E. (1965). Cramming More Components onto Integrated Circuits. Electronics, 38(8), 114-117.

- National Association of the Robotics Market Participants (2016). Analytical Research: World Robotics Market.

- Nizhegorodtsev, R. M. (2002). Information Economy. Book 1. Information Universe: Information Bases of Economic Growth. Moscow: Kostroma.

- Popov, E. V. (2016). Networks. Ekaterinburg: AMB.

- Powell, W., & Brantley, P. (1992). Competitive Co-Operation in Biotechnology: Learning Through Networks? In N. Nohria & R. Eccles (Eds.), Networks and Organizations: Structure, Form, and Action (pp. 78-94). Boston, MA: Harvard Business School Press.

- Prause, G., & Atari, S. (2017). On Sustainable Production Networks for Industry 4.0. Entrepreneurship and Sustainability Issues, 4(4), 421-431.

- Ministry of Industry and Trade of Russia (2017). Press Release of the Meeting of the Presidential Council on Strategic Development and Priority Projects of July 5, 2017.

- Ragulina, Y. V., Semenova, E. I., Zueva, I. A., Kletskova, E. V., & Belkina, E. N. (2018). Perspectives of Solving the Problems of Regional Development with the Help of New Internet Technologies. Entrepreneurship and Sustainability Issues, 5(4), 890-898.

- Romanova, O. A., Akberdina, V. V., & Bukhvalov, N. Y. (2016). Common Values in Modeling the Modern Techno-Economic Paradigm. Economic and Social Changes: Facts, Trends, Forecast, 3(45), 173-190.

- Romanova, O. A., Korovin, G. B., & Kuzmin, E. A. (2017). Analysis of the Development Prospects for the High-Tech Sector of the Economy in the Context of New Industrialization. Espacios, 38(59), 25.

- Russian Federal State Statistics Service (2017). Data on the Use of Information and Communication Technologies and the Production of Computers, Software and Services in These Areas.

- Ryazanov, V. (2013). Time for a New Industrialization: Russian Prospects. Economist, 8, 24-36.

- Samašonok, K., Išoraitė, M., & Leškienė-Hussey, B. (2016). The Internet Entrepreneurship: Opportunities and Problems. Entrepreneurship and Sustainability Issues, 3(4), 329-349.

- Shatrevich, V., & Strautmane, V. (2015). Industrialisation Factors in Post-Industrial Society, Entrepreneurship and Sustainability, 3(2), 157-172.

- Valtukh, K. K. (2009). Reproduction and Pricing. Theory. System Statistics Studies. Moscow: Yanus-K.

- Varian, K. R. (2005). Economic Theory of Information Technology. In L. G. Melnik (Ed.), Socio-Economic Problems of the Information Society. Sumy: ITD “Universitetskaya kniga”.

- Webster, F. (2006). Theories of Information Society. Routledge.

- Weiber, R. (2003). Empirical Laws of the Network Economy. Theoretical and Practical Aspects of Management, 4, 45-57.

- Weiber, R. (2005). Laws of the Network Economy. Problems of Forecasting, 4, 86-91.

- White, H.C. (2002). Markets from Networks: Socioeconomic Models of Production. Princeton: Princeton University Press.

- Williamson, O. (1979). Transaction-Cost Economics: The Governance of Contractual Relations. Journal of Law Economics, XXII(2), 223-261.

- Williamson, O. E. (2007). The Economic Institutions of Capitalism. Firms, Markets, Relational Contracting. In C. Boersch & R. Elschen (Eds.), Das Summa Summarum des Management. Gabler.

APENDIX