The impact of information and communication technology (ICT) on commercial bank performance: evidence from South Africa

Опубликована Сен. 18, 2014

Последнее обновление статьи Дек. 5, 2022

Abstract

This paper contributes to the ongoing debate regarding the contribution of Information and Communication Technology (ICT) to firm’s performance. As the ICT impact on bank performance is beyond the scope pf most similar studies, this study further investigates the impact of Information and Communication Technology Cost Efficiency (ICTCE) on the performance of banks as well. The study assessed the impact of ICT on the performance of South African banking industry using annual data over the period 1990-2012 published by Bankscope – World banking information source. Data analysis is carried out in a dynamic panel environment using the orthogonal transformation approach. The robustness of the results was affirmed by residual cointegration regression analysis using both Pedroni and Kao methods. The findings of the study indicated that the use of ICT increases return on capital employed as well as return on assets of the South African banking industry. The study discovers that more of the contribution to performance comes from information and communication technology cost efficiency compared to investment in information and communication technology. The study recommends that banks emphasize policies that will enhance proper utilization of existing ICT equipment rather than additional investments

Ключевые слова

Return on capital employed, bank, return on assets, information and communication technology cost efficiency, performance, South Africa

Introduction

There is no doubt that commercial banks play an important role in the economic development of any nation. The need for efficiency and effectiveness in the running of the banks as leading players in the cohort of financial services providers of a nation thus cannot be overemphasized. Recent advances in the technological world giving birth to the emergence of Information and Communication Technology (ICT) have led to remarkable changes in the ways businesses are run in contemporary times.

Considering the dynamism in the drivers of economies across the globe, it is notable that the world has moved currently to a knowledge-based economy of which the ICT has become one of the principal driving forces (San-Jose, Ituralde, and Maseda, 2009). The effects of ICT are seen in the improvements in productivity and economic growth at the level of the firm (Brynjolfsson and Hitt, 1996) and the economy overall (OECD, 2004; Oliner and Sichel, 2000; Stiroh, 2002).

ICT refers to a wide range of computerized technologies that enables communication and the electronic capturing, processing, and transmission of information. These technologies include products and services such as desktop computers, laptops, hand-held devices, wired or wireless intranet, business productivity software, data storage and security, network security etc. (Ashrafi and Murtaza, 2008). With the use of ICT, businesses can interact more efficiently, and it enables businesses to be digitally networked (Buhalis, 2003). With the use of ICT, the time constraint, and distance barrier to accessing relevant information is eliminated or drastically reduced hence it improves coordination of activities within organizational boundaries (Spanos et al., 2001).

Considering the nature of its operations and services, the banking sector is relatively amenable to innovative technologies (Polasik and Wisniewski, 2008). Delgado and Nieto (2004) argue that the development of electronic communication channels has had a profound impact on the banking industry. The electronic distribution of retail banking services for example, emerged with the introduction of automated teller machines (ATMs), a technology pioneered by Barclays Bank in 1967 (Batiz-Lazo and Wood, 2002; Batiz-Lazo and Wardley, 2007).

Subsequently, the twentieth century have witnessed the rise in popularity of personal computers and the launch of a new electronic banking channel called PC banking which was offered first to the customers of Citibank in 1984 (Shapiro, 1999). As the Internet becomes popularized in the 90s, there was a marked proliferation of electronic banking (Polasik and Wisniewski, 2008).

Evidence from previous empirical studies indicate that ICT has a positive impact on banks’ financial performance, owing to the multitude of benefits it offers its users and providers alike. Such studies include those conducted in the USA (DeYoung, 2005; DeYoung et al., 2007), Spain (Hernando and Nieto, 2007). The decision to provide online services is currently perceived as vital for customer retention and maintaining competitive advantage (DeYoung and Duffy, 2002).

The most important improvement arising from the use of ICT in the enhancement of operations and activities of commercial banks hinged on the reduction in overhead expenses. Specifically, the costs related to the maintenance of physical branches, marketing and labor can be cut appreciably (Hemado and Nieto, 2007). In their study of Turkish online banking, Polatoglu and Ekin (2001) reported that the average cost of online transactions was $0.10 compared to $2.10 for a teller. Similarly, based on a sample of Polish banks, Polasik (2006) estimated that the cost of Internet and in-branch bank transfers was €0.08 and €0.46 respectively.

The benefits of application of ICT in the enhancement of banking services is not only limited to cost reduction benefits alone, the innovation is found also to have significant contribution to giving access to customers residing outside the branch network and create opportunities for effective cross - selling, amongst others (Sachan and Ali, 2006).

The relationship between investment in ICT and business performance has received massive attention from researchers in various countries over the years. The results from these studies have been markedly conflicting. Thus, whether the level of investment in ICT actually brings real benefits to the banks or not is still a matter of concern in academic circles. This is because while some posit a positive relationship between ICT investment and performance (Becchetti, Bedoya & Paganetto, 2003; Hernando and Nunez, 2004; Indjikian and Siegel, 2005) some argue to the contrary (OECD, 2004; McKinsey, 2004). Hence, there is a need for further studies to contribute to the ongoing debate on the nature of the relationship between ICT investment and bank performance.

Furthermore, while most of the previous studies have focused on the relationship between ICT investment and bank performance, none of the studies have attempted to investigate the relationship between ICT cost efficiency and bank performance - an approach that is completely different from investigating the same relationship from ICT investment perspective. This new dimension to the investigation is to extend the investigation further for robustness, complementary or confirmatory purposes.

Moreover, investigation of the relationship between ICT investment and ICT cost efficiency and bank performance has never been carried out in South Africa from available stock of documented studies in this area. These are the contributions that the study stands to make to the body of existing knowledge on the subject matter. To achieve these objectives, the study examines the relationship between ICT investments, ICT cost efficiency and bank performance in South Africa.

We regard the understanding of this subject as an attempt to pave the way for further investigations by both industry and academia to enable researchers, investors, management and ICT managers to be able to deal with and justify the resources spent on acquisition of technology, as well as plan, implement and evaluate efficiency and effectiveness of ICT strategies.

The rest of the paper is structured as follows: Section 1 deals with theoretical background and hypotheses. Section 2 describes the methodology adopted for the study. Section 3 presents the results of the study, whilst the final section covers the conclusion and recommendations of the study.

1. Literature review

1.1. Theoretical background and hypotheses. ICT is a combination of information technology and communication technology. It merges computing with high speed communication link carrying data, sound and video (Alabi, 2005). It deals with the collection, storage, manipulation and transfer of information using electronic means. Communication technology refers to the physical devices and software that link various computer hardware components and transfer data from one physical location to another (Laudon, 2001).

The relationship between ICT and performance has attracted the attention of researchers in recent times. Several studies have been conducted to investigate this relationship. It is however worthy of note that there has never been a consensus on whether ICT contribute to organizational performance or not.

Different theoretical approaches have been adopted by researchers to investigate the nature of the relationship between ICT and firm performance over the years. Transaction cost theory (Williamson, 1975); Value chain analysis (Porter, 1985); and Resource-based view which is a more recent theory that is widely embraced by many such as Bharadwaj (2000), Wade and Hulland (2004), Kim et al. (2006), Rai et al. (2006), Wu et al. (2006), Ordanini and Rubera (2010), Lee, Koo and Nam (2010), Fahy and Hooley (2011); Rashidirad, Syed and Sol- tani (2012).

The resource-based view (RBV) of the firm posits that firms compete on the basis of “unique” corporate resources that are considered to be valuable, rare, difficult to either imitate or substituted by other resources. The theory stemmed from the area of strategic management research and widely attracts attention as a suitable tool to examine the value delivered by IT resources (Melville, 2004; Wade & Holland, 2004).

The resource-based theory rationalizes firm’s superior performance to organizational resources and capabilities. The resource-based view of the firm links the performance of organizations to resources and skills that are firm specific, rare and difficult to imitate or substitute (Barney, 1991). Hence, it is a theory that is mostly preferred by researchers in this area of study. This paper consequently is based on this theory. The paper highlights the importance of ICT investment (ICTINV) and ICT cost efficiency (ICTCE) as pivotal determinants of commercial banks capability and examines the relationship between ICTCE, ICTINV, and performance of commercial banks in South Africa.

1.2. Resource-based view of ICT and firm performance. Extant literature reveals that firms do compete on the basis of unique corporate resources that are valuable, rare, difficult to imitate, and non-substitutable by other resources (Barney, 1991; Comer, 1991; Schulze, 1992). RBV operates under the assumptions that the resources needed to conceive, choose and implement strategies are heterogeneously distributed across firms whose differences remain stable over time (Barney, 1991).

Resources can be broadly defined to include: assets, knowledge, capabilities, and organizational processes (Bharadwaj, 2000). Grant (1991) however distinguishes between resources and capabilities and further classifies resources into tangible, intangible and personnel-based resources. The tangible resources include: financial capital and physical assets of the firm such as plant, equipment, and stocks of raw materials whereas, intangible resources include reputation, brand image, and product quality while personnelbased resources include technical know-how, and other knowledge assets including dimensions such as organizational culture, employee training, loyalty, etc.

The ability of a firm to create competitive advantage depends on its capability, which is the extent to which the organization can assemble, integrate, and deploy valued resources to create or sustain competitive advantage in the industry to which it belongs (Russo and Touts, 1997).

1.3. ICT investment (ICTINV). The information and communication technology infrastructure of an organization comprises of its physical ICT asset stock. The business functionality of an organization depends on the reach and range of the stock of this resource. It is a major business resource and a key source for attaining long-term competitive position (McKenney, 1995). Barney (1991) contended however, that physical assets, in and of themselves, can only serve as sources of competitive advantage if and only if they outperform equivalent assets of competitors.

This notion arises out of the fact that considering the fact that physical asset can be easily duplicated by competitors and as such may not be regarded as sources of competitive advantage in themselves. They can however, become sources of competitive advantage when their synergetic benefits are exploited to enhance the organizational competitiveness.

The relationship between ICT investment and firm performance has been studied by several researchers over the years. Bitler (2001) investigated the relationship between information and communication technology investments and small firms’ performance. His study reveals that there was a significant performance difference between firms that adopt ICT and those that do not adopt the technology.

In their study conducted to examine technological progress and its effects in the banking industry using relevant data, Berger et al. (2003) find that ICT investment leads to improvements in costs. The improvement was hinged on productivity increase in form of improved “back-office” technologies which is in form of organization- related benefits such as reduced costs of operation as well as improved “front-office” technologies which is in form of benefits to customers such as improved quality and variety of banking services.

Evidence from other empirical studies conducted on the contribution of automated teller machines (ATMs) to banks’ profitability reveal that investment in ATMs increases both the volume and value of deposit accounts, reduces banking transaction costs, reduces the number of staff and the number of branches and consequently improves banks’ profitability (Abdullah, 1985; Katagiri, 1989; and Shawkey, 1995).

In his study on analysis of the values of return on asset (ROA) arising from ICT investment in the US, Kozak (2005) finds that the value of the return on asset for the US banking sector has increased by 51% thereby suggesting that improvement in ICT investment, associated with extensive office networks and range of offered services have helped to generate additional revenues for banks thus pointing to the fact that a huge number of diverse operations require higher ICT investment.

Furthermore, Osei and Harvey (2011) in their study (covering fifteen banks over a period of ten years) on investments in ICT and bank business performance in Ghana find that investment in ICT tend to increase profitability (ROA and ROE) for high ICT level banks than for lower ICT level banks.

Considering the foregoing and from literature, we thus hypothesize that:

H1: There is a positively significant relationship between ICT investment and performance of banks in South Africa

1.4. ICT cost efficiency (ICTCE). ICT use has continued to permeate virtually every organization and is being applied in a wide range of areas. It has provided new ways to store, process, distribute, and exchange information within companies and with customers (Kollberg and Dreyer, 2006). The recent ICT developments have enormous implications for the operations, structure and strategy of organizations (Buhalis, 2003).

Application of ICT to enhance the performance of organizations of all types around the world do not only help to cut costs and improve efficiency but also for providing better customer services (Ashrafi and Murtaza). Spanos et al. (2002) posit that ICT has the ability to enhance, coordinate and control the operations of many organizations and can also increase the use of management systems.

Conversely, Ongori and Migiro (2010) maintain that the impact of globalization has obliged many organizations to adopt ICT in order to survive in the present competitive era especially in the area of competing with large organizations. Bresnahan et al. (2002) argue that durable productivity gains have been achieved in enterprises that use ICT. This is traceable to the fact that ICT helps in the effective low of data in organizations thereby assisting organizations to obtain information at any given time, which in turns helps these organizations to reach their desired target. Furthermore, ICT brings about changes in businesses and helps to create competitive advantage hence, organizations of all types tend to adopt the innovation (Apulo and Latham, 2011).

However, on the basis of the socio-technical view (STV) of an organization, it is instructive to note that the ICT acquisition is in itself not a guarantee of improved organizational performance. The principle of STV holds that for there to be an optimal benefit from acquisition of ICT, its potential must be optimally harnessed in the interest of achievement of organizational objective (Trist, 1990).

The theory posits that technology rarely possesses the capacity to advance the overall performance of an organization. The import of this view lies in its recognition of interdependencies between technological and social factors as well as sequential impacts of technology. The theory argues that organizations are neither exclusively social nor predominantly technical systems but are rather best conceived as sociotechnical systems.

The two dimensions of an organization though are independent but yet are correlative thus; organizational activities and outcomes are optimal when both social and technical elements of an organization are strong (Trist, 1990). This theory (STV) complements and builds on the RBV which holds that a firm’s combination of technological and human inputs are socially complex, therefore organizational routines can be difficult to imitate, forming the basis of competitive advantage and superior performance (Barney, 1991; and Barney and Ketchen, 2001).

The STV principle underscores the argument in favor of ICT cost efficiency being a necessary condition for the attainment of optimality in the deployment of ICT to enhance organizational performance. Cost efficiency in the spirit of strategic cost management is concerned with strategies aimed at obtaining maximum possible revenue with minimum possible inputs (Fethi & Pasiouras, 2010; Casu & Giradone, 2004, 2006). Furthermore, Casu (2004), and Tanna (2009) posit that efficiency can be measured in terms of observable increase in efficiency owing to technical progress which is a function of technological change.

Hence, from literature and theory, we thus hypothesize that:

H2: There is a significant relationship between ICT cost efficiency and performance of commercial banks in South Africa.

1.5. Bank performance. Measurement of bank performance is a complicated activity. Researchers have used different approaches to assess the performance of banks in various countries at various times. However some of the most reliable yardsticks that have been used in the past to measure bank

performance are the return of assets (ROA) and return on equity (ROE).

Ahmed and Khababa (1999) in their assessment of bank performance in Saudi Arabia employed three ratios as measures of performance - ROE, ROA and percentage change in earnings per share. Sinkey (1992) posits that return on asset is a comprehensive measure of overall bank performance from an accounting perspective being a primary indicator of managerial efficiency as it indicates how capable the management of a bank has been in converting the bank’s asset into net earnings.

Rose and Hudgins (2006) however maintain that ROE is a good measure of accounting profitability from the shareholders perspective. It approximates the net benefit that the stockholders have received from investing their capital.

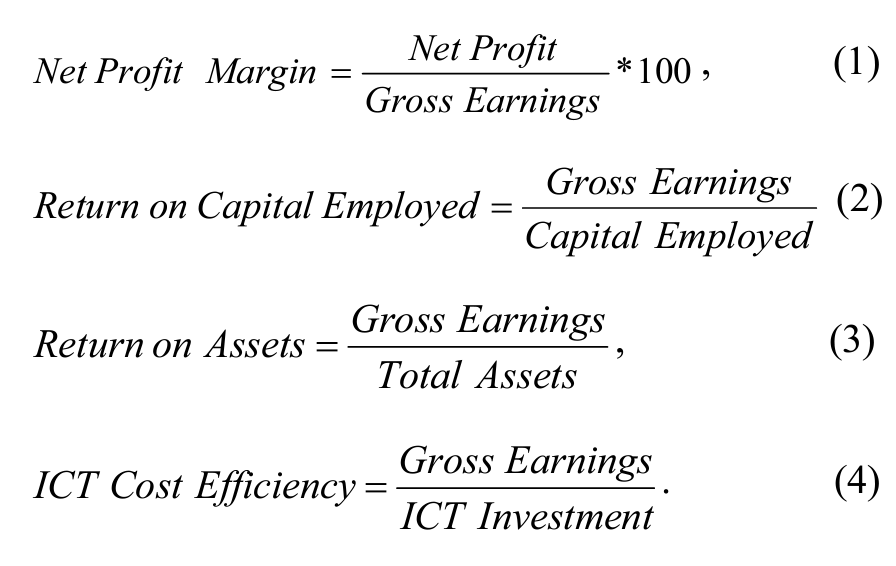

Akintoye (2004) also identified three ratios that can be used as proxies for organizational performance namely: Net Profit Margin (NPMARG), Return on Capital Employed (ROCE), and Return on Assets (ROA). Arising from the principles of both the resource-based view and sociotechnical view is another measure of organizational performance, which depends on the basis of the organization’s information and communication technology cost efficiency (ICTCE). This is a measure of ICT capability of an organization - the extent to which the organization can assemble, integrate, and deploy valued resources to create or sustain competitive advantage in the industry to which it belongs (Russo and Pouts, 1997). These variables of organizational performance in their nominal formats are as expressed in their respective ratios as follows:

2. Methodology

2.1. Data and sources. In this study, secondary data in the form of panels have been used. The data were collected from the annual reports and accounts of the banks covered by the study as published by bankscope - World banking information source. The period covered by the banks’ financial reports is from 1990 to 2012. The data retrieved from the bankscope report comprises of net profit (NP), total asset (TA), information and communication technology investment (ICTINV), gross earnings (GE), and capital employed (GE).

Performance indicators (financial ratios) of interest to the study (dependent variables) based on literature are: net profit margin (NPMARG), return on capital employed (ROCE), return on assets (ROA). These indicators of performance are computed (as shown above) from the financial report of the banks to suit the objectives of the study.

It must be pointed out that the dataset contained some missing units. To eliminate the missing units, especially in the dependent variables, five-year moving average backward was adopted. We are cautious to adopt the same process for all the dataset in order to maintain some originality of data distribution.

- Sample size and sampling technique. According to Asika (2006), it is practically impossible to take a complete and comprehensive study of the entire population going by nature and pattern of distribution. Hence a representative sample is used from the population of study. Since the interest of this study is to investigate the impact of information and communication technology on performance of banks in South Africa, the four biggest banks were thus purposively selected for the study being the banks that controlled the lion share of the South African banking population. These banks according to PWC South Africa (2013) are Absa, FirstRand, Nedbank and Standard Bank.

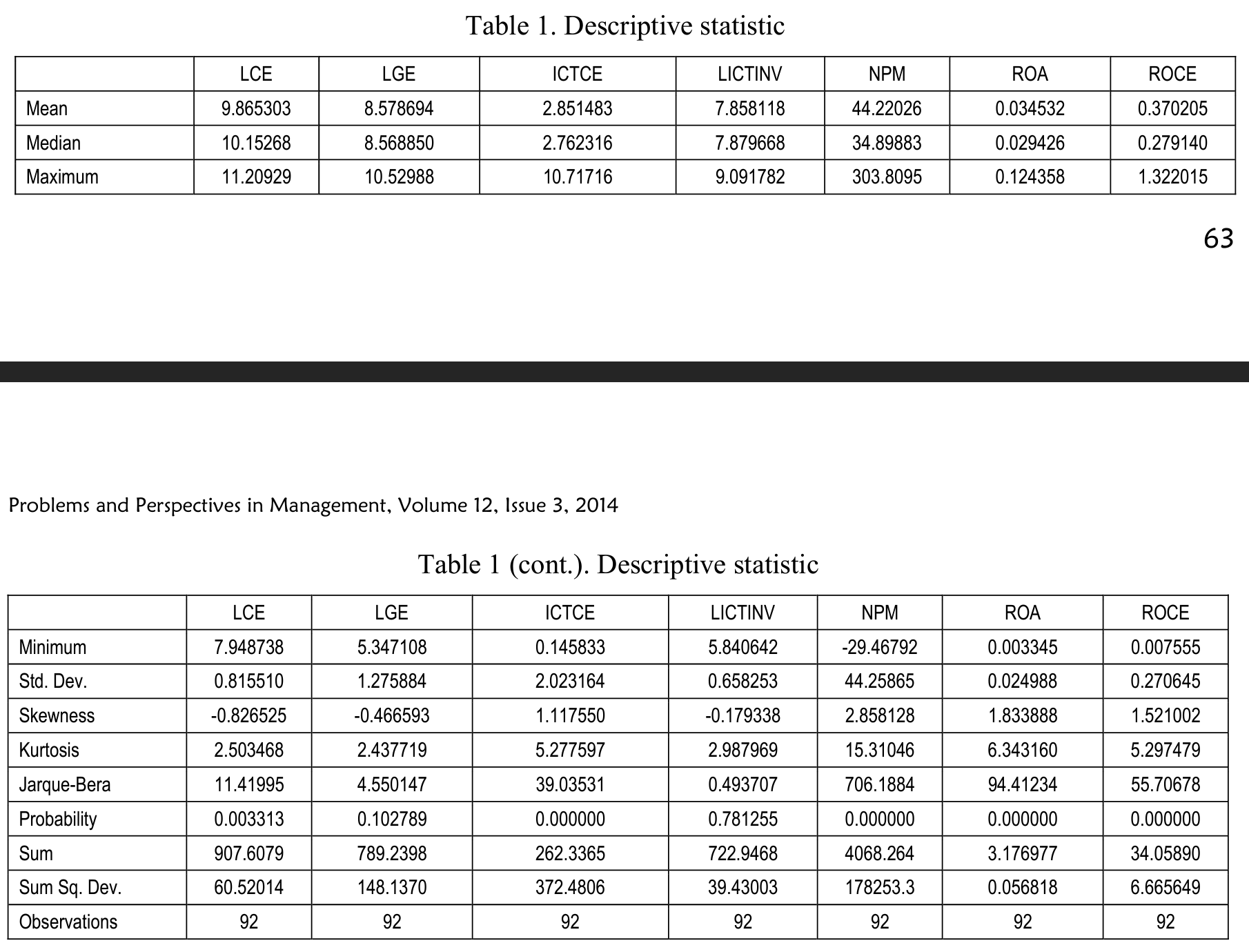

- Data analysis. The estimation began with descriptive statistics. This was done to establish that the dataset was normally distributed. In statistical analysis, it is a necessary condition that dataset must pass the tests of normal distribution otherwise, they are to be transformed so as to make them conform to the basic assumptions of Ordinary Least Squares (OLS) regression. The result of the descriptive statistics is presented in Table 1.

The data being highly skewed and with high Jarque- Bera statistic was transformed to conform to the normality assumption preparatory to rigorous parametric analysis. This was done by logging some of the variables after which a new descriptive statistics as shown in Table 1 (above) indicate appreciable conformance with normality requirements judging from the statistically high significant p-values recorded for most of the variables. The moderate values exhibited by Jarque-Bera, the low Skewness coupled with the Kurtosis statistics that line within normal range, all point to unskewness of the distribution. In this wise, the null hypothesis of normal distribution can therefore not be rejected.

Generalized Method of Moment. This analysis helps us to define the type and level of significance of the relationship that exist between the dependent variables and the independent variables. To control for the effect of the disturbance terms, the Hausman regression was conducted which affirm the statistical significance of both period and fixed effects. Further, the data analysis was also carried out in a dynamic panel environment using the orthogonal transformation approach. This is to further ascertain the specific time periods during which the relationship under investigation was significant. The table of the regression results is as shown below.

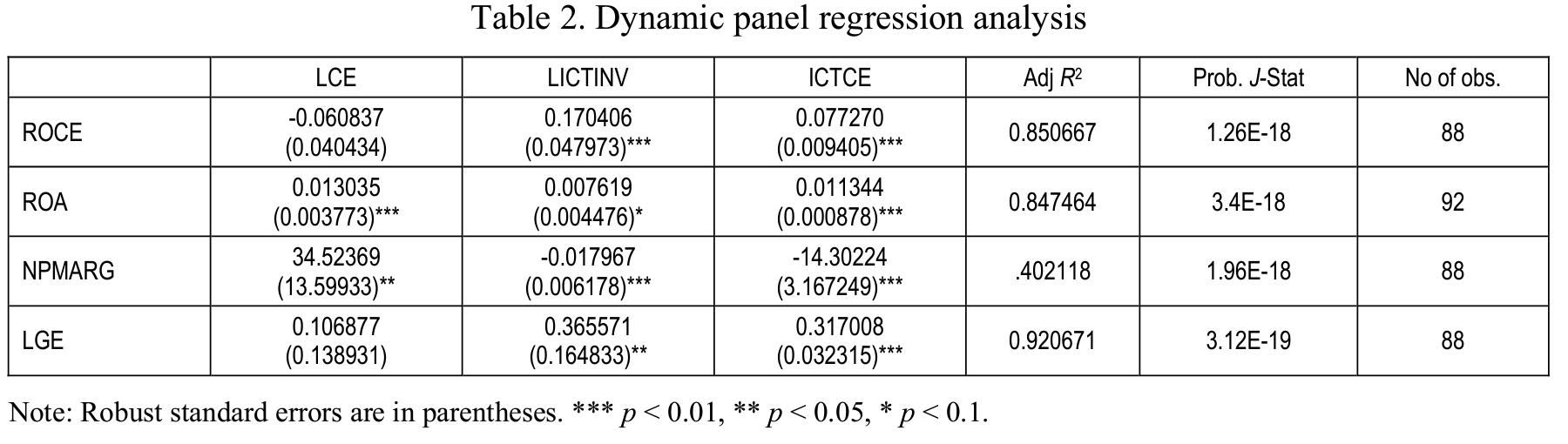

The interpretation of Table 2 begins with the test of goodness of fit. From the table, the three indicators of the goodness of fit (the Adjusted R-squared (with the singular exception of the value for NPMARG), the Probability p-statistics, and the p-value of the regression) all allude to the goodness of fit of the model.

More specifically, the p-value for the four dependent variables with respect to ICTCE in the models are all statistically significant at 99% confidence levels. Looking at each of the variables, it is observable that the effect of ICT investment, ICT cost efficiency and log of capital employed is significant on all the dependent variables to varying degree of significance with the exception of the log of capital employed on ROCE and log of gross earnings. With these results, we do not reject the two hypotheses of this study.

Furthermore, the implication of this result is that the effect of ICTINV and ICTCE is more on the explained variables (ROA, ROCE, LGE and NPMARG) than the effect of capital employed on the same response variables. Hence, policies aimed at ensuring optimality of bank performance should be directed more at ICTCE and ICTINV than on Capital employed. However, it is notable from the table that the highest priority should be placed on ICTCE, followed by ICTINV in that order.

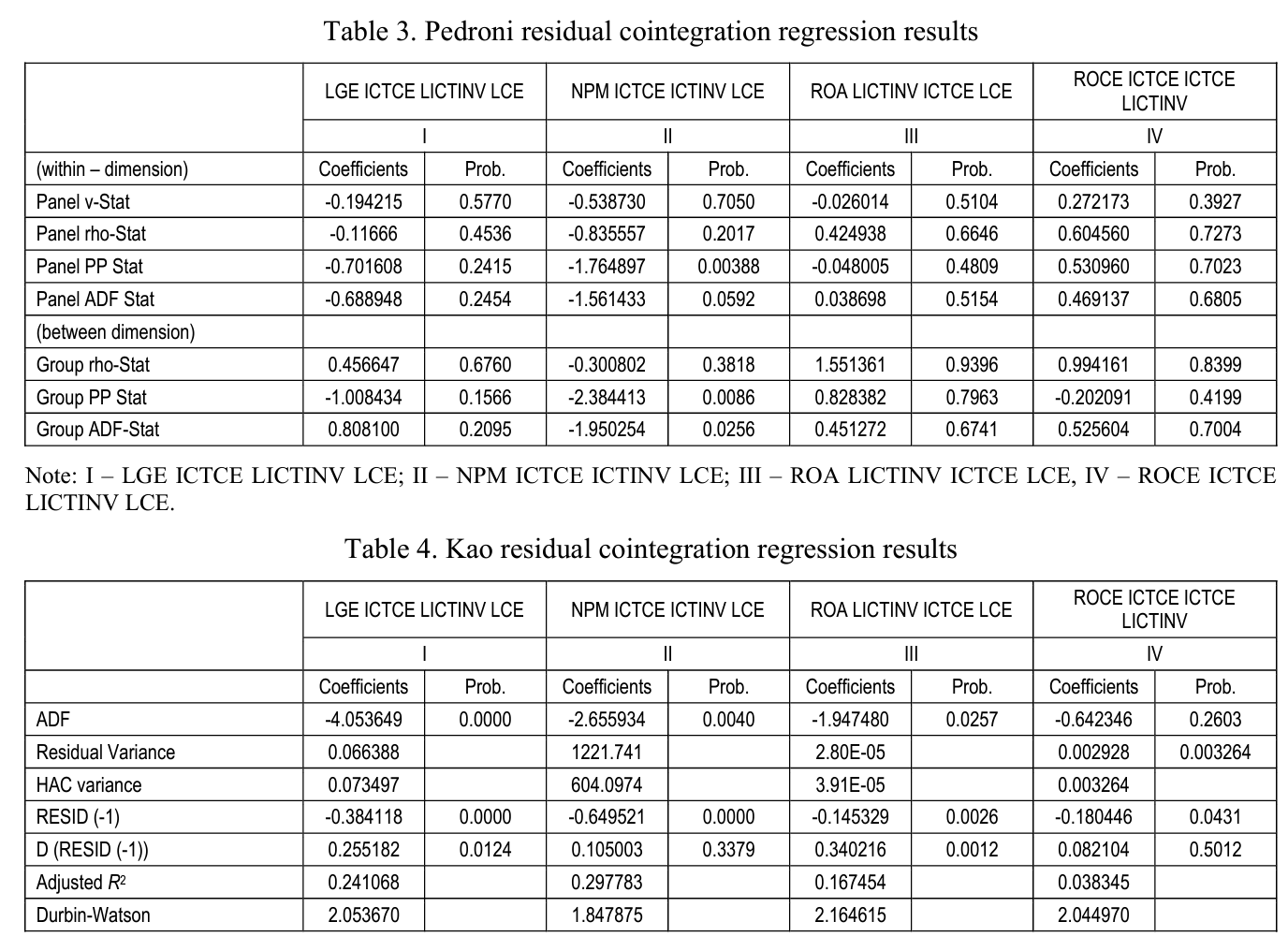

Having established the presence of a significant and positive relationship between ICTINV and ICTCE, the next investigation that was carried out is to ascertain whether or not the relationship between the regressors and the response variables has a long run dimension. This was done by the conduct of the residual cointegration regression tests using two approaches - Pedroni residual cointegration regression and Kao residual cointegration regression. The results of the two residual cointegration regressions are as presented in Tables 3 and 4 below.

Having satisfied the necessary pre-condition for cointegration regression, we proceeded to carry out the residual cointegration regression using two methods namely: the Pedroni and Kao residual cointegration regression. The essence of this is to establish the truism or otherwise of presence of long run relationship within the various series of the variables under investigation. From the results of the test statistics (Panel v, Panel rho, Panel PP, Panel ADF, Group rho, Group PP, and Group ADF), it is noteworthy that most of the seven test statistics have highly insignificant p-values either at 1%, 5% or 10% significance levels for all the four series (LGE ICTCE LICTINV LCE, ROA ICTCE LICTINV LCE, ROCE ICTCE LICTINV LCE, and NPM ICTCE LICTINV LCE) which implies that the null hypothesis of no cointegration is rejected. This is an affirmation of the Pedroni residual cointegration test results.

Furthermore, the test statistics on the basis of Kao residual cointegration was also carried out for confirmatory purposes. It is interesting to note that the Kao residual cointegration test is more sensitive if compare to the Pedroni residual cointegration test. This is in view of the fact that while all the four series are cointegrated in the case of the Pedroni residual cointegration test, with Kao residual cointegration tests, only two of the four series are cointegrated at 1% significance level judging from the ADF /-statistic and their corresponding p-values leading to the rejection of the null hypothesis of no cointegration in the series (these are ROCE ICTCE LICTINV LCE and ROA ICTCE LICTINV LCE) while for the other two series i.e. LGE ICTCE LICTINV LCE and NPM ICTCE LICTINV LCE, we do not reject the null hypothesis of no cointegration. Further studies may be needful to establish this observation of Kao residual cointegration being more sensitive than Pedroni residual cointegration as found in this study.

The consistency and reconcilability of the cointegration results obtained using the two methods are indicative of the robustness of the cointegration regression results (especially for the two series: ROCE ICTCE LICTINV LCE and ROA ICTCE LICTINV LCE). This confirms the fact that the relationship between the variables in the series is not spurious. Moreover, the results further indicate that the variables in the series have a long run relationship. It is however worthy of note that the results indicated a much higher contribution to performance from ICTCE compared to that from ICTINV. This result suggests that whereas the investment in ICT is worth the while for management of banks in South Africa, emphasis should be placed on policies that will enhance proper utilization of ICT equipment rather than additional investments.

Discussion

This study analyzed the relationship between ICTINV, ICTCE and performance of banks in South Africa. The results of the analyses are presented in tables 1-4. We developed two hypotheses that have been empirically tested with data generated from Bankscope published reports on financial reports of banks from 1991 to 2012. The four biggest banks in South Africa were used in the study for better representation. The results allowed for the following conclusions to be reached.

Firstly, the results indicate that the effect of the explanatory variables (ICTINV, ICTCE, and CE) on the response variables (ROCE, ROA, NPMARG, and GE) is the most remarkable for Return on Capital Employed and Return on Asset. This result is consistent with that of Kozak (2005) who’s study on the analysis of the values of return on assets (ROA) for US banking sector increased by 51% owing to ICT investment. He argues that a huge number of operations require higher ICT investment. Similarly, Osei and Harvey (2011) in their study covering fifteen banks over a period of ten years with regard to ICT investment and Ghanaian banks’ perfor-mance reveal that investment in ICT tend to increase banks’ profitability and that high ICT level banks perform better than low ICT level banks.

Secondly, the results suggest that the contribution of ICTCE to the performance indicators is much higher than that of ICTINV. It is inferred from these results that it is not just enough to acquire ICT equipment but that is more important to ensure cost efficiency in the deployment of ICT facility to enhance performance of banks in South Africa.

The hypothesis that was advanced in support of a positive relationship between ICT investment, ICTCE and the various performance indicators was confirmed judging from the results of the dynamic panel regression (Gross Earnings with 92% explanatory power, ROCE with 85% explanatory power, and ROA with 84% explanatory power). This result is consistent with the findings of Becchetti, Bedoya & Paganetto (2003), Hernando & Nunez (2004), Bayo-Moriones & Lera-Lopez (2007) and Garces-Ayerbe (2009) which posited that a positive relationship exists between ICT investment and firm performance. This is in tandem with a priori expectation. Consequently, we do not reject either of the two hypotheses

This investigation provides empirical evidence to increase our knowledge of the relationship between ICT investment (ICTINV), ICT cost efficiency (ICTCE), and performance of South African banks. The conclusion obtained from the results show that ICT investment and ICT cost efficiency have a significant relationship with performance of banks in South Africa. It is however worthy of note from the results that the influence of ICT cost efficiency on firm performance is higher than that of ICT investment.

Conclusion

The paper concludes that the performance of banks is influenced both by ICT investment as well as ICT cost efficiency. However, it is worthy of note that the impact of ICTCE on performance of banks is more than that of ICT investment. The implication of these findings underscores the need for policy makers to emphasize policies that enhance optimal utilization of ICT resources rather than embark on additional investments.

References

- Abdullah, Z. (1985). A Critical Review of the Impact of ATMs in Malaysia, Banker’s Journal Malaysia, 28, pp. 13-16.

- Ahmed, A.M. & Khababa, N. (1999). Performance of the banking sector in Saudi Arabia, Journal of Financial Management Analysis, 12 (2), pp. 30-36.

- Akintoye, R.I. (2004). Investment Division Concept, Analysis and Management, Lagos, Glorious Hope Publishers.

- Alabi, D. (2005). Information Technology and E-Marketing: Prospects and Challenges for Marketing Practitioners in an Emerging Economy, An Unpublished Paper Delivered at the 2005 MMN Marketing Educator Conference, University of Lagos, Nigeria.

- Apulu, I. and Latham, A. (2011). Drivers for information and communication technology adoption: a case study of Nigerian small and medium sized enterprises, International Journal of Business Management, 12 (2), pp. 51-60.

- Apulu, I. & Latham, A. (2010). Benefits of information and communication technology in small and mediumsized enterprises: a case study of a Nigerian SME, Proceedings of the 15th Annual Conference on UK Academy for Information Systems (UKAIS), March 23-24, Oriel College, University of Oxford.

- Ashrafi, R. & Murtaza, M. (2008). Use and Impact of ICT on SMEs in Oman, Electronic Journal Information Systems Evaluation, 11 (3), pp. 125-138. [Online] Available: http://www.ejise.com/volume-11/volume11issue3/ashrafiAndMurtaza.pdf (October 10,2009).

- Asika, N. (2006). Research Methodology in Behavioral Sciences, First Edition. Ibadan: Longman Publishers Nig. Ltd.

- Ba'tiz-Lazo, B. and Wardley, P. (2007). Banking on change: information systems and technologies in UK high street banking 1919-1969, Financial History Review, 14 (2), pp. 177-205.

- Ba'tiz-Lazo, B. and Wood, D. (2002). Historical appraisal of information technology in commercial banking, Electronic Markets, 12 (3), pp. 1-12.

- Barney, J.B. (2001). Is the Resource-based View’ a Useful Perspective for Strategic Management Research? Yes, Academy of Management Review, 26 (1), pp. 41-56.

- Bayo-Moriones, A. & Lera-Lopez, F. (2007). A firm level analysis of determinants of ICT adoption in Spain, Technovation, 27, pp. 352-366.

- Becchetti, L., Bedoya, D.A.L., Paganetto, L. (2003). ICT investment, productivity and efficiency: Evidence at firm level using a stochastic frontier approach, Journal of Productivity Analysis, 20, pp. 143-167

- Berger, A.N. & Wharton Financial Institutions Center Philadelphia (2003). The Economic Effects of Technological Progress: Evidence from the Banking Industry, Forthcoming, Journal of Money, Credit, and Banking, 35 (2), pp. 141-176.

- Bharadwaj, A.S. (2000). A Resource-Based Perspective on Information Technology Capability and Firm Performance: An Empirical Investigation, MIS Quarterly, 24 (1), pp. 169-196.

- Bitier, M.P. (2001). Small Businesses and Computers: Adoption and Performance, (online). http://www.frbsf.org/publications/economics/papers/2001/ (accessed 15 July 2007).

- Bresnahan, T., Brynjolfsson, E. and Hitt, L. (2002). Information Technology, Workplace Organization, and the Demand for Skilled Labor: Firm-level Evidence, Quarterly Journal of Economics, 117 (1), pp. 339-376.

- Brynjolfsson, E. and L. Hitt (1996). Paradox Lost? Firm-Level Evidence on the Returns to Information Systems Spending, Management Science, 42 (4), pp. 541-558.

- Buhalis, D. (2003). eAirlines: strategic and tactical use of ICTs in the airline industry, Information and Management, 41, pp. 805-825.

- Casu, B., Girardone, C. (2004). Financial conglomeration: Efficiency, productivity and strategic drive, Applied Financial Economics, 14, pp. 687-696.

- Casu, B., Girardone, C. (2006). Bank competition, concentration and efficiency in the single European Market, The Manchester School, 74, pp. 441-468.

- Conner, K.R. (1991). A Historical Comparison of the Resource-Based Theory and Five Schools of Thought within Industrial Organization Economics: Do I Have a New Theory of the Firm, Journal of Management, 17 (1), pp.121-154.

- Delgado, J. and Nieto, M.J. (2004). Internet banking in Spain some stylized facts. Monetary integration, market and regulation, in Hasan, I., Hunter, W., Becchetti, L. and Bagella, M. (Eds), Research in Banking and Finance, 4, pp. 187-209.

- DeYoung, R. (2005). The Performance of internet-based business models: evidence from the banking industry, Journal of Business, 78 (3), pp. 893-947.

- DeYoung, R. and Duffy, D. (2002). The challenges facing community banks: straight from the horses’ mouths. Federal reserve bank of Chicago, Economic Perspectives, 26 (4), pp. 2-17.

- DeYoung, R., Lang, W.W. and Nolle, D.L. (2007). How the internet affects output and performance at community banks, Journal of Banking and Finance, 31 (4), pp. 1033-1060.

- Fahy, J. & Hooley, G. (2011). Sustainable competitive advantage in electronic business: towards a contingency perspective on the resource-based view, Journal of Strategic Marketing, 10 (4), pp. 241-253.

- Fethi, M.D. & Pasiouras, F. (2010). Assessing bank efficiency and performance with operational research and artificial intelligence techniques: a survey, European Journal of Operational Research, 204, pp. 189-198.

- Grant, R.M. (1991). The Resource-based Theory of Competitive Advantage, California Management Review, 33 (3),pp. 114-135.

- Hernando, I. and Nieto, M.J. (2007). Is the internet delivery channel changing banks’ performance? The case of Spanish banks, Journal of Banking an d Finance, 31 (4),pp. 1083-1099.

- Katagiri, T. (1989). ATMs in Japan, Bank Administration, 65 (2), pp. 16-19.

- Kim, I. Benbasat (2006). The effect of trust-assuring arguments on consumer trust in internet stores: application of Toulmin’s model of argumentation, Information Systems Research, 17 (3), pp. 286-300.

- Kollberg, M. & Dreyer, H. (2006). Exploring the impact of ICT on integration in supply chain control: a research model, Department of Production and Quality Engineering, Norwegian University of Science and Technology, Norway.

- Kozak, S.J. (2005). The Role of Information Technology in the Profit and Cost Efficiency Improvements of the Banking Sector, Journal of Academy of Business and Economics,

- Laudon, D P. & Laudon, J.P. (2001). Management Information Systems: Organisation and Technology in the Network Enterprises, 4th Prentice Hall International in US.

- Lee, Koo & Nam (2010). Cumulative strategic capability and performance of early movers and followers in the cyber market, International Journal of Information Management, 30, pp. 239-255.

- McKenney, J.L. (1995). Waves of Change: Business Evolution Through Information Technology, Harvard Business School Press, Cambridge, MA.

- Melville, M., Kraemer, K. & Gurbaxani (2004). Information technology and organizational performance: an integrative model of IT business value, MIS Quartely, 28 (2), pp. 283-322.

- OECD (2004). Information and communications technology - OECD Information technology outlook 2004, Retrieved June 1,2007, from http://www.oecd.org/dataoecd/20/47/33951035.pdf

- Oliner, S.D. and Sichel, D.E. (2000). The resurgence of growth in the late 1990s: Is information technology the story? Journal of Economic Perspectives, 14 (4), pp. 3-22.

- Oliner, S.D. and Sichel, D E. (2007). Information technology and productivity: Where are we now and where are we going? Federal Reserve Board. Retrieved June, 1, 2007, from http://132.200.33.130/Pubs/FEDS/2002/200229/200229pap.pdf

- Ongori, H. & Migiro, S O. (2010). Information and Communication technology adoption: a literature review, Journal of Chinese Entrepreneurship, 2 (1), pp. 93-104.

- Ordanini, A., Rubera, G. (2010). How does the application of an IT service innovation affect firm performance? A theoretical framework and empirical analysis on e-commerce, Information & Management, 47, pp. 60-67.

- Petter, S., Straub, D. and Rai, A. (2007). Specifying formative constructs in information systems research, MIS Quarterly, 31 (4), pp. 623-656.

- Polasik, M. (2006), Bankowosc elektroniczna, Istota - stan -perspektywy, CeDeWu, Warszawa.

- Polasik, M. and Wisniewski, T.P. (2008). Empirical analysis of internet banking adoption in Poland, UBM, 27 (1), pp. 32-52

- Polatoglu, V.N. and Ekin, S. (2001). An empirical investigation of Turkish consumers’ acceptance of internet banking services, International Journal of Bank Marketing, 19 (4), pp. 156-165.

- Porter, ME. (1985). Competitive advantage, New York: Free press.

- PWC South Africa (2013).

- Rashidirad, M., Syed, J. & Soltani, E. (2012). The strategic alignment between competitive strategy and dynamic capability and its impact on e-business, International Proceedings on Economic Development and Research, pp. 52-54. Accessed on 2014/02/11.

- Rastrick, K. & Comer, J. (2010). Understanding ICT Based Advantages: A Techno Savvy Case Study, Interdisciplinary Journal of Information, Knowledge, and Management, 2 (17), pp. 305-326

- Rose, P.S. & Hudgins, S.C. (2006). Bank Management & Financial Services, (6th Ed.) McGraw-Hill, New York.

- Russo, M.V. and Fouts, P.A. (1997). A Resource-based Perspective on Corporate Environmental Performance and Profitability, Academy of Management Journal, 40 (3), pp. 534-559.

- San-Jose, L., Ituralde, T. and Maseda, A. (2009). The influence of information communications technology (ICT) on cash management and financial department performance: An explanatory model, Canadian Journal of Administrative Sciences, 26 (2), pp. 150-169.

- Schulze, W.S. (1992). The Two Resource-Based Models of the Firm: Definitions and Implications for Research, Academy of Management Best Paper Proceedings, pp. 37-41.

- Shapiro, J. (1999). Innovation in financial services case study: home banking, MIT IPC Working Paper 99-004, Massachusetts Institute of Technology, Boston, MA, March.

- Shawkey, B. (1995). Update Products ATMs: The Right Time to Buy? Credit Union Magazine (USA), 61 (2), pp. 29-32.

- Sinkey, Jr. & Joseph, F. (1992). Commercial Bank Financial Management, In the Financial-Service Industry, (4th Ed.), Macmillan Publishing Company, Ontario.

- Spanos, Y.E., Prastacos, G. & Poulymenakou, A. (2002). The relationship between information and communication technologies adoption and management, Information & Management, 39 (8), pp. 659-675.

- Stiroh, K.J. (2001). Investing in Information Technology: Productivity Payoffs for U.S. Industries, Current Issues in Economics & Finance, 7 (6), pp. 1-6.

- Stiroh, K. (2002). Information technology and the US productivity revival: A review of the evidence; the closer one looks, the more persuasive it is, Business Economics, 2002. Retrieved June 1, 2007, from http://www.ny.frb.org/research/economists/stiroh/ks_rev2.pdf

- Trist, E. (1990). Introduction to volume II: A Tavistock anthology, E. Trist and H. Murray, Philadelphia, PA: University of Pennsylvania, pp. 36-60.

- Wade, M. & Holland, J. (2004). The resource based view and information systems research: review, extension and suggestions for future research, MIS Quarterly, 28 (1), pp. 107-142.