The impact of socioemotional wealth on family firms' financial performance

Опубликована Март 11, 2015

Последнее обновление статьи Дек. 8, 2022

Abstract

The authors study the effect on performance of family endowment on the business from the perspective of socioemotional wealth (SEW), i.e. the stock of affect-related value which the family attaches to the business. The researchers analyze the impact of ownership and board characteristics on profitability, taking into account the possible moderating factors of the family generational stage, firm size, qualified presence of non-family shareholders and firm risk. The authors analyze 2,884 medium-large Italian private firms comparing 1,944 family and 940 non-family firms using correlation and pooling GLS regressions during 2001-2010. It is shown that in the first generational stage family firms outperform non-family businesses. A family CEO, together with a board including numerous family members, positively affects performance in the first generational stage, but the effect is reversed in the later generational stages. The findings suggest developing by further research the relationship between performance and the emotional links among family members belonging to a nuclear family or to family branches. Moreover it would be advisable to check our findings by a cross-national study, in order to test how institutional and cultural context may affect SEW and performance. The study suggests that family businesses must be able to adapt firm management and the structure of the board, taking into account the moderating effects that these conditions have on SEW and performance

Ключевые слова

Performance, firm generational stage, family endowment, socioemotional wealth

Introduction

Family firms are a common organizational structure all over the world. In Italy, France and Germany the percentage of family businesses is more than 60% (Faccio & Lang, 2002). Many studies have dealt with the performance of these organizations, focusing mostly on listed firms (Allouche et al., 2008; Anderson & Reeb, 2003; Simoes Viera, 2014; Villalonga & Amit, 2006). The availability of private firms’ data is limited and is an obstacle for research development in this area. Our study focuses on medium-large unlisted firms comparing the performance of family and non-family businesses. The characteristics of medium-large firms allow a comparison with the results of empirical studies on listed companies. The studies on family firms’ performance provide mixed results because of the different family firm definition assumed, based on different ownership thresholds, on management, or on combinations of ownership and management. Family firms represent a complex world with different models of governance and management, which affect performance differently. We study, from a Socioemotional wealth (SEW) perspective, the effect on performance of family endowment in the business, analyzing ownership and board characteristics that shape the SEW. The concept of socioemotional wealth, or “affective endowments”, refers to the utilities family owners derive from the non-economic aspects of the business, such as identity, the ability to exercise family influence, and the preservation of the family dynasty and values (Gomez-Mejia et al., 2007). The intensity of the SEW is proxied by Berrone (2012): family and management ownership, ownership dispersion, family CEO, presence of multiple family members on the board and weight of the non-executive members on the board. We take into account the possible moderating factors of SEW highlighted by literature (Gomez-Mejia et al., 2011), i.e. family generational stage, firm size, qualified presence of non-family shareholders and firm risk.

Previous studies analyzed the effect of some board characteristics on performance, and considered the effect of CEO provenance (Barontini & Caprio, 2006) neglecting the impact of other dimensions. Our findings show that family and non-family firms present lower profitability levels in the first 25 years (first generational stage) of their life. Family outperform non-family firms, this is statistically and economically significant in the first 25 years when SEW is high. We show that both a family CEO and the presence of multiple family members on the board positively affect performance but, when the later generational stage intervenes, moderating the SEW, the effect becomes negative. We contribute in developing knowledge on private firms and to the family business literature, testing the effect of SEW on firm performance and addressing the issue of the evolution of SEW over a firm’s generational stages.

To our knowledge, this is the first paper documenting that, for private firms, there is not an inverted U-shaped relationship between family ownership and performance as we find a growing non-linear monotonic relationship.

1. Theoretical background

1.1. Literature review. The separation of ownership and control causes conflicts of interest and asymmetric information between owners and managers (Fama & Jensen, 1983). Personal ownership involvement aligns the interests of owners and managers so agency costs are minimized in family-controlled firms (Schulze et al., 2003). Family firms’ agency costs are not negative but generally lower than they are in non-family firms (Chrisman et al., 2005). Several papers analyzed family firms behavior and performance by referring to agency theory (Le Breton-Miller et al., 2011; Schulze et al., 2001; Villalonga & Amit, 2006), but this theoretical framework does not fully explain the complexity and variety of behaviors among the family firms.

Gomez-Mejia et al. (2007), building on the behavioral agency theory (Wiseman & Gomez- Mejia, 1998) developed a general “SEW model” to explain family firms’ particularities. According to the behavioral agency theory, decision makers’ act in order to avoid losses; family businesses’ behavior is influenced by the family members’ affective or emotional commitment in the firm, as a stock of affective values that the family derives from its controlling position. Family owners derive utility from exercising authority, acting altruistically regarding family members and preserving the family firm’s social capital (Arregle et al., 2007). The SEW consists of multiple dimensions: family control and influence, identification of family members with the firm, family social ties, emotional attachment between the family and the firm and between family members involved in the firm (Berrone et al., 2012). Therefore the identity of the family members is closely tied to the business and the preservation of family owners’ SEW becomes an end in itself, guiding firm behavior (Gomez Mejia et al., 2011) by influencing corporate governance, management, strategies, and approach towards risk (Berrone et al., 2010; Gomez Mejia et al., 2007; Gomez-Mejia et al., 2010). The preservation of the SEW implies the pursuit of instrumental objectives which may be summarized in the following:

- keeping control and influence over the business;

- perpetuating the family dynasty through the business;

- preserving family reputation and image.

Sustaining family business reputation (Berrone et al., 2010) and perpetuating the family dynasty (Sirmon & Hitt, 2003) would benefit financial performance, as they imply a long-term investment horizon.

The desire to preserve and increase the family’s SEW, through control of the business, drives major managerial choices. If SEW is threatened, the family would make choices in order to avoid SEW losses, despite economic efficiency considerations, and run the risk of financial losses.

The empirical literature on family firms’ performance presents mixed results. Some studies on listed firms find that family firms perform better than non-family firms (Anderson and Reeb, 2003a; Simoes Vieira, 2014) but international research confirms this evidence only when the founder is alive and shows that firms with a descendant family CEO and non-family firms are not statistically distinguishable (Barontini and Caprio, 2006). Empirical studies analyze the effect of the CEO characteristics - belonging or not to the family, founder or descendent - on firm performance finding that the owner-manager conflict in non- family firms is more costly than the conflict between family and non-family shareholders but the contrary holds true in the case of a descendent-CEO (Villalonga & Amit, 2006). Moreover the literature shows that heirs may be worse managers than outside CEOs (Bennedsen & Nielsen, 2010) and that family control influences profitability but family ownership has no significant effect (Sacristän- Navarro et al., 2006). However some studies show that widely-held corporations outperform heirs and founder-led family firms (Morck et al., 1988).

Some authors point out that this contrasting evidence is affected by the different definition of family firms that these studies apply (Allouche et al., 2008; Maury 2006; Miller et al., 2012). The multiplicity of definitions is related to the heterogeneity among the family firms, as they have different models of governance and management, and the family’s socioemotional endowment can have different intensities and affect the performance differently.

1.2. Hypothesis development. Families’ most important objective is the preservation of the affective endowment in the firm, thus performance itself is an instrumental objective to the maintenance of SEW. Family control and influence in the firm is a key dimension of SEW (Berrone et al., 2012; Gomez-Mejia et al., 2007) and the empirical evidence shows that families avoid opening up the capital to outside investors (Sirmon & Hitt, 2003). Further, while being risk-averse, they prefer debt financing to protect their control. Positive performance is a source of cash flow for the firm and allows it to finance activities without recourse to external sources. Moreover, profitability ensures the business’s perpetuation for future family

members and the “renewal of family bonds to the firm through dynastic succession” (Berrone et al., 2012, p. 259). So, we expect family firms to pursue profitability in order to preserve SEW, outperforming non-family businesses.

Hl. The extent to -which family firms outperform non-family firms depends on the SEW intensity.

Family ownership is an indicator of SEW (Berrone et al., 2012). As family ownership increases the sense of identity and the ability to exercise family influence grow and, at the same time, the risk of losing control is reduced: the motivation to preserve SEW increases but the risk of losses of SEW decreases. We therefore expect the performance to grow with an increase of family ownership, but less than proportionally.

Empirical literature supports the hypothesis that performance is an increasing function of managerial ownership (Mikkelson & Partch, 1997; Morck et al., 1988) but some studies suggest that this relation can be non-monotonic. Large concentrated shareholders may benefit more from pursuing objectives such as firm growth or expropriating wealth from the company through excessive compensation, related- party transactions, or special dividends, than from increasing shareholder value. Studies on US listed firms show a reversed U-shaped relationship between family ownership and performance (Anderson & Reeb, 2003). Listed firms can rely on a set of equity-related instruments that make possible the presence of atomistic shareholders, who have no ties whatsoever with the controlling family. These instruments are closed to private companies for their characteristics in terms of regulation and visibility, and minority shareholders are part of the network of contacts of the family.

Family social ties is the third dimension of SEW and the family businesses “proactively engage more primary, internal stakeholders as a way to strengthen relational trust, and gain endorsement over the firm’s direction and management” (Cennamo et al., 2012, p. 1155). Family owners tend to attach a higher value to social legitimacy that they feel more sensitive to negative assessments by outsiders and they attach a lot of importance to how they are judged by others (Berrone et al., 2010). Therefore, we do not expect a significant depressive effect on private firms’ performance due to the exploitation of minorities.

H2. Private firms ’ performance is an increasingly non-linear monotonic function offamily ownership.

Empirical studies show that family involvement in management creates stronger ties between the family and the business. These results in an increased effort to preserve SEW (Gomez-Mejia et al., 2007). Literature suggests that the family’s constant presence in the firm produces notable effects on its reputation and that this, in turn, incentivizes family managers to improve performance (Anderson et al., 2003). Moreover, the empirical evidence on listed firms shows that family CEOs have a positive effect on performance (Anderson & Reeb, 2003; Chu, 2011; Maury, 2005).

H3. Family involvement in private firms active management has a positive effect on performance.

When multiple family members are involved in active management their career opportunities, influence, social ties, and emotions are connected to the company and the family identification with the firm increases. This gives them a greater incentive to act in order to keep the business alive for a long time as a source of SEW. So, we would expect better performances in cases where “multiple family members” are on a given firm’s board. On the other hand, differences in the evolution stages of family firms can influence the SEW priorities of owners and managers: the emphasis on preserving SEW fades with the passing of generations (Gomez-Mejia et al., 2011) because family branches emerge, weakening family ties and identification with the firm (Le Breton-Miller & Miller, 2013).

According to the taxonomy proposed by Gersick et al. (1997), when the family firm enters the siblingpartnership stage, the family members who sit on the board belong to different nuclear families and, as each of them must first satisfy the needs of her or his own family, they tend to pursue parochial interests (Corbetta & Salvato, 2004). The goals of individuals no longer coincide with those of the family unit; the alignment of the goals of the family members is rare and, when it occurs, is transient. Family stage has a moderating effect on SEW, and while, in the first generation, the presence of multiple family members indicates a major commitment of the family in the business, in the generations which follow it is an indicator of family fragmentation.

H4a. The presence of multiple family members in the first generation is positively related to performance.

H4b. The presence of multiple family members in the next generations is negatively related to performance.

2. Empirical research

2.1. Sample. This paper analyzes 2,884 medium- large Italian private firms and 19,978 firm-year observations, covering the period 2001-2010. The dataset was extracted from AIDA (Bureau van

Dijk), which is the most complete and reliable financial information source about Italian private companies. Our sample covers the population of private non-financial firms with the following characteristics: active in the year 2010 in the form of a limited company, and with revenues of over €70 million in at least one year1 (The threshold on revenues ensures the availability of the basic balance sheet items, management and Board information to carry out our analysis). We completed the database by entering the data on ownership and governance using public filings from the Italian Chamber of Commerce Register.

2.2. Variables. We use a broad definition of ‘family firm’ in order to highlight the effects of SEW on performance depending on the degree of family involvement in the business, ranging from the control of proprietary rights to the direct management of the firm and the presence of numerous family members on the board. Following Minichilli et al. (2010, p. 212), we define family control as the power to appoint the board of directors, both directly or through financial holdings. We assume a threshold of 50% of voting rights as the ownership structure of privately-held firms, especially in Italy, is very concentrated and presents a limited numbers of shareholders with large blockholdings. Based on this definition, our sample consists of 1,944 family and 940 non-family firms.

We use as dependent variables two measures of return on assets: ROAEbit - net operating income before extraordinary and financial items scaled by the book value of total assets - and ROANet income - net income scaled by total assets. The empirical literature commonly uses ROA to test family and CEO effect on performance (Miller et al., 2012; Anderson & Reeb, 2003; Barontini & Caprio, 2006).

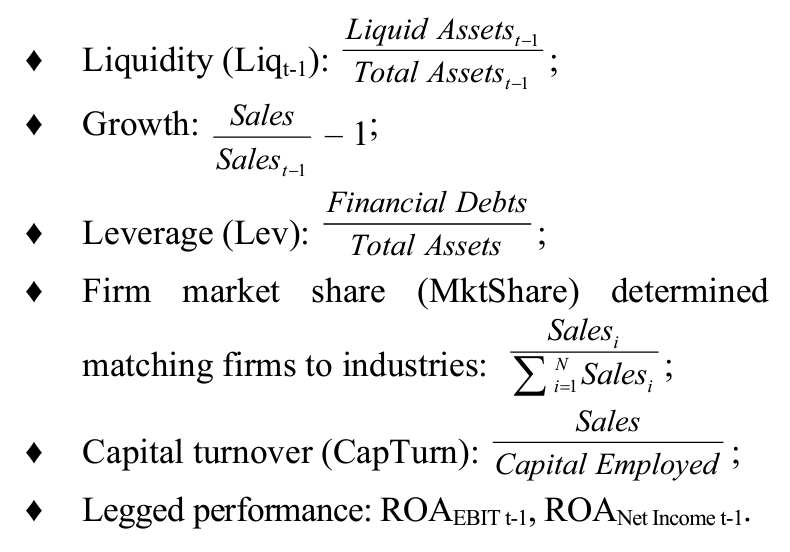

As independent variables, we use some indicators related to the SEW dimensions: family ownership (FamOwn), management ownership (MgtOwn), and two dummy variables: family CEO (DFamcEo) and the presence of multiple family members on the board (DmuitiFM)- We also use, as independent variables, the possible SEW moderators found in the literature (Gomez-Mejia et al., 2011): firm generational stage, firm size, the qualified presence of non-family shareholders and firm risk. In order to highlight family generational stage, in line with Blanco-Mazagatos et al. (2007), we create a dummy variable (Dage) distinguishing firms less than twenty- five years old (first generation businesses) from the other firms. This is an arbitrary cut off but it is around the time that second generation siblings begin to enter the business (Xi et al., 2013). We measure firm size by the natural log of assets (Size). As an indicator of qualified presence of non-family shareholders, we use a dummy variable (Outsiders) which identifies the firms in which outsiders hold more than 20% of the voting rights. This cut off corresponds to the percentage of rights laid down by Italian legislation at which liability action against the CEO can be undertaken. As a proxy of firm risk we use the operational leverage degree (OpLev) measured as the EBITDA divided by EBIT.

We also control for the year and industry effect using dummy variables - Dyear and Dindustry - for other governance-related variables, i.e. the weight of non-executive members on the board (NonExec), ownership dispersion (OwnDisp), CEO age (CEOAge), and some accounting variables:

3. Results and robustness checks

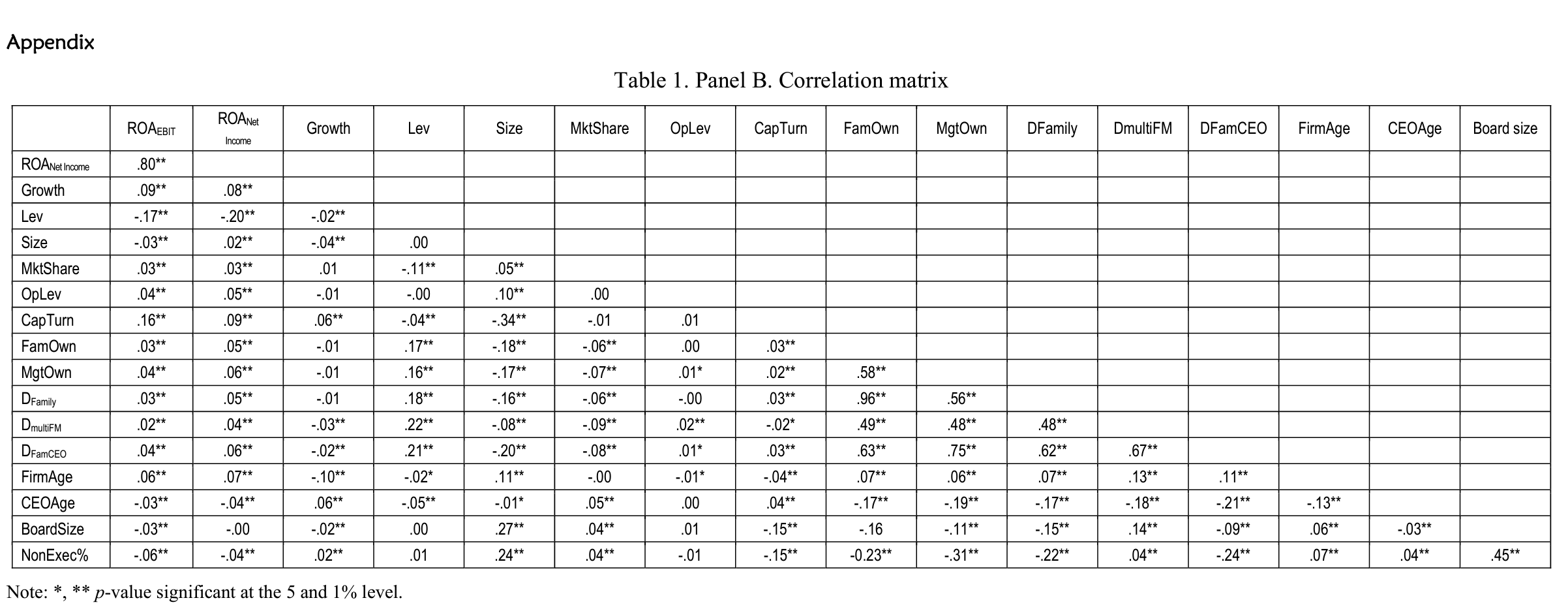

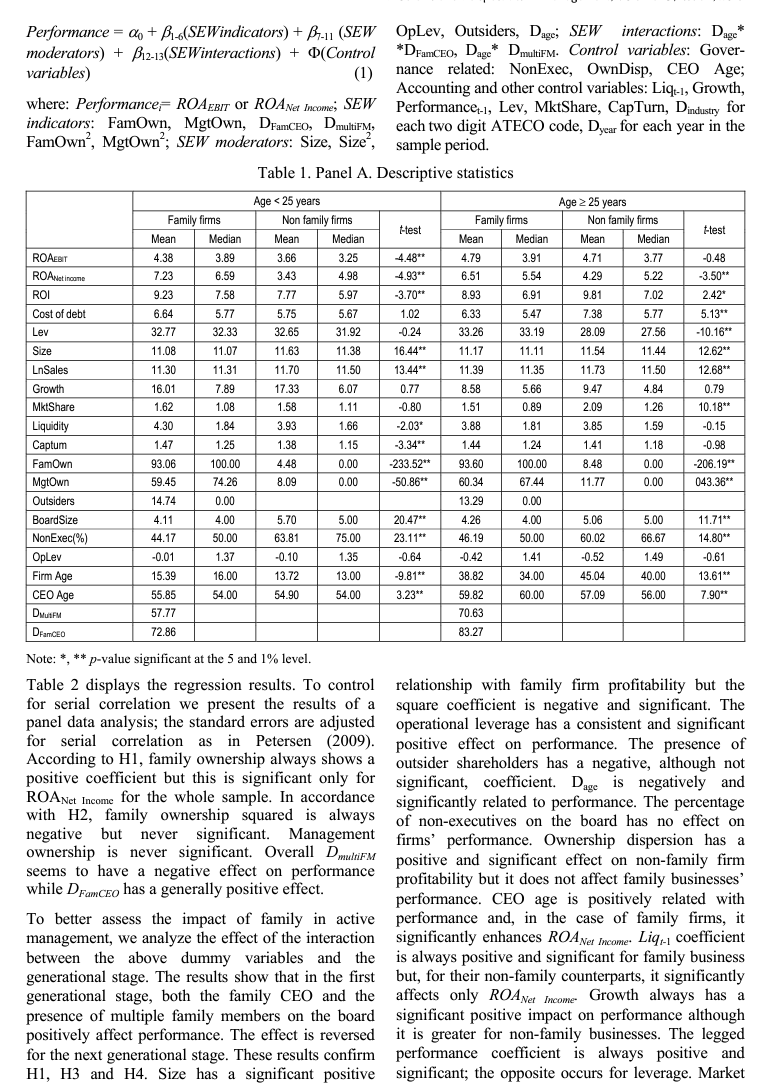

Table 1 - Panel A presents the means, medians and t-test for the above variables for family and non- family firms. It highlights the generational stage, distinguishing firms with less than 25 years from the others. Family firms always perform better than non-family businesses, especially in the first 25 years. In line with previous studies, family firms are smaller but differences tend to fade with age. In the first 25 years, family firms show a higher degree of liquidity and capital turnover. Family firm boards are smaller and present a lower percentage of nonexecutives. In the appendix, Table 1 - Panel В displays Pearson’s correlation coefficients. Coherent with the preservation of SEW by the means of family control, firms managed by a family CEO and with multiple family members on the board (DmuitiFM) are smaller, have a lower growth and market share, and higher operative and financial leverage. Moreover, capital turnover is positively related to the presence of a family CEO, while it is weakly negatively related with DmultiFM. We tested for multicollinearity examining the variance inflation factor for each independent variable. The results indicate that multicollinearity is not a problem for our set of variables.

This kind of analysis potentially suffers from endogeneity problems as, in the case of family firms, the observed relations between performance and family ownership could be the result of a reversed causality (Anderson & Reeb, 2003; Maury, 2006).

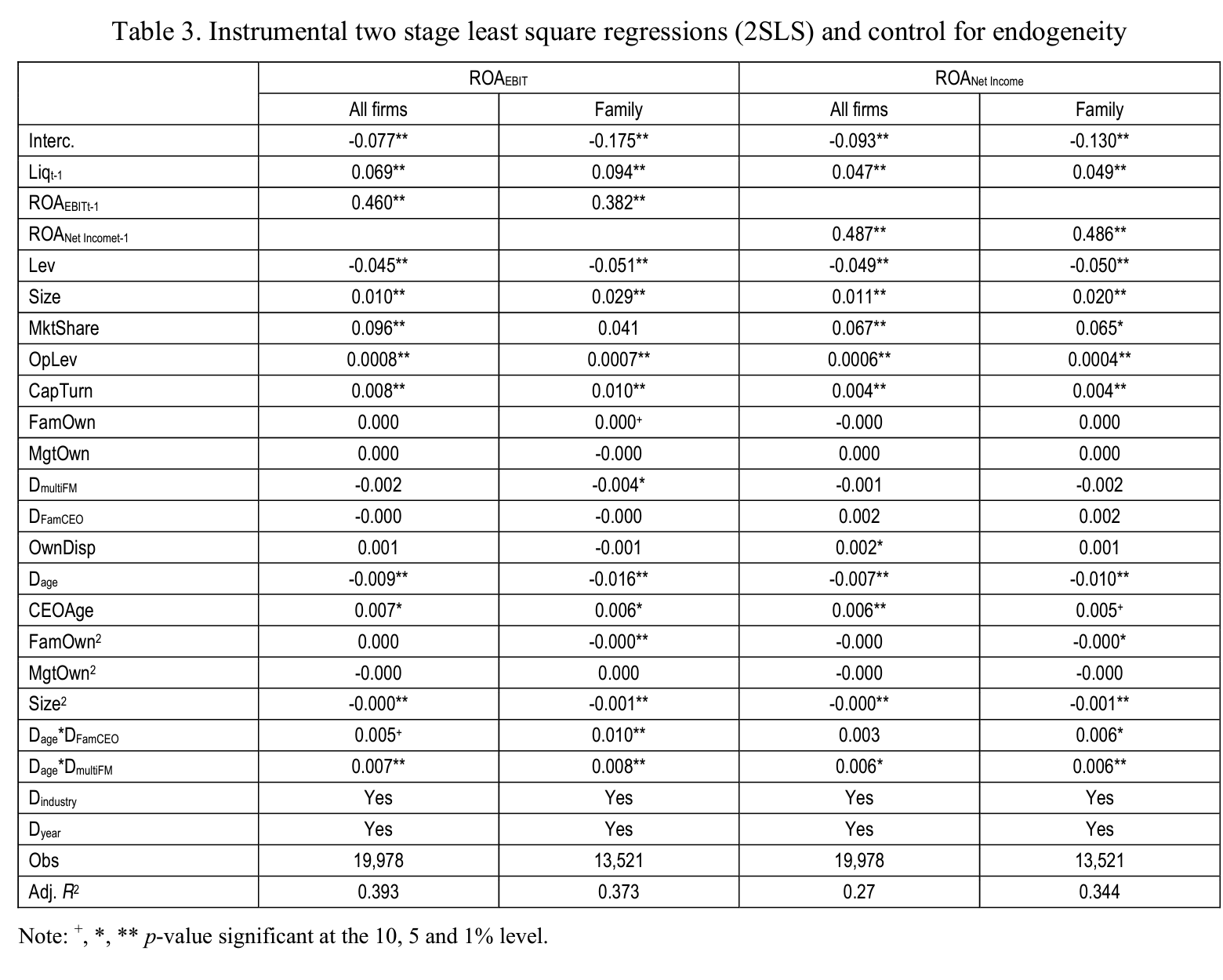

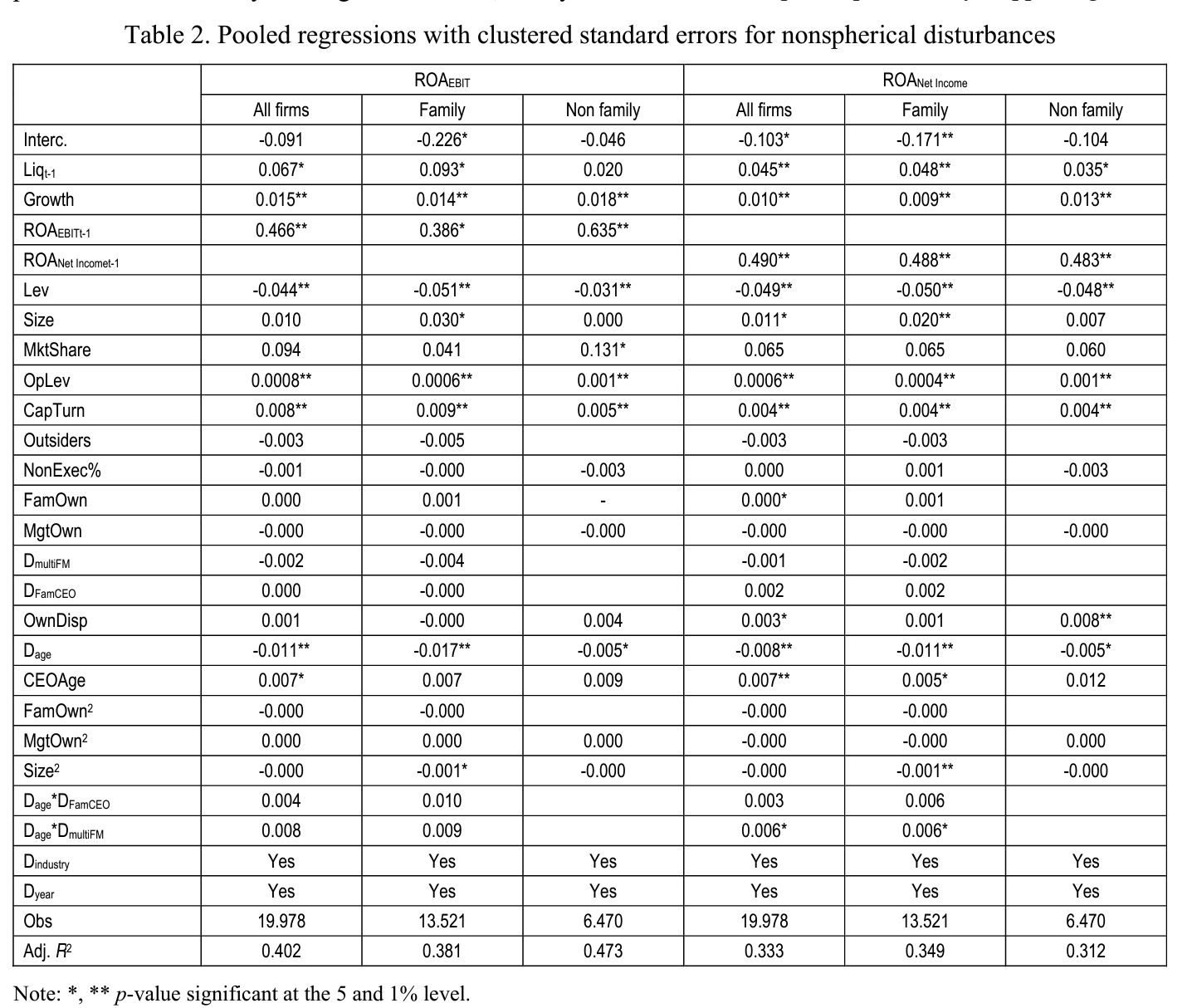

For Italian firms starting from a 100 per cent family stake, diluting ownership below 25 per cent of voting rights would take 90 years against the 20 and 30 years employed, respectively, by U.K. and German family firms (Franks et al., 2009). Our sample family ownership is, on average, around 93% and this suggests that arguing for reversed causality between performance and family holdings is untenable; in any case, we test the robustness of the results, using instrumental variable two stage least squares (2SLS) estimates (Anderson & Reeb, 2003). To test the robustness of the SEW indicators and moderators we choose the instrumental variables from the control variables and we modeled family ownership using growth, the presence of outsider shareholders and the percentage of non executives on the board as instruments. Overall, the two-stage least square results shown in Table 3 in appendix are consistent with the GLS estimates presented in Table 2. The most relevant differences are related to family ownership and the interaction between the SEW indicators and moderators. Family ownership becomes weakly significant for ROAebtt while the negative and significant coefficients for the squared variable points to the existence of a monotonic nonlinear relationship with profitability, supporting H2.

The control for endogeneity also provides stronger evidence for the increasing non-linear monotonic relation between size and family firm profitability. In this analysis the coefficients of the interaction variables show more clearly the positive effect on performance of a family CEO and the presence of multiple family members on the board in the first generational stage. There is no evidence of a positive relationship between family CEO and performance in the next generational stage, while

the negative effect of DmultiFM becomes significant after the first 25 years. So, we consider H3 as verified for the first generational stage and Hl and H4 verified. Of the control variables, firm market share also assumes a significant positive coefficient in the case of family firms.

4. Discussion

We show that family businesses perform better than non-family firms, but the result is highly dependent on the effect of SEW indicators and moderators. Contrary to the results on listed firms (Anderson & Reeb, 2003) for private firms we do not find evidence of an inverted U-shaped relationship between family ownership and performance. For private firms the relationship assumes a non-linear monotonic increasing shape. There are probably several reasons for this. The first is the high degree of ownership concentration in private firms, so family shareholders have fewer possibilities to expropriate minority shareholders. Moreover, in private firms the outsider shareholders are probably connected to the business family network and, on the one hand, they have different monitoring incentives than minority shareholders in listed firms, on the other, families are committed to strengthening the relational trust with then- stakeholders (Cennamo et al., 2012) as they are sensitive to the assessment of outsiders (Berrone et al., 2010).

Our results on the effect of family involvement are consistent with the literature. In the first generational stage the family CEO is usually the founder, his identity is inextricably tied to the firm, “the intention to handling the business to the next generations” (Berrone et al., 2012, p. 264) is higher, and he plans the succession looking at the commitment to the business (Pardo-del-Val, 2009) so there is a strong incentive to achieve profitability conditions that preserve SEW for a long time. Similarly, in this generational stage, having multiple family members on the board positively affects performance. These are usually members of the nuclear family so, on the one hand, then- identification with the firm is very high and, on the other, the affective ties of each member with the others are strong: the firm is seen as an extension of the family. In the next generational stages multiple family members on the board usually belong to different family branches whose identification with the firm tends to diminish. Moreover, the affective ties between the members are weaker, conflicts more likely, and the embeddedness of the business within the family (Ее Breton-Miller & Miller, 2011) becomes detrimental to performance. We extend the results in Sciascia et al. (2014) showing that, both family and non-family firms, tend to perform better after the first 25 years. Therefore the lower profitability in the first generational stage is not related to a negative effect of SEW, rather is attributable to conditions that affect all firms in the first stage of their life, such as not having reached a strong position in the market or not having built a network of consolidated relationships with suppliers of goods, labor and capital.

If we compare the profitability of family and non- family firms we observe that, on average, the former perform better than the latter in all generational stages but that the differences are significant only in the first. We can explain these results as the effect of family endowment and social ties that facilitate the acquisition of the above conditions of profitability. When the next generational stage intervenes as a SEW moderator, family and non- family firms performances are not significantly different.

We confirm the moderating effect of size on SEW and its relationship with profitability which is significant only in the case of family firms. Size has a positive effect on performance but the significant negative coefficient of the squared variables indicates that, as they increase in size, family firms’ performance increases less than proportionally. This result is in line with the suggestion that when the company grows in size the family is required to share influence with parties that are likely to have a lower sense of psychological linkage with the firm and behave opportunistically - this would reduce the commitment to preserve SEW and profitability (Wasserman, 2006).

Our results show that operational leverage positively affects all firms, family and non-family, but the operating leverage coefficient is smaller for family firms. This is in line with the suggestion that family firms are less willing to engage in high-risk projects (Gomez-Mejia et al., 2007). According to Gomez- Mejia et al. (2011, p. 688) under high risk conditions, when the firm’s survival is under threat and the family risks losing “the standard of living, patrimony, and SEW”, they are more likely to assume choices that reduce SEW and risk operates as a SEW moderator.

Conclusions

This study applies the socioemotional wealth (SEW) model to the analysis of performance and sheds light on the conflicting puzzle offered by the empirical literature which shows mixed results in the comparison between family and non-family firms’ performance. These may be due to the different definitions of family firms and the related SEW features. We find that the intensity of SEW explains the differences in behavior between family and nonfamily businesses and between family businesses, and in the first generational stage SEW intensity makes family firms outperform non-family businesses. Our study also has practical implications as it reinforces the findings on the importance of the fit between CEO-type and the nature of the organizations they have to manage (Miller et al., 2013). Here we extend this observation in relation to board characteristics and structure. We show that under different conditions, i.e. different firm generational stages, the family CEO and a board including numerous family members performs better or worse than a board composed of professionals. This suggests that family businesses must be able to adapt firm management and the structure of the board, taking into account the moderating effects that these conditions have on SEW and performance. In this study we take into account only some SEW

References dimensions and do not address the emotional aspects of SEW. Families are characterized by a wide range of emotions both positive and negative, that arise from everyday situations and, given the fine boundary between family and business, permeate the organization, influencing the decisionmaking process and affecting performance. Our findings on the effect of numerous family members on the board in the first and subsequent firm generational stage suggest a relation between performance and the emotional links between family members, which depend on whether they belong to a nuclear family or to family branches. Moreover, this study focuses on a single country and the specific institutional and cultural context researched may lead to different results from those that might be found in other countries. Therefore it would be advisable to check our findings by a cross-national study, in order to test how institutional and cultural context may affect SEW and performance.

References

- Allouche, J., Amann, B., Jaussaud, J. and Kurashina, T. (2008). The impact of family control on the performance and financial characteristics of family versus nonfamily businesses in Japan, a matched-pair investigation, Family Business Review, 21 (4), pp. 315-329.

- Anderson, R.C. and Reeb, D.M. (2003). Founding-family ownership and firm performance, evidence from the SP500, Journal of Finance, 58 (3), pp. 1301-1328.

- Anderson, R.C., Mansi, A.M. and Reeb, D.M. (2003). Founding family ownership and the agency cost of debt, Journal of Financial Economics, 68 (2), pp. 263-285.

- Arregle, J.L., Hitt, M., Sirmon, D. and Very, P. (2007). The development of organizational social capital, attributes of family firms, Journal of Management Studies, 44 (1), pp. 73-95.

- Barontini, R. and Caprio, L. (2006). The Effect of Family Control on Firm Value and Performance, evidence from Continental Europe, European Financial Management, 12 (5), pp. 689-723.

- Bennedsen, M. and Nielsen, K. (2010). Incentive and entrenchment effects in European ownership, Journal of Banking & Finance, 34, pp. 2212-2229.

- Berrone, P., Cruz, C. and Gomez-Mejia, L.R. (2012). Socioemotional Wealth in Family Firms, theoretical dimensions, assessment approaches, and agenda for future research, Family Business Review, 25 (3), pp. 258-279.

- Berrone, P., Cruz, C., Gomez-Mejia, L.R. and Larraza-Kintana, M. (2010). Socioemotional wealth and organizational response to institutional pressures, do family controller firms pollute less? Administrative Science Quarterly, 55, pp. 82-113.

- Blanco-Mazagatos, F., De Quevedo-Puente, E. and Castrillo, L.A. (2007). The trade off between financial resources and agency costs in the family business: an exploratory study, Family Business Review, 20 (3), pp. 199-213.

- Cennamo, C., Berrone, P., Cruz, C. and Gomez-Mejia, L.R. (2012). Socioemotional Wealth and Proactive Stakeholder Engagement, why family-controlled firms care more about their stakeholders, Entrepreneurship Theory and Practice, 36, pp. 1153-1173.

- Chrisman, J.J., Chua, J.H. and Sharma, P. (2005). Trends and directions in the development of a strategic management theory of the family firm, Entrepreneurship Theory and Practice, 29, pp. 555-575.

- Chu, W. (2011). Family ownership and firm performance, influence of family management, family control, and firm size, Asia Pacific Journal of Management, 28, pp. 833-851.

- Corbetta, G. and Salvato, C. (2004). Self-serving or self-actualizing? Models of man and agency costs in different types of family firms, a commentary on “comparing the agency costs of family and non-family firms, conceptual issues and exploratory evidence”, Entrepreneurship Theory and Practice, 28, pp. 355-362.

- Faccio, M. and Lang, L.H.P. (2002). The ultimate ownership of Western Europe corporations, Journal of Financial Economic, 65 (3), pp. 365-395.

- Fama, E.F. and Jensen, M.C. (1983). Agency problems and residual claims, Journal of Law and Economics, 26, pp. 325-344.

- Franks, J., Mayer, C., Volpin, P. and Wagner, H.F. (2009). The life cycle of family ownership, a comparative study of France, Germany, Italy and U.K., Working paper, London, London Business School.

- Gersick, K.E., Davis, J.A., Hampton, M.M. and Lansberg, I. (1997). Generation to generation, life cycles of the family business, Boston, MA, Harvard Business School Press.

- Gomez-Mejia, L.R., Cruz, C., Berrone, P. and De Castro, J. (2011). The bind that ties, Socioemotional wealth preservation in family firms, The Academy of Management Annals, 5 (1), pp. 653-707.

- Gomez-Mejia, L.R., Haynes, K.T., Nunez-Nickel, M., Jacobson, K.J.L. and Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms, evidence from Spanish olive oil mills, Administrative Science Quarterly, 52 (1), pp. 106-137.

- Gomez-Mejia, L.R., Makri, M. and Larraza-Kintana, M. (2010). Diversification decisions in family-controlled firms, Journal of Management Studies, 47(2), pp. 223-252.

- Le Breton-Miller, I. and Miller, D. (2013). Socioemotional wealth across the family firm life cycle, a commentary on “Family Business Survival and the Role of Boards”, Entrepreneurship Theory and Practice, 37, pp. 1391-1397.

- Le Breton-Miller, I., Miller, D. and Lester, R.H. (2011). Stewardship or Agency? A Social Embeddedness Reconciliation of Conduct and Performance in Public Family Businesses, Organization Science, 22 (3), pp. 704-721.

- Maury, B. (2006). Family ownership and firm performance, empirical evidence from Western European corporations, Journal of Corporate Finance, 12 (2), pp. 321-341.

- Mikkelson, W.H., Partch, M.M. and Shah, K. (1997). Ownership and operating performance of companies that go public, Journal of Financial Economics, 44 (3), pp. 281-307.

- Miller, D., Minichilli, A. and Corbetta, G. (2013). Is family leadership always beneficial? Strategic Management Journal, 34 (5), pp. 553-571.

- Minichilli, A., Corbetta, G. and MacMillan, I.C. (2010). Top management teams in family-controlled companies, ‘familiness’, 'faultlines', and their impact on financial performance, Journal of Management Studies, 47 (2), pp. 205-222.

- Morck, R., Shleifer, A. and Vishny, R. (1988). Management ownership and market valuation, an empirical analysis, Journal of Financial Economics, 20, pp. 293-315.

- Pardo del Val, M. (2009). Succession in family firms from a multistaged perspective, International Entrepreneurship and Management Journal, 5 (2), pp. 165-179.

- Petersen, M.A. (2009). Estimating standard errors in finance panel datasets, comparing approaches, Review of Financial Studies, 22 (1), pp. 435-480.

- Sacristän-Navarro, M., Gomez-Anson, S. and Cabeza-Garcia, L. (2011). Family ownership and control, the presence of other large shareholders, and firm performance, further evidence, Family Business Review, 24 (1), pp. 71-93.

- Scherr, F.C. and Hulburt H.M. (2001). The debt maturity structure of family firms, Financial Management, 30, pp. 85-111.

- Schulze, W.S., Lubatkin, M.H. and Dino, R.N. (2003). Exploring the agency consequences of ownership dispersion among the directors of private family firms, Academy of Management Journal, 46, pp. 179-194.

- Schulze, W.S., Lubatkin, M.H., Dino, R.N. and Buchholtz, A.K. (2001). Agency relationship in family firms, theory and evidence, Organization Science, 12, pp. 99-116.

- Sciascia, S., Mazzola, P. and Kellermanns, F.W. (2014). Family management and profitability in private family- owned firms: introducing generational stage and the socioemotional wealth perspective, Journal of Family Business Strategy, 5 (2), pp. 131-137.

- Simoes Viera, E.F. (2014). The effect on the performance of listed family and non-family firms, Managerial Finance, 40 (3), pp. 234-249.

- Sirmon, D.G. and Hitt, M.A. (2003). Managing resources, linking unique resources, management, and wealth creation in family firms, Entrepreneurship Theory and Practice, 27, pp. 339-358.

- Villalonga, B. and Amit, R. (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics, 80, pp. 385-417.

- Wasserman, N. (2006). Stewards, Agents, and the Founder Discount, executive compensation in new ventures, The Academy of Management Journal, 49 (5), pp. 960-976.

- Wiseman, R.M. and Gomez-Mejia, L.R. (1998). A Behavioral Agency Model of Managerial Risk Taking, The Academy of Management Review, 23 (l),pp. 133-153.

- Xi, J., Kraus, S., Filser, M. and Kellermanns, F.W. (2013). Mapping the Field of Family Business Research, past trends and future directions, International Entrepreneurship and Management Journal.