A Study on The Internet Connectivity in The Philippines

Published: Aug. 30, 2016

Latest article update: Dec. 26, 2022

Abstract

This study aims to help address concerns about the growing demand of wider bandwidth Internet connection in the Philippines. Using articles and research of international organizations and content from official websites of the Philippine government, this paper has carefully examined the slow Internet connectivity and the high cost that the end-users pay for it. This paper suggests that this inefficiency hampers the motivation of users to innovate in a way that could contribute to inclusive growth and the development of an inclusive information society. Through a comparison of the current global ICT situation with the current situation in the Philippines, this paper shows that the country's Internet infrastructure lags behind among those of contemporary developing countries in Asia, particularly in terms of Internet connectivity. In 2015, Thailand had an average Internet speed of 7.4 Mbps, Sri Lanka 7.4, and Malaysia 4.3. Meanwhile, the Philippines had a meager average Internet speed of 2.8 Mbps, placing the country at 104 among 160 countries, with developed countries in Asia such as South Korea (23.6 Mbps) and Singapore (12.9 Mbps) ranking 1 and 12, respectively. Findings show that the lack of competition in the Internet connectivity market, among other reasons, is at the root of the dilemma of slow and costly Internet connection. Assessing the accomplishments of the Republic of Korea and other broadband-leading countries has provided practical insights and recommendations that can promote competitiveness. Furthermore, related literature argues how ISP practices may affect Internet speed and cost. This study offers an approach in improving Internet connectivity in the Philippines by bridging the gap between the Internet infrastructure market and government policies.

Keywords

Internet Connectivity, Internet Bandwidth, Internet Service Provider (ISP), Internet Exchange Points (IXP), Domestic Peering, Internet Speed, Internet Penetration, Broadband Internet Access, Mobile Penetration

1. Introduction

In this digital age, the Internet has become a powerful tool for connecting people, information, ideas, resources, and services. It has become a driving force of the economy and has provided employment, transformed industries, improved infrastructure, and provided efficient communication among enterprises and individuals across the globe. With a slow Internet connection, citizens are less likely to be motivated to participate in today’s information society. In some countries, the essential role of this tool is well understood, and the right to broadband Internet access as a means of communication is spoken of as a fundamental right. When it comes to providing the nation with Internet access, the Philippines has been steadily catching up with other countries over the past few decades. The country established its first ever online connection on March 29,1994. Such a milestone opened the doors for progress, allowing Filipinos to access all the information the Internet could offer. The Philippines was named the fastest growing Internet population in the last five years with a growth of 531%, and its population is predicted to reach a 66 million mark this year. Likewise, the country has been known as the “texting capital of the world” and the “social media capital of the world” at various times over the last few years. The level of consumer engagement with mobile and technology has come to differentiate the country from other fast-growing peers in Asia.

The purpose of this study is to evaluate the cause of the slow Internet connection in the Philippines and the high cost that end-users pay for it. Examining related articles, this paper compares the current ICT situation in the country and that of the global arena with emphasis on internet connectivity and its support infrastructures as well as the underlying cause of high cost Internet connection. Likewise, it analyzes the current Internet ecosystem and the gaps of slow Internet speed, evaluates the current situation of the Internet Service Providers (ISPs) in the country, identifies the essential role of Internet Exchange Points (IXPs), and assesses the growing demand for Internet speed. The poor quality of service that ISPs are currently providing in the country are the result of a lack of competition in the national Internet backbone market, a topic which this paper addresses. This paper also discusses the critical role of the different Philippine government instrumentalities in improving the internet infrastructure industry. Finally, this paper sets out concrete recommendations to improve the Internet connectivity in the country, reduce the cost of Internet connection, and create conditions conducive to vibrant and healthy competition, which would provide the growing base of Internet users a wider bandwidth Internet connection. This paper will likewise show that the lack of competitiveness in the market results in costly yet poor Internet connection.

Part 2 discusses related literature that supports this paper in assessing several concerns regarding the peering relationship that affects local traffic, with a special focus on South Korea’s success story with broadband Internet. Part 3 explains the Philippine economy and the current ICT situation and, more importantly, the Internet infrastructure of the country. The comparison between the Philippines and the global ICT situation will lead to the conclusion that the country lags behind developed countries and even its other Asian counterparts in terms of Internet connectivity, which will be discussed in Part 4. This part will also reveal the reasons behind the poor connectivity. The analysis of the value chain in the provision of Internet access in the Philippines is discussed in Part 5, while Parts 6 and 7 provide recommendations, a conclusion, and some comments regarding future work.

2. Related Work

2.1. Broadband Policies in the Republic of Korea and other Broadband Leading Countries

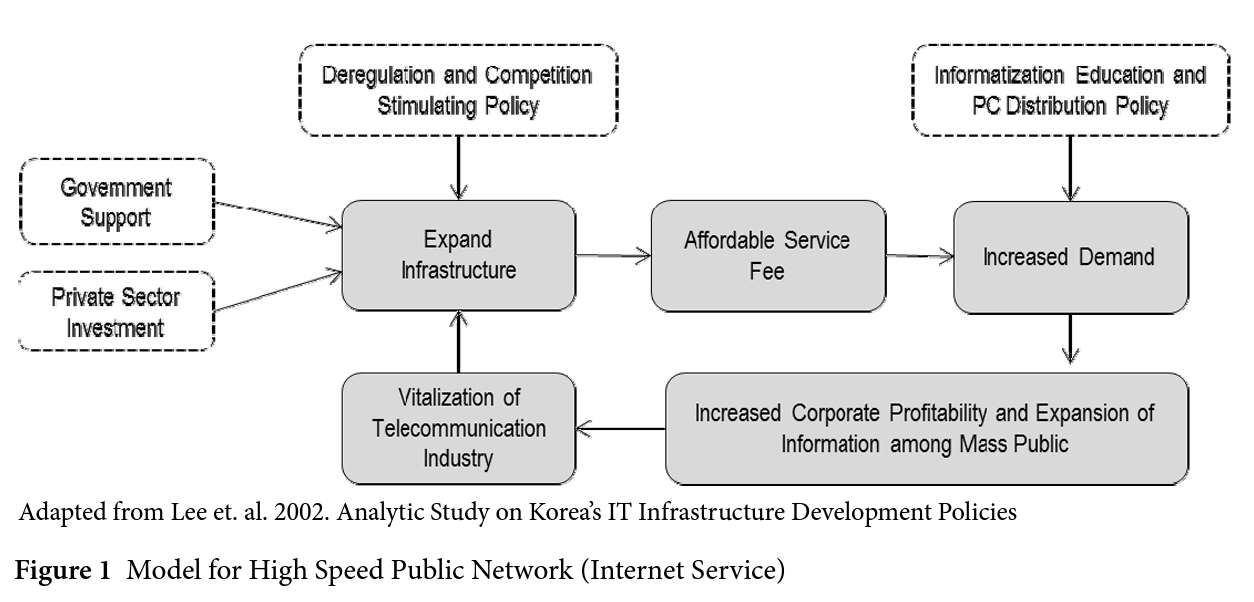

Building a nationwide broadband network infrastructure and allowing people to “always” be connected to “high-speed” Internet is viewed as the first step toward becoming an “information society”. The development of a broadband network is a key element to empowering competitiveness in many nations. In many cases, a country’s approach to broadband often includes strategies that lead to the formulation of policies and regulations. South Korea’s ICT infrastructure has ranked the country first worldwide in the UN ICT Development Index. This achievement is attributed to the country’s “Informatization Policy,” which has been developed since 1996. In keeping with such policy, the project of building infrastructure for high-speed communication networks has been ongoing since 1995. Kim, et al(2010) focus their research on Korea’s policies and regulations. South Korea shows how an integrated, holistic approach to developing broadband was critical to the program’s success. Strategic development frameworks have been the basis of broad policy goals and the creation of supply- and demand-side policies, such as those that lowered market entry barriers and spurred demand. Efforts have included public investment in broadband infrastructure and incentives for private investment, initiatives to aggregate and expand demand for broadband services, policies to promote universal access to broadband, and support for industrial and competition policies. Also included is the establishment of a pricing policy that is acceptable to users, with the expectation that demand will be created and that supply will follow through the active competition among service operators. The model employed by the Korean government to expand the usage of Internet service is shown in Figurel Broadband networks and services grew quickly due to intense facilities- and services-based competition. Most supply-side policies have aimed at expanding the private sector’s role in helping to achieve the government’s goals for infrastructure rollout and service and application development. In 1998, commercial

broadband Internet was introduced, gaining more than Is there a difference between “Internet” and “broadband Internet”? 10 million Internet users in 1999 and more than 10 million broadband Broadband Internet refers to high-speed Internet access that is always on and faster than the traditional dial-up access. In the 90s, “Internet” refers to dial-up access, it was when broadband was not yet developed. Internet subscribers in 2002. By late 2005, operators began focusing on advanced next generation access networks. In the beginning of2008, operators distributed Fiber to the Home (FTTH) nationwide to connect high-speed Internet to the households of individual subscribers, upon which the Korean Internet infrastructure ranked first in the world. By mid-2012, the country’s broadband Internet subscribers exceeded 18 million.

The Korean government’s approach to promoting ICT in general and the broadband market in particular has involved formulating strategic development frameworks based on informatization master plans that run over a number of years and include the implementation of regulations and competition policies. Before broadband Internet emerged, the government introduced competition in the local and long distance call sectors by giving licenses to multiple carriers. In this process, for instance, the Ministry of Information and Communication (MIC) granted Hanaro Telecom Inc (now SK Telecom) a license to become a local call carrier to compete against Korea Telecom. This promoted the development of the country’s high-speed Internet infrastructure and facilitated open competition in the high-speed Internet market. The intense competition led to relatively low prices and, subsequently, a rapid increase in demand. There have been three phases in the evolution of the country’s broadband regulatory environment: a) light regulation to promote competition in the early, developing, and mature stages of broadband, until 2005; b) increased regulation from 2005-07, in response to the growing dominance of KT and the operators’ financial crisis; and c) a return to lighter regulation in some areas as the market matured, since 2007.

Likewise, the informatization plans paved way for the creation of a mechanism called the Informatization Promotion Fund, which would finance projects that could foster the use of information. The primary objective of the fund is to ensure that profits from the ICT industry remain in the ICT industry. Money from the fund is used to support ICT-related R&D, develop and diffuse standardization in the ICT industry, train ICT human resources, promote broadband network rollout, and promote e-Government. The government also actively fostered competition for services in the early stages of the market through performance monitoring, announcements of connection speeds, and the introduction of service-level agreements for broadband services.

Kim et. al (2010) also include in their research the IT infrastructure and policies of broadband-leading countries such as Finland, France, Japan, Sweden, United Kingdom, and USA. In this study, they formulated three building blocks that countries may implement to develop their broadband market, one of which was the use of competition to promote market growth. These broadband leaders used collaborative approaches between the public and private sectors to promote and later universalize broadband services. In some cases, public investments aimed at specific gaps or triggered larger private investments. Furthermore, the above-mentioned countries relied on competition to expand the broadband market. Some focused on facility competition, while others focused on service competition.

2.2. Internet Peering

Internet penetration in the world is rapidly growing. NLkabel and Cable Europe (2013), in its study, found that the average sufficient provisioned speeds in 2013 were estimated to be at 15.3 Mbps (downstream) and 1.6 Mbps (upstream). The demand for bandwidth is expected to grow exponentially from 2013 to 2020. In 2020, sufficient subscription speeds for the average user are forecasted to be approximately 165 Mbps (downstream) and 20 Mbps (upstream). In addition, Machina Research hinted that there will be a vast number of new M2M connections in the coming years as loT is starting to gain traction with the availability of smartphones and tablets. The continued rapid growth of the Internet has generated an urgent need to adopt routing arrangements. There are two kinds of Internet interconnection arrangements: peering relationships between core Internet Service Providers (ISPs) and transit sales by core ISPs to other ISPs.. The market for Internet services has a vertical structure in which core ISPs produce an intermediate output (full routing capability or core Internet service) that they and non-core ISPs use to produce Internet services for end users. In many developing countries, poor connectivity between ISPs often results in local traffic being routed over large international networks or core ISPs, simply to reach destinations within the country of origin. Several studies have shown that the use of Internet Exchange Points (IXPs) can improve the quality of Internet services in a country by reducing the

delays associated with unnecessary routing traffic. South Korea, for example, has established 6 different IXPs for the efficient traffic communication between the country’s ISPs. Multiple Internet service providers (ISPs) can connect at a single IXP, creating the potential for a range of technical and economic benefits for the local Internet community. By keeping local traffic local and avoiding international links, local operators and users can reap substantial cost savings, provide substantial local bandwidth, and significantly improve local Internet performance.

Jensen (2013) identified that, for Internet providers and users, the advantages of locally routing Internet traffic via a common exchange point are that: a) substantial cost-savings are made by eliminating the need to put all traffic through more expensive long-distance links to the rest of the world; b) more bandwidth becomes available for local users because of the lower costs of local capacity; c) Local links are often up to ten times faster because of the reduced latency in traffic, which takes fewer hops to get to its destination; d) local content providers and services, which rely on high-speed low-cost connections that have become available, benefit from the broader user-base available via the IXP; and e) more choices for Internet providers become available through which to send upstream traffic to the rest of the Internet, which contributes to a smoother and more competitive wholesale transit market. While ISPs peering through IXP helps reduce traffic and cost, Milgrom, Bridger, and Srinagesh (2000) present a contrasting idea regarding the economics of peering between two core ISPS. They argued that a vertical market structure with relatively few core ISPs can be relatively efficient given the technological economies of scale and transaction costs arising from Internet addressing and routing. Their analysis of costs identifies instances in which an incumbent core ISP’s refusal to peer with a rival or potential rival promotes economic efficiency. Refusal to peer with a rival will raise its rival’s costs and ultimately increase prices for end user. Such a conclusion contradicts the principle that intensifying competition can promote economic efficiency.

3. The Philippines and The Global ICT Situation

3.1. National Context

The Philippines is a sovereign country made up of 7,107 islands located in Southeast Asia. It has a total area of 300,000 square kilometers, making it the 64th largest country in the world in terms of area. The country is generally divided into three major islands-Luzon, Visayas and Mindanao, with Manila City on the island of Luzon as its capital. The country’s population is about 92.34 million people based on the 2010 population census, making it the 7th most populated country in Asia and the 12th most populated country in the world. There are also 12 million Filipinos living overseas. The Philippine economy is the 39th largest in the world, with an estimated 2014 gross domestic product (GDP-nominal) of $289,686 billion or $2,828 GDP per capita. Primary exports include semiconductors and electronic products, transport equipment, garments, copper products, petroleum products, coconut oil, and fruit. Major trading partners include the United States, Japan, China, Singapore, South Korea, the Netherlands, Hong Kong, Germany, Taiwan, and Thailand.

The increase of the population alongside the country’s economic structural shift from agriculture to industry brought an enormous increase to the Internet penetration rate of the nation. With this growth, the use of ICT equipment such as desktop and laptop computers, servers, printers, scanners, switch hubs, modems, fax machines, among others, has naturally increased. Between 2013 and 2014, the ICT industry in the Philippines had a growth of 11.4% (International Data Corporation, 2014). The IDC further stated that the ICT market would reach a total of USD 6.76 billion in 2014, with hardware contributing 76% and software and services 7% and 18%, respectively. In 2010, there were 7,408 establishments in the country with 96.8% of them using computers with Internet access [10]. The increasing demand for electricity brought about by this growth would threaten the power situation in the country. In 2015, the country had a total generating capacity of 18,765 MW and a total power generation of 82,413 GWh, yet power failures have occurred This is the installed and dependable capacity, respectively in 2014. We have 2015 figures already which became available just this month.. The National Electric Grid is composed of three sub-grids - the Luzon, Visayas and Mindanao Grids.

3.2. Philippine Telecommunication and Internet Timeline

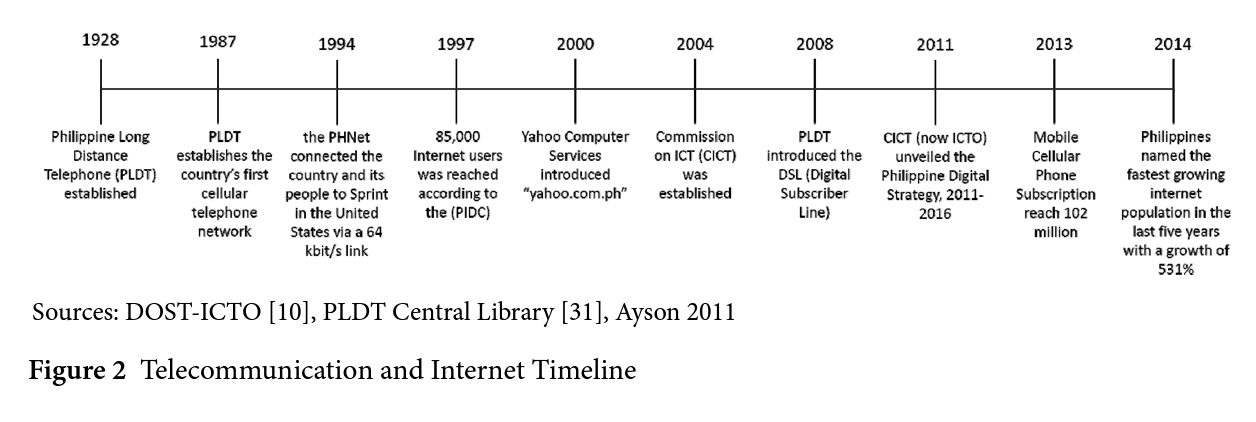

When it comes to providing the nation with access to international telecommunication, including the Internet, the Philippines has been steadily catching up to other countries over the past few decades. This progress started with the establishment of the country’s first telecommunications company in 1928. The country established its first ever online connection on March 29, 1994, as shown in Figure 2. Such a milestone opened the doors for progress, allowing Filipinos the access to the unlimited information provided by the Internet. Since that time, the number of Internet users in the country has grown significantly, reaching 38 million in 2014.

3.3. E-Govemance

The Philippine E-Government I took out “compared to other countries,” because the drop should not be compared to other countries, as you’re not implying that other countries also saw a drop. Ok, thanksunderwent a drop in ranking according to the United Nations E-Government Survey 2014. Traditionally, the Philippines had been a strong performer in the UN E-Government Rankings, rank 66th in 2008 before falling to 78th in 2010 and 88th in 2012. In the same survey (see Table 1), the country was ranked 95th while other countries in South-Eastern Asia, such as Singapore (3rd) and Malaysia (52nd), performed well. The decline was attributed to the country’s weak telecommunication infrastructure; the UN Survey ranked the country at 115th in this particular area. The Philippine Digital Strategy 2011-2016 further contributed to this drop in ranking, as it lacked strong e-Government leadership and coordination among departments and the various levels of government. Similarly, the government blamed the lack of shared infrastructure, proper ICT tools, and sufficient capacity and training for the slow progress of e-government services and weak engagement with its citizens. Two governmental entities played an essential role with regards to providing direction for the ICT playing fields in the country, the Department of Science and Technology - Information and Communication Technology Office (DOST-ICTO) and the National Telecommunication Commission (NTC).

Table 3 E-Government Development in South-Eastern Asia

Country | E-Government Development Index | World E-Government Development Ranking | ||||

2014 | 2010 | 2008 | 2014 | 2010 | 2008 | |

Singapore | 0.9076 | 0.7476 | 0.7009 | 3 | 11 | 23 |

Malaysia | 0.6115 | 0.6101 | 0.6063 | 52 | 32 | 34 |

Brunei Darussalam | 0.5042 | 0.4796 | 0.4667 | 86 | 68 | 67 |

Philippines | 0.4768 | 0.4637 | 0.5001 | 95 | 78 | 66 |

Vietnam | 0.4705 | 0.4554 | 0.4558 | 99 | 90 | 91 |

Thailand | 0.4631 | 0.4653 | 0.5031 | 102 | 76 | 64 |

Indonesia | 0.4487 | 0.4026 | 0.4107 | 106 | 109 | 106 |

Cambodia | 0.2999 | 0.2878 | 0.2989 | 139 | 140 | 139 |

Lao PDR | 0.2659 | 0.2637 | 0.2383 | 152 | 151 | 156 |

Timor-Leste | 0.2528 | 0.2273 | 0.2462 | 161 | 162 | 155 |

Myanmar | 0.1869 | 0.2818 | 0.2989 | 175 | 141 | 144 |

Source: UNPAN 2010, UN E-Government Survey2014 [46]

3.3.1. Information and Communication Technology Office (ICTO)

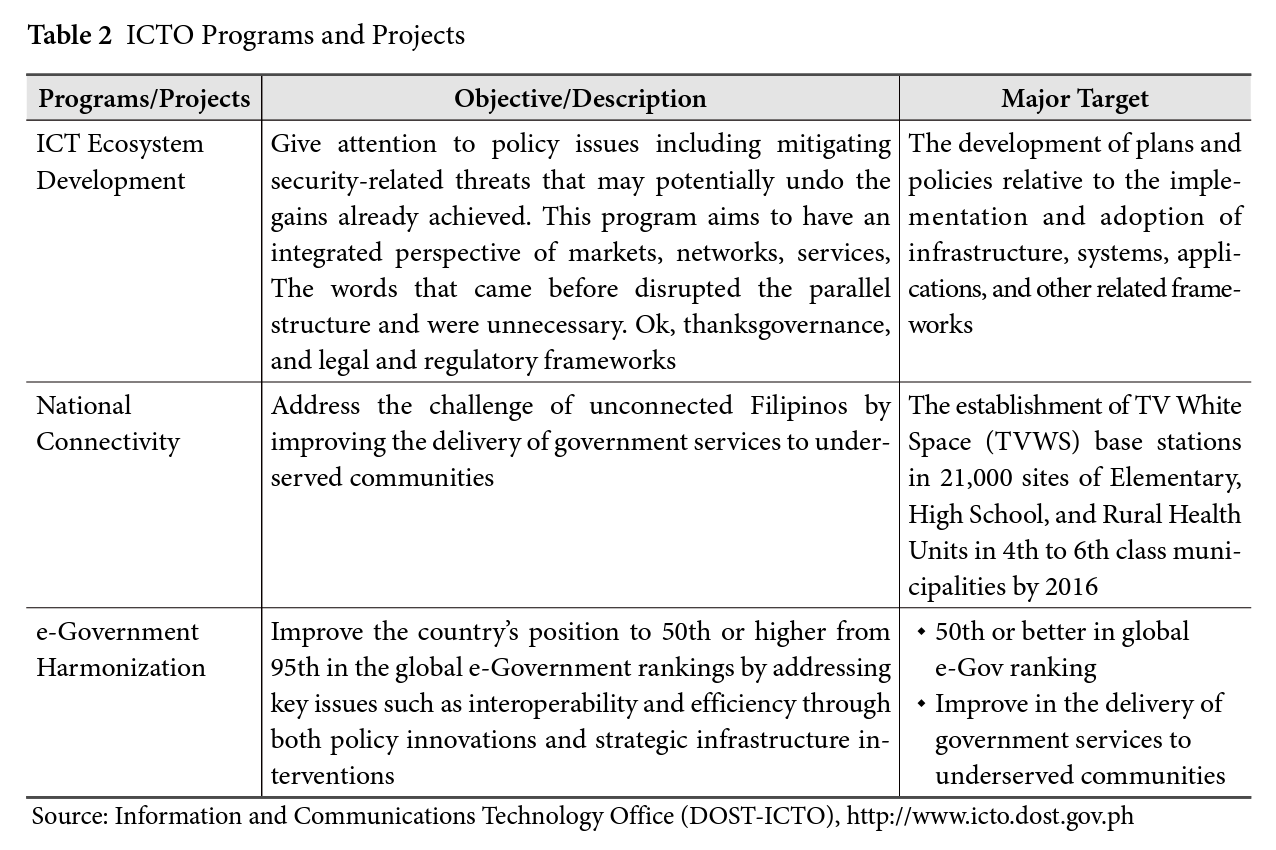

The Department of Science and Technology (DOST) - ICTO plays an essential role in the ICT playing field. Among its functions, it is responsible for formulating, recommending, and implementing an appropriate policy and program framework that will promote development and improve global competitiveness of the country’s information and communications technology industry through research and development and effective linkages to industry. Table 2 shows some of the programs and projects of ICTO that are currently being implemented for the objective of improving internet connectivity.

It should be noted that while the goals listed here are reasonable and critical for promoting innovation and competitiveness, the ICTO must enjoin all the players in the industry to strive toward the goal of improving the Internet infrastructure of the country. To strengthen the mandate of the ICTOs, the Philippine Congress has been striving to create a Department of Information and Communication (DICT) since 2008, and on May 20, 2016, through RA 10844, DICT was created, replacing ICTO.

3.3.2. National Telecommunication Office

NTC, on the other hand, is an agency associated with the Office of the President of the Philippines. It is responsible for the supervision, adjudication, and control over all telecommunications services throughout the country. NTC works hand in hand with DOST-ICTO and the DOST - Advanced Science and Technology Institute (DOST-ASTI) to reach NTC’s Mission and Vision, Performance Pledge, and e-Government Master Plan of 2013-2016, Does what follows apply to “NTC’s Mission and Vision... Plan of2013-2016"? all of which aim to improve processes in government to provide better services for hoth citizens and businesses and promote public participation. In order to provide the rural areas with Internet access, NTC has set the minimum broadband speed in the country and required Internet service providers (ISP) to disclose average data rates per location. On August 13,2015, NTC issued Memorandum Circular No. 07-08-2015, requiring ISPs to have a “Broadband” data connection speed of at least 256 kilobits per second (kbps), an International Telecommunications Union standard speed. There have been efforts from the ISPs and the National Government to address this concern. However, it is more challenging for ISPs to build infrastructure and provide customers with dependable Internet connection. The country’s geographic condition impedes the expansion of telecommunication networks to rural areas.

3.3.3. Local Government Units and Other Government Entities

A lack of strong e-Government leadership and coordination among departments and various levels of government have been identified as areas of concern. “Red tape,” or bureaucratic procedures, is also among the challenges of the ICT industry. Telecommunication giants in the country say bureaucratic red tape hampers infrastructure that could improve data services in the country. Low Internet access is also a major concern. Digital literacy is increasingly crucial in order for people to participate in society. Many schools, however, are not yet fully equipped with Internet access and computing devices to help children become digitally literate. In addition, many teachers are insufficiently trained to teach ICT literacy. The need for sufficient ICT training lies in the hands of educators in order for students to gain a high level of digital literacy.

3.4 ICT Plans and Policies

3.4.1. The Philippine Digital Strategy (PDS) 2011-2016

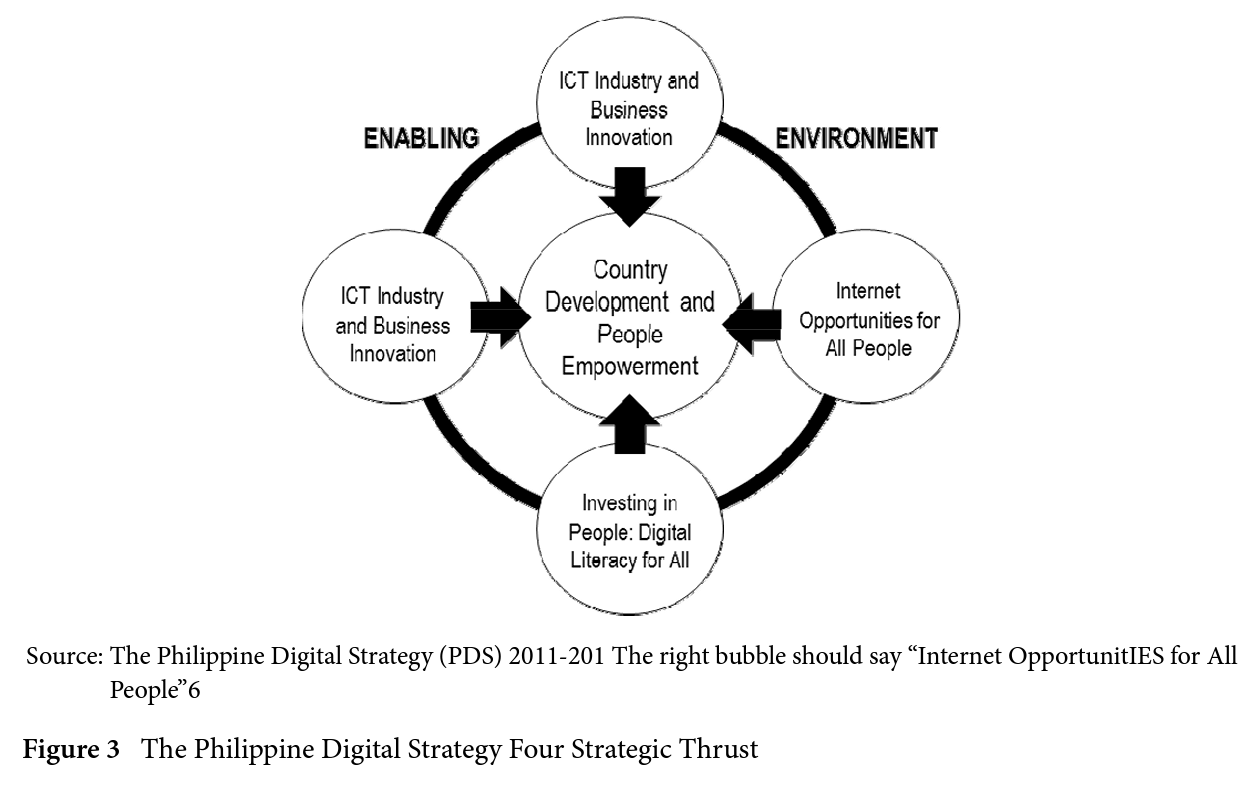

To address the growing concerns regarding the ICT industry, the Philippine Government, through the DOST-ICTO, has formulated its Philippine Digital Strategy (PDS) 2011-2016. PDS is the overall government plan for utilizing ICTs for Philippine development. The said document sets out a direction that would harness the potential of ICTs and respond to the global trends towards a digital economy and a knowledge-based society. It would also ensure that the country is prepared to compete in this digital economy and take advantage of the opportunities it offers. The plan is comprised of four strategies:!) Transparent Government and Efficient Services - recognize how ICT can help transform the delivery of government services to its citizens and businesses to make them more responsive, available, accessible, and efficient; 2) Internet Opportunities for All People - incorporate the development of the needed infrastructure to overcome the connectivity deficit in the Philippines and increase broadband coverage and penetration; 3) Investing in People: Digital Literacy for All - harness the potential of ICTs and respond to the global trends towards a digital economy and knowledge-based society while highlighting the fact that in order for the country to reap the many rewards that go along with a full-fledged digital economy, human capital development must keep pace with advances in technology. Investing in people benefits the economy by making them more competitive, creating more jobs, and encouraging economic growth; and 4) ICT Industry and Business Innovation for National Development - address the needs of the private sector, such as an enabling environment, skilled workforce, and a coherent national brand and positioning of the country as a leading ICT and BPO destination. Figure 3 shows the four strategic thrusts and how they are connected and supported through an enabling environment that empowers people and develops the country.

3.4.2. E-Government Master Plan

The DOST-ICTO also prepared the E-Government Master Plan (EGMP) to serve as a blueprint for the integration of ICTs for the government. The plan recognizes that the issue of interoperability and harmonization is not solely a technical problem but also one that includes many organizational concerns that need to be addressed. The plan also describes the systems of governance (e.g. institutions, agencies, processes, resources and policies) that need to be strengthened to make its implementation possible and sustainable. As the EGMP’s implementation strategy, the Medium-Term ICT Harmonization Initiative (MITHI) places a premium on government interoperability, collaboration, and shared resources. MITHI highlights the need to develop basic national electronic registries that will be used to support interoperability efforts. The E-Government Master Plan (EGMP) was prepared to serve as a blueprint for the integration of ICTs for the government. While this plan attempts to promote efficiency among government transactions, the need for faster Internet speed is necessary.

3.5 Internet Infrastructure

3.5.1. Internet Service Provider, and National and International Backbone

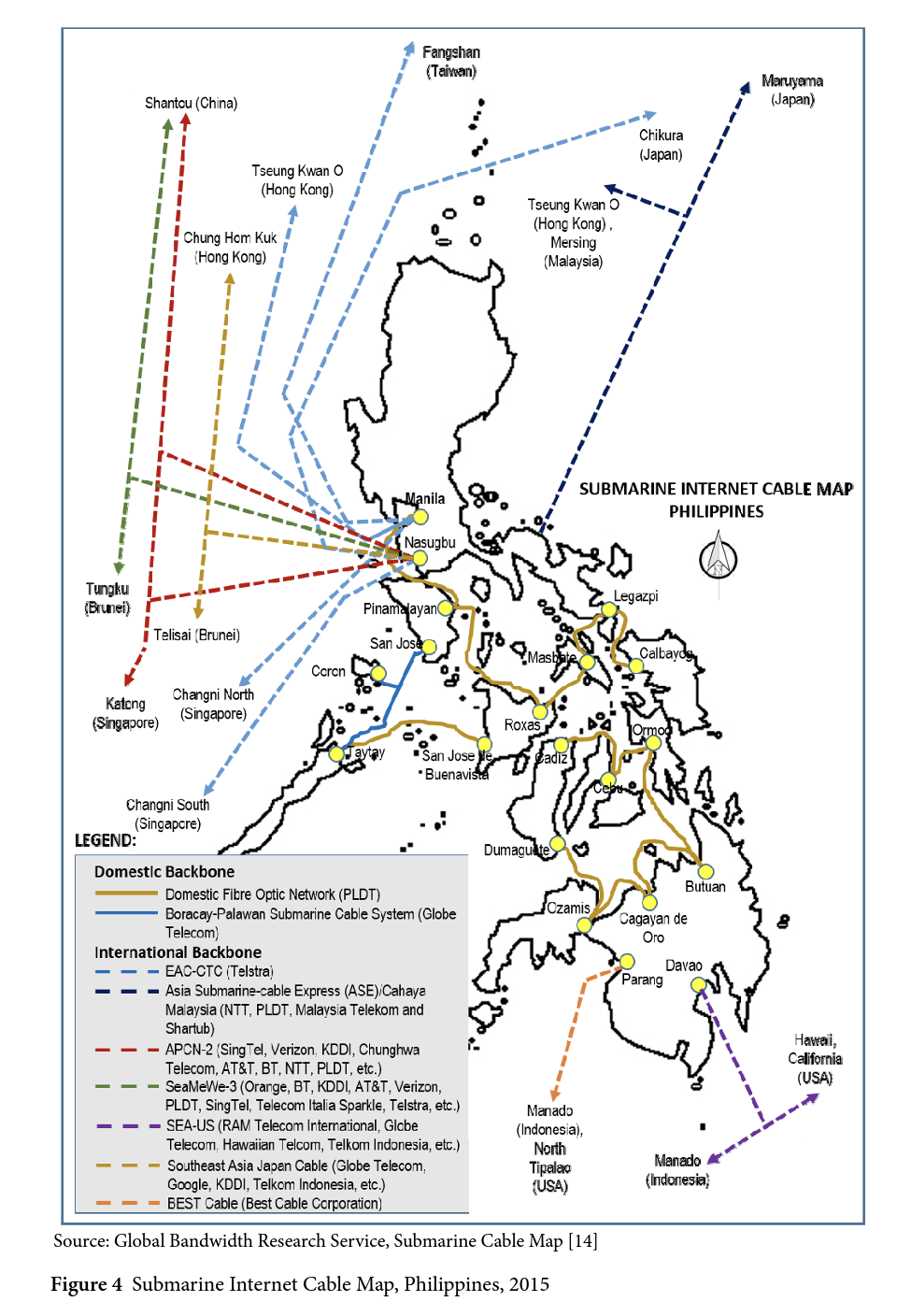

ISPs provide services that allow their end users to access, use, and participate in the Internet through email services and web hosting; they provide the equipment necessary to connect to the Internet. The local ISPs in the Philippines include Philippine Long Distance Telephone Company (PLDT), Globe Telecom, Smart Telecommunications, Sky Broadband, Bayantel, Mozcom, Eastern Telecoms, Wi-Tribe, and Converge ICT. PLDT is the most widely used ISP in the entire country. In 2014, PLDT HOME, through its DSL service, was recognized as the broadband provider with the fastest and strongest Internet connection among all the Internet service providers (ISP) in the country according to a nationwide market study conducted by the Philippine Survey and Research Center (PSRC). Having more undersea cables running across the country (see Figure 4), PLDT is referred to as an Internet Access Provider (IAP) and is considered the country’s national backbone.

Local ISPs connects to the national backbone, the PLDT, in order to connect to the Internet. In most cases, this interconnection cascades multiple times from one ISP to another, which are commonly called lAPs or core ISPs, until it reaches a Tier 1 network. A Tier 1 network company runs a facility in the network that can reach every other network on the Internet without purchasing IP transit or paying settlements for the peering. Larger ISPs with their own backbone networks agree to allow traffic from other large ISPs in exchange for traffic on their backbones. They also exchange traffic with smaller ISPs, allowing them to reach regional end points. Among the companies that belong to Tier 1 networks are AT&T of the United States of America and NTT Communications of Japan, while Vodafone of UK and Hurricane Electrics of US belong to Tier 2 networks. Figure 4 shows that there are only two different local players connected to the international backbones. PLDT is part-owner of the existing SeaMeWe 3, ASE, and APCN-2 international fiber optic submarine cable systems. The PLDT provides connection between the Philippines and the rest of Asia, Africa, and Europe. On the other hand, Globe Telecommunications Inc. is part-owner of the SEA-US cable system and Southeast Asia-Japan Cable (SJC) Systems which have a capacity of 17 terabits and is upgradable to 23 terabits. SEA-US connects the Philippines to the USA while SJC connects the country to the rest of Asia. Globe Telecom, however, relies on PLDT for its local transit as it has limited underground cables, as shown in Figure 4.

3.5.2. Internet Exchange Points

IXP provides a common place for ISPs to exchange their Internet traffic between autonomous network systems. The exchange points are often established in the same city or country to avoid latency. This process is also called “domestic peering.” A more detailed explanation of this Internet infrastructure and its advantages for the ISPs and their users has been given in the literature review (Part 2, Related Works). Peering generally involves no monetary compensation for using the peering partner’s network, while in a transit relationship, one party pays the other party for delivery of its data traffic to and from the rest of the Internet. IXPs operating in the Philippines are the Philippine Open Internet Exchange (PhOPENix), Philippine Internet Exchange (PhIX), Bayan Telecommunications Internet and Gaming Exchange, Manila Internet Exchange (Manila IX), and Globe Internet Exchange (GIX).

4. Philippine and Global ICT Situation Comparison

4.1. The Internet, Fixed (Wired) and Mobile Broadband Penetration, Internet Connection Speed and Connection Cost

The Internet in the Philippines has been undergoing development since it was first made available in 1994. In that year, the Philippine Network Foundation (PHNet) connected the country and its people to Sprint in the United States via a 64 kbit/s link. More recently, the Philippines was named the fastest growing Internet population in the last five years with a growth of 531% with regard fixed (wired) and mobile broadband penetration. The number of Internet users in the country has reached 39.8 million in a population of 100 million population, signifying Internet penetration of 39.8% by the end of 2014, and it is predicted to reach 66 million by this year. The Internet saw a 10% user growth in 2014. In 2013, the fixed broadband penetration of the country was 2.6 per 100 inhabitants, ranking 110 out of 190 countries. This figure is almost four times that of the world’s fixed broadband penetration of 9.4 per 100 inhabitants. On the other hand, the mobile broadband penetration was posted at 20.3 per 100 inhabitants, placing the country at a rank of 79 out of 138. This figure was closely similar the world’s mobile broadband penetration of 26.7 per 100 inhabitants. In terms of household broadband penetration, the country ranks at 57th among 160 countries surveyed with just 23 out of 100 homes having access to broadband Internet in 2013. In terms of Internet connection speed, the Philippines is among the countries with the slowest. In the 1st quarter of 2015, the average connection speed of South Korea, which ranks No. 1 in the world, was 23.6 mbps, while the Philippines had an average connection speed of only 2.8 mbps, 8 times lower than that of South Korea. South Korea’s rise to prominence with respect to its Internet broadband is discussed in the literature review (Part 2).

Table 3 Average Connection Speed, Asia Pacific Countries (APAC)

Global Rank | Country/Region | QI 2015 Avg. Mbps | QoQ Change | YoY Change |

1 | South Korea | 23.6 | 6.3% | 0% |

3 | Hong Kong | 16.7 | -0.4% | 26% |

6 | Japan | 15.2 | 0.4% | 4.0% |

12 | Singapore | 12.9 | 11% | 54% |

23 | Taiwan | 10.5 | -0.8% | 18% |

40 | New Zealand | 8.4 | 14% | 50% |

42 | Australia | 7.6 | 3.7% | 28% |

45 | Thailand | 7.4 | 4.2 | 43% |

73 | Sri Lanka | 4.8 | 12% | 71% |

78 | Malaysia | 4.3 | 4.7% | 22% |

84 | China | 3.7 | 7.6% | 17% |

94 | Vietnam | 3.2 | 19% | 57% |

104 | Philippines | 2.8 | 5.0% | 35% |

115 | India | 2.3 | 11% | 31% |

117 | Indonesia | 2.2 | 15% | -8.8% |

Source: The AKAMAIs State of the Internet, Report, QI 2015

Table 4 Cost of Internet Connection per Mbps, by Select Asian Countries

Country | Cost (US Dollar per Mbps) |

Philippines | 20.35 |

Indonesia | 18.83 |

Malaysia | 10.29 |

Singapore | 2.56 |

Thailand | 2.29 |

Vietnam | 2.25 |

Ookla Report, 2014

Table 3 shows that the country ranked 104th out of 144 qualified countries worldwide and 13th out of 15 Asia Pacific Countries (APAC). Although the country benefits from the presence of two fiber-optic backbone networks linking most parts of the country, the Internet speed remains very slow. With regards to cost, Table 4 shows that Philippine Internet users spend $20.35 per Mbps, compared to the worldwide average of $5.21 per Mbps. Is this right? I guessed here, as you did mention in what category Philippines ranked 161st. This cost placed the Philippines at 161st out of 202 countries in terms of cost of Internet connection per Mbps. One of the main reasons for the high cost of Internet in the country is that there are only two major service providers. The lack of competition in the market has kept the prices high.

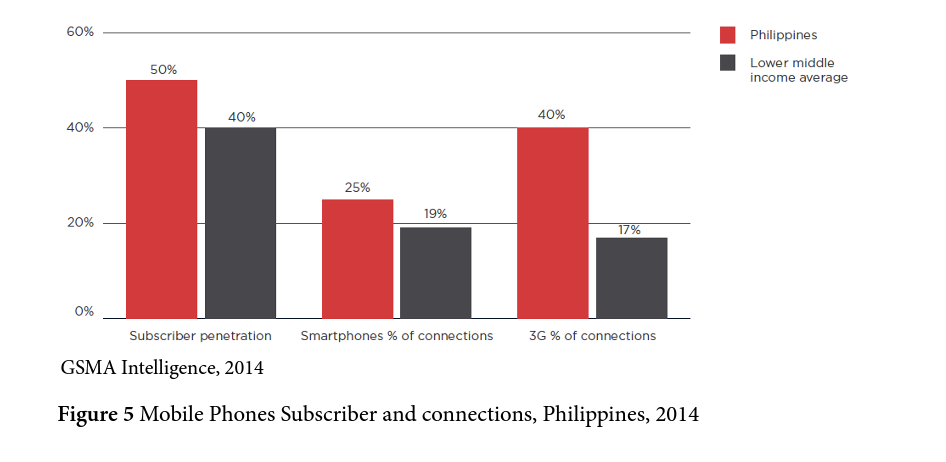

4.2. Mobile Phones Penetration

Mobile phone users in the Philippines are also rapidly growing and adapting quickly to new technologies. The country is well ahead of expectations given its status as a lower middle income country. Figure 5 shows that 50% of the total population subscribes to mobile services, with 3G penetration within 40%. Smartphone adoption meanwhile is around 25%, although some of these are 2G users, implying that that there is high demand for mobile Internet services from both low and higher end consumers. Hence, the country has been known as the “texting capital of the world” and the “social media capital of the world” at various times over the last few years. However, it is the level of consumer engagement with mobile technology that differentiates the country from its fast growing peers in Asia.

4.3. Networked Readiness Index (NRI)

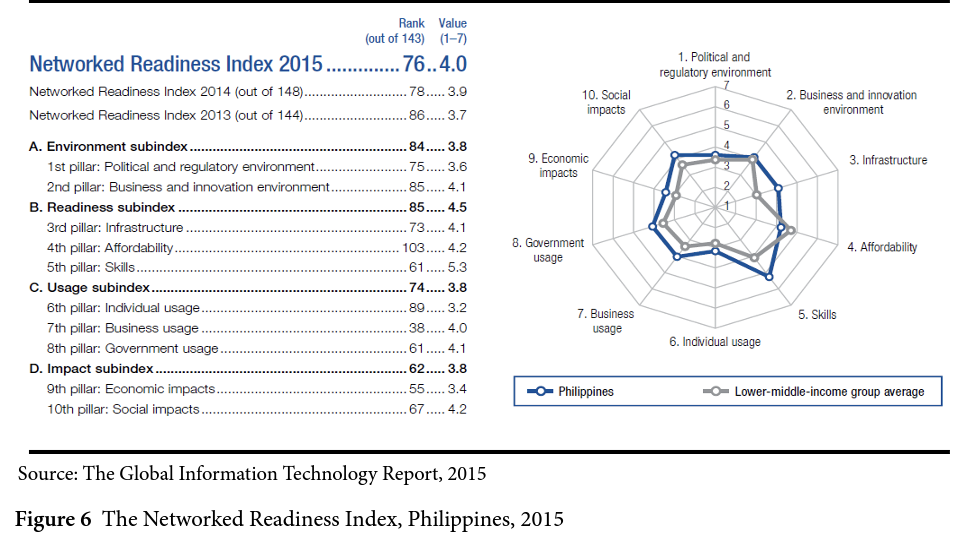

Several areas have slow progress, a situation which has placed the country in the lower rankings of the Global Information Technology Report 2015. Among these areas were low connectivity at a higher cost, weak e-government leadership, low Internet access, insufficient ICT teaching capability, and power shortages. The Global Information Technology Report assesses the state of networked readiness of 143 economies using the Networked Readiness Index (NRI) and examines the role of ICTs in supporting inclusive growth through a number of contributions by leading experts and practitioners. The Philippines is ranked 76th with an NRI value of 4, trailing far behind its Southeast Asian counterpart Malaysia, which had an NRI value of 4.9 and a rank of 32nd worldwide.

5. Analysis of The Value Chain in The Provision of Internet Access in The Philippines

5.1. Key players in the provision of Internet connectivity

5.1.1. Government Instrumentalities, ICT Plans and Policies

The country was ranked 95th in the e-government ranking according to the UN E-government Survey of 2014. This low ranking is attributed to the lack of strong e-government leadership and coordination among departments and the various levels of government, and these two factors have been identified as areas for concern according to the PDS. The government is also hindered from making progress in improving e-government services and increasing engagement with its citizens due to a lack of shared infrastructure, proper ICT tools, and sufficient capacity and training. It should be noted that while the goal is reasonable and critical for promoting innovation and competitiveness, the ICTO must strengthen its power to unite all the players in the industry under the goal of improving the Internet infrastructure of the country. There have been efforts from the National Government and the ISPs to address this concern. It is, however, challenging for ISPs to build infrastructure and provide customers with a dependable Internet connection. The country’s geographic conditions impede the expansion of telecommunications networks to rural areas. “Red tape,” or bureaucratic procedures, is one of the challenges of the ICT industry. Telecommunication giants in the country say bureaucratic red tape hampers infrastructure that could improve data services in the country. Low Internet access is also a major concern. Digital literacy is increasingly crucial in order for people to participate in society. The need for sufficient ICT training lies in the hands of educators who can enable students to gain a high level of digital literacy. These ICT skills are essential for the continued growth of the IT/BPO industry and other industries such as agriculture, tourism, fisheries, and manufacturing. The plans and policies that have been formulated and implemented, the PDS and the E-GMP, attempt to promote efficiency among government transaction. However, the need for faster Internet speed is still necessary, and this speed relies on the availability of wider bandwidth in the country. Although these plans provide concrete strategies and identify programs/projects that can upgrade ICT resources and utilize current human resources, Internet infrastructure is still considered a gray area of concern.

5.1.2. National Backbone and Internet Service Providers

Service providers are highly dependent on the access provider. Local ISPs, as part of the Internet structure, communicate to the Internet via an Internet Access Provider (IAP), a larger network that has access to the Internet. The ISP purchases transit to an IAP responsible for providing access and carrying customer traffic. ISPs do not require a major start-up investment. A server, authentication software, and a connection with the access provider are sufficient for them to operate. Given this setup, the economic or financial barriers when entering this market are minimal, and strong competition in this market segment should exist. Buying transit from an IAP, however, is costly, and as Internet users grow, ISPs grow, and purchasing transit is more likely to grow. In order to reduce the transit expenses, ISPs have to look for suitable networks with which to peer, as peering may lower the cost of transit. Domestic peering, which is practiced worldwide through the Internet Exchange Point (IXP), is not fully realized. The international standard for Internet Service Providers (ISP) requires countries to have their own IXP (Internet Exchange Point) to allow for the faster exchange of local traffic from other local ISP customers. The Philippine Government has established the Philippine Open Internet Exchange (PHOpenIX) through the National Telecommunication Commission (NTC). This IXP is used by almost all the ISPs, including Infocom, Evoserve, Pacific Internet, Globe (Sky & Bayan) but is not used by PLDT (Smart), which is the widest used ISP in the country. Regarding Internet backbones, there are only two different players in the country that are connected to international backbones. Although these companies

have been taking efforts to upgrade their infrastructures, they cannot meet the demands of the enormous growth of Internet penetration throughout the country.

5.2. Challenges in the Provision of Internet Infrastructure and Connectivity

5.2.1. The Internet Service Provision Market

Like many developing countries that suffer from slow Internet connectivity, the bottlenecks mainly result from the fact that the entire infrastructure used in providing Internet connection is in the hands of the incumbent operator. In the current set-up in the Philippines, the incumbent operators are privately-owned companies. Akue-Kpakpo (2012) argues that in the value chain, these companies are vertically integrated and control the process from end to end, which sometimes result in imperfect competition since incumbents may use a number of ploys to restrict competition. As ISPs are dependent on them, IAPs may apply full control in their Internet service provision through actions such as denying them access to the wired local loop and refusing to lease international bandwidth. IAPs in the country are also among the competitors of the local ISPs. This denial and refusal concern may occur since NTC has no direct hand in the negotiations between the two parties. Carriers, however, are required by law to make network components available to competitors, allowing full interconnection. Prices and fees, however, are negotiated by the interconnecting parties, which causes potential for unhealthy competition. As discussed in Part 2 (Related Works), competition is crucial to the healthy development of a market. Competition for services of the market should be fostered through performance monitoring schemes, setting of connection speeds, and introducing service level agreements for broadband services. The Korean example of creating policies that strengthen deregulation and competition provides a potential solution to these problems.

5.2.2. Internet Infrastructure and Geographical Settings

Being an archipelago presents a challenge for interconnectivity. For a country with 7,107 islands with some separated by vast seas, the investment on installing fiber optic cables is considerable. This is likewise a challenge to the country’s energy sector since interconnection of the National Grid requires another large investment. Not all the islands are connected to the grid such as the Island of Mindanao, the second largest island of the country. Figure 3-3 shows that the undersea cable of the two local ISPs does not connect to all the islands. As Internet and mobile penetration of the country increases, Internet bandwidth also increases. This means that installing additional undersea fiber optic cables is necessary, which means an additional investment for the IAPs. As stated in the previous chapter, the Philippines was named the fastest growing Internet population in the last five years with a growth of 531%. This rapid growth in a short span of time would incur a great amount of adjustment from IAPs. With the growth in end users for immediate high bandwidth and the inability of service provider deployments to meet those needs, service providers find themselves stranded. The country has excellent access to multiple international submarine cables as shown in Figure 4 and, consequently, has above average international bandwidth capacity). A recent upgrade by the leading telecommunications and multimedia company PLDT was announced in August 2014. PLDT has partnered with Hong Kong-based PCCW Global to undertake a new international fiber optic project, the Asia-Africa-Europe 1 (AAE-1) Cable System through a 25,000-kilometer undersea cable network system that will connect Asia, the Middle East, East Africa, and Europe and provide 100 Gigabits per second (Gbps) with a minimum capacity use of 10 Gbps. In August 2012, PLDT also announced that it had doubled its international bandwidth capacity and raised the resiliency of its overseas links with the completion of a $400-million 7,200-kilometer Asia Submarine-Cable Express (ASE) optical fiber cable system. PLDT shared a $55 million investment with leading telecom firms in Asia. The undersea cable network uses 40 Gbps technology that is upgradeable to 100 Gbps with a minimum design capacity of 15 TerabitsO However, the upgrading was only for international traffic. Tier 1 network and international IAPs have major investors that have provided large bandwidths capable of carrying out heavy traffic from countries all over the world. The real bottleneck is in the local traffic, a topic that has not been addressed in recent years.

6. Recommended Solutions to The Growing Internet Infrastructure Demand in The Philippines

The ICT revolution has shaped the country’s economy, culture, and governance. The government, therefore, should take hold of the opportunities that ICT provides by enhancing the Philippine Internet infrastructure, which is necessary for different sector to participate in the information and communication economy, especially considering that the Philippines is receiving more attention in the world as one of Asia’s fastest growing economies. To this end, the country has to resolve some weaknesses to provide full utilization of its strengths by tapping its economic potentials and advantages. Development requires a determined leadership and coordination across government departments, industry, and the people. Based on the above-mentioned analysis, the following are recommended: 1) Provide a mechanism that creates a special fund to ensure that profits from the ICT industry remain in the ICT industry. Money from the fund should be used to support ICT-related R&D, develop and diffuse standardization in ICT industry, train ICT human resources, promote broadband network rollout, and promote e-Government (see Related Works);

2) Strengthen policy that will force ISPs and IAPs to avoid violating NTC regulations; 3) Promote an arena of competitiveness to cause market disruption, which may naturally resolve the high cost of Internet connection services. This could invite additional players to stir competition and help lower prices and improve services; 4) Strengthen policies that force ISPs to use the Philippine Open Internet Exchange (PHOpenIX) for domestic peering. The purpose of this measure would be to minimize the part of an Internet Service Provider’s (ISP) network traffic that went through an upstream provider. In addition, while the setting of the minimum broadband speed of256 Kbps in the country was a decent start to compel ISPs in improving their services, there is still a need to increase the minimum broadband speed in the future. The 256 Kbps minimum speed is ideal only for home and small business enterprises; medium to large companies and government agencies ideally need a steady download speed of at least 4-8 mbps; 5) Strengthen implementation of TV white space (TVWS) utilization that can reach out and bring connectivity to remote areas of the country. TVWS is a wireless data communications standard technology that uses vacant frequencies located between broadcast TV channels to provide wireless data connectivity; 6) Improve the spirit of innovation in the Internet sector by supporting academe (Universities and Colleges) and ICT startups; and 7) provide incentives for privately-owned ICT research and development institutions.

7. Conclusion and Future Work

This study focused on the need for the Philippine government to intervene in the current Internet infrastructure industry market by carefully formulating policies to promote competition. The accomplishments of broadband leading countries, especially the Republic of Korea, in terms of broadband provision have offered interesting lessons. There are only two major players in the industry, which results in a tendency for them to be complacent about improving their services. Thus, only limited bandwidths are available for Internet users. In such a situation, only 50% of the leased bandwidth is made available by the ISPs for the users during peak hours in order to accommodate the entire nation, a practice called “bandwidth throttling”. This practice is common worldwide because it minimizes the part of an Internet service provider’s network traffic that went through an upstream provider and allows for a faster exchange of local traffic from other local ISP customers. Hence, it is necessary to enjoin ISPs to connect to a common IXP such as the Philippine Open Internet Exchange (PhOPENix) established by the Philippine Government, in spite of the challenges doing so presents for government instrumentalities. The role of the government in stirring the competitiveness of the Internet infrastructure industry is also a significant factor that could address this concern. The intensification of competition makes the quality of products/services the most important factor in ensuring economic competitiveness. The cost of Internet connection services will also be reduced due to the competitive market. The identification of the specific bandwidth of the local, national, and international backbones is not included in this study due to limited resources. The details of this bandwidth could enhance the analysis of this study. There are also current developments made by the ISPs that were not included in this paper due to the limited information they provided. Hence, for future work, such data should be included in order to provide an analysis with more specific recommendations and conclusions. The presence of a domestic backbone with a capacity to convey larger volumes of data will help revolutionize the Internet industry in the country.

References

- Basa, M., 2015, Slow Internet? Blame Red Tape: TelCos, Published in Rappler January.

- Belson, D., J. Thompson, J. Sun, R. Moller, M., Sintorn and G. Huston, 2015, AKAMAI's State of the Internet Q1 2015 Report. AKAMAI Technologies.

- Blackman, C. and L. Srivastava, 2011, Telecommunications Regulation Handbook, Tenth Anniversary Edition. International Telecommunication Union (ITU), The World Bank, InfoDev and International Finance Corporation.

- Chapin L. and C. Owens, 2005, Interconnection and Peering among Internet Service Providers: A Historical Perspective, Interisle Consulting Group.

- Dr. Peering International, 2010, Internet Transit Prices: Historical and Projected, Internet Peering White Papers.

- Dutta S., T. Geiger and B. Lanvin, 2015, The Global Information Report Technology, World Economic Forum.

- DOST-ICTO, 2011, Philippine Digital Strategy 2010-2016. Information and Communications Technology Office (DOST-ICTO).

- Jensen, M., 2013, Promoting the Use of Internet Exchange Points: A Guide to Policy, Management and Technical Issues, Internet Society Report.

- Kim Y., T. Kelly and S. Raja, 2010, Building broadband: Strategies and Policies for the Developing World. Global Information and Communications (GICT) Department, World Bank.

- Yun K., H. Lee and S. Lim, 2002, The Growth of Broadband Internet Connections in South Korea: Contributing Factors. Asia/Pacific Research Center, Stanford University, Stanford, California.