Analysis of development of savings and loans unit in the cooperative of the republic of indonesia prosperous of cirebon district

Published: Jan. 1, 2020

Latest article update: Nov. 16, 2022

Abstract

The development of the savings and loan cooperative system today needs an increase that can make the system even better and correct according to the rules and laws of the Republic of Indonesia. The current cooperative system provides many loans and savings so that to make a good system it must do research that discusses it. Thus in this study discusses how the analysis of the development of cooperative systems in the savings and loan units of the cooperative of the Republic of Indonesia prosperous employees of Cirebon district, in this study explained how the process and review of the savings and loan cooperative system so far, its development, role and what are the factors that exist in the system this savings and loan cooperative

Keywords

Analysis, Development of Saving, Cooperative Unit

INTRODUCTION

In the context of developing cooperatives as business entities, basically what needs attention is how to choose the right institutional system that better supports the development of economic activities with the aim of supporting the welfare of society at large. In other words, the emphasis will clarify the importance of the existence of business entities that are managed by and for the community. This is very relevant to the existence of cooperatives. The development of economic activities in accordance with this context is economic activity which also aims to increase the added value of available resources developed with a business approach, as well as economic activities that develop towards ensuring high participation from the community.

In this case, not only participation in participating in enjoying the results of the development of economic activity. Furthermore, the existence of cooperatives is considered important if the development of economic activities is also oriented towards increasing the dignity and dignity of the community, both directly and indirectly. In this connection the discussion of cooperative development becomes very relevant and the need for concrete commitment and support from various parties who have competence, such as from universities in actually participating in supporting cooperative development.(Suhartono, 2011)

Based on experience, mutual assistance activities (mutual cooperation, solidarity, and economic calculation) between individuals and businesses will be more successful in overcoming both social and economic problems. Especially in the face of a market economy where market competition is very tight will cause SMEs increasingly powerless. In this economic helplessness, economic forces such as large businesses will dominate SMEs both in marketing their products and in providing the means of production. This causes small and medium enterprises to join in a forum (organization), by helping each other and working together not only to deal with oligopolies and monopolists, but also to increase the ability to produce and market their products. The organization is called a cooperative. In this chapter the history of pioneering the development of cooperative organizations will be elaborated on which began in Europe and spread throughout the world including Indonesia. (Partomo, 2004)

Cooperative is a form of business entity that is expected to play a role in the national economy. Where the cooperative as a pillar of the national economy whose main task is to empower the economy of the people in general and members in particular. One of the functions in carrying out this task is to collect funds from members who have excess capital in the form of savings and help members who need or lack of capital channeled in the form of loans through business units that handle this activity, namely the cooperative savings and loan unit (USP).(Partomo, 2004)

KPRI is a cooperative established by civil servants and managed for the benefit of civil servants. Therefore, KPRI in its activities is more focused on the welfare of civil servants as members.(Suhartono, 2011)

KPRI Sejahtera Cirebon Regency is a cooperative formed to prosper the community, especially employees of the Health Department and Cirebon District Hospital. The development of KPRI Sejahtera was very good in managing cooperative products, KPRI established several business units namely the Savings and Loans Unit, the Waserda Unit, the ATK / Photocopy Unit and the Vehicle Workshop / Washing Unit. With increasing quantity and savings members can provide effort for their members as well.

The reason for choosing the location of this apprenticeship at KPRI Sejahtera is that this cooperative is a fairly large cooperative and its development is quite interesting, where it can be seen from the large number of members, capital and also the high value of savings and loans in the savings and loan unit This cooperative, it is in line with the purpose of this study is to focus on the development of savings and loan units.

From the explanation above, the authors are interested in conducting research by taking the title "Analysis of the Development of Savings and Loans in the Cooperative Employees of the Republic of Indonesia (KPRI) Prosperous District of Cirebon". The objective is to analyze the development of savings and loan units in order to meet the members' capital needs, to find out the factors that influence the development of the KPRI Credit Savings Unit in Cirebon Regency.

METHOD

This research uses descriptive design. The purpose of descriptive research design as explained by Sakaran (2008) is to describe the aspects that are released from a phenomenon that researchers study from an individual, organization, industry, or other perspective. Thus descriptive research presents data in a very meaningful form so that it helps to understand the characteristics of a group, helps in systematic thinking about aspects of a particular situation, provides ideas for further search and research, and helps in decision making. The research design shows the research process from planning to analysis to obtain research findings.(Ekasari et al., 2017)

RESULTS AND DISCUSSION

Data analysis

As we know since the birth of the new order, all aspects of people's lives in general and economic life in particular have undergone significant changes. The management of economic activities is guided by the references contained in article 33 paragraph 1 of the 1945 Constitution, which is based on the principle of kinship and is reflected in the mutual cooperation system which forms the basis of the order of life of the Indonesian people since long ago. Based on the provisions of Article 33 Paragraph 1 of the 1945 Constitution in which there is a mutual cooperation principle, the appropriate economic form is Cooperative.

Seeing the guidelines above and seeing the needs of the employees of the Cirebon District Health Office at the time and the intention to prosper the employees, a meeting was held between all employees of the Cirebon District Health Office. So based on deliberations between all employees of the Cirebon District Health Office proposed by the Head of Service where in the deliberation resulted in an agreement to form a forum that is a Cooperative.

At that time the Cirebon District Health Service Office, located on Jalan Kesambi Cirebon, which was headed by Dr. H. Achmad Ali oversees approximately 17 Puskesmas spread across Cirebon Regency with a total number of 190 employees having an initiative to establish a container for the welfare of the community especially employees of the Cirebon District health department.

So based on the results of the deliberation in 1977 the Office of the Cirebon District Health Office tried to establish a Cooperative which was later given a name “SEJAHTERA”. Where as the founder of the Prosperous Cooperative is Mr. Dr. Achmad Ali, as Head of Office / Rand ep. Cirebon District Health, Mr. Ali Bin Seff as Deputy Head of Service, Mr. H. Тагу о Adnan R and Mr. Maskud.

Membership in KPRI Sejahtera in 2010 was 2,007, in 2011 it declined 9 people from 2010 to 1,998. in 2012 decreased by 38 people from 2011 to 1,960 people, in 2013 decreased by 22 people from 2012 to 1,938 people. Whereas in 2014 to 1,927. In 2015 there was an increase of 18 people from 2014 to 1,945 people and in 2016 it increased to 1,952 people, and finally in 2017 the number of KPRI members was 2,013 or up 61 people from 2016.

Based on the results of this interview, it can be concluded that:

- The Micro Islamic Waqf Bank already has a good marketing implementation, the community around the Islamic boarding school already knows the existence of this institution and the program owned by the Waqf Bank. The program owned by this institution is in the form of a financing product for developing small and medium enterprises for the poor and the product has a very low margin of around 2%. Even though this institution was only formed in 2017, its existence has spread to remote villages.

- The sharia marketing strategy used by the Kempek Micro Syariah Waqf Bank is in the form of God, which has a religious nature, a sharia marketer believes that Allah is always close and watches over him when he is carrying out all his activities. The second is Akhlaqiyyah, his character which prioritizes morals and morals. Third is Realistic, flexible marketing concepts, innovation with market conditions. Fourth is Humanistic, Islamic

humanistic sharia is created for humans according to their capacity without distinguishing race, color, nationality and status. Supporting factors in the implementation of marketing strategies are that the area coverage is not so broad so it does not need to require a good strategy. The name of the Waqf Bank is already great because it carries the distinctive name of Kempek. While the inhibiting factor may be that the Waqf Bank has not involved the typical Kempek santri in the company's operations. - Development of Deposits in the KPRI Sejahtera Savings and Loans Unit

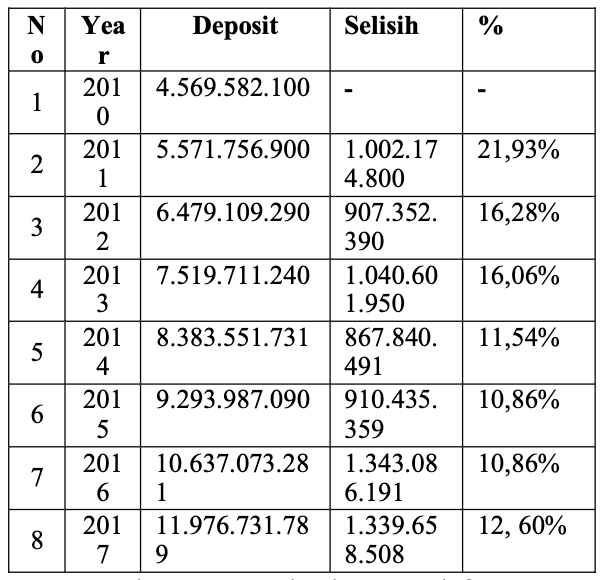

To clarify the picture of the development of the Republic of Indonesia Prosperous Employee Cooperative savings for 8 years can be seen in the table below:

Based on the table above, it can be seen that the savings collected and owned by development cooperatives every year always increase. In 2010 to 2011 member savings increased by 21.93% or a nominal equivalent of Rp. 1,002,174,800. In 2012 cooperative deposits increased by 16.28% or equivalent to Rp. 907,352,390. In 2013 cooperative deposits increased by 16.06% or a nominal equivalent of Rp. 1,040,601,950. In 2014 cooperative deposits increased by 11.54% or a nominal equivalent of Rp. 867,840,491. In 2015 cooperative deposits increased by 10.86% or a nominal equivalent of 910,435,359. Whereas in 2016 it increased by 14.45% or a nominal amount of Rp. 1,343,086,191 and in 2017 the increase in deposits that occurred was 12.60% or a nominal amount of Rp. 1,339,658,508.

The largest increase in deposits occurred in 2011 as indicated by a percentage of 21.93%. In general, the increase in deposits made by members was due to the increase in the main initial savings of Rp. 250,000 increased to Rp. 500,000. besides the entry and exit of members (the number of members) also affects the development of the value of deposits in the cooperative savings and loan unit.

Development of Loans in the KPRI Sejahtera Savings and Loans Unit

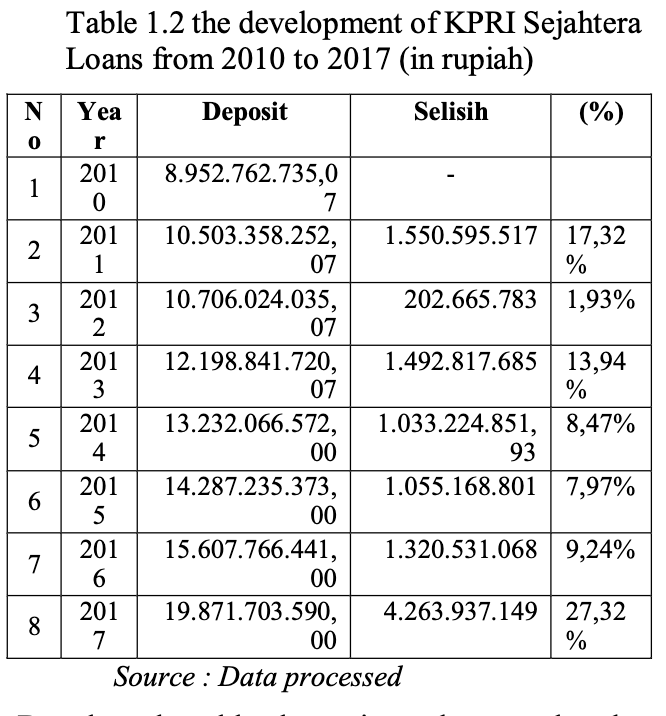

The development of loans referred to here is the granting or channeling of loans by cooperatives to cooperative members. To clarify the picture of the development of loans in the Savings and Loans Unit of the Republic of Indonesia Prosperous Employees Cooperative District of Cirebon for 8 years can be seen in the table below:

Based on the table above, it can be seen that the development of loans by members or which also means loans extended or provided by cooperatives to members always increases. In 2010 the total loan amounted to Rp. 8,952,762,735.07 and an increase of 17.32% or as much as 1,550,595,517 in 2011. In 2012 the number of loans increased by 1.93% or as much as Rp. 202,665,783. In 2013 the number of loans increased by 13.94% or as much as Rp. 1,492,817,685. In 2014 the number of loans increased by 8.47% or as much as Rp. 1,033,224,851.93. In 2015 the number of loans also increased by 7.97% or as much as Rp. 1,055,168,801. while in 2016 it increased by 9.24% or as much as Rp. 1,320,531,068 and in 2017 the increase in loans that occurred was 27.32% or as much as Rp. 4,263,937,149

Discussion

- Development of Deposits in the KPRI Sejahtera Savings and Loans Unit

Based on the results of research and interviews with KPRI Sejahtera employees, that the value of deposits owned by KPRI Sejahtera experienced significant development. This can be seen from the development of the value of savings which always increases every year from 2010 to 2017, recorded from 2010 to 2017 the value of savings in savings and loan units of KPRI prosperous always increases. The biggest increase occurred in 2011 in the amount of 21.93% or equivalent to Rp. 1,002,174,800.

Savings owned by the KPRI Sejahtera savings and loan unit come from the principal savings and mandatory savings paid by members, where the principal savings and mandatory savings are the main sources of own capital owned by the cooperative savings and loan unit which will later be used to run the business wheel rotation of the savings unit borrow it. The increase in the value of deposits owned by the KPRI prosperous savings and loan unit is inseparable from the increase or increase in the value of the principal savings which originally amounted to Rp. 250,000 to Rp.500,000. in addition, the quality of services provided by cooperatives to members also affects the development of the value of existing deposits in the cooperative. As a form of providing these services, cooperatives make a policy where the mandatory savings by members are deducted directly from the salary received by members each month, so members do not need to come directly to the cooperative to pay it.

The development of the level of savings in the cooperative savings and loan unit is very influential on the business development of cooperatives, from which savings cooperative capital comes from. The greater the level of deposits owned by cooperatives, the greater the ability of cooperatives to provide capital that will be used to run their businesses and provide loans to members. In theory (Soedirman, 2006: 4) explained that it is important for members to play an active role in every activity carried out in cooperatives, because the progress of the cooperative is determined on the participation of members. And cooperatives must provide adequate services in every activity carried out, as well as provide information, contribute capital, determine the programs that must be carried out by management and oversee the running of cooperatives. So that members prefer cooperatives to other business entities. Participation in this case is the participation of members in paying principal savings and compulsory savings as well as the utilization of cooperative services themselves, as a result the greater the participation of members the greater the opportunity for cooperatives to develop.

- Development of Loans in the KPRI Sejahtera Savings and Loans Unit

During the past seven years or rather from 2010 to 2017, the development of loans in the KPRI Sejahtera savings and loan unit has always been increasing every year. The biggest increase occurred in 2017, amounting to 27.32% or equivalent to Rp. 4,263,937,149 the increase cannot be separated from the many members of the cooperative participating in the savings and loan unit.

Based on the results of research and interviews with employees and members of the KPRI Sejahtera Cirebon District, the development of the number of loans in the KPRI Sejahtera savings and loan unit is inseparable from the efforts made. The effort to attract members' interest is by providing a very easy process, only with the requirement of photocopy of ID card, stamp duty and letter of submission. Making loans here is also more practical because payments are deducted directly from the salaries of the members themselves. Compared to other financial institutions, KPRI Sejahtera gives SHU to its members.

The higher the number of loans in the KPRI Sejahtera savings and loan unit, the greater the benefits obtained by the cooperative. This will have a very good impact on the development of a cooperative savings and loan unit in order to meet the needs of

members and capital requirements for their members

- The role of the KPRI Sejahtera Savings and Loans Unit in order to meet the needs of members

Based on the results of research and interviews, the role of savings and loan units in order to meet the needs of members is quite good, it can be seen from the value of deposits and the value of loans that continues to increase. This increase illustrates that cooperatives are able to meet the needs of their members.

The purpose of the existence of a savings and loan unit is to help the credit needs of members who are in dire need with light conditions, educating members to actively save regularly so that they can form their own capital and educate members to live frugally by setting aside a portion of their income. So the role of the KPRI Sejahtera loan union simulation greatly affects the members 'needs, so the members' welfare is also fulfilled.

- Factors influencing the development of the KPRI Sejahtera Saving and Borrowing Unit in Cirebon Regency

Capital

Capital owned by KPRI Sejahtera Cirebon Regency comes from own capital and external capital. Own capital is the main source of income for cooperatives derived from the principal savings and mandatory savings paid by members. Capital is a factor that influences the development of KPRI Sejahtera because with increasing capital the cooperative can be easy to develop. This is reinforced from the data on the value of capital owned by the cooperative itself. Noted from 2010 to 2017, the value of Sindiri capital owned by cooperatives continues to increase every year, in 2011 increased by 21.93% from 2010, in 2012 increased by 16.28%, in 2013 increased by 16, 06%, in 2014 it increased by 11.54%, in 2015 it increased by 10.86%, in 2016 it increased by 14.45% and in 2017 it increased by 12.60%. The biggest increase in equity occurred in 2011 which amounted to 21.93% or Rp. 1,002,174,800.

Increasing their own capital, cooperatives have a great opportunity in their efforts to provide loans to their members, from the opportunity to provide loans to these members, the benefits of cooperatives will always increase and be large. Of the magnitude of these benefits will have an impact on the development of cooperatives.

Participation

Based on the results of the study can be obtained data that states that the development of the value of deposits and the value of loans in KPRI Prosperous Cirebon District continues to increase. The development of the value of deposits occurred in 2010 to 2017, where the biggest increase occurred in 2011 which amounted to 21.93% or equivalent to Rp. 1,002,174,800. Whereas the biggest increase in loan value occurred in 2017, amounting to 27.32% or equivalent to Rp. 4,263,937,149.

The increase in the value of deposits held by cooperatives is a reflection of the increased participation of members in providing financial contributions by paying principal savings and compulsory savings which are the main sources of cooperatives. The higher the contribution made by members, the greater the capital owned by the cooperative, so that the cooperative will be able to provide greater opportunities in providing loans to its members, so that the benefits obtained by cooperatives will be even greater. While the development of the value of loans owned by cooperatives is a reflection of the increased participation of members in the utilization of cooperative services in making loans, it will provide a large profit to the cooperative.

The higher the participation of members, the greater the capital and profits gained by cooperatives, this will have an impact on the development of cooperative savings and loan units. Capital and profits provided by the participation of members affect the development of cooperatives. So that from the capital and profits the cooperative can run the business well, and have an impact on the development of cooperatives.

CONCLUSION

Based on research that has been done by researchers, the following conclusions can be drawn:

- The development of savings in the KPRI Sejahtera savings and loan unit for 7 years has increased from 2010 to 2017, recorded from 2010 to 2017 the value of deposits in the KPRI prosperous savings and loans unit has always increased. The biggest increase occurred in 2011 in the amount of 21.93% or equivalent to Rp. 1,002,174,800. The increase in the value of deposits owned by the KPRI prosperous savings and loan unit is inseparable from the increase or increase in the value of the principal savings which originally amounted to Rp. 250,000 to Rp.500,000. in addition, the quality of services provided by cooperatives to members also affects the development of the value of existing deposits in the cooperative. As a form of providing these services, cooperatives make a policy where the mandatory savings by members are deducted directly from the salary received by members each month, so members do not need to come directly to the cooperative to pay it.

- The development of loan value over the past seven years or rather from 2010 to 2017, the development of loans in the KPRI Sejahtera savings and loan unit always increases every year. The biggest increase occurred in 2017, amounting to 27.32% or equivalent to Rp. 4,263,937,149 the increase cannot be separated from the number of cooperative members participating in the savings and loan unit. The increase was inseparable from the cooperative's effort in facilitating the loan process to its members.

- The development of the KPRI Sejahtera savings and loan unit is growing rapidly with the fulfillment of the members' needs, such as the need for member funds provided in the form of loans which from the fulfillment of this also impacts on the welfare of its members

REFERENCES

- Ekasari, R, Pradana, M. S., Adriansyah, G., Prasnowo, M. A., Rodli, A. F., & Hidayat, K. (2017). Analisis Kualitas Pelayanan Puskesmas Dengan Metode Servqual. Jurnal Darussalam: Jurnal Pendidikan, Komunikasi Dan Pemikiran Никит Islam, 9(1), 82. https://doi.org/10.30739/darussalam.v9i1.118

- Partomo, T. S. (2004). Usaha Kecil Menengah Dan Koperasi. (9), 1-16.

- Suhartono, I. (2011). Strategi Pengembangan Koperasi Berorientasi Bisnis. Jurnal.Stiema.Ac.Id, 4(7), 33-47.