Tax audit of legal entities, assisted by informational technology performed from revenue authorities

Published: July 31, 2022

Latest article update: Aug. 22, 2022

Abstract

This paper aims to explain how an information system upgrade aids tax authority efficiency in a developed country with significant deficiencies and weaknesses in its tax system and citizens’ tax awareness. Simultaneously, this research considers modern tax audit methods and their effect on legal entities. Through literature review, a questionnaire was drafted and sent to state tax auditors responsible for public revenue. As a result, a research tool was created to measure changes in a period of ten years regarding tax audit and the extent informational audit tools help to simplify the audit task. For the purpose of homogeneous empirical research, the sample used relates to Audit Data Analytics (ADA) auditors from a new body of controllers utilizing modern informational technology systems. Regarding offered utility and assistance from a tax system tool; auditors can facilitate and identify a tax offence more effectively in matters of time as well as credibility of each case. Greece as a turbulent sample country through turmoil originating from events such as the 2009 fiscal crisis, a series of tax reforms and political instability can explain the intricacies a state faces in order to formulate consistent tax audit authorities supported by informational systems.

Keywords

Tax authorities, informational systems., audit tools, tax legislation, Tax audit

INTRODUCTION

Changes in audit procedures, tax administration, tax legislation and tax policy in general have been the subject of various studies in recent years. In Greece, tax control is a very important mechanism of the state, because it contributes to the compliance of businesses with the law, to the increase of public revenues and to the equality of citizens' participation in tax debts. Most profitable companies are often targets of tax audits, which are the best sources of government additional taxes (Larina, 2005). Tax audit is currently at a critical stage in its development as there is a growing demand for audit services. Audit of taxpayers has been defined as the activity carried out by the tax authorities in order to detect whether there is a non-fulfillment of tax obligations (Das-Gupta and Gang, 1996). A tax audit is generally defined as the examination of whether a taxpayer has properly prepared his financial statements, has correctly assessed and submitted his tax liabilities and has fulfilled all his other obligations in accordance with the tax law system in general (Grampert, 2002). In addition to the above, the concept of 'tax audit' also includes all the actions aimed at gathering the necessary information and evidence to properly evaluate the financial position of a company in order to obtain an accurate and complete picture of the financial activities of the company, its competence and scope of activity. All of the above will ultimately lead to safe conclusions and an accurate assessment of its tax liabilities (Dilip and Swapan, 2002). It is a fact that in an increasingly competitive globalized environment, the objective of the national economy is to create an advanced and dynamic tax system that will provide the necessary public revenue and help improve the country's international competitive position (Bronchi, 2001). However, tax systems are not just a simple fiscal policy process for a country. The legal, political, organizational and socio-economic aspects must also be taken into account when adopting a tax system (Robbins, 2002). The key factors to tackle tax evasion and increase tax audit efficiency were found in matters of flexibility and effectiveness (Guyton et al., 2018). Moreover, the combination of reliable but simple and efficient procedures in a user-friendly system were found significant, similar to that of an auditor’s training (general and specialized). The purpose of this investigation is to properly reflect the views of the Independent Authority for Public Revenue auditors on the utility of audit tools, the complexity of the procedures, the legislation and the general difficulty in identifying tax offenses. To achieve the purpose of the work more fully and to better understand the data and data presented, the work consists of five chapters.

LITERATURE REVIEW

The concept of tax audit

del Buey Torres (2004) conducted a tax audit. The purpose of this study is to provide insights on tax audit aspects, both private and public. The conclusions argue that the scope of a financial audit in the tax area should approach all non-compliant energy tax methods. Concerning the similarities of audit at international level, it is stated that external confirmations, computer systems and dynamic analysis are used to prove the financial position of the company. The results also suggest that the auditor is responsible for a financial fraud when he or she deliberately conceals information about it. Chatzipanagiotou (2010)’s research attempted to identify significant problems during the tax audit and to indicate that tax authorities should use simple and directly applicable practices. The proposed interventions focus on four areas that address the most effective use of human resources, the training of workers, the positive change of public opinion and the use of modern technology. In particular, the proposed practices mentioned in the research focus on:

1. Changing organizational culture to serve the citizen / customer and increase efficiency and speed of operations.

2. Providing citizens with instant access to existing electronic services.

3. Effective and equitable use of human resources resulting from the application of modern practices and methods of personnel management and evaluation

4. Providing education through distance learning and the use of experiences, special skills and skills.

5. Adopt and adapt good practice internationally.

6. Training and orienting citizens on their tax obligations and rights through the creation of online educational sites.

7. Developing tax awareness through the introduction of tax and entrepreneurship lessons at all levels of education.

8. Changing public opinion towards the positive and optimistic side that the state uses for the public interest.

One year later, Panas (2011) conducted a tax evasion survey to examine the behavior and characteristics of taxpayers. The sample consists of 1969 people over 18 years old selected randomly. The results revealed that 25% of respondents will hide part of their income from tax authorities, given the likelihood, and the percentage is higher in groups of low-educated, entrepreneurs and unemployed. Six out of ten responded that in the past they had been given the opportunity to hide some of their income, but they did not. Another study examining the significant problem of tax evasion is conducted by Artavanis et al. (2012). Researchers have used an innovative method to estimate the extent of tax evasion and its distribution across different business sectors. The study was based on the idea that banks are adjusting to the financial environment of Greece and other countries with widespread tax evasion, lending based on estimates of real rather than household income reported. In addition to the above, it is noted that the average freelancer spends 82% of his declared income on loan repayments and in some areas such as financial services, doctors, lawyers, the rate exceeds 100%. In another recent study, Colon and Swagerman (2015) explored the motivations for participating in improved relationships within the tax control framework for multinational corporations in the Netherlands. The first part outlines the key principles for applying the tax audit framework for Dutch multinationals and the second part explores the incentives for enhanced participation by conducting research on the tax managers of these companies. The results of the research revealed that there are two key incentives for Dutch multinationals to engage in enhanced relationships: first, the perceived view of improving the organization's environment and second, the belief that this will be enforced by law in the coming years. Sinha (2007) studied audit productivity by evaluating the use of the metric "tax inefficiency per audit hour". The researcher has alternatively proposed "total tax scarcity and effort control function" as a measure to measure control productivity and conducted an empirical analysis in 12 business industries, which showed that tax scarcity per hour is not a reliable metric and the proposed model. The study better explains the results of tax audits. From their side tax authorities should also consider ways to increase the indirect trust of taxpayers. Such measures as for example building a long term relationship between a special tax officer and the taxpayer have a significant impact on compliance (Gangl et al., 2019). Nuredo et al. (2019) ascertain that the improvement of the support of the tax system techniques and the consciousness of the taxpayers have a correlation with the effectiveness of the tax audit. Moreover, Chalu and Mzee (2018) punctuate the need to have experienced and adequately trained auditors as well as an explicit institutional framework and concrete audit procedures in the tax audits. In another interesting study, Ho and Lau (1999) discuss changes related to tax control in a very critical economic environment such as that of Hong Kong. In June 1991, a new audit system, known as Field Audit, was introduced by the Hong Kong Department of Internal Revenue to increase the voluntary compliance of businesses with tax legislation. Field Audit staff was authorized to examine the validity of the information released by the companies, comparing their actual returns with those reported in tax documents and conducting on-the-spot checks.

Greek case

Tax legislation system in Greece

The 2009 fiscal depreciation reached the Greek economy around 2011 and lasted for approximately six years. During this period, a gradual increase was observed in the high income inequality of Greece compared to other states of the European Union, which was maintained for the following years and intensified the problem (Mitrakos 2018). During the period of 2017-2018 of the Greek crisis, a series of taxation reforms were made in order to modernize the national tax system (ΟΕCD, 2017). The goal was to make the tax system flexible to abrupt changes and adaptable, while at the same time simple it in order to endorse its stability (International Monetary Fund, 2017). The changes in the tax and accounting system in Greece were based on the International Accounting Standards (I.A.S.). The purpose for these reforms originated from a set of quantitative and monetary objectives aiming to maintain positive growth rates and generate surpluses in transactions (Lois et al. 2019). Most of these objectives were determined by the International Monetary Fund in cooperation with the European Union (Regulatory reform in Greece, 2001). One of the most crucial goals of these reforms was to address and tackle modern economic crime cases and techniques. This direction concentrates on the research of Beasley et al (2020) which gives a comprehensive and documented view as to the contribution of auditing in the fight against tax evasion and fraud. The research focuses on the importance of the existence of controls, as they aim to combat economic crime and specifically to detect, investigate and deal with organized economic crime. Tax audit is classified as an external audit (Carmichael et al., 1996), carried out mainly by tax executives. In Greece, this role is given to the Independent Authority for Public Revenue (IAPR), a separate state tax agency, and audits are performed by specialized tax officials. It has been argued that Greek authorities avoided have radical reforms on the country's tax system for many years (Bronchi, 2001). However, in various cases the Greek parliament approved changes to tax laws or imposed additional regulations to improve the existed tax legislation. According to Ballas (1994), the tax system is "a cloudy system of contradictory laws, judicial and ministerial decisions that clearly conceal special interests". In addition to the above, tax audit procedures’ complexity, in combination with the citizen’s perception of high tax rates, and the inextricable link between accounting/taxation led to increased tax evasion and “creative accounting” incidents (Baralexis, 2004). This implies that high taxes, increasing business complexity and consecutive changes in tax legislation may play a significant role in Greek businesses non tax compliance. This led to great amounts of revenue loss and distorted the competitiveness rules of the Greek market. In order to address this problem, it is necessary for Greek authorities to design a flexible and effective tax audit system, based on simple, fast and efficient procedures, supported by user-friendly control systems as well as highly trained and qualified auditors.

Greece’s tax information system reforms

IAPR, through the development and use of a Greek integrated information system, "ELENXIS", which is part of the “Business Solution and Central Information Infrastructure Development” program for the integrated control system of the General Secretariat of Pyblic Administration Information Systems (Partalis, 2012), implements strategies and hypothetical scenarios. Through a risk analysis and classified factors (Ministry of Finance, 2008) the system selects possible auditees (companies being audited). Once a case is selected, a case-manager digitally sends it to the “central office”. The latter’s tax officials determine which tax audit agency is responsible for each case, based on turnover, income, geographical or other criteria. The case is then assigned and the respective head of the department entrusts it to the appropriate auditor. Through "ELENXIS" the case is monitored at every stage, disclosing information to all liable tax officials, ensuring procedural transparency and accountability. The aforementioned information and procedure are classified. Thusly the tax auditor, through this particular informational system’s application can be informed about the auditee's tax profile and information (tax statement, previous tax offences etch.) that assist him in the audit procedure. At the same time, "ELENXIS" helps significantly in drafting audit reports, provisional worksheets and final tax liabilities. During the last decade Greek Tax Agencies integrated another electronic tool to “Elenxis” control subsystem. “Sesam Analysis” (Manual of Selected Operating Systems Services Procedures of I.A.P.R., 2018) allows the user to input data and perform a series of analyses with various options and filters depending on each case. The procedure is simplified and quickly extracts results. The integrated information systems surpasses manual (or previous information systems) in terms of time and cost effectiveness. This is especially important for cases of legal entities with vast accounting records and tax information. For example, regarding interest expenses, Article 49 of the Greek Tax Code that apply on sub funding refers to net interest expenses up to three million euro while surplus interest expensed should not exceed 30% earnings before interest, taxes, depreciation, and amortization (EBITDA).

Intra-group transactions and Amandeus database

Between companies belonging to the same group must apply the 'principle of equal distance' (Article Income tax code, 2018). In Greece, intra-group transactions, and transfer of operations are performed according to the general guidelines of OECD, as well as Articles 50 and 51 of the Income Tax Code (ITC). The related parties referred in Article 2 of the ITC are required to keep the Documentation File, consisting of the Basic Documentation File and the Greek Documentation File. Affiliated enterprises should also document their transfer prices through standardized files. If the native company is Greek then it must provide a "Basic Documentation File ". This file provides general information about the associated companies, the pricing strategies followed and the OECD documentations method used by the group to transfer pricing transactions. If a Greek company is a subsidiary of a foreign parent company, it must provide the "Greek Documentation File". This file complements the “Basic Documentation File” providing similar information for the group and the Greek subsidiary. These files should be updated of any change, be always available and submitted at fixed intervals (Karagiorgos et al., 2016). The file is drafted according to the submission deadlines of the income tax return accompanied by the “Transfer Pricing Documentation Summary” submitted digitally through the Independent Authority for Public Revenue’s (IAPR) platform. For the purpose of controlling intra-group transactions, ADA has been using the Amandeus database subscription in recent years. The AMADEUS Database is a privately owned pan-European financial data base with data on over twenty-four million companies.

SAMPLE AND METHODOLOGY

Research sample

The purpose of the research is to investigate the role of tax audit tools and procedures and the effectiveness of finding tax offenses. For the purpose of this study, on June 2019, questionnaires were sent (manually and via email) to tax auditors of the Independent Authority for Public Revenue, various other audit tax agencies in Athens and Thessaloniki (the two largest economic centers of Greece). In Greece an approximate number of one thousand auditors are employed in state tax agencies. The sample consisted of 96 state tax auditors which are considered representative of the total population (Table 6). The objectives of the research were to interpret the changes of the last decade in tax audit and more specifically to the extent audit tools (Elenxis, Taxis, etc.) help to simplify procedures. In addition, an effort was made to identify the most frequent tax offences performed by the regulated companies as well as the difficulties of identifying them depending on each industry. For the purpose of homogeneous empirical research, the sample used relates to ADA auditors from the new body of controllers that make the most of the Elenxis system.

Research questionnaire

The questions used were Likert-type multiple-choice and grading scale, where the respondents were asked to state their degree of agreement or disagreement. The questionnaire is divided into five sections. The first section, “Descriptive Statistics” deals with demographics and auditors’ characteristics. It consists of seven questions referring to gender, age group and level of education. Then, the last three questions cover years of experience and training. The second section tries to present the auditors’ opinion regarding the audit tools and consists of eight questions. The first question concerns the Elenxis system’s simplicity and the second is its time saving capabilities. The third question concerns the degree of sufficient training in the use of Elenxis. The fourth and fifth questions investigate speed of information, and whether other tools help in the process. Finally, the last three questions examine the implementation of “Sesam” as an audit tool, in matters of user friendliness for implementation, efficiency, and sufficient training. The third part deals with tax legislation and consists of five questions measuring frequency of changes, degree of complexity, the extent of different interpretations and possible necessary simplifications (Drogalas et al., 2015). The next part continues with nineteen questions that examine the extent of discrepancies in declared gross income and expenditure as well as differences found in aggregate situations and errors in doubtful debts predictions. Two questions investigate the extent to which differences are found in the case of "closed warehouse" auditors and in the valuation of inventories, respectively. Closed warehouse is an audit verification that counts the stock of some main types of business activity which must be in accordance with the quantified quantity, after taking into account any justified breaches or isolations or losses, etc. The next questions investigate the degree of detection of expenses not recognized for gross income deduction, net profits and counterfeit transactions. One question was added to measure the degree of detection of general violations. Five questions investigate VAT outflows and legislation.

Finally, three questions examine tax authorities, data bases and intra-group transactions’ assistance in the audit process. The last part deals with general information on audits and procedures and contains nine questions. It investigates the difficulty in finding infringements, the auditors' opinion to tax legislation changes’ necessity, simplicity and costly. Two questions concern the auditors' liability and expertise.

Questionnaire statistical analysis methodology

The statistical package SPSS (Statistical Package for Social Sciences) was used for statistical processing and analysis of the questionnaire responses. In particular, the completed questionnaires, which were handwritten, recorded the responses electronically using the Google docs form and were then exported in excel spreadsheet and then the figures were entered into the SPSS statistical package. The data were extracted from both the tables and the charts from the statistical package.

RESEARCH RESULTS

After recording the replied questionnaires, the results are then processed and presented as they arise. This chapter describes descriptive data as formulated through the statistical analysis provided by the SPSS software package.

Descriptive statistics

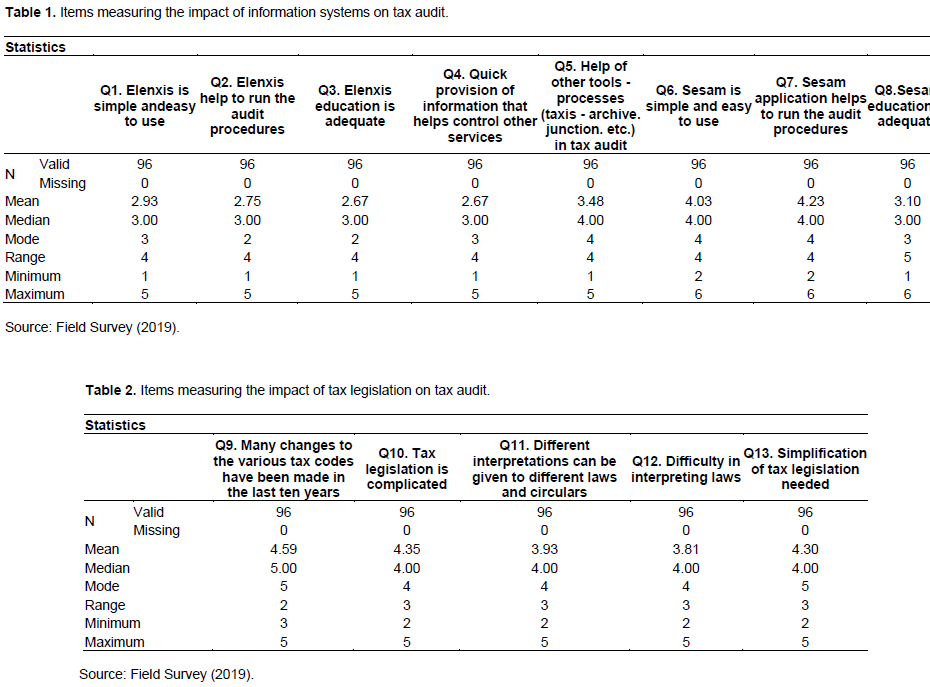

For a better understanding of the 'tax legislation' parameter, the descriptive data for the five questions in this section are summarized in Table 1. According to the table, the maximum average is question 7 (Q7.), which refers to whether the application of Sesam helps to quickly perform the test. In contrast, question 3(Q3.), which refers to the adequacy of training on the use of Elenxis, has the lowest average. However, the analysis of Table 1 is given in the conclusions. Table 2 shows that the largest average belongs to the first question, namely the changes that have been made in the legislation over the last decade; it shows how difficult these changes make the audit work. The lower average is in the fourth question where it is examined whether auditors spend more time trying to interpret laws than audit findings or not; it is explained that if one considers that an audit and a prioritized case should be completed within a reasonable time space.

Factor analysis

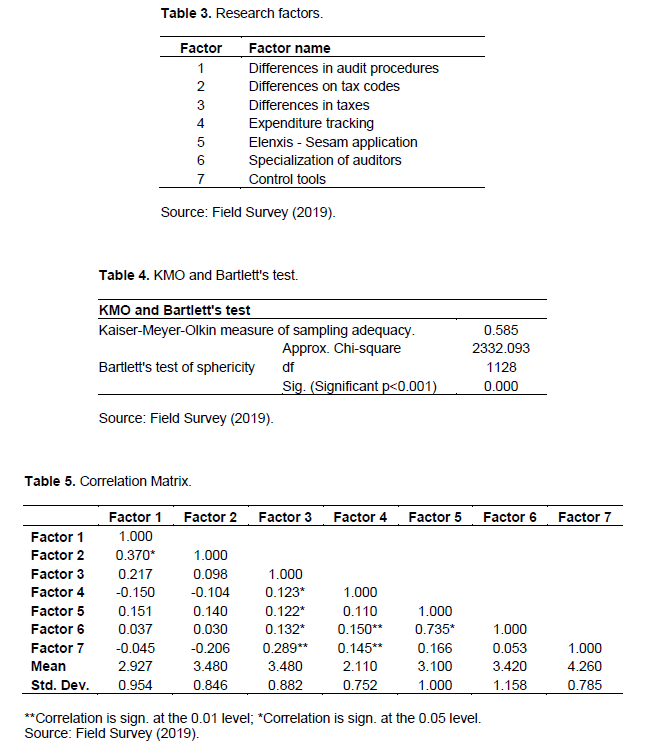

Table 3 gives 10 factors with the corresponding loadings of the variables in these ten factors, after the orthogonal rotation of the 10 factors. The rotation is intended to increase the large loads and respectively to reduce the small ones. From this table the synthesis of the factors is done. The criterion used is the magnitude of the load of each variable on the factors that is the variable belongs to the factor to which it has a large charge. Thus, questions 15, 16, 17, 18, 20, 22, 23, 24, 25, 26, 28 and 30 belong to the first factor. Questions 10, 11 and 38 belong to the second factor. The third factor is questions 12, 13 and 14, while the fourth factor is 37. The fourth factor is questions 27, 29, 34, 35, 36 and 37. Questions 3, 19 and 21 are to the seventh factor while the eighth factor belongs to questions 1, 2, 3, 4, 7, 8 and 9. Finally, the ninth factor has questions 39, 40, 41 and 42, while the tenth questions 5, 6, 31 and 32. At this stage the factors that were created will be named. This is achieved by carefully studying the variables that make up each table. These variables were initially analyzed for their correlations using the Pearson’s Correlation coefficient (Taraldsen (2020). Finally, the empirical analysis is completed by listing the results of the multiple regression analysis. Since the relationship between the variables X and Y is linear, the following multiple linear regression models were used to examine the strength of association between the different independent variables and the dependent variable:

y = b0 + b1X1 + b2X2 + b3X3 + b4X4 + b5X5 + b6X6 + b7X7 + ei

Where, Y: is the dependent variable "Tax audit infractions tracking", X1, X2, X3, X4, X5, X6, X7 : are the independent variables; b1, b2, b3, b4, b5, b6, b7 : are the independent variables parameters or coefficient which quantify the relationship with the dependent variable; ei: is the error.

Thus, the first factor will be called "Differences in audit procedures". Therefore, with this factor we determine if there are differences in the declared gross income with those of the books, in the declared expenses, in the realization of a closed warehouse, in the valuation of the inventors that is, in the fake and fictitious data. In addition, it is checked whether there are differences in the provisions for doubtful receivables, in the registration of balances from the General and Detailed Ledger in the General Assembly and A.X., in the net profits between the books and the submitted income tax returns and in other taxes. Finally, it is ascertained whether there are violations of the K.F.A.S.- G.A.S. – I.A.S., displacement of outflows, incorrect transfer of data and whether intra-community deliveries have taken place. The second factor is called the "Differences on Tax Codes". This is where the changes and complexity in the various tax codes come into play, if there are different interpretations in the laws and if the tax legislation can be simplified. The third factor could be called "Tax Differences". Therefore, this factor controls the differences in taxes such as VAT, contributions, VAT, tax procedure code, etc. It is additionally related to tax violations of self-employed and tradesmen so as in industrial and commercial enterprises too. "Expenditure tracking" is the title of the fourth factor, while the fifth is called Elenxis application. In other words, we check if this application is simple and helps to the audit procedure. The sixth factor is called "Auditor Specialization". Therefore, the auditors should be specialized and the procedures for charging taxes and fines should be simpler.

Finally the seventh factor can easily be called "Control Tools", which are considered very important for control. Table 4 summarizes the factors with their nomenclature. The KMO and Bartlett’s Test is then performed. The results are shown in Table 4. Based on the literature, large values ??of the Kaiser-Meyer-Olkin index (above 0.50), as an index comparing the observed correlation coefficient with the partial correlation coefficients, indicate that the method of factor analysis of variables is acceptable as a technique for data analysis. As shown in Table 4, the value of the KMO index is quite good, 0.585. At the end of the statistical analysis, the components of the sections are extracted, using factor analysis of the scales on whether the methodology and useful tools assist tax control in Greece.

Factor analysis correlates a large number of interrelated variables by grouping them into factors. After grouping, the variables of each factor are more correlated with each other than those of other factors (Table 5). In other words, it aggregates many variables by creating few factors. Specifically, we will use Principal Components with the Principle Component Analysis - Varimax Rotation to extract agents. There is a statistically significant correlation between the incorrect transfer of book data to the submitted VAT returns and the differences in net earnings between books and income tax returns. In other words, the incorrect transfer of the data of the books to the submitted VAT returns. It is increasing, so that there are differences in net profits between books and income tax returns.

1. There is a statistically significant correlation between the difficulty of detecting tax offenses in freelancers (designated by= Law 2238/94) and in service providers (plumbers, electricians, etc.).

2. A statistically significant correlation between the detection of expenditures above € 294 for simplified and € 881 for duplicate books not recognized for gross income deduction, with differences in the aggregate statements of article 20 KBS.

3. There is a statistically significant correlation between easy-to-use and simple Elenxis application and whether it helps to perform the test quickly. However, the easier and simpler the application of Elenxis is, the faster the execution of the test.

4. There is a statistically significant correlation between intra-Community deliveries without the relevant tax information and differences in other taxes being legal, with the need for changes in tax legislation (Schweder and Hjort, 2016).

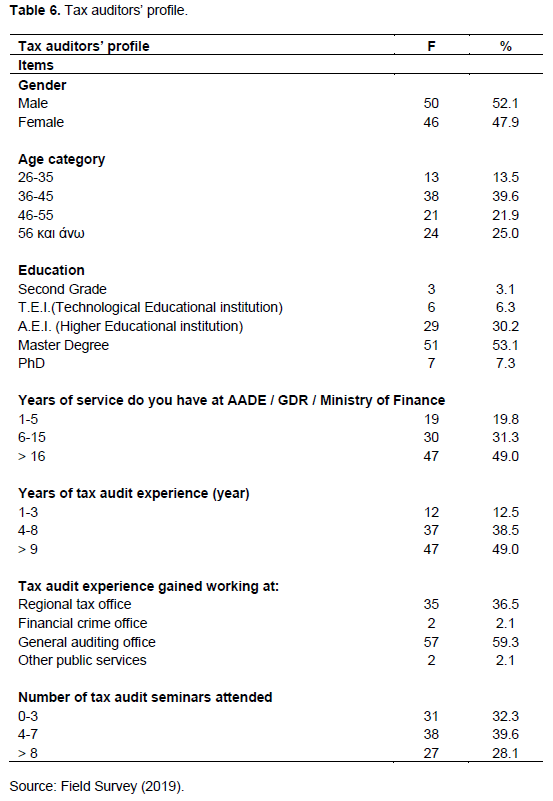

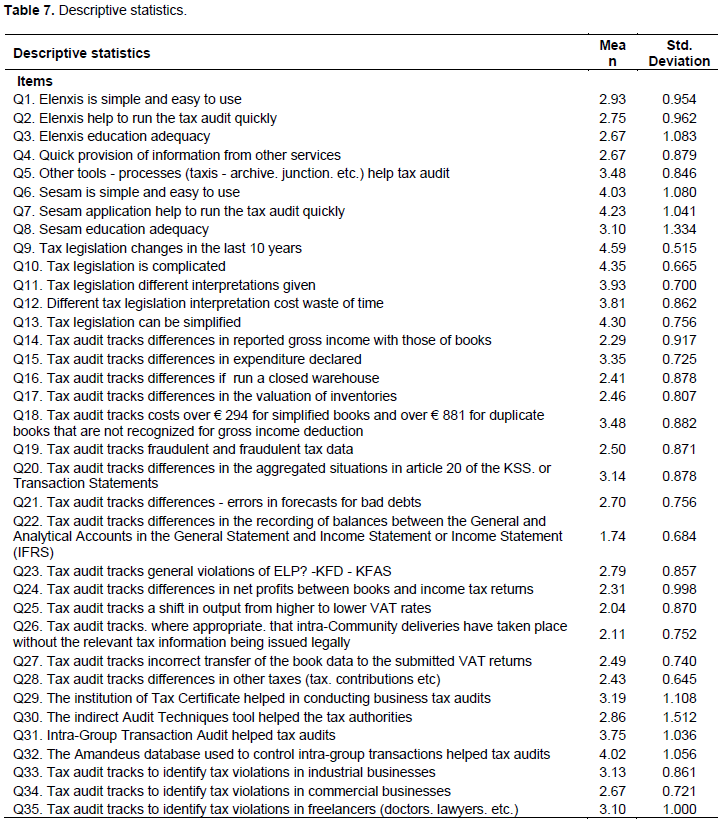

The Descriptive Statistics table is then exported. The results are shown in Table 6. As far as tax auditors’ profile is concerned of the 96 people who completed the questionnaire 52% were men and 48% were women. Moreover we can identify that the largest percentage of auditors sample belongs to the age of 36-45 (39.6%) with a pretty small number of young auditors aged 26-35 (13.5%). Regarding the level of education of the auditors more than 90% stated that they have a university degree and above (that is postgraduate or doctoral degree), which demonstrates that the employees have a high level of educational training. Touching the experience of the respondents almost half of the auditors have a lot of previous service in tax audit services and almost half of them have extensive audit experience, as experience of 9 years or more corresponds to 49.0%. Most of the auditors who participated in the survey gained this working experience in K.E.ME.EP (Large Enterprise Control Center). Of course, the purpose of this research was to mainly check the tax audit of legal entity, so more questionnaires were given to those specialized auditors. Question 7 examines the training of the respondents and specifically the number of seminars, related to audit that each has attended showing that the vast majority of auditors (80.6%) have attended several seminars considering the importance of the work they have performed. On confirming whether or not the control tools help the audit procedure the range fluctuates from large to moderate. Auditors find the Elenxis application easy and simple to use and the use of Sesam electronic tool very helpful in carrying out their audit work (Table 7). However, further training in the use of these new tools would be beneficial to auditors and audit procedures in general. Also, information that helps the audit is not provided fast enough by other services and this may occur to delay the completion of the audit and the rapid detection of violations from various intersections as well. As far as the tax legislation is concerned it seems to a very large extent that there are changes and complexity in the laws concerning the codes of various taxes. This complicates the audit procedure and leads to more time being spent in the interpretation of laws and orders than in the audit verifications. Simplification of the tax legislation is required by the majority of auditors. Subsequently, the messages regarding the audit procedures show significant space for improvement, as there are no major differences – omissions in the declared gross income with those of the books of the controlled entities, in the declared expenses, in the valuation of the inventories, in the net profits between the books and the submitted tax statements. From the results of the part of the general information about the audit procedure, it is shown that it is moderately easy to detect tax violations in both commercial and industrial enterprises. Consequently, the tax audit and the detection of infringements is also moderate and perhaps a little more difficult in some categories of tradesmen, such as tradesmen who provide services, since the provision of services is known to be difficult to identify and evaluate as well. There is a great convergence of views on the issue of simplifying the audit process by making the procedures for imposing taxes and fines simpler and faster, both for the rapid confirmation of revenues and for their faster collection; and also to balance the management costs in time and revenue to carry out the respective tax audit. Finally it is evident from the above table the necessity of the expertise of the auditors, a fact which indicated that there is a wide range in the audit work and this applies to the detriment of the completeness of the audit.

DISCUSSION

It is clear from the answers that the need for auditors' expertise suggests a wide range of audit related operations and reforms to the detriment the completeness of an audit. Going two steps above, correlations analysis of the fifteen factors was performed. Useful inferences were drawn from the statistical analyses, where the most important can be considered:

There is a statistically significant correlation between the incorrect transfer of book data to the submitted VAT returns and the differences in net earnings between books and income tax returns; in other words, the incorrect transfer of the data of the books to the submitted VAT returns (POL 1124/18.06.2015). It is increasing, so that there are differences in net profits between books and income tax returns. There is a statistically significant correlation between the difficulty of detecting tax offenses in freelancers and in service providers (plumbers, electricians, etc.) (POL 1036/2017).

1. There is a statistically significant correlation between the detection of expenditures above € 294 and € 881 for duplicate books not recognized for gross income deduction, with differences in the aggregate statements of article 20 KBS.

2. There is a statistically significant correlation between easy-to-use and simple Elenxis application and whether it helps to perform the test quickly. However, the easier and simpler the application of Elenxis is, the faster the execution of the test.

3. There is a statistically significant correlation between intra-Community deliveries without the relevant tax information and differences in other taxes being legal, with the need for changes in tax legislation.

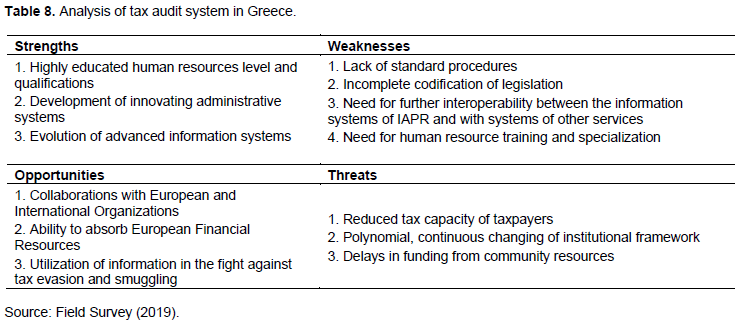

SWOT analysis of tax audit system in Greece

Taking into account the analysis of the results of this research, a SWOT analysis can be performed for the purpose of evaluating both the current situation and the future formation of the tax audit in Greece. We can identify the strengths and weaknesses as internal factors based on the function of tax audit, the opportunities and threats on the external environment that affect the tax audit procedures (Table 8).

Case of tax audit of legal entities in Azerbaijan: compare and contrast analysis

The tax administration in Azerbaijan uses a variety of venture formats to be more productive. Tax audit system uses mobile and cameral controls and they are both regarded to be precious components of the Ministry of Taxes of the country. These types of tax audits are done by pairing tax returns from taxpayers and the real information of their fiscal activity through their financial reports in compliance with the legislation. The difference between these two types of controls is that on cameral audits the financial reports and the tax returns are compromised in the tax control whereas on mobile tax review the financial reports are checked straight in the enterprises (Hajiyev and Sebzaliyev, 2003). Something similar occurs in Greece after the revision of K.B.S. and the introduction of the new K.F.D. (that is from 01/01/2014) with the tax audits to be carried out either as office inspections or as on – site inspections respectively.

The Tax Code of the Republic of Azerbaijan was revised in January 2019 to expedite the tax audit and in particular to simplify the exchange of information between taxpayers and tax authorities. Through the new Tax Code the documents are sent to taxpayers electronically and do not require stamping. The new forms of tax audit (that is the mobile tax audits) cover the operations of the last three years of tax payers. As long as the taxpayer gets the results of the tax audit he can file a complaint within 30 calendar days (Stamatopoulos and Karavokyris, 2014) to the superior tax authority for the higher tax authority to make the final decision concerning the tax and the infringements of the taxpayer (Tax Code of the Republic of Azerbaijan). On the other hand, the new Tax Code of the IPRA has made many similar provisions to the Tax Code of Azerbaijan as electronic notifications are also provided to taxpayers; the tax audits cover the last five years of the activities of taxpayers with emphasis on the last three years of their activities and as long as the taxpayers get the results of the tax audit they can file their complaints within the next 30 calendar days to the superior tax authority which is called Dispute Resolution Address (D.R.A.), for the D.R.A. to make the final decision concerning the tax and the infringements of the taxpayer (Tax Code of Greece).

Over the study of the two tax systems of these two countries, we also detect that both countries have made tax reforms and significant progress in tax administration and in tax control. Efforts are being made to improve inspections for small and medium – sized businesses(SME) with more risk –based inspections for SMEs and more electronic tax audits for SME entities (Pashayeva, 2019). The Former Minister of Taxes and Economy of Azerbaijan in 2019, Mikayil Jabbarov said that the main proposal for their economy was the reduction of taxes from non – oil (that is most of the tax revenue of Azerbaijan comes from the oil) and private sector citizens (Pashayeva, 2019) and the improvement of the partnerships between taxpayers and tax authorities. From the other side the Former Minister of Greece in 2019; Christos Staikouras said that the main proposal for the Greek economy was the reduction of permanent taxes related to the ownership of real estate, to the taxes of the legal entities and the reduction of VAT. In addition to this, George Pitsilis, the manager of the IPRD said in the Delphi Economic Forum on March 2022 that the target for the IPRD and the tax audits is a totally digital Administration and Control.

OUTCOME OF CONCLUSIONS

Through this research, conclusions can be drawn about the utility and assistance of tax system tools and procedures to auditors and how they facilitate the identification of tax offenses. Generally, findings from the study demonstrate that modern tax control processes must be constantly expanded and adapted to international practices (Fetters, 2018). Findings from the survey suggest that continuous tax education on the function of the tax audits under the IAPR is vital to ensure taxpayers’ assertive perception of the system. Moreover, specialization and vigorous training of the tax auditors are required to improve the qualifications’ level of expertise and audit skills. It is also critical for tax auditors to cultivate a climate of trustworthiness between them and the taxpayers. It is noteworthy that the findings of this survey can be applicable to being also reproduced by similar developed or fast emerging economy that is worldwide since it can be generally applauded that the amelioration of tax audit can reduce the problems of tax evasion and other tax irregularities. In addition to this, the scope of the tax audit should be broader in a way that can and will reserve suitable submission of accurate returns for befitting computation. Finally, specialized and qualified tax auditors equipped with the appropriate working materials are needed so they can improve their efficiency as well as the effectiveness of the tax audit.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

del Buey Torres PA (2004). Opinion poll about tax audit. Managerial Auditing Journal 19(8):979-1005. | |

Artavanis N, Morse A, Tsoutsoura M (2012). Tax Evasion Across Industries: Soft Credit Evidence From Greece pp. 12-25. | |

Ballas AA (1994). Accounting in Greece. European Accounting Review 3(1):107-121. | |

Baralexis S (2004). Creative accounting in small advancing countries: The Greek Case. Managerial Auditing Journal 19(3):440-461. | |

Beasley MS, Goldman N, Lewellen C, McAllister M (2020). Board Risk Oversight and Corporate Tax - Planning Practices. Journal of management Accounting Research 33(1):7-32. | |

Bronchi C (2001). Options for reforming the tax system in Greece, OECD Economics Department Working Papers. OECD Publishing 291:1-74. | |

Carmichael D, Willingham J, Schaller C (1996). Auditing Concepts and Methods. A Guide to Current Theory and Practice. 6th edition, McGraw-Hill Company. P 4. | |

Chalu H, Mzee H (2018). Determinants of tax audit effectiveness in Tanzania. Managerial Auditing Journal 33(1):35-63. | |

Colon D, Swagerman D (2015). Enhanced Relationship participation incentives for (dutch) multinational organizations. Journal of Accounting and Taxation 7(1):93-101. | |

Das-Gupta A, Gang IN (1996). Value added tax evasion, auditing and transactions matching. Social Science Research Network Electronic Library, working paper series, Rutgers University. | |

International Monetary Fund (IMF) (2017). Greece: Selected Issues. IMF Country Report. Available at: | |

Drogalas G, Sorros I, Karagiorgou D, Diavastis I (2015). Tax audit effectiveness in Greek firms: Tax auditors' perceptions. Journal of Accounting and Taxation 7(7):123-130. | |

Fetters J (2018). The handbook of lighting surveys and audits. Boca Raton: Chapman and Hall/CRC. | |

Dilip KS, Swapan KB (2002). Tax audit: Bangladesh panorama. Managerial Auditing Journal 17(8):464-477. | |

Gangl K, Hofmann E, Hartl B, Berkics M (2019). The impact of powerful authorities and trustful taxpayers: evidence for the extended slippery slope framework from Austria, Finland, and Hungary. Policy Studies 41(1):98-111. | |

Grampert M (2002). Tax audit. Swedish National Tax Board. | |

Guyton J, Leibel K, Manoli DS, Patel A, Payne M, Schafer B (2018). Tax enforcement and tax policy: evidence on taxpayer responses to EITC correspondence audits. National Bureau of Economic Research. | |

Chatzipanagiotou E (2010). Problems during tax audit and proposals to the Tax Administration. Ministry of Economy. | |

Hajiyev R, Sebzaliyev SM (2003). Basics of Audit. Azerbaijan State Economics University Publishing House, Baku. Unpublished. | |

Ho D, Lau P (1999). Tax audits in Hong Kong. International Tax Journal 25:61. | |

Karagiorgos A, Sivakis J, Karagiorgos T (2016). A presentation of Strategic Transfer Pricing, The Involvement Taxation and examples of understanding the Method, Contributions to Accounting Research II. Honorary Volume, Anastasios Tsami, Panteion University. | |

Ministry of Finance (2008). Tax audit methods and techniques: from home and on-site tax audit, Tax Audit Guide. | |

Larina N (2005). An overview of tax audits in Russia. The CPA Journal 75(6):14-15. | |

Lois P, Drogalas G, Karagiorgos A, Chlorou A (2019). Tax compliance during fiscal depression periods: the case of Greece. EuroMed Journal of Business 14(3):274-291. | |

Mitrakos T (2018). Economic inequalities, poverty and social exclusion, the international experience and the case of Greece during the recent crisis. Social Politics 9:7-24. | |

Nuredo BY, Lekaw DM, Mariam MW (2019). Effectiveness of tax audit: A study in Kembata Tembaro Zone, Southern Ethiopia. International Journal of Commerce and Finance 5(1):34-50. | |

ΟΕCD (2017). Economic Policy Reforms 2017: Going for Growth, OECD Publishing, Paris, France. Available at: | |

Panas E (2011). Research on tax evasion: Study the behavior and characteristics of the taxpayer. Economic Chamber of Greece. | |

Pashayeva D (2019). Directions for Improving the Tax Administration and Tax Control Under Modern Conditions in the Republic of Azerbaijan. Izvestiya Varna University of Economics 63(4):344-359. | |

Regulatory Reform in Greece (2001). Government capacity to assure high quality regulation in Greece. Organisation for Economic Co-operation and Development. Available at: | |

Robbins D (2002). Handbook of Public Sector Economics, Public Administration and Public Policy. | |

Sinha P (2007). An examination of tax audit productivity. Journal of State Taxation 25(2):29-36. | |

Partalis A (2012). Thesis of Elenxis, An integrated information Control System, University of Macedonia, Greece. | |

Stamatopoulos D, Karavokyris A (2014). Income Tax Code: Analysis-Interpretation publications Tax Institute, Athens 2014. | |

Taraldsen G (2020). Confidence in Correlation. Available at: | |