Trends and patterns of the banking sector digitalization process

Published: Jan. 1, 2020

Latest article update: Sept. 22, 2022

Abstract

Due to a number of negative events for the Russian economy, the process of digitaliza-tion and implementation of financial technology (fintech) may become the main com-petitive advantages to determine the growth prospects of the banking business of Russia in the short and medium term. In addition to projects implemented with the support of the government and the Bank of Russia, large Russian banks are currently investing heavily in fintech and are actively implementing innovative pilot projects. The article reveals the key technologies of digital transformation in Russia are technologies such as Big Data and predictive analytics, artificial intelligence, robotics, machine learning and chat bots, distributed ledger technologies, open interfaces, optical recognition of the In-ternet of Things, virtual and augmented reality. The article considers the experience of the leaders in the field of digital banking in the Russian Federation –Sberbank, Tinkoff Bank, and VTB Bank. Besides, the article discusses the main trends and patterns of the digitalization process in the Russian banking sector, which include maintaining cyber-security, introducing B2B marketplaces, digitalizing public services, developing cross-border cooperation, and creating common IT platforms. In this regard, the trend to cre-ate banking ecosystems in order to attract and maintain customer loyalty, providing both financial and non-financial services through super applications, should be noted

Keywords

Digital banking, financial technology;fintech, digital transformation, banking sector, digitaliza-tion

Introduction

The beginning of 2020 has been characterized by several events, which expose a significant risk to the growth of the Russian economy. The breakdown of the OPEC+ deal and the subsequent disruption in the balance of supply and demand in the oil market, the pandemic of the coronavirus infection COVID-19 and the associated economic downturn create an environment for a moderately negative or crisis scenario for the development of the Russian banking sector in 2020.

The peculiarity of 2020 is, unlike previous stressful situations (primarily in 2008-2009 and partly in 2014-2015), the problem is not the financial system (global or Russian), but the real economy. Both worldwide and in Russia, financial systems and central banks have been more prepared for the beginning of 2020: the necessary tools and experience were accumulated, regulation was significantly improved. Experts and analytics assess the current stability of the Russian banking sector as higher than during previous crises. A significant role in this situation is played by the previous getting rid of “weak players” from the sector. Given the extremely high uncertainty with the development of the COVID-19 pandemic, the extent of the damage to the global and Russian economies is not yet known and forecasting with sufficient accuracy is now practically impossible. In this situation, a high level of digitalization may become the main competitive advantage that determines the growth prospects of the banking business in the new decade.Основная часть

Discussion

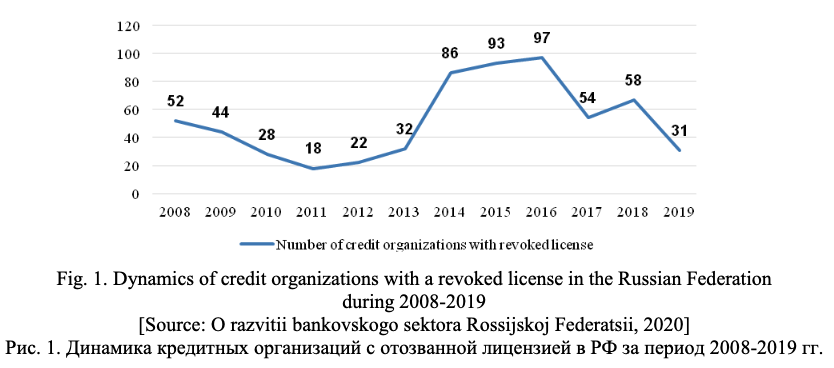

During 2008-2018 banking sector in Russia has tended to be consolidated and reorganized after the 2008 crisis. The dynamics of revoked licenses of credit organizations in the Russian Federation for the period 2008-2019 is shown in the Fig. 1, according to the official website of the Bank of Russia statistics.

Thus, according to Fig. 1, it is possible to conclude during 2008-2016 there was an active increase in the number of license revocation and liquidation of credit organizations. The largest number of revocations and liquidations were observed in 2015-2016, namely 93 and 97, respectively, which is 1.8 times more than in 2008. Nevertheless, 2019 is characterized by a significant decrease in the rate of revocation of licenses of credit organizations: 31 licenses were revoked against 58 in 2018 and 54 in 2017, which indicates the end of the period of active cleansing of the market from unscrupulous players.

Initially, the active introduction of digital technologies has begun in the banking sector, which controls gold and foreign exchange flows, as a trigger for the global economy. As the most important segment of the economy of any state, the financial sector reflects the most progressive solutions in digitalization, namely in the field of financial technologies. Innovations proposed in this area are aimed at improving financial performance through better and personalized service for lower customer costs [Andreev M.Ju., 2010].

Small and medium-sized banks had traditionally been considered to work more efficiently with medium-sized enterprises, since they are able to flexibly respond to customer requests, pay more attention to them, while large players sometimes are physically unable to delve into all the problems of small and medium-sized businesses.

Currently, however, digitalization is fundamentally changing the landscape of the banking sector. This process has become even more obvious and fast in quarantine due to the COVID-19 pandemic. A medium-sized universal bank will inevitably have to play on the same field with large competitors. It is easier for large credit organizations to create unique personalized offers for each client using advanced IT services and Big Data technology.

Competition in the banking services market is shifting from the price area to the area of quality of service, ease of interaction and communication channels, completeness of the product offer, opportunities for personalization and product design.

Therefore, only banks capable of offering the clients the full range of products and services in the most convenient way can actively build up their client base and sources of income. In order to do that, they need not only vision, but also large investments, the ability to handle huge amounts of data and powerful analytics. However, for most Russian banks, the implementation of such projects is extremely difficult. Experts believe in the medium term small and some medium-sized banks may “not cope” with the growing competition in the market. Meanwhile, competition between large banks will only increase.

Large Russian banks adhere to the transformation into digital organizations that provide a wide range of financial products and services. They invest heavily in fintech and are actively implementing innovative pilot projects. Through a full-scale digital transformation, banks will be able to provide customers with a wide range of services within their own financial and even non-financial ecosystems. The creation of such platforms is already taking place in the largest banks, which gives them significant competitive advantages [Shhegolev, A.V., Alenina, K.V. and Jakushina A.V., 2019].

The limited funds for digital transformation are partially offset by the creation of nationwide platforms with a range of technological services. Due to the formation of a nationwide financial infrastructure, the competitive capabilities of various groups of banks are partially equalized, the role of the bank’s geographical location is leveled, conditions are created for a significant reduction in the cost of doing business, and the availability of financial services is increased.

In addition to projects implemented with the support of the government and the Bank of Russia, financial institutions themselves are actively involved in the process of digital innovations implementation. The key technologies of digital transformation in Russia are big data analysis and predictive analytics, artificial intelligence, robotics, machine learning and chat bots, distributed ledger technologies, open interfaces, optical recognition, Internet of Things, virtual and augmented reality [Bolsun V.S., 2019]. Furthermore, according to KPMG, 72 % of banks are planning to develop artificial intelligence technology in the next two years, 61 % of the banks surveyed have already implemented or are testing robots, 45 % of banks have already implemented predictive analytics in several processes [Cifrovye tekhnologii v rossijskih bankah]. Moreover, banks have already occupied leading positions in the use of chat bots in industrial operation among various fields of activity. New technologies allow different banks to reduce costs and constantly improve the quality of services provided; thereby equalizing market conditions.

However, competition is pushing an increasing number of banks to develop services for individuals and entrepreneurs based on partner services, turning them into ecosystems. The main feature of the ecosystem is that a client through one of its participating companies can access all other organizations included in ecosystem through related services, possibly even on special (preferential) conditions that exist only within its boundaries. The technical capabilities that the created ecosystem will provide its participants include a customer identification system, fast data exchange, unified software interfaces and other services [Radkovskaja, N.P. and Fomicheva, O.E., 2018].

Several criteria are generally used in order for an organization to become an “ecosystem center”. Firstly, organizations should have a large-scale client base and a high level of trust with the client. Secondly, they must be open to change and ready to adapt to a changing business environment. Thirdly, organizations need to own customer data and use it to improve collaboration. Fourthly, a recognizable brand and a positive perception of the organization in the financial market are needed [Bykanova, N.I., Solovej, Ju.A., Gordya, D.V. and Kon'shina, L.A., 2020].

It should be singled out for mention that in the context of the COVID-19 pandemic, ubiquitous lockdown and most employees working remotely, digital services have become more relevant than ever. The process promptly and simultaneously affected the organization of the functioning of banks, and products and services offered to customers

Sberbank as the largest bank in Russia is one of the forces driving the digitalization process. Two years ago, it presented the strategy of transition to ecosystem principles. Currently, this ecosystem includes companies specializing in various fields of activity, including e-commerce, medicine, telecommunications, cloud technologies, communications, identification, services for optimizing business processes, et al.

Another striking example of digital banking in Russia is Tinkoff Bank, which calls itself a “technology company with a banking license”. It offers online banking and lifestyle services and is constantly developing the latest technologies (machine learning and artificial intelligence are used in almost all processes).

Analytics call the emergence of super apps (applications that combine many services to

maximize the client’s vital needs) is one of the main trends of 2019-2020. The banking industry is increasingly intersecting with other industries, thus Russian banks create super apps. This distinguishes the Russian market from the foreign one, where banks are less developed from the point of view of technology, there financial services are usually integrated into non-banking applications.

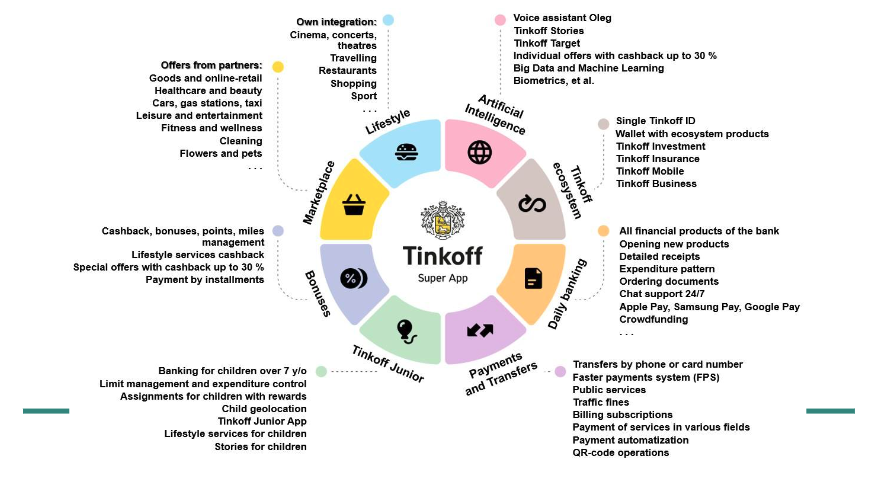

Formally, it is possibly to call VK (VKontakte – the largest Russian online social media and social networking service) the first Russian super app based on platform of mini-applications, but Tinkoff Bank was officially the first in a press release to launch the super app. In April 2019, Tinkoff launched the Entertainment section in its application (including restaurant reservation and movie ticket purchase services), then created its own travel agency, connecting to all major Russian booking systems, investing about $ 2 million in the project. Finally, in December 2019, Tinkoff announced the launch of its super app, the structure of which is shown in Fig. 2.

Thus, Tinkoff super app is designed to solve any tasks in the field of finance, leisure, and lifestyle. The application offers solutions for a large number of financial tasks: ordering a new card, issuing an additional card, taking a loan, opening a deposit, buying insurance, opening an account for business, et al. It is also possible to order a SIM card from the virtual mobile operator Tinkoff Mobile. Transfers, payment for services, donations can be carried out.

Tinkoff Bank offers payment by QR code, though this method of payment is not very common among sellers. In addition, user can select the categories of increased cashback and see special offers with discounts from partners, store documents in an electronic wallet. Investments are in a separate application.

The “non-financial” part of the Tinkoff super app is concentrated in the Services tab. Third-parties are integrated according to the White Label – that is, they are deprived of branded identification marks, user can find out about the service provider through the Info tab. Currently, the following categories are presented: ordering flowers; cosmetics; payment for online training; purchase of tickets to cinema, theaters, concerts, quests, sporting events – separately in different mini-apps; restaurant reservation, and calling a taxi through Yandex.Taxi; airtickets purchase, hotel reservation, travel insurance – all with cashback; cleaning; doctor appointment; shopping – information about all shopping centers of the city; insurance; purchase of goods through goods.ru marketplace.

Financial services are still at the center of the Tinkoff super app, they were assigned the main screen. All services will be integrated with the voice assistant Oleg and will support single authorization via Tinkoff ID soon. Different levels of integration are available – from “difficult”, at the level of Tinkoff own services, to “simple”, through the Open API, for which it is enough to go through moderation. It is expected that by 2023 the ecosystem will unite more than 20 million people (currently the number of users reaches 10 million customers).

Following Tinkoff Bank, VTB Bank picked up the trend, announcing creating a lifestyle platform, investments in which would amount to more than 2.5 billion rubles. The services of taxi calling, food delivery, restaurant reservations, movie tickets, theater, sporting events, air and train ticket purchases will be combined within a single platform. As for financial services, it will include virtual cards, payments and transfers, credit products. The platform wants to collaborate with market leaders in different industries.

VTB Bank has promised to launch its own superapp in the summer of 2020. It is expected that by the end of 2022 the number of lifestyle platform users will reach 4 million people. In addition, by this time, 500 thousand bank cards should be issued for users of the platform.

It is expected that the general trend towards digitalization of the banking sector will contribute to the emergence of similar super-applications from other market participants. Over the past few years, the needs of consumers of financial services have changed: they are no longer interested in banks or in the financial services that they offer. Customers need services and products to solve specific life tasks, and the business is transformed in accordance with this request. Currently, companies and financial institutions strive to satisfy as many needs as possible from different areas of their clients' lives. In addition, the boundaries between different industries are gradually blurring due to a shift in focus from products to customer needs, which are often cross-industrial in nature. All these processes take place against the background of the formation and growing up of the “digital” generation of people who are used to using modern technology in everyday life.

However, the basic asset in the digital space is information, and data security is one of the components of the foundation of the digital economy. In order to ensure information interaction and coordination of efforts to combat crime in the IT sector, the Bank of Russia has created a Center for Monitoring and Response to Computer Attacks in the Credit and Financial Sphere (FinCERT of the Bank of Russia). Recognizing the need for consolidation on the issue of information security, the Association of Banks of Russia launched a cyber threat data exchange platform [Platforma obmena dannymi o kiberugrozah].

The platform allows participants to automatically receive verified and relevant information automatically online. The platform is based on the REST API, which allows to automate the settings of security features without the participation of people. Credit organizations, if necessary, can get the support of technical specialists who will help to set up a credit institution’s protection for future use and integration with the platform. The advantages of the platform are the aggregation of more than 26 sources of threat data (FinCERT of the Bank of Russia, telecom operators, BI.ZONE), downloading only useful information to protect the bank, and automating the process of applying this information. The functionality of the platform can be used both in the largest and in small organizations that do not have advanced security features and highly qualified

personnel.

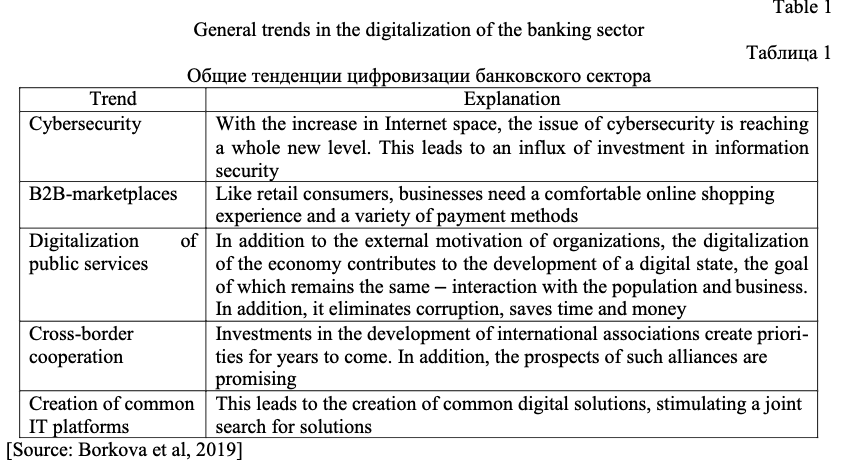

Thus, some general trends in the digital transformation of the banking industry can be highlighted (Table 1).

Thus, Sberbank is one of the leaders in the field of cybersecurity in Russia. It formulates its development strategy, considering the regularity of cyberattacks, and seeks to enhance data security by reducing time and money losses. As for B2B marketplaces, in 2018 Sberbank launched SberB2B, a platform for conducting sales transactions of goods and services for any customers and sellers. The main reason was the negative dynamics of the development of the B2B sector in the country, which leads to significant losses of time and money. In the field of digitalization of public services, a great example is created by March 2019 system that provides the remote issuance of certificates for housing property in Moscow. As for cross-border cooperation, the project “Interreg. Baltic Sea Region”, aimed at development in areas of innovation, modern transport and natural resource management is noteworthy. Among the common IT platforms, ERA can be mentioned – the 3rd generation blockchain platform DATACHAINS.world, which has become a solution not only for individuals, but also for commercial companies and government

agencies.

Conclusion

Thus, it can be concluded that digitalization helps to blur the boundaries between the banking and non-banking areas of activity, and this leads to the creation of fundamentally new means of payment that radically change the banking environment overall. In addition, it should be taken into consideration that digitalization has a direct and increasing impact on economic growth, affects the dynamics of GDP, as well as the productivity and well-being of agents in all sectors of the economy. Nowadays, the degree of digitalization of the economy shows the country's position on the world scene. Consequently, issue of improving the policy of digitalization of the Russian economy is becoming increasingly important if the country is faced with the goal of increasing competitiveness, labor efficiency and productivity.

References

им. А. А. Дородницына, 2010. № 46. С. 135-136.

С. 166-171.