I. Introduction

The concept of “value chain” was introduced by Porter (1985) to describe the full range of activities, which are required to bring a product or service from conception, through the different phases of production, distribution to consumers, and final disposal after use. As the product moves from one player in the chain to another, it is assumed to gain value (Hellin and Meijer, 2006). As such, the value chain can be used as a tool to disaggregate a business into major activities, thereby allowing the identification of sources of competitive advantage (Brown, 1997). This concept has, over the years, been the object of a fast-growing literature in economics and management (Abecassis-Moedas, 2006).

Since its introduction, the use of value chains and value chain analysis has been extended to various applications beyond the study of individual firms. Value chain analysis has been employed to examine and evaluate entire industries and industry clusters, as well as specific systems within firms. It has likewise been employed to examine activities that are increasingly spread over several countries or the so-called “global value chain” (GVC). This segment of the value-chain literature is also known as global commodity chains, global production networks, or international supply chains (Sturgeon, Linden, and Zhang, 2012). GVC defines economic upgrading “as a shift to higher-value-added products, services, and production stages through increasing specialization and efficient domestic and international linkages” (Ernst, 2004, page 90); and it emphasizes the importance of international linkages to create cross-border forward and backward linkages such as international knowledge linkages that compensate for the narrow base of domestic knowledge (Lall, 1997; Ernst, 2004). Recently, this aspect of the literature has been extended to examine whether economic upgrading, especially by global firms, necessarily leads to social upgrading which is defined as the “improvement in workers’ rights and entitlements, and enhancement of the quality of their employment” (Lee, Gereffi and Barrientos, 2011, page 4).

It is difficult in one paper to cover the wide range of the value chain literature. Thus, this paper is focused on providing an analysis of a selective set of literature within the value chain model as originally conceptualized by Porter (1985). The purpose of this paper is to provide a brief examination of frameworks underlying value chain analysis, to identify the factors that influence how well or how badly the chain works, and to suggest areas for future research.

II. Frameworks for Value Chain Analysis: Discussion

One way to classify value chains is in terms of who drives the chain: buyer-driven chains versus producer-driven chains. Buyer-driven chains are common in labor-intensive, consumer goods industries where large retailers, merchandisers and trading companies play a central role in establishing production networks usually in developing (exporting) countries; while producer-driven chains are characteristic of capital-intensive and technology-oriented industries dominated by large transnational corporations which play a key role in managing the production networks (Abecassis-Moedas, 2006). Buyer-driven chains are typical in garments, footwear, toys, housewares, and consumer electronics, whereas producer-driven chains are observed in semiconductors, electrical machinery, and automobiles.

Regardless of who drives the chain, however, value added should be reflected through the natural sequence of operations, from stage to stage. Value added implies both value creation and value capture. Since every strategically significant activity to be performed requires an investment in resources, it follows that each link in the chain is expected to add value (Chivaka, 2007). Likewise, a chain player’s ability to compete and succeed depends on its position along the industry chain, and how much value it is able to create and capture. Danskin et al. (2005) did a series of case studies examining the value chain of Invista, a textile and apparel firm and subsidiary of Du Pont. Research focused on each stage of the chain, from raw material extraction to primary manufacturing (fiber and fabrics) to fabrication of commodity products to manufacturing with product development (patents and proprietary features) to marketing to distribution of consumer products to retailers and final consumers. A key finding of the study is that external knowledge management systems bring value chain members closer to each other and enhance value added throughout the chain.

It is apparent that value-creating activities occur at two levels, namely: within the industry in which a company exists (industry value chain) and within a company itself (firm’s value chain) (Chivaka, 2007). Creation of value is a function of the ability to deliver high performance on the benefits that are important to the customer (Kothandaraman and Wilson, 2001). Creating value for customers that exceeds the cost of doing so is the ultimate goal of any generic strategy (Porter, 1985). Value, therefore, instead of cost should be the basis for determining competitive position.

While earlier management literature tended to focus on the firm as the main production unit, more recent studies have used value chain analysis that goes beyond the boundaries of the firm and even the industry. Value chain analysis addresses the weaknesses of traditional analysis, which tends to be static and limited in terms of identifying factors for success (Kaplinsky and Morris, 2003). Value chain analysis focuses on the dynamics of complex linkages within a network, wherein both value creation and value capture occur in a value system that includes suppliers, distributors, partners, and collaborators, thus extending the firm’s access to resources and opportunities (Zott, Amit and Massa, 2011).

Value chain analysis requires the “mapping of the market” to track and analyze the contribution of the different chain actors and the relationships among themselves. An understanding of the interactions within a value chain helps identify the factors that influence how well or how badly the chain works. The resulting market map defines the value chain actors, the enabling environment and the service providers. The enabling environment includes critical factors that create the operating conditions within which the value chain operates, such as infrastructure, policies, and regulations, as well as institutions and processes that shape the market ecosystem. These factors are beyond the control of the value chain members, but studying them is important in order to ascertain the trends affecting the chain and the drivers of these trends, thereby identifying opportunities for lobbying and policy entrepreneurship (Hellin and Meijer, 2006). Service providers, on the other hand, include business or extension services that provide support to the value chain, such as providers of market information, financial services, transport services, R&D facilities, and accreditation services.

Industry level value chain analysis is an effective way to examine the interaction among different players in a given industry. It helps identify the resources required to compete successfully in a specific industry, and how each chain members can maximize their individual returns and those of the value chain (Walters and Rainbird, 2007). All business firms are part of a value-creating network. However, some firms have greater influence than others in shaping the network; others have minor roles to play and tend to be shaped by the network instead (Kothandaraman and Wilson, 2001).

Walters and Rainbird (2007) found that cooperative innovation combines elements of product and process innovation management within a “network structure” to create a product-service response that neither partner could create using only its own resources. The product-service response extends in both directions of the value chain - upstream and downstream.

It is important for developing countries to appreciate the significance of assessing the performance of its industries from a value chain perspective. This is especially useful when it comes to SME-dominated sectors, such as handicrafts and novelty items. Value chain configuration and characteristics determine the chances of success of small enterprises in an industry where production agents (craft workshops and factories, production contractors, artisan brokers, and traders) are becoming the lead firms (Zhang, 2014).

Value chain analysis (VCA) includes both qualitative and quantitative approaches. There are no strict rules as to how it should be conducted, although Hellin and Meijer (2006) strongly suggest that a qualitative approach be used first, followed by a quantitative investigation. Observation, semi-structured interviews, focus group meetings, and questionnaires are recommended to build up an understanding of the various chain players and how they interact with one another.

1. Value Configuration Analysis

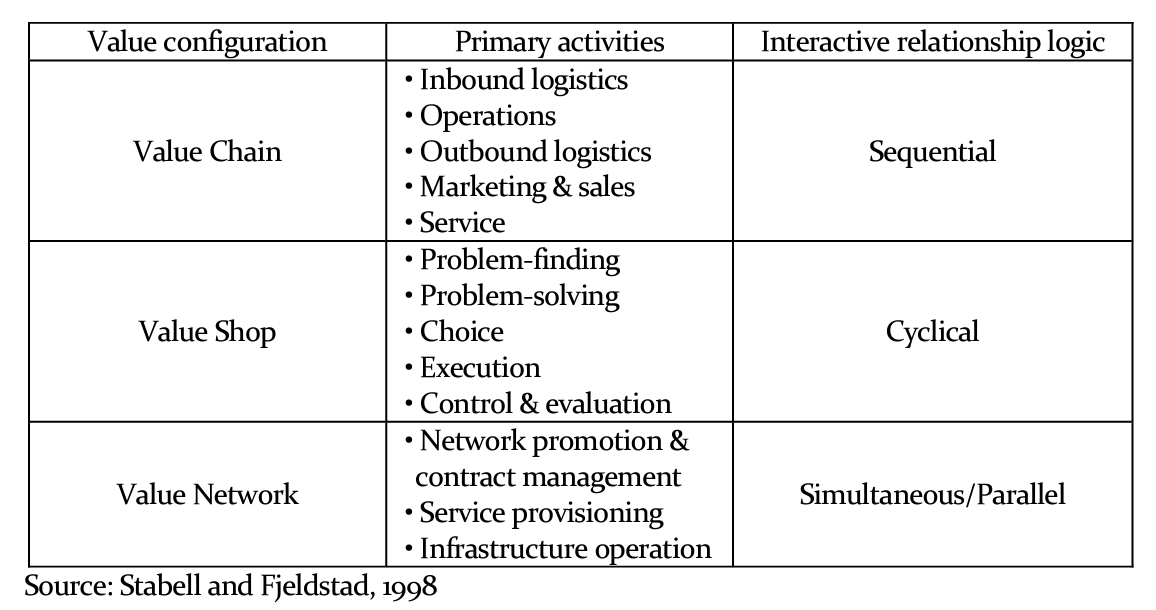

As a framework for analysis of both firm-level and industry-level competitive strengths and weaknesses, the value chain needs to be disaggregated into its strategic components for better understanding each component’s impact on cost and value. Stabell and Fjeldstad (1998) go further to suggest that value chain analysis must evolve into value configuration analysis, “an approach to the analysis of firm-level competitive advantage based on the theory of three value creation technologies and logics.” In addition to the value chain, Stabell and Fjeldstad introduced two other value configurations: the value shop and the value network. All three configurations are based on value creation logic: the value chain is grounded on the transformation of inputs into products; the value shop, on solving and resolving customer concerns; and the value network, on linking customers.

According to Stabell and Fjeldstad, the primary activity and support activity categories are distinct for each of the value configurations.

Baig and Akhtar (2011) presented an alternative view of how value creation happens between and among firms within supply chain relationships, following the concept of value configuration analysis introduced by Fearne et al. (2012). They showed how complex sets of supply chain interdependencies exist necessitating the use of various coordination mechanisms to achieve efficiency. A new approach was proposed in defining an enterprise’s position in the chain that goes beyond the traditional definition. Using the case study method of investigation, Baig and Akhtar (2011) examined the supply flows of Sea Air Land (SAL), a Delhi logistics services company. From results of their research, the following theoretical propositions were formulated: (a) Porter’s value chain model provides useful but only partial understanding of value creation in supply chain relationships; (b) The value network model, earlier introduced by Stabell and Fjeldstad (1998) provides a complementary understanding of value creation for firms focusing on intermediate processes (example: distribution); (c) Assuming that different value models coexist in creating efficient supply chain relationships, then we accept that value logic interaction facilitates understanding the collective business reasoning of the supply chain system as well as the reasoning driving individual firms in the supply chain system; and (d) The focus on single and interlinked chains in the supply chain literature needs to be complemented with an understanding of co-producing, layered and interconnected supply chain structures.

2. Dimensions of Value Chain Analysis

Various authors have specified ways of approaching value chain analysis by prescribing the examination of the value chain’s critical dimensions. According to Fearne et al. (2012), taking a broader perspective by incorporating environmental and social impacts within the value chain framework ensures that the chain achieves sustainable competitive advantage. In order to achieve this, they offer three dimensions that can be used in value chain analysis, namely: (1) the boundary of analysis; (2) scope of value considered; and (3) governance.

Boundary of analysis Most studies of value chains focus on the intra-firm standpoint, consistent with Porter’s original value chain concept (Fearne et al., 2012). However, value chains are now being viewed more and more as systems of multiple firms, where each firm recognizes the need for harmonized strategies along the length of the chain. This makes for stronger partnerships among the actors in the chain, and ultimately results in greater benefits for the customers. Nevertheless, the boundary of analysis may have to extend beyond inter-firm, to include “end-of-life product management” (Rose et al., 2000).

Scope of value considered In the analysis of value chains, it is important to look into the sources and beneficiaries of the value created by the chain. While it is essential to focus on customer value, there is need for value chain analysis to be more dynamic and explore how activities and attributes affect consumer behavior, since individual customers evaluate a product’s attributes differently, considering among many other factors, their gender, culture and socio-economic status, which influence their ability and willingness to buy and pay for their purchases (Fearne et al., 2012). It is therefore appropriate for value chain analysis to identify and work within specific market segments, instead of regarding customers as a single homogenous group.

Governance From the perspective of value chain analysis, Gereffi (1994) defines governance as “authority and power relationships that determine how financial, material, and human resources are allocated and flow within a chain.” Fearne et al. (2012) observed that some earlier studies that applied value chain analysis limited their investigation to identifying the flow of materials and information. This approach fails to consider the potential impact of relationships within and along the chain that could result in productive collaboration essential to generating innovation and ensuring the competitiveness of the chain and its members.

Boehlje (1999), on the other hand, suggested six dimensions of the value chain, namely: (1) processes; (2) product flow; (3) financial flow; (4) information flow; (5) incentive systems; and (6) governance. Value chain processes include activities that create the attributes or products that will be demanded or used by the consumer/end user. Product flow features of the chain include transportation and logistics necessary to move the products between processes, the details of flow scheduling to make sure that products are available at various stages of the process without accumulating excessive inventory, the enhancement and maintenance of various quality attributes, and the utilization of plant and equipment in all stages of the value chain to reduce downtime or bottlenecks. A critical issue in managing the product flow in a value chain is managing slack or flexibility and interdependencies to accommodate unexpected interruptions or events. Financial flow occurs across the chain participants and processes and includes funds transfer technology and the sharing of financial performance information among participants. Information flow also occurs across the chain. Important elements of this dimension are the accuracy of messages, the strength of these messages, the cost of messaging, the speed of transmitting and receiving messages, and the openness to sharing among participants. Incentive systems include rewards for performance and sharing of risk, price premiums, profit sharing, cost-sharing, financial assistance, loan guarantees, long-term commitment, and market access. Finally, chain governance refers to the coordination system within the value chain. Alternative forms of coordination include: open access markets, various forms of contracts, strategic alliances, joint ventures, franchising arrangements, networks and cooperatives, and vertical ownership. The choice of system will have a significant impact on who has power and control in a value chain and how risks and rewards are shared.

3. Value Chains versus Supply Chains

According to Fearne et al. (2012), there are significant differences between value chain and supply chain philosophies. Whereas supply chain thinking is suitable for commodities and commodity markets, value chain thinking is more applicable to differentiated products and segmented markets. The goal of supply chain management is to reduce costs, increase margins, and increase market share; that of value chain management is to add value and segment the market with differentiated products designed to increase profitability at all stages in the chain. Moreover, while the focus of supply chain management is on efficiency, market access, and increased distribution, the emphasis of value chain management is on quality, service, and agility with distribution determined by consumer demand rather than capacity utilization.

Other authors, on the other hand, do not distinguish between supply chains and values chains (Singh, 2007; Boehlje, 1999). In his study of the organic cotton industry of India, Singh interchangeably uses supply chain and value chain to refer to the industry network. Boehlje explains the difference between supply/value chain approach and traditional economic analysis, stressing that the chain model focuses on function performed “rather than the agents that perform it,” and suggests that such emphasis encourages interdependence among the stages in the supply/value chain.

4. Applications of Value Chain Analysis

In order to draw conclusions as to the future of mobile commerce (m-commerce) Barnes (2003), studied the key players and technologies in the m-commerce value chain in relation to infrastructure and services, as well as content. His study focused on the business-to-consumer market, considered as the most embryonic sector of m-commerce. Barnes identified six major components of the m-commerce value chain, namely: (1) mobile transport; (2) mobile services and delivery support; (3) mobile interface and applications; (4) content creation; (5) content packaging; and (6) market making. Through qualitative analysis of the value chain, Barnes was able to identify the emergence of geo-location technologies as the most crucial factor that will drive m-commerce forward. These technologies enable location-based services (LBS) applications, which are key to adding value to the mobile ecosystem.

Rogan et al. (2010) also applied qualitative value chain analysis to investigate the role of market and regulatory structures in the creation of an enabling environment for the supply and promotion of emergency contraception. Through in-depth and semi-structured interviews with contraception clients, providers, industry respondents, and stakeholders from national and provincial government, the authors mapped the emergency contraception value chain. Results of the study indicated possible reasons for the low use of emergency contraception. A significant finding is that fiscal and structural barriers delay the provision of emergency contraception to both public and private health facilities. Value chain analysis was found to be a helpful tool in studying the industry, particularly the supply-side constraints. As in most researches utilizing value chain analysis, progressive policies and effective interventions especially by government were indicated as necessary in addressing issues faced by the industry.

5. Innovation and Value Chains

Chiu et al. (2012) studied the R&D and production efficiencies of 21 Chinese high-technology businesses using value chain data envelopment analysis (DEA) as evaluation framework. This framework allowed the measurement of R&D and production efficiencies in a single implementation, consisting of two stages: stage one involves the calculation of R&D process efficiency, the output of which is patents; patents in turn serve as inputs to stage two, which involves the calculation of production efficiency. Findings from the study show that R&D efficiency does not relate to operation efficiency. The additional value of innovation and R&D in operation performance is not adequately apparent among most of the high-tech businesses; only a few businesses actually pay attention to both R&D and operation efficiencies, although under the value chain framework, simultaneously allocating resources for both R&D and production efficiencies is critical for the success of high-tech enterprises. Another interesting finding is that improving both R&D and operation efficiencies require decreasing R&D resource consumption and increasing operational final outputs, as well as reducing patents that do not effectively create value.

Loebis and Schmitz (2005) studied the furniture industry of Central Java, Indonesia to determine whether SMEs in this sector have benefited from their participation in the global market. They cite two opposing views on the source of innovation: local cluster theory asserts that knowledge needed for upgrading of products and processes comes from within the cluster, while global value chain theory stresses that such knowledge comes from outside the cluster, in particular from global buyers. Loebis and Schmitz found through visits to Semarang, Jepara and Klaten and discussions with business people in these and other locations in Central Java, that while the furniture chains are buyer-driven, the upgrading prospects depend largely on the nature of relationships that producers have with their buyers. In some instances, producers find themselves in a captive relationship with their large foreign buyers. However, this is not necessarily disadvantageous to the small producer because of the mutual commitment between producer and buyer to address problems jointly. Unfortunately, such buyers also procure from other countries, such as Vietnam and China, which may offer better deals. Thus, while Loebis and Schmitz concluded that involvement in global value chains of furniture makers in Central Java has indeed benefitted the sector, they question whether such benefits are sustainable.

Zhu (2013) tests the value-chain framework using the DEA network model to evaluate the innovation efficiency of 13 cities in the Province of Jiangsu in China. The results of the study show that upstream R&D efficiency does not show any relation with downstream technological commercialization efficiency; the latter plays a more important contribution to overall innovation efficiency than the former.

III. Conclusion

This paper has shown that value chain analysis is an effective way to examine the interaction among different players in a given industry. Although all business firms are part of the value-creating network, some firms have greater influence than others. R&D efficiency, as evaluated within the value-chain framework, does not relate to operational efficiency or technological commercialization efficiency. Basically, Porter’s value chain model provides useful but only partial understanding of value creation in supply chain relationship. Industrial upgrading in the context of global value chain emphasizes the importance of international linkages. Porter’s “closed-economy” model has not realistically taken into consideration globalization that increased the mobility of trade, investment and knowledge beyond national borders. This situation is confirmed, for instance, by the finding that small and medium enterprises in the Indonesian furniture industry have benefited from this global value chains. Furthermore, in global production networks, global flagships (e.g. original equipment manufacturers and global contract manufacturers) dominate such networks because of their capacity for system integration (Ernst, 2004; Pavitt, 2003). Services such as transport and warehousing, banking, insurance, business services and communication services complement global goods production.

IV. Areas for Future Research

There is a proliferation of early works on value chains and value chain analysis as shown in this literature review. Reflecting on the range of publications, it may be surmised that value chain analysis is a useful and practical approach to understanding relationships, components and actors within a sector or industry, whether from a local perspective or a global point of view. A closer look at the researches included in this brief review will show the diversity of application of value chain analysis and its variants and extensions.

The traditional or Porter view of value chain analysis is a good starting point for any study of value chains but it has shortcomings, which can be addressed by examining activities spread over several countries in a particular industry within a global value chain framework. Future research could examine the global value chain in selected industries such as furniture, textile and apparel, and consumer electronics.

In addition, there are findings from studies using value chain analysis that need validation. There are also issues associated with the value chain analysis model itself that need to be further investigated and addressed. This literature review is by no means complete. It is in fact part of an ongoing research meant to formulate propositions and/or hypotheses with respect to specific unresolved issues related to value chains and value chain analysis. With an expanded literature review, meta-analysis could be performed to gain better understanding of the status of value chain analysis as a research method and a tool for policy and decision-making, at the level of the firm, the industry, and the broader global community.