Firm failure causes: a population level study

Published: March 11, 2015

Latest article update: Dec. 8, 2022

Abstract

Business failure may be the result of either voluntaristic (internal) firm actions/decisions, deterministic environmental (external) events or both given causes (integrative approach). This study examines the prevalence of these causes of business failure. Results indicate that the largest proportion of firm failures is explained by the integrative approach, although two other perspectives hold a prominent role also. Moreover, internal causes of failure are more frequent than external. The findings based on multinomial logistic regression revealed that the causes of failure also vary with the size and age of firms. The implications of the results for research and practice are discussed

Keywords

Voluntaristic, firm age and size, firm bankruptcies, deterministic and integrative perspectives, failure cause

Introduction

Firm failure has been studied for decades, but the extant research has been dominated by studies seeking to predict failure. Studies focused on identifying the causes of business failure are both scanty (Altman and Narayanan, 1997) and fragmented, often covering narrow domains (Mellahi and Wilkinson, 2004). Moreover, the known empirical research on failure causes has used a variety of research designs (see in comparison e.g. Hall, 1992; Gaskill et al., 1993; Baldwin et al., 1997). The literature so far lacks a thorough understanding of why firms fail at the population level and whether different types of firms fail for different reasons. Therefore, this research seeks to fill important gaps in the literature. The objective of this research is to examine causes of firm failure at the population level by using a novel taxonomy. Variations in the causes of business failure are also examined among firms of differing size and age. In this study we define “failure” narrowly in terms of bankruptcy or permanent insolvency, as it is the most widely used definition in the literature. Still, we acknowledge that, when using other indicators of failure (see them in Cochran, 1981), such as not achieving goals or expected rate of return, the failure causes may differ from those found in this study.

The rest of the paper is structured as follows. The literature review outlines the various domains essential for this study and provides hypotheses to guide the research. The review begins by considering theories and some empirical studies on the causes of firm failure. This provides a Oliver Lukason acknowledges financial support from Estonian Research Council grant IUT20-49 “Structural Change as the Factor of Productivity Growth in the Case of Catching up Economies” and Estonian Science Foundation grant number ETF8546 “Internationalization processes: a typology, frequency and impact factors”. Richard Hoffman acknowledges financial support from Fulbright Grant, USA. Authors thank Jaan Masso and Andres Ѵбгк for comments that led to the improvement of paper. framework by which causes of business failure can be identified and classified. This is followed by a literature review of studies focusing on firm failure causes with an emphasis on how the causes may differ for firms of varying age and size. The data and research methods used in the empirical portion of the study are then described. This is followed by a section detailing the results of the statistical analyses conducted to test the hypotheses. The final section summarizes the results, discusses them in the light of available literature, outlines study implications for practice and provides directions for future research.

1. A review of literature

1.1. Theories of the causes of firm failure and empirical evidence. Early theories about the causes of firm failure reveal a contrast between two competing approaches, namely the industrial organization and population (organization) ecology perspectives as opposed to strategic choice and organization studies perspectives (Astley and van de Ven, 1983; Daily, 1994; van Witteloostuijn, 1998; Mellahi and Wilkinson, 2004). Thus, at one extreme, firms have to face their fate and can do nothing or very little to survive (e.g. population ecology) while at the other extreme (e.g. strategic choice), most of the firm’s destiny depends on the actions of its managers. These divergent views stem from the disagreement over the extent to which managers are able to influence firm performance (see Day and Lord, 1988), in other words whether environmental (external) forces dominate over management decisions (firm’s internal actions), or the other way round. The organization ecology approach (Hannan and Freeman, 1977; Freeman and Hannan, 1983; Freeman et al., 1983; Hannan and Freeman, 1984) considers the birth and death of firms as having characteristics similar to that occurring in nature. Also, multiple other scholars (e.g. Carroll, 1984; Wholey and Brittain, 1986; Singh and Lumsden, 1990; Amburgey and Rao, 1990) have contributed to the population ecology theory of organizations. In the ecological perspective, there are at least six main theoretical explanations of firm mortality (Singh and Lumsden, 1990), namely fitness set theory, liability of newness, density dependence, resource partitioning, liability of smallness, and the effects of founding conditions. The industrial organization perspective is a broad area of economic theory that considers various interactions between firms and markets. It proceeds from the idea that the firm’s external environment (i.e. whole economy, industry, regulation) matters more than firm’s actions (e.g. Aldrich and Pfeffer, 1976; Rumelt, 1991).

By contrast, the strategic choice (voluntaristic) perspective is not dominated by a major underlying theory according to Mellahi and Wilkinson (2004). Instead, a range of competing theories (i.e. groupthink theory, upper echelons theory, curse of success theory, threat-rigidity effect theory) have been developed. Of these many “voluntaristic” theories, the upper echelons theory (Hambrick and Mason, 1984) and the threat-rigidity effect theory (Staw et al., 1981) seem to be the most frequently cited in the failure literature. Subsequent research has emphasized the need to integrate both the strategic choice and deterministic perspectives (see e.g. Astley and van de Ven, 1983; Hrebiniak and Joyce, 1985). For example, Hrebiniak and Joyce (1985, pp. 338-339), outline four different types of organizational adaption based on high and low levels of strategic choice and environmental determinism. The various interactions of the organization with its environment have been viewed in several follow-up studies (e.g. Yasai-Ardekani, 1986; Koberg, 1987; Jennings and Seaman, 1994), although they do not directly consider these interactions in the context of firm failure. Mellahi and Wilkinson (2004) have outlined a general theoretical model that integrates the deterministic and choice approaches, namely viewing failure as an interaction between four broad factors: environmental, ecological, organizational, and psychological. Two of these factors originate from outside the firm and the rest originates from inside the firm. As a result, such an integrative approach basically identifies factors both internal and external to the firm as the primary causes of business failure.

Recent studies have tended to emphasize the integrative perspective. For example, Ropega (2011, p. 479) has noted that failure cannot be attributed to one or few causes from internal factors (i.e. some management action or inaction) or external factors (i.e. some development in the firm’s environment or in other words actions of parties outside the firm) alone, but instead, their interactions must always be considered. Similarly, Crutzen and van Caillie (2008) emphasize that the firm’s position at the market (i.e. misalignment or alignment with environment) determines how the firm deploys its resources. This deployment is often based on the firm’s internal policies. This emphasis on resource deployment also reflects the prominence of resource-based view in explaining firm failure (e.g. Thornhill and Amit, 2003).

A relatively small number of studies have examined specific reasons for business failure. Some of these studies have used an integrative approach combining both the voluntarisitic and deterministic perspectives by using the taxonomy of external and internal factors to represent the primary causes of business failure (e.g. Baldwin et al., 1997; Arditi et al., 2000; Blazy and Chopard, 2012; Laitinen and Lukason, 2014). Studies applying entrepreneurs’ understanding of failure causes (e.g. Gaskill et al., 1993; Carter and van Auken, 2006) are often characterized by the usage of different taxonomies than the internal-external approach, although the specific causes are quite similar to other studies.

Internal or external causes of business failure have not been unequivocally established in the literature. Boyle and Desai (1991, pp. 34-36) note that failure causes can be classified as originating from either inside or outside of the firm, namely internal causes are those decisions/actions that are under management’s control while external causes are events that are outside of management’s control. Baldwin et al. (1997, p. 16) use a similar distinction between internal and external failure causes as originating either from within or outside of the firm’s control respectively.

Empirical research of specific failure reasons has relied on different data sources and data collection methods. Data sources have largely included information from court and/or trustees (e.g. Blazy and Chopard, 2012; Crutzen and van Caillie, 2010), entrepreneurs, i.e., owners or managers (e.g. Bruno et al., 1987; Gaskill et al., 1993) and venture capitalists (Zacharakis et al., 1999). Studies reveal that the perceptions of the actual causes of business failure vary depending on the type of data source used (e.g. Rogoff et al., 2004; Franco and Haase, 2010). In addition, a variety of data collection methods have been used to gather information on failure causes such as interviews (e.g. Peterson et al., 1983; Bruno et al, 1987), questionnaires (e.g. Gaskill et al., 1993; Baldwin et al., 1997), and court documents (e.g. Hall, 1992; Blazy and Chopard, 2012).

We begin by first examining the causes of failure themselves. The research has not yet established whether internal or external causes are most frequently associated with firm collapse. According to the population ecology model discussed earlier, external causes would be the primary causes of firm failure. The strategic choice would favor internal causes as they represent management actions. In one study, Baldwin et al. (1997) found external and internal reasons for failure to be almost equally important in explaining firm failure. Whereas, Arditi et al. (2000), Gaskill et al. (1993), and Hall (1992) all observed that internal factors were the most frequent causes of firm failure. Using an integrative perspective, Mellahi and Wilkinson (2004, p. 32) noted that either environmental (external) or organizational (internal) factors serve as causes to firm failure only in extreme cases. The latter observation suggests that business failure is caused by a combination of both internal and external factors most of the time. However, this is merely a theoretical assumption. Given the competing views of the primary causes of business failure, we offer the following, only one of which will be supported:

Hypothesis 1.1. Based on the deterministic perspective, external factors are the most frequent cause of bankruptcy.

Hypothesis 1.2. Based on the voluntaristic perspective, internal factors are the most frequent cause of bankruptcy.

Hypothesis 1.3. Based on the interactionistic perspective, simultaneously occurring external and internal factors are the most frequent cause of bankruptcy.

1.2. The context of firm size and age in studies of failure causes. The population ecology perspective incorporates two prominent streams explaining why firms fail: the liability of smallness reflecting firm size and the liability of newness or adolescence reflecting firm age. The primary themes behind these streams are that smaller or younger firms are more likely to fail (Mellahi and Wilkinson, 2004), with some evidence offered to explain such phenomenon.

In general, the literature (e.g. Aldrich and Auster, 1986; Bumgardner et al., 2011; Penrose, 1995) suggests that the liability of smallness stems from the fact that, compared with larger firms, small firms have fewer resources - less capital and less skilled employees. On the other hand, the liability of newness is based on the fact that newer firms have to develop procedures, acquire new skills, and establish relationships with stakeholders, all of which already exist in older firms (e.g. Stinchcombe, 1965; Thornhill and Amit, 2003). A recent study (Tackler et al., 2013) concluded that both size and age play a role in the demise of firms. First, we examine the relationship of firm size and failure. Numerous studies have been conducted to explain how firm size may impact firm characteristics, performance and responses to their environment. Dean et al. (1998) has noted that small firms are more flexible and faster in making decisions, at least partly due to the lack of excessive bureaucracy, but in turn they mostly concentrate on narrow market-niches. Larger firms, on the other hand, strive for market share growth due to their economies of scale and scope and to their power over suppliers and customers. Dean et al. (1998) found that smaller firms tended to go bankrupt more often. Recently, Fackler et al. (2013) found a strong positive relationship between small size of firm and a higher risk of failure. One study has examined the relationship between the specific causes of failure and firm size, namely Hall (1992) found that differences in the reasons for failure varied with firm size. Specifically, this study found that operational management problems (internal causes) were the most common cause of failure; it accounted for 48% of failures among the smallest firms and 55% of failures among the largest firms. Thus, it is important to shed more light on the relationship between the actual causes of firm failure and the firm’s size.

One of the benefits of large size, besides economies of scale and possessing greater financial resources (e.g. Aldrich and Auster, 1986), is having a better reputation (Baum, 1996; Dean et al., 1998). A firm’s reputation not only facilitates attracting customers but also qualified managerial talent (e.g. Fackler et al., 2013). Furthermore, the greater resource base of larger firms enables them to adjust better to downturns in their environment (e.g. Bumgardner et al., 2011). Thus, it is unlikely that larger firms will fail due to either internal or external causes alone. Therefore, we propose that with an increase in size, the integrative approach of failure causes achieves a more prominent role.

By contrast smaller firms have the opposite characteristic of being resource constrained (Penrose, 1995) and have more difficulty hiring qualified employees (e.g. Baum, 1996). Consequently, small firms are more vulnerable to poor decision making which may lead to the risk of failure. Thus, it appears that smaller firms are particularly susceptible to fail due to poor management or internal causes.

The impact of adverse environmental (external) factors on the failure rate of large and small firms is less clear. Dean et al. (1998) found that industry structure differentially impacted the formation or development of large and small firms. However, the impact of external causes on the failure risk of large and small firms has not been thoroughly investigated. Arguments for and against the failure risk due to firm size have been made (e.g. Dean et al., 1998; Penrose, 1995) but not substantiated. For example, the flexibility of smaller firms may enable them to cope with external changes while the structural inertia of large firms may make it difficult for such firms to respond appropriately. On the other hand, the resource differences between small and large firms may enable the larger firms to respond more appropriately to adverse external events. We do not have sufficient support to propose a relationship between firm size and external causes of failure alone. Thus, we propose that causes of firm failure are associated with changes in firm size in the following way:

Hypothesis 2.1. The larger the firm, the more likely it is to fail primarily due to the presence of both internal and external causes.

Hypothesis 2.2. The smaller the firm, the more likely it is to fail due to the presence internal causes.

Hypothesis 2.3. Firm failure only due to external causes is not affected by size.

The liability of newness hypothesis (Stinchcombe, 1965) suggests that younger organizations face disadvantages compared with mature firms because younger firms have to develop new procedures, routines, and skills. This is a costly process that may lead to inefficiencies. By contrast more mature organizations have advantages in terms of reputation and more stable relationships with stakeholders. The studies that have examined business failure and firm age (Hall, 1992; Baldwin et al., 1997; Thornhill and Amit, 2003) have established that younger firms fail more often due to internal causes (e.g. operational management problems, inexperienced and incompetent management, different management failures) while older firms fail largely due to external causes (environment, competition, demand). Thus, the relevance of the deterministic and voluntaristic perspectives regarding the causes of firm failure is partly contingent on the age of the firm. Moreover, Henderson (1999, p. 281) noted that conditions such as the liability of newness or obsolescence can be present at the same time in the population of firms. Despite this, there is no strong theoretical nor empirical evidence to suggest that firm age is a factor when considering business failure due to a combination of internal and external causes. Thus, we believe the integrative hypothesis is invariant to firm age. There is stronger evidence that business failure among younger firms may be best explained by the voluntaristic hypothesis. Immature firms fail due more to their lack of experience (Thornhill and Amit, 2003) or limited resources (Hall, 1992). More recently, Egeln et al. (2010) found that successful young firms often fail due to a lack of financial resources. They reasoned that this does not necessarily reflect managerial incompetence but rather mistakes made by inexperienced managers. In another study, Fackler et al. (2013) found that smaller firms had a higher risk of mortality and that the risk of failure was strongest for small young firms. These firms seemed to have been more resource constrained. Based on the discussion above, we argue that younger firms are more likely than mature firms to fail due to internal causes - the voluntaristic hypothesis. Finally, we believe the deterministic hypothesis best explains the failure of older firms. Mature firms are more likely to fail due to changes in their environment which their rigid routines are unable to adjust to (Thornhill and Amit, 2003). The following are offered:

Hypothesis 3.1. Firm failure due to the presence of both internal and external causes is not affected by age.

Hypothesis 3.2. The younger the firm, the more likely it is to fail due to the presence of internal causes.

Hypothesis 3.3. The older the firm, the more likely it is to fail due to the presence of external causes.

2. Data and methodology

2.1. Sample. Our initial sample was derived from 1706 court judgments on firm bankruptcies that occurred in Estonia during the period 2002-2009 and were obtained from the Data System of Courts (judgments since year 2006) and the Database of Court Statistics and Decisions (judgments up to year 2005). In this study, we apply “bankruptcy” and “(permanent) insolvency” as synonyms, although in the results section it has also been discussed, that due to the setup of Estonian legal system the latter term would be better. This accounted for 41% of the total insolvencies in the country during that time period; whereas, for the years 2006-2008, this set of cases represented 70% of all bankruptcies in the country. Cases were excluded from the final sample when information about the causes of business failure were not disclosed, or were disclosed too briefly (for instance, if it was just noted that the firm bankrupted because of “different economic reasons” or “grave error in management occurred”), thus, not permitting their proper classification. This resulted in a final sample of 1281 cases and the number of bankruptcies peryear breaks down as follows: 2002 - 60 cases, 2003 - 145, 2004 - 132, 2005 - 133, 2006 - 182, 2007 - 168, 2008 - 232, 2009 - 229. However, the sample sizes vary for the testing of Hypotheses 2 and 3 due to the lack of availability of data on firm size, therefore being reduced to 854 cases.

2.2. Failure causes, firm types and statistical method. As the literature review demonstrated, there are multiple ways to collect data about the causes of firm failure. It is important that the causes attributed to firm failure be identified impartially (Fredland and Morris, 1976; Beaver, 2003) and that they capture all of the events having an underlying effect on firm failure (Dubrovski, 2009; Ropega, 2011). Thus, we must exclude management’s or owner’s opinions in identifying failure causes, as they may be biased. The only stakeholder left with sufficient knowledge of what happened to the firm would be a trustee. In many countries insolvency legislation requires that trustees (usually appointed by the courts) should find out and file what the main causes of firm failure were - the same obligation is set forth in the Estonian Bankruptcy Act (i.e. EBA). Trustees do not follow any predefined methodology when listing the causes, therefore, a large variety of different approaches to describing firm failure causes may appear in court judgments; this in turn makes their unification under a common taxonomy challenging. The reliability of the trustees’ opinions are based on the fact that they must pass an exam in Estonia; the exam tests their knowledge of different business topics (including accounting and business planning), and in addition, they must be able to clarify their reasons to the court. Thus, the trustees should be capable of determining the causes of firm failure. Several prior studies have already used opinions from trustees or the court to determine the causes of business failure (e.g. Baldwin et al., 1997; Blazy and Chopard, 2012). It is also likely that the trustees’ opinions themselves may not be an exact representation of reality due to bias. However, since we examine the relationships at the population level, one can assume that trustee bias is randomly distributed over the large number of opinions represented in the data.

Because the EBA does not establish a distinct format for how the causes should be listed, a general taxonomy should be selected to summarize a large variety of failure causes for a population of firms. The broadest available taxonomy is the one dividing failure causes into internal and external causes as described earlier. This taxonomy also incorporates the voluntaristic and deterministic perspectives for classifying failure causes. When applying the intemal/extemal taxonomy, three groups of firms are created: a) those failing due to only internal causes, b) those failing due to only external causes, and c) those firms failing due to both internal and external causes. This classification is represented by using a single nominal variable of failure causes (in following analysis marked as FAIL), by denoting the previously described three causes with respect- tive values and names: a) 1 - INT, b) 2 - EXT, and c) 3 - INTEXT. For guidance in classifying specific failure causes as either internal or external to the firm or both, we applied the specific lists of failure causes developed in the previous studies by Boyle and Desai (1991) and by Baldwin et al. (1997). In the cases when a failure cause was not given in the previous studies, we applied the logic of whether the cause was under management control (classified as internal) or not (classified as external). Moreover, in every failure process numerous causes can follow each other in succession, sometimes leaving the initial triggers undisclosed. For example, if a trustee noted, that a firm failed because of the bankruptcy of a debtor, the cause was coded as external, but if the previous situation was accompanied by the fact that firm had engaged in too liberal credit sales without collateral, the failure cause was coded as being both internal and external (resulting it to be classified as INTEXT in the variable labeled FAIL). Additional detail on the classification of failure causes may be found in Lukason and Hoffman (2014, p. 90). In order to guarantee the validity of our method of classification, we asked an independent researcher to classify the failure causes using our method on 50 cases selected randomly from our sample. There were no differences in the classification by the independent coder, providing validity for our classification method and permitting us to retain all 1281 cases in our sample.

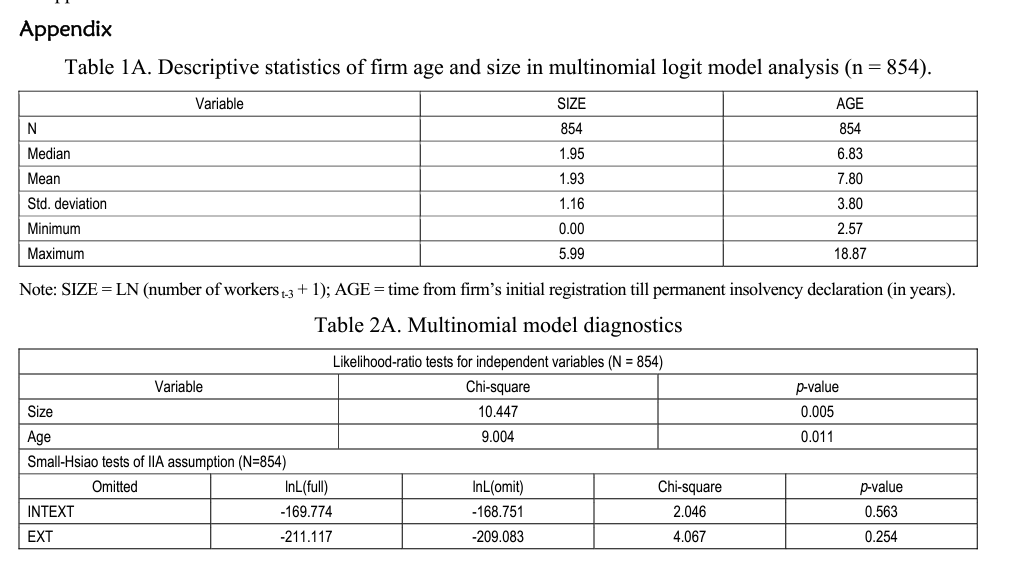

Size is measured using the number of employees. There are two distinct reasons for using this size measure. First, in failing firms financial figures tend to change more quickly than do the number of employees as failure approaches. Second, the number of employees facilitates the international comparability of our results, as this measure varies less across countries among similar types of firms than do financial measures. The variable SIZE is calculated as LN (number of workers +1), because numerous firms in the dataset have reported no employees (the owners may be the only employees and pay or expect to pay dividends instead of a salary). To capture size prior to bankruptcy, the number of employees is obtained from period t-3, where t denotes the bankruptcy year. The choice of t-3 is based on the fact that in the Lukason and Hoffman (2014) study most firms had failed between t-2 and t-1. Firm age (the variable AGE) is measured in years from the date of the initial registration of firm to the date of the declaration of permanent insolvency at the court. We intentionally do not apply here “bankruptcy declaration”, the reason of which is disclosed in the results section. The descriptive statistics of the variables SIZE and AGE appear in Appendix.

In order to study, how firm size and age are related to the causes of business failure, a multinomial logistic regression was employed for the analysis. The nominal variable FAIL (i.e. failure causes) served as the dependent variable with SIZE and AGE as independent variables. We did not control for different sectors/industries in the analysis for the following reasons. Firms often operate in several different industries, thus, classifying the firms was problematic and could lead to some bias. Also, the Estonian database did not include the sector/industry for many firms making classification for all firms impossible. The legal form of business (i.e. 0 for private or 1 for public limited company) for the firms in our sample was significantly and positively correlated with SIZE (Spearman correlation coefficient 0.301, p = 0.000), therefore, the legal form variable was excluded. Specifically, public limited firms were much larger than private limited ones in the dataset based on a comparison of means and medians of SIZE (for both tests, p < 0.01) for those two types of firms.

3. Results of hypotheses testing

To analyze the first set of hypotheses concerning the predominant causes of failure among the national population of firms, we examined the frequencies of the causes attributed to each business failure. The distribution among the categories of the causes of failure is as follows: internal causes only - 31%, external causes only - 26%, and combined internal and external causes - 43%. Thus, Hypothesis 1.3. is supported because it suggested that most frequently bankruptcy would be the result of both internal and external combined causes, and thus, the integrative approach held the most prominent role in explaining firm failure. Correspondingly, Hypotheses 1.1. and 1.2. are rejected. Although it must be noted that cases emphasizing only one environment (i.e. either voluntaristic or deterministic causes) together represent the simple majority (57.5%) of failures. These findings support the theoretically proposed argument by Mellahi and Wilkinson (2004) that integrative approach has the best explanatory power in explaining firm failures. Although, the presence of other perspectives is also very high, which according to Mellahi and Wilkinson (2004, p. 32) should be present in only extreme situations. The results show internal causes are more frequent than external (present respectively for 73.7% and 68.7% of cases), which is an expected result based on the review of literature, but similarly to Baldwin et al. (1997) study, the differences in the representation of internal and external causes are not large. We also checked if the firms included in the analysis were similar to the bankrupted firms excluded from the analysis. The median tests with AGE (p =253) and SIZE (p 0.660) indicate that the firms analyzed were not significantly different from those excluded from the analysis. Thus, the current dataset appears to be representative of the typical bankrupted Estonian firm from the same period. We also tested the robustness of the results with respect to how much the trustees have studied their specific cases. Namely, when a firm is assetless, then the trustee composes only a preliminary report and its activities are not governed by the bankruptcy committee. For such assetless firms, the process results in the abatement of the bankruptcy proceeding and liquidation of firm thereafter. Thus, in case of a declaration of bankruptcy, the trustees have more time and financial resources to work on the specific case. The chi-square test with the variable FAIL and the binary variable of insolvency type (either previously given abatement of proceeding or bankruptcy declaration) indicates no differences in the reasons given for failure (p-value of test 0.939), thus, there is no reason to suspect bias for the cases where the trustees may have spent less time on a particular case.

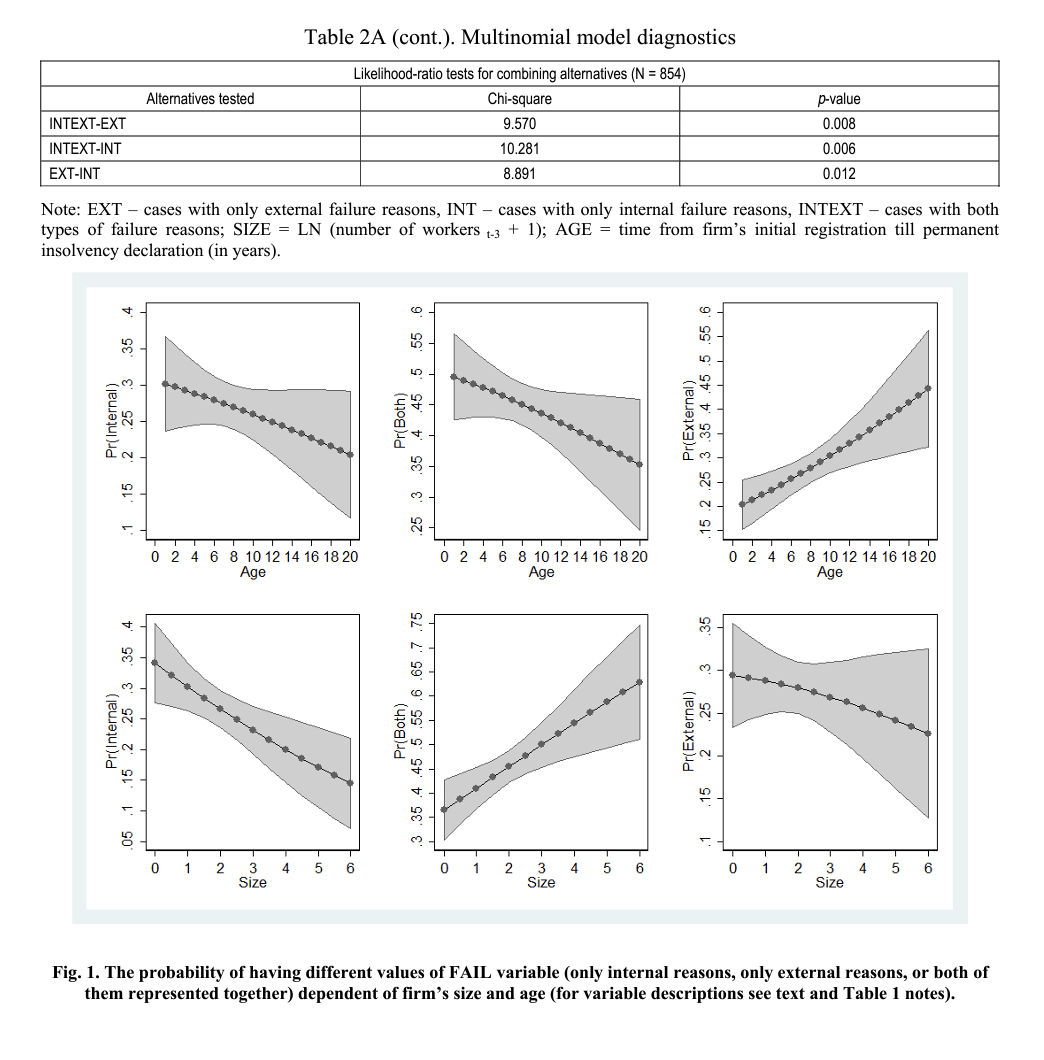

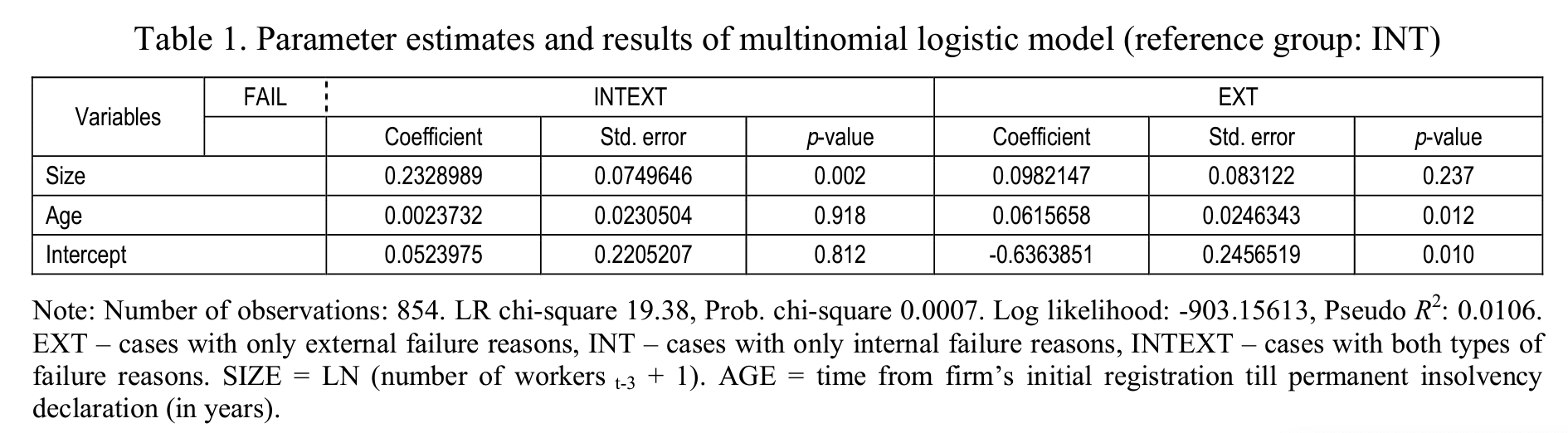

The test of the second and third set of hypotheses concerning the relationship between firm size and age and the causes of business failure employed the multinomial logit model with FAIL as the dependent variable and AGE and SIZE as the independent variables (see model in Table 1 and its marginal effects in Table 2). The multinomial model is significant (for LR chi-square, p = 0.0007), and it is presented with INT (i.e. only internal causes reported) as the reference category. It should be noted that the multinomial logit analysis is based on 854 out of 1281 cases, because of missing data about the number of employees for multiple firms.

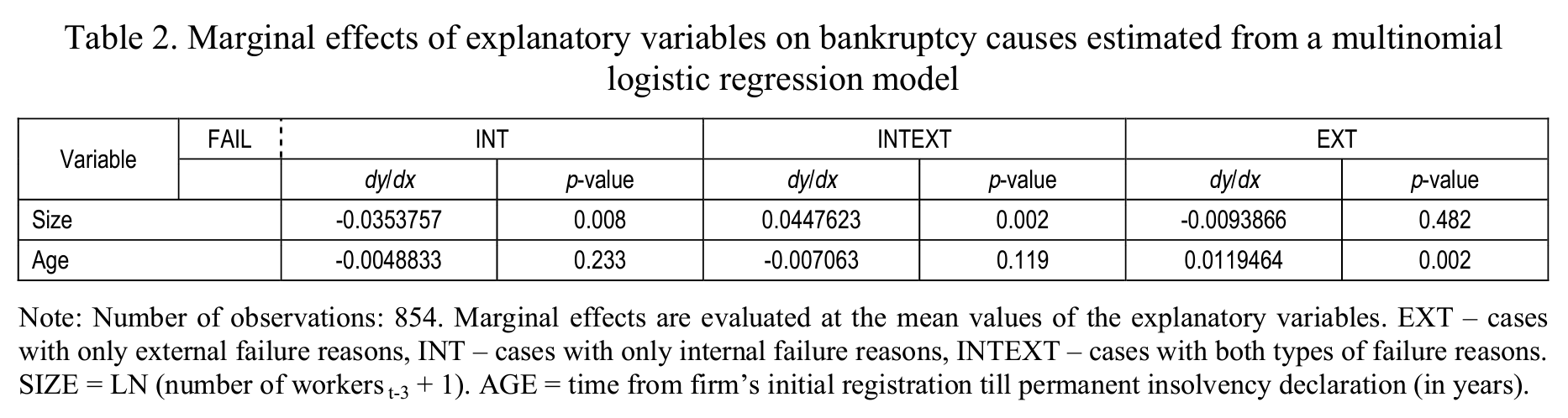

Table 1 indicates that increasing the variable SIZE by one, increases the odds by around 26.2% (when then coefficient 0.233 is transformed from multinomial odds to simple odds) that the combined internal and external causes are the reasons for failure as compared to only internal causes, while all other variables in the model are constant. When examining the results in Table 2, then a change in firm size is not associated with EXT (external causes only), thus supporting Hypothesis 2.3. On the contrary, size is significantly related to INT (internal causes) and INTEXT (combined causes), lending support for both Hypothesis 2.1. and 2.2. Namely, when size increases it is less likely that a firm fails due to only internal reasons. On the contrary, it is more likely that it fails because of both, internal and external reasons combined. It should be also noted, that the only significant relationship at /»-level 0.05 is between INT and INTEXT. Thus, given an increase in size, firm failure due to only internal reasons is clearly replaced by the combined internal and external causes. Table 2 indicates that an increase by one in SIZE (a logarithmic variable) makes failure due to the combined causes (INTEXT) 4.5% more likely while the failure causes due to internal factors alone (INT) are 3.5% less likely.

Table 1 shows that increasing variable AGE by one, increases the odds by around 6.3% (multinomial odds are transferred into simple odds) that a firm is failing due to external causes alone instead of only internal causes. Also, although not shown in Table 1, an increase in the variable AGE by one increases the odds by 6.1% that external causes are the reasons for business failure compared with the combined internal and external causes. The results in Table 2 indicate that with an increase in firm age, it is more likely that the firm fails primarily due to external causes, thus supporting Hypothesis 3.3. As the effect of firm age on the other FAIL values remains insignificant, Hypothesis 3.1. is supported, but Hypothesis 3.2. is rejected. Also, with the increase in firm age, there is significant relationship between INT & EXT and INTEXT & EXT failure cause categories, thus, sharply increasing the share of EXT cases for failed older firms. Table 2 indicates that an increase in AGE by one makes the reasons for failure due to external causes (belonging to the EXT group) 1.2% more likely. The probability of having different failure causes dependent of age and size has also been summarized on Figure 1 (see Appendix).

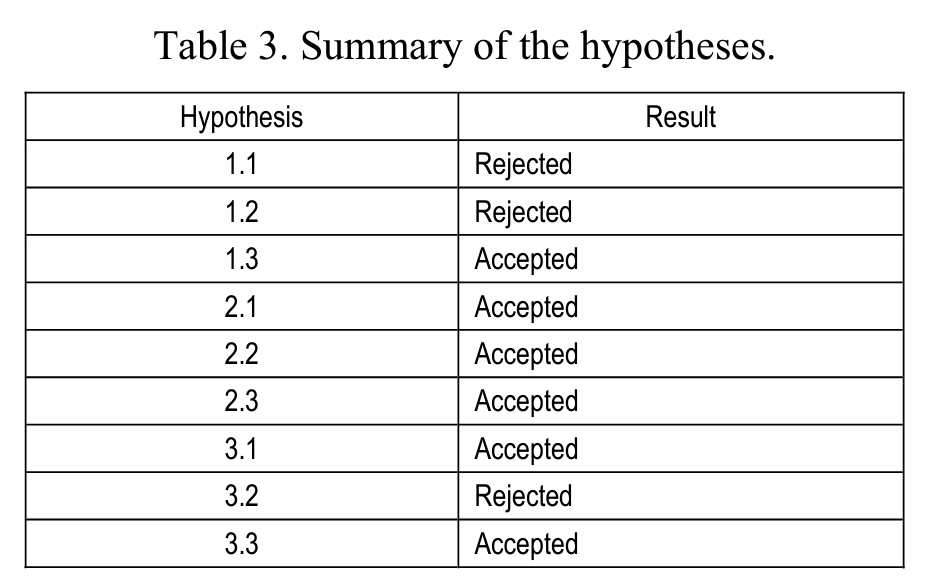

Several tests were conducted to check the goodness of fit of the multinomial logit model (see Appendix). Likelihood ratio tests indicate that the effects of both variables (AGE and SIZE) are significant at the p < 0.012 level. The likelihood ratio tests to check for the possibility of combining the categories of the dependent variable (FAIL) indicate that the categories of failure causes cannot be combined. The results of the last test, namely Small-Hsiao test, show that the irrelevant alternatives are independent from each other; this is the underlying assumption of multinomial logit model. Thus, all the tests commonly conducted for multinomial logit model indicate that it is a robust model. All the results of hypotheses testing have also been summarized in Table 3.

Conclusion with discussion and implications

The current study offers new and important insights to the literature on the causes of firm failure. Several unresolved issues were addressed by examining the causes of failure among a whole population of available court bankruptcy judgments. The findings support the proposition offered by Mellahi and Wilkinson (2004) that most cases of failure would be attributed to both, internal and external causes, although the share of such failure cases is not that much larger than those caused by either internal or external causes alone. Although the data tended to support the integrative approach, when examining the results for internal and external causes alone (i.e. internal causes present respectively for 73.7% and external for 68.7% of cases) the data provides a little more support to the strategic choice perspective (e.g. Hambrick and Mason, 1984; Hrebiniak and Joyce, 1985) of firm failure rather than the population ecology perspective. According to the latter perspective (e.g. Hannan and Freeman, 1977; Amburgey and Rao, 1990), the predominant causes of failure would be external to the firm. Still, since the typical firm in our analysis is small, the results should be treated with a caution.

Another important finding of this study is that firm size and age do have an impact on the type of causes associated with the firm’s failure. Given an increase in firm size, the probability of failure due to both internal and external failure causes increases. For very large firms, failure resulting from only internal reasons is rare. This is consistent with Hambrick and D’Aveni’s (1988) view of large corporate failure as a lengthy downward spiral process, where multiple internal and external factors contribute at different points in time, thus lending support to integrative approach. This probably reflects better control over the firm’s internal actions within larger firms as suggested by the literature on the liability of size (e.g. Stinchcombe, 1965; Dean et al., 1998).

With an increase in firm’s age, the probability that failure is caused by only external factors increases, but the probability of failures caused by both, internal and external causes together, remains high through all age groups. The high probability of failure due to only external causes lends some support to liability of obsolescence perspective (e.g. Fackler et al., 2013) in explaining the bankruptcies of older firms.

This study also reveals the value of using multiple theoretical perspectives. Studies at the population level normally rely on deterministic theories - population ecology (e.g. Hannan and Freeman, 1977; Amburgey and Rao, 1990) to explain the phenomenon under study. Our population level analysis of the causes of business failure reveals evidence not only for the deterministic perspective but also for the voluntaristic or strategic choice perspective (e.g. Hrebiniak and Joyce, 1985; Jennings and Seaman, 1994) as well as the integrative (environment and choice) perspective (Mellahi and Wilkinson, 2004; Ropega, 2011). Our results appear to validate the use of multiple theoretical perspectives when examining complex phenomena.

The study can be improved in a number of ways. First, by broadening our definition of failure beyond merely bankruptcy, we might reveal more diverse causes and failure processes. Moreover, examining similar data in other countries would assist in verifying the extent to which these results can be applied to business failures elsewhere. The firm failure process can be influenced by numerous factors, including legal, economic, cultural, and others; therefore, it is difficult to conclude without separate specific analysis whether and in which countries the results obtained herewith would be valid. The use of a more complex model and different research methods (e.g. questionnaire) would permit a look into the specifics of failure causes and, therefore, facilitate finding out more elaborate and interesting connections between firm failure and its causes. Several implications for managers and outside parties such as creditors, can be drawn from the results. Firstly, depending on the age and size of the firm, different stakeholders can monitor different indicators of a firm in order to foresee probable failure. Since older firms experience bankruptcy mainly because of external reasons, paying attention to especially sudden and severe environmental developments is crucial. On the contrary for very young firms, internal actions, either separately or in conjunction with external developments are the key contributors to failure. Thus, in case of young firms, the daily managerial decisions should be closely monitored in order to avoid failure. In the case of large firms, the key issue is what managers do under changing environmental conditions. Large firms seem to have enough internal control, thus, business failure primarily due to internal reasons only is quite rare for these cases. These implications are tempered by the fact that more work needs to be done before we can rely too much on the causes of failure as a way to monitor a firm’s failure process accurately.

References

- Aldrich, H.E. and Auster, E.R. (1986). Even Dwarfs Started Small: Liabilities of Age and Size and Their Strategic Implications, Research in Organizational Behavior, 8, pp. 165-198.

- Aldrich, H.E. and Pfeffer, J. (1976). Environments of Organizations, Annual Review of Sociology, 2, pp. 79-105.

- Altman, E.I. and Narayanan, P. (1997). An International Survey of Business Failure Classification Models, Financial markets, Institutions & Instruments, 6 (2), pp. 1-57.

- Amburgey, T.L. and Rao, H. (1990). Organizational Ecology: Past, Present, and Future Directions, Academy of Management Journal, 39 (5), pp. 1265-1286.

- Arditi, D., Kale, S. and Koksal, A. (2000). Business Failures in the Construction Industry, Engineering, Construction and Architectural Management, 7 (2), pp. 120-132.

- Astley, W.G. and van de Ven, A.H. (1983). Central Perspectives and Debates in Organization Theory, Administrative Science Quarterly, 28 (2), pp. 245-273.

- Baldwin, J., Gray, T., Johnson, J., Proctor, J., Raffiquzamann, M., Sabourin, D. (1997). Failing Concerns: Business Bankruptcy in Canada, Analytical Studies Branch, Statistics Canada, Ottawa.

- Baum, J.A.C. (1996). Organizational Ecology, in Clegg, S.R., C. Hardy and W.R. Nord (eds), Handbook of Organization Studies, Sage, London, UK, pp. 77-114.

- Beaver, G. (2003). Small Business: Success and Failure, Strategic Change, 12 (3), pp. 115-122.

- Blazy, R. and Chopard, B. (2012). (Unsecured Debt and the Likelihood of Court-Supervised Reorganization, European Journal of Law and Economics, 34 (1), pp. 45-61.

- Boyle, R D. and Desai, H.B. (1991). Turnaround Strategies for Small Firms, Journal of Small Business Management, 29 (3), pp. 33-42.

- Bruno, A.V., Leidecker, J.K. and Harder, J.W. (1987). Why Firms Fail, Business Horizons, 30 (2), pp. 50-58.

- Bumgardner, M., Buehlmann, U., Schuler, A. and Crissey, J. (2011). Competitive Actions of Small Firms In A Declining Market, Journal of Small Business Management, 49 (4), pp. 578-598.

- Carroll, G. (1984). Organizational Ecology, Annual Review of Sociology, 10, pp. 71-93.

- Carter, R. and van Auken, R. (2006). Small Firm Bankruptcy, Journal of Small Business Management, 44 (4), pp. 493-512.

- Cochran, A.B. (1981). Small Business Mortality Rates: A Review of Literature, Journal of Small Business Management, 19 (4), pp. 50-59.

- Crutzen, N. and van Caillie, D. (2008). The Business Failure Process. An Integrative Model of the Literature, Review of Business and Economics, 53 (3), pp. 287-316.

- Crutzen, N. and Van Caillie, D. (2010). Towards a Taxonomy of Explanatory Failure Patterns for Small Firms: A Quantitative Research, Review of Business and Economics, 55 (4), pp. 438-462.

- Daily, C.M. (1994). Bankruptcy in Strategic Studies: Past and Promise, Journal of Management, 20 (2), pp. 263-295.

- Day, D.V. and Lord, R.G. (1988). Executive Leadership and Organizational Performance: Suggestions for a New Theory and Methodology, Journal of Management, 14 (3), pp. 453-464.

- Dean, T.J., Brown, R.L. and Bamford, C.E. (1998). Differences in Large and Small Firm Responses to Environmental Context: Strategic Implications from a Comparative Analysis of Business Formations, Strategic Management Journal, 19 (8), pp. 709-729.

- Dubrovski, D. (2009). Management Mistakes as Causes of Corporate Crisis: Managerial Implications for Countries in Transition, Total Quality Management, 20 (1), pp. 39-59.

- Egeln, J., Falk, U., Heger, D., Höwer, D. and Metzger, G. (2010). Ursachen für das Scheitern junger Unternehmen in den ersten fünf Jahren ihres Bestehens, ZEW & ZIS, Neuss & Mannheim, Germany.

- Fackler, D., Schnabel, C. and Wagner, J. (2013). Establishment Exits In Germany: The Role of Size and Age, Small Business Economics, 63 (3), pp. 683-700.

- Franco, M. and Haase, H. (2010). Failure Factors in Small and Medium-Sized Enterprises: Qualitative Study from and Attributional Perspective, International Entrepreneurship and Management Journal, 6 (4), pp. 503-521.

- Fredland, J.E. and Morris, C.E. (1976). A Cross Section Analysis of Small Business Failure, American Journal of Small Business, 1 (1), pp. 7-18.

- Freeman, J. and Hannan, M.T. (1983). Niche Width and the Dynamics of Organizational Populations, American Journal of Sociology, 88 (6), pp. 1116-1145.

- Freeman, J., Carroll, G.R. and Hannan, M.T. (1983). The Liability of Newness: Age Dependence in Organizational Death Rates, American Sociological Review, 48 (5), pp. 692-710.

- Gaskill, L.-A.R., Manning, R.A. and Van Auken, H.E. (1993). A Factor Analytic Study of the Perceived Causes of Small Business Failure, Journal of Small Business Management, 31 (4), pp. 18-31.

- Hall, G. (1992). Reasons for Insolvency amongst Small Firms - A Review and Fresh Evidence, Small Business Economics, 4 (3), pp. 237-250.

- Hambrick, D C. and D’Aveni, R. (1988). Large Corporate Failures as Downward Spirals, Administrative Science Quarterly, 33 (1), pp. 1-23.

- Hambrick, D C. and Mason, P.A. (1984). Upper Echelons: The Organization as a Reflection of Its Top Managers, Academy of Management Review, 9 (2), pp. 193-206.

- Hannan, M.T. and Freeman, J. (1977). The Population Ecology of Organizations, American Journal of Sociology, 82 (5), pp. 929-964.

- Hannan, M.T. and Freeman, J. (1984). Structural Inertia and Organizational Change, American Sociological Review, 49 (2), pp. 149-164.

- Henderson, A.D. (1999). Firm Strategy and Age Dependence: A Contingent View of the Liability of Newness, Adolescence and Obsolescence, Administrative Science Quarterly, 44 (2), pp. 281-314.

- Hrebiniak, L.G. and Joyce, W.F. (1985). Organizational Adaptation: Strategic Choice and Environmental Determinism, Administrative Science Quarterly, 30 (3), pp. 336-349.

- Jennings, D.F. and Seaman, S.L. (1994). High and Low Levels of Organizational Adaptation: An Empirical Analysis of Strategy, Structure, and Performance, Strategic Management Journal, 15 (6), pp. 459-475.

- Koberg, C.S. (1987). Resource Scarcity, Environmental Uncertainty, and Adaptive Organizational Behavior, Academy of Management Journal, 30 (4), pp. 798-807.

- Laitinen, E.K. and Lukason, O. (2014). Do Firm Failure Processes Differ Across Countries: Evidence from Finland and Estonia, Journal of Business Economics and Management, 15 (5) (forthcoming).

- Lukason, O. and Hoffman, R. (2014). Firm Bankruptcy Probability and Causes: An Integrated Study, International Journal of Business and Management, 9(11), pp. 80-91.

- Mellahi, K. and Wilkinson, A. (2004). Organizational Failure: A Critique of Recent Research and a Proposed Integrative Framework, International Journal of Management Reviews, 5 (1), pp. 21-41.

- Penrose, E. (1995). The Theory of the Growth of the Firm, 3rd ed. New York, Oxford Press, USA.

- Peterson, R.A., Kozmetsky, G. and Ridgway, N.M. (1983). Perceived Causes of Small Business Failures: A Research Note, American Journal of Small Business, 8 (1), pp. 15-19.

- Rogoff, E.G., Lee, M.-S. and Suh, D.-C. (2004). “Who Done It?" Attributions by Entrepreneurs and Experts of the Factors that Cause and Impede Small Business Success, Journal of Small Business Management, 42 (4), pp. 364-376.

- Ropega, J. (2011). The Reasons and Symptoms of Failure in SME, International Advances in Economic Research, 17 (4), pp. 476-483.

- Rumelt, R.P. (1991). How Much Does Industry Matter? Strategic Management Journal, 12 (3), pp. 167-185.

- Singh, J.V. and Lumsden, C.J. (1990). Theory and Research in Organizational Ecology, Annual Review of Sociology, 16, pp. 161-195.

- Staw, B.M., Sandelands, L.E. and Dutton, J.E. (1981). Threat-Rigidity Effects in Organizational Behavior: A Multilevel Analysis, Administrative Science Quarterly, 26 (4), pp. 501-524.

- Stinchcombe, A. (1965). Social Structure and Organizations, in J.G. March (Ed.), Handbook of Organizations, Rand McNally & Company, Chicago, USA, pp. 142-193.

- Thornhill, S. and Amit, S. (2003). Learning About Failure: Bankruptcy, Firm Age, and the Resource-Based View, Organization Science, 14 (5), pp. 497-509.

- Van Witteloostuijn, A. (1998). Bridging Behavioral and Economic Theories of Decline: Organizational Inertia, Strategic Competition, and Chronic Failure, Management Science, 44 (4), pp. 501-519.

- Wholey, D. and Brittain, J.W. (1986). Organizational Ecology: Findings and Implications, Academy of Management Review, 11 (3), pp. 513-533.

- Zacharakis, A.L., Meyer, G.D. and DeCastro, J. (1999). Differing Perceptions of New Venture Failure: A Matched Exploratory Study of Venture Capitalists and Entrepreneurs, Journal of Small Business Management, 37 (3), pp. 1-14.

- Yasai-Ardekani, M. (1986). Structural Adaptations to Environments, Academy of Management Review, 11 (1), pp. 9-21.