Fiscal decentralization and macroeconomic stability: the experience of Ukraine’s economy

Published: Feb. 14, 2018

Latest article update: Dec. 11, 2022

Abstract

T he main objective of this research is to study the role and impact of fiscal decentralization on the macroeconomic stability of the country. The paper analyzes and systematizes approaches to the definition of ‘macroeconomic stability’ concept. T he key factors that impact macroeconomic stability are identified. In the framework of this research, the authors identify fiscal decentralization as one of the factors affecting macroeconomic stability. To determine the strength and statistical significance of the above mentioned relationship, the authors suggest presenting macroeconomic stability as a functional dependency between macroeconomic stability and the level of fiscal decentralization, which is described by the following variables: the growth rate of money supply, investment and openness of the economy, fiscal decentralization. In this case, it is suggested to determine the level of fiscal decentralization in three directions: expenditure decentralization, revenue decentralization and expenditure decentralization simultaneously

Keywords

Stability, macroeconomic stability, expenditure, revenue, growth rate, decentralization

INTRODUCTION

European integration processes, functioning in a changing environment, uncertainty and inconsistency of government decisions cause socio-eco- logical and economic conflicts and contradictions in all spheres of economic activity. Consequently, this leads to imbalances and instability in the national economy. Thus, it is necessary to distinguish the factors and study the strength of their impact on macroeconomic stability.

It should be noted that one of the priority goals of Sustainable Development Strategy “Ukraine - 2020” is to ensure national macroeconomic stability, which in turn will form the basis for further sustainable growth of the country. The Strategy aims to achieve these goals by implementing a number of reforms, including decentralization reforms. In addition, decentralization policy is aimed at moving away from the centralized governance model, ensuring effective local self-government and building an effective regional government system in Ukraine, implementation of The European Charter of Local Self-Government, the principles of subsidiarity, universal and financial self-sufficiency of local authorities (Strategy, 2015).

Thus, studying the role and impact of fiscal decentralization on the macroeconomic stability of the national economy is relevant. Therefore, it is necessary to use and combine several modern economic and mathematical methods for the analysis of decentralization impact on macroeconomic stability of the country.

1. LITERATURE REVIEW

The variety of methods used to analyze macro- economic stability, on the one hand, depends on the complexity of definition of essence and content of‘macroeconomic stability’ concept, and, on the other hand, on the deep analysis of all dependencies between indicators used as a result of this complexity.

Therefore, in economic literature, there are several approaches to the definition of macroeconomic stability concept: as the equilibrium of the basic macroeconomic indicators (Zuchowska, 2013; Hurduzeu & Lazar, 2015; Ionita, 2015), as the process of good macro-management of the country’s economy through setting out an effective government policy (Kuroyanagi et al., 1996), as the stability of financial and monetary system of the national economy (Guarata & Pagliacci, 2017; Vasilyeva et al., 2016; Polchanov, 2017), as a stability of financial market, particularly banking sector (Slav’yuk, 2017; Yushko, 2016), as a reduction in the amplitude of fluctuation of the main macroeconomic indicators (Ahangari et al., 2014; Montiel & Serven, 2006), as the basis for sustainable economic growth (Haghighi et al., 2012; Easterly & Kraay, 2000), as sustainable development of the corporative sector in economy and stock market, which is a base of national economy (Chigrin & Pimonenko, 2014; Leonov et al., 2014), etc. Besides, Kmetovä et al. (2017), noted that the effective and legitimate tax systems which correspond to EU requirements were considered to be an integral part of the strategy which leads straight to macroeconomic stability. Moreover, Zigman (2017) noted that fiscal councils are extremely important to ensure a macroeconomic stability through conducting the fiscal policy and decreasing the influence of politics on public finance management. Dzomira (2017) approved that macroeconomic stability depends on the public sector stability. In this case, Dzomira (2017) proposed to minimize the governance and financial health risks in the public sector. However, the concept of macroeconomic stability includes price level stability as the key part.

Studying the impact of decentralization on economic growth and macroeconomic stability Martinez-Vazquez and Mcnab (2006) conclude that decentralization has a positive impact on price stability in developed countries, although they indicate that this impact is much less clear in developing and transitional countries. As an indicator of macroeconomic stability, the authors use the inflation rate, while emphasizing that for more thorough evaluation of macroeconomic stability, it is better to use a composite index, equal to the sum of the unemployment rate and the inflation rate, however, relevant data shortage for 52 developing and developed countries for the period 1972-1997 did not allow the authors to conduct a more in-depth research.

Iqbal and Nawaz (2010) studying the impact of Pakistan’s fiscal decentralization on macroeconomic stability use Misery Index equal to the sum of the unemployment rate and the inflation rate as an indicator of macroeconomic stability. The assessment presented by the authors reports a positive and statistically significant impact of fiscal decentralization on macroeconomic stability, highlighting the positive effect of decentralization reforms being undertaken by the Government of Pakistan. Using Misery Index as an indicator of macroeconomic stability allowed Osmond Okonkwo and Godslov (2015) with the help of Error Correction Model (ECM) to ground the idea about a significant impact of fiscal decentralization and fiscal dependence ratio on macroeconomic stability in Nigeria. A number of studies have also shown the positive impact of decentralization on macroeconomic stability. Makreshanska and Petrevski (2015) reported that decentralizing government activities contributes to lowering inflation in the group of 11 former transition economies from Central and Eastern Europe (CEE) for the period from 1997 to 2001. King and Ma (2001) found that in developed countries, decentralization has a negative impact on macroeconomic instability, but that dependence for 49 countries during the period 1973-1994 is not significant for the whole sample. Akai and Sakata (2002) used a set of data that incorporated minimal historical differences, culture and stage of economic development of the U.S. to determine the real impact of fiscal decentralization on economic growth. Shah (2006) who distinguished between centralized and decentralized fiscal regimes (the Brazilian Federation and the unitary regime in China), found that this is a decentralized fiscal system that has the highest potential for macroeconomic management improvement.

One of the conclusions of the work “Decentralization and macroeconomic instability: The importance of political and institutional factors” (Jalil et al., 2012) is the denial of conventional wisdom regarding catastrophic impacts of decentralization on macroeconomic stability.

Nevertheless, it should be mentioned that Feltensteina and Iwata (2005) based on the analysis of vector autoregressive (VAR) model with latent variables for China for the period 1952-1996 come to the opposite conclusion stating about negative relationship between inflation and decentralization. The same conclusion is shared by the author of “Fiscal decentralization, central bank independence and inflation: a panel investigation” (Neyapti, 2004) who thinks that, despite country’s low-inflation and high- inflation fiscal decentralization has statistically negative effects on inflation. Treisman (2000) by using a panel data set of 87 countries for the period 1970-1980 finds that there is no clear relationship between decentralization and the level of inflation, and all theoretical approaches to a possible relationship between decentralization and macroeconomic outcomes result in three alternative theories: the commitment theory, the theory of collective action, and the theory of continuity.

Thornton (2007) conducted a study of 19 OECP countries for the period 1980-2000 and found that the dependence of impact of revenue decentralization on inflation was not statistically significant. At the same time, for more qualitative analysis of relationship between fiscal decentralization and economic growth, the author focuses on the share of revenue of sub-national governments, over which sub-national governments have full autonomy.

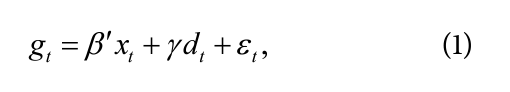

Scientists from The University of Queensland (Australia) Bodman, Campbell, Heaton, and Hodge (2009) investigated the impact of decentralization on the Australian economy at both aggregate and state levels using the regression model:

where gt - the value of the macroeconomic variable of interest in period t = 1972, 2005; xt - a set of control variables that are useful in explaining the determinants of the macro- economic variable, including a constant term; dt - a measure of fiscal decentralization; st - the error term, both in period t, did not show straightforward impact of fiscal decentralization on the Australian economy. Consequently, at the aggregate level, decentralization is found to decrease medium-term economic growth, worsen the budget balance and increase, and at the state level, decentralization is generally found to have no significant impact on the distribution of income but a weak negative effect on economic growth the size of the public sector (Bodman et al., 2009).

2. OBJECTIVE

Keeping this in view, the prime objective of this study is to assess the impact of fiscal decentralization on current macroeconomic stability of Ukraine, complemented by the authors’ proposals to incorporate different approaches to the measure of macroeconomic stability.

3. DATA AND METHODS

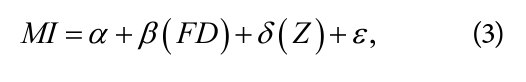

We use the empirical model suggested by Bodman, Campbell, Heaton, and Hodge (2009), Iqbal and Nawaz (2010), Makreshanska and Petrevski (2015) to analyze the relationship between fiscal decentralization and macroeconomic stability. It is given in the following functional form:

where MI represents the various alternative measures of macroeconomic stability; f (FD) - functional dependence between macroeconomic stability and the level of fiscal decentralization.

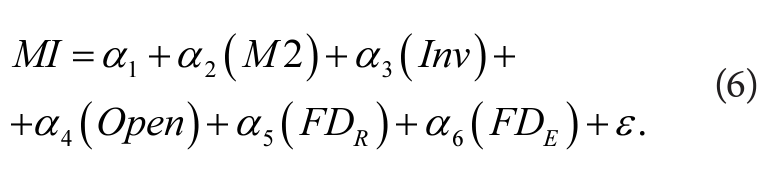

Model (2) can be presented as a regression equation:

where FD represents the various alternative measures of fiscal decentralization; Z is a vector of other exogenous variables explaining the behavior of macrostability over time (the growth rate of money supply М2, investment Inv and openness of the economy Open); a, ß and 5 are the constant, s represents the error term.

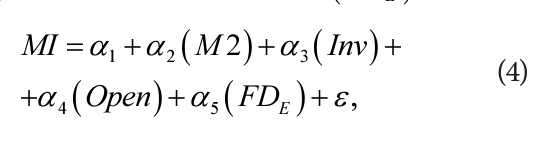

As stated in Iqbal and Nawaz (2010), evaluation of fiscal decentralization can be realized both for revenues and expenditures, hence, the regression equation can be of three types:

for expenditure decentralization (FDe ):

where М2 - money supply М2 as percent of GDP; Inv - gross fixed capital formation as percent of GDP; Open - ratio of foreign trade turnover (export plus import) to country’s GDP; FDE - the ratio of local budgets expenditures to the consolidated budget expenditures; a1..a5 - constant;

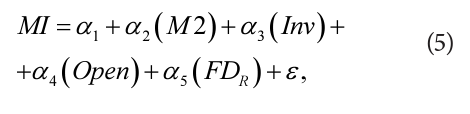

for revenue decentralization (FD3):

where ID,, - the ratio of local budgets revenue to the consolidated budget revenue;

for revenue and expenditure decentralization simultaneously:

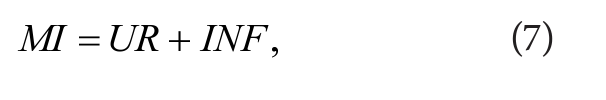

As a measure of macroeconomic stability, we will use the following variables:

- the inflation rate: we use the annual change in the Consumer Price Index (CPI) as a given indicator (Martinez-Vazquez & Macnab, 2006);

- Misery Index, which is the sum of unemployment rate and inflation rate (Iqbal & Nawaz, 2010; Okonkwo & Godslove, 2015):

where MI is Misery Index, UR unemployment rate and INF is inflation rate of the economy;

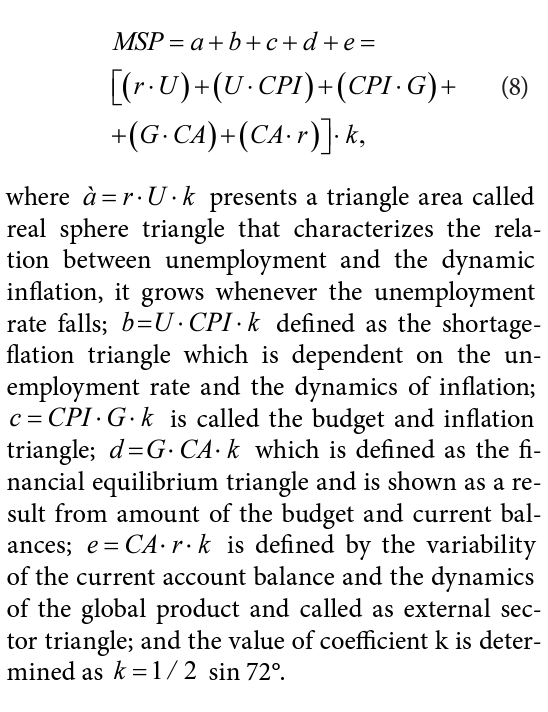

- synthetic index MSP, based on the concept of “macroeconomic stabilization pentagon”, was

suggested by the Director of the Institute of Finance in Warsaw, Professor of Economics Kolodko (1993) and was further developed in research by Zuchowska (2013), Hurduzeu and Lazar (2015), Ionita (2015). The basis for this concept is the calculation of the area of the pentagon. Its vertices consist of basic macro- economic indicators (index of changes in the GDP level (r); unemployment rate (U}; rate of inflation or consumer price index (CPI}-, ratio of budget balance to GDP in percent (G); current account balance (C4), which is presented as a ratio of current account balance to GDP in percent):

Lyulyov and Shvindina (2017) have used statistical data set for low and middle income countries between the period 2000-2015 to conduct a detailed analysis of macroeconomic stability based on MSP, MSP I and MSP2 indicators.

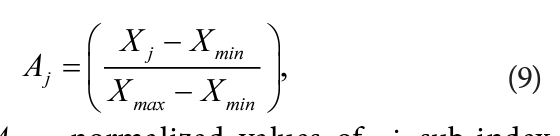

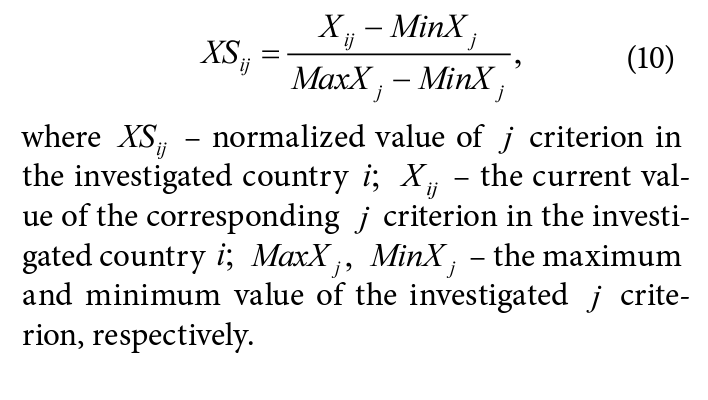

- the indicator of macroeconomic stabilization IMS was suggested by Serbian scientists Dr. Constantin Zaman, Consultants Paris and CASE Warsaw and Branko Drcelic, Deputy Head of Treasury Administration - Ministry of Finance of Serbia (Zaman & Drcelic, 2009), which sums up the values of five normalized sub-indices of stability: real GDP growth, unemployment, inflation, budget deficit and foreign debt. The procedure for the normalization of the sub-indices of the indicator of macroeconomic stabilization (IMS) is performed in the following manner:

where Aj - normalized values of J sub-index of the indicator of macroeconomic stabilization (IMS); Xmax and Xmin - the maximum and minimum value of the corresponding sub-index of the indicator of macroeconomic stabilization (IMS) which may vary in the range:

- from 0 to 10 for change in GDP (g);

- from 5 to 25 for change in unemployment rate (w);

- from 0.92 to 4.61 for change in inflation (p):

- from -10 to 2 for change in budget deficit as a percentage of GDP (bd);

- from 10 to 65 for change in foreign deficit/ debt (fd).

- Index of Macroeconomic Stability (MS) is based on the arithmetic mean of normalized indicators method: 1) the fiscal deficit to GDP ratio; 2) the sum of the unemployment and inflation rates; 3) the external debt-to- GDP ratio (Briguglio et al., 2009). The normalization procedure is carried out using the formula:

4. RESULTS

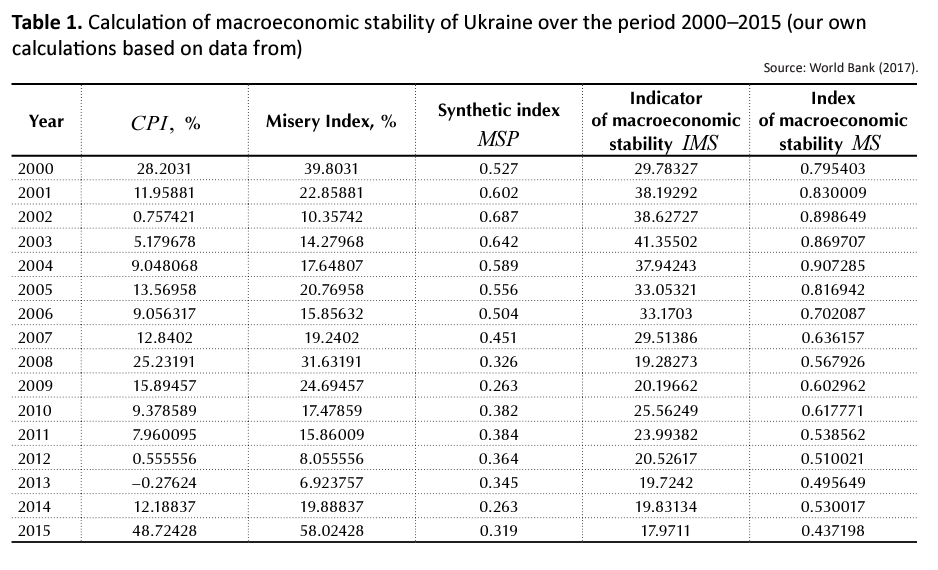

To apply the proposed method for assessing the impact of fiscal decentralization on macroeconomic stability, we have calculated the variables of macroeconomic stability (Table 1) as dependent variable of the regression equation (3), based on the collected and processed statistical date set from Ukraine (World Bank, 2017) covering the period from 2000 to 2015.

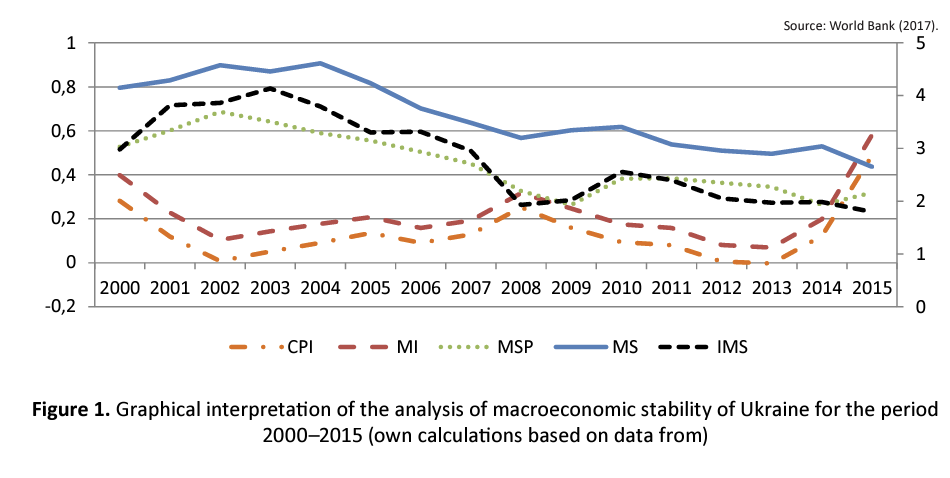

Figure 1 shows that the value of macroeconomic stability, regardless of the evaluation method, steadily moved from peaks to troughs, which can be divided into three periods: the pre-crisis period (2000-2006), the crisis period (2007-2010), and post-crisis period (2011-2015). In particular, during the period of stable industrial production growth, low inflation, public debt reduction, Ukraine’s 2003 IMS level was the highest compared to other analyzed periods and was 41.36, which can be interpreted as a very stable economy (Zaman & Drcelic, 2009). The indicators of macroeconomic stability MSP and MS show the same positive dynamics during that period. At the same time, MSP decline from 0.527 in 2000 to 0.326 in 2008 allows to conclude about the lack of proper coordination in economic policies in Ukraine to achieve a high level of macroeconomic stability. It should be mentioned that in all the graphs in Figure 1, the peak of macroeconomic stability decline is the financial and economic crisis of 2008-2009, and despite the gradual recovery of the economy in 2011-2015, the level of macro- economic stability of the country remains significantly lower than the growth rate in the pre-crisis period.

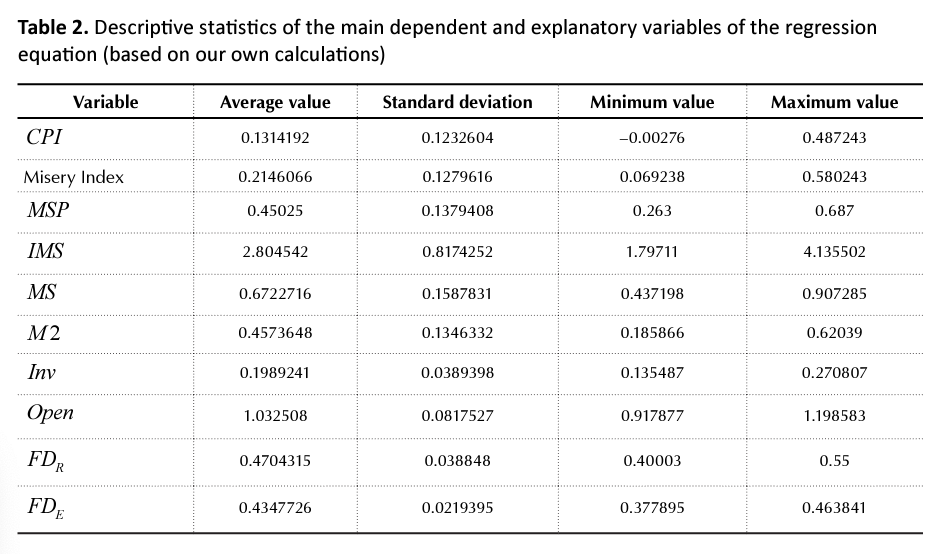

Table 2 presents data characteristics for the main explanatory factors of the regression equation (3) and their descriptive statistical characteristics.

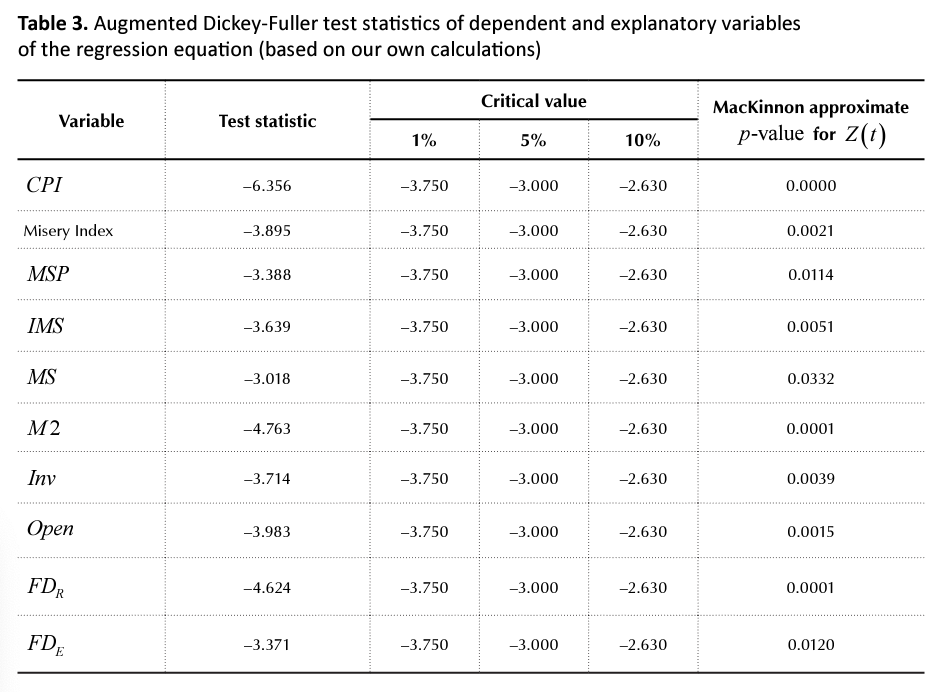

The statistical analysis of the dependent and explanatory variables of the regression equation (3) using the Augmented Dickey-Fuller (ADF) test showed that the data in this series are non- stationary in this study; therefore, in order to obtain a correct explanation of the results, we will perform the procedure for finding the first statistical data differences. In this case, the data are expressed in logs, and the first differences are explained as growth rates and result in the stationarity of the series (Table 3).

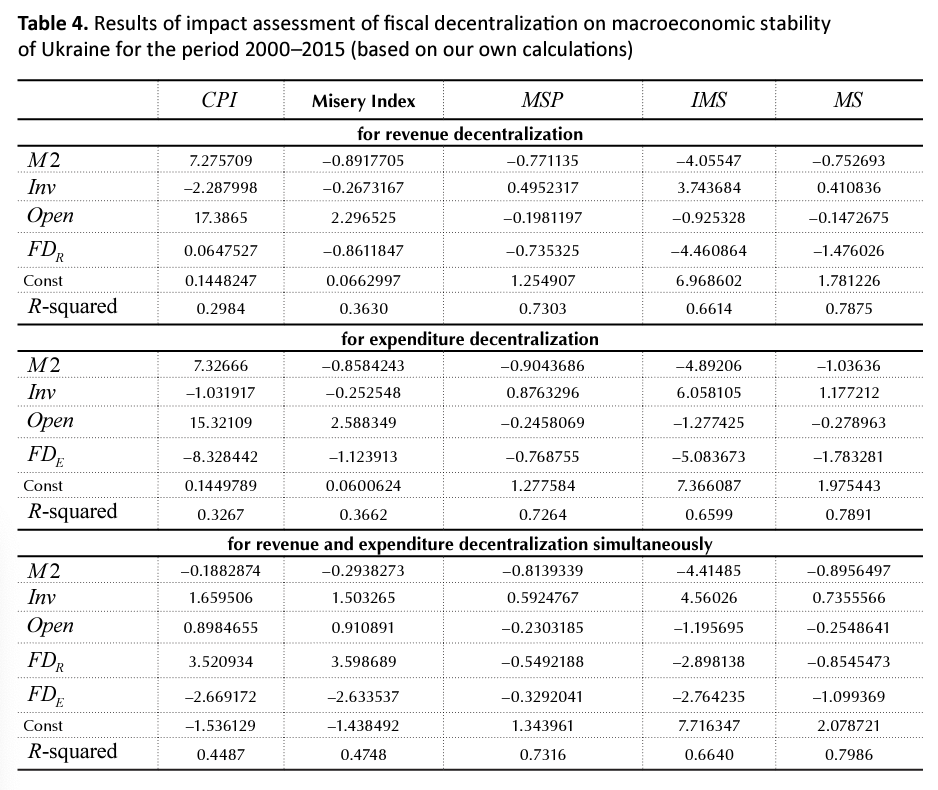

The stationarity of data series allows using the OLS method (least squares) to set up the regression equations (4)-(6). Results are reported in Table 4. We emphasize that, if the indicator of macroeconomic stability of the country is an integral indicator that characterizes the main goals of macro- economic policy of the state: high rates of production development, full employment, slowdown in inflation, external payments balance, a stable exchange rate of the national currency, etc., the accuracy of the dependent variable assessment, which is explained by the dependence model, increases. In particular, R-squared value varies from 0.6614 to 0.7986 when using MSP, IMS and MS as an integral indicator of macroeconomic stabilization.

Empirical findings of the study indicate that the relationship between income decentralization and macroeconomic stability in Ukraine for the period 2000-2015 is negative and statistically significant. Such negative relationship is mainly caused by 2000-2014 Ukrainian model of formation and use of budget funds, based on centralization of financial resources in the State Budget of Ukraine and the mechanism of subsidies for local budgets (Valigura & Ambryk, 2016). The findings of the study indicate that decentralization reforms initiated in 2014 in Ukraine in compliance with the European Charter of Local Self-Government are aimed at implementing European integration vector for local and regional democracy development, and will ultimately lead to a stable macro environment.

CONCLUSION

The current study analyzes the relationship between fiscal decentralization and macroeconomic stability in Ukraine for the period 2000-2015. The results of the empirical analysis of the constructed regression equations, which are based on the study of independent random variables impact: the growth rate of money supply, investment and openness of the economy, fiscal decentralization (predictors) and dependent macroeconomic stability variable, showed that the accuracy of the findings increases, when we use the indicator of macroeconomic stability of the country as an integral indicator (synthetic index MSP, indicator of macroeconomic stabilization IMS, index of macroeconomic stability MS), which characterizes the main goals of macroeconomic policy of the state: high rates of production development, full employment, slowdown in inflation, external payments balance, stable exchange rate of the national currency, etc.

The analysis of macroeconomic stability, regardless the assessment method, allowed us to conclude that there was a lack of proper coordination in economic policies in Ukraine to achieve a high level of macroeconomic stability. In particular, in the pre-crisis period (2000-2006), Ukraine achieved a very stable economy level with the highest IMS compared to other periods analyzed and was 41.36, but in the post-crisis period 2011-2015, the level of macroeconomic stability remained much lower than the growth rate in the pre-crisis period. Meanwhile, the results of the regression equations analysis allow the authors to conclude that decentralization reforms in Ukraine in 2014 will ultimately lead to a stable macro environment.

ACKNOWLEDGEMENT

This research was funded by the grants from the Ministry of Education and Science of Ukraine (No. g/r 0117U003260 and No. g/r 0117U003932) and from the Research Council of Lithuania (No. TAP LU-4-2016).

REFERENCES

- Ahangari, A., Arman, A., & Saki, A. (2014). The estimation of Iran’s macroeconomics instability index. Management Science Letters, 4(5), 871-882.

- Akai, N., & Sakata, M. (2002). Fiscal decentralization contributes to economic growth: evidence from state-level cross-section data for the United States. Journal of urban economics, 52(1), 93-108.

- Bodman, P., Campbell, H., Heaton, K. A., & Hodge, A. (2009). Fiscal decentralization, macroeconomic conditions and economic growth in Australia (MRG @ UQ Discussion Paper, 26). University of Queensland, School of Economics.

- Briguglio, L., Cordina, G., Farrugia, N., & Vella, S. (2009). Economic vulnerability and resilience: concepts and measurements. Oxford development studies, 37(3), 229-247.

- Chigrin, O., & Pimonenko, T. (2014). The Ways of Corporate Sector Firms Financing for Sustainability of Performance. International Journal of Ecology & Development, 29(3), 1-13.

- Dzomira, S. (2017). Governance and financial health risk in an emerging economy’s public sector. Public and Municipal Finance, 6(1), 83-87.

- Easterly, W., & Kraay, A. (2000). Small states, small problems? Income, growth, and volatility in small states. World development, 28(11), 2013-2027.

- Feltenstein, A., & Iwata, S. (2005). Decentralization and macroeconomic performance in China: regional autonomy has its costs. Journal of Development Economics, 76(2), 481-501.

- Guarata, N., & Pagliacci, C. (2017). Understanding Financial Fluctuations and Their Relation to Macroeconomic Stability. Inter- American Development Bank.

- Haghighi, H. K., Sameti, M., & Isfahani, R. D. (2012). The effect of macroeconomic instability on economic growth in Iran. Research in Applied Economics, 4(3), 39-61.

- Hurduzeu, G., & Lazar, M. I. (2015). An assessment of economic stability under the new European economic governance. Management Dynamics in the Knowledge Economy, 3(2), 301.

- Ionita, R. O. (2015). The Evolution of the Macroeconomic Stabilisation Pentagon In Romania, Czech Republic And Hungary. The Annals of the University of Oradea, 25(1), 733-741.

- Iqbal, N., & Nawaz, S. (2010). Fiscal decentralization and macroeconomic stability: Theory and evidence from Pakistan.

- Jalil, A. Z. A., Harun, M., & Mat, S. H. C. (2012). Decentralization and macroeconomic instability: The importance of political and institutional factors. Journal of Business and Policy Research, 7(1), 49-59.

- Kmetová, O., Freňáková, M., & Pachta, M. (2017). Fiscal interest of the state and respecting the rights and legitimate interests of the taxable entities in case of refund of excess remission of value added tax. Investment Management and Financial Innovations, 14(2-1), 207-217.

- King, D., & Ma, Y. (2001). Fiscal decentralization, central bank independence, and inflation. Economics Letters, 72(1), 95-98.

- Kolodko, G. W. (1993). Stabilization, recession and growth in a postsocialist economy. MOCT-MOST: Economic Policy in Transitional Economies, 3(1), 3-38.

- Kuroyanagi, M., Yano, J., Nakanishi, Y., Komatsu, M., Futamura, H., & Mihira, T. (1996). Macroeconomic Stabilization and Monetary Policy of Four Asian Countries Japan, Korea, Indonesia, and the Philippines-Targets, Effectiveness and Results. Economic Analysis, 145, 9-197 (in Japanese).

- Leonov, S., Frolov, S. & Plastun, V. (2014). Potential of institutional investors and stock market development as an alternative to savings allocation of households. Economic Annals – XXI, 11-12, 65-68.

- Lyulyov, O., & Shvindina, H. (2017). Stabilization pentagon model: application in the management at macro- and micro- levels. Problems and Perspectives in Management, 15(3), 42-52.

- Makreshanska, S., & Petrevski, G. (2015). Fiscal Decentralization and Inflation in Central and Eastern Europe.

- Martinez-Vazquez, J., & Macnab, R. M. (2006) Fiscal Decentralization, Macrostability and Growth. Hacienda Pública Española / Revista de Economía Pública, 179(4), 25-49.

- Montiel, P., & Servén, L. (2006). Macroeconomic stability in developing countries: How much is enough? The World Bank Research Observer, 21(2), 151-178.

- Neyapti, B. (2004). Fiscal decentralization, central bank independence and inflation: a panel investigation. Economics Letters, 82(2), 227-230.

- Okonkwo, O. N., & Godslove, E. K. (2015). Fiscal Decentralization and Nigerian Macroeconomic Performance and Economic Stability. International Journal of Economics and Finance, 7(2), 113-121.

- Polchanov, P. (2017). Coordination of state fiscal and monetary policy the in the context of post-conflict recovery. Accounting and Financial Control, 1(2), 19-28.

- Slav’yuk, R., Shkvarchuk, I., & Kondrat, I. (2017). Financial market imbalance: reasons and peculiarities of occurrence in Ukraine. Investment Management and Financial Innovations, 14(1-1), 227-235.

- Shah, A. (2006). Fiscal decentralization and macroeconomic management. International Tax and Public Finance, 13(4), 437-462.

- Strategy of Sustainable Development “Ukraine – 2020” (2015).

- Thornton, J. (2007). Fiscal decentralization and economic growth reconsidered. Journal of urban economics, 61(1), 64-70.

- Treisman, D. (2000). Decentralization and inflation: commitment, collective action, or continuity? American Political Science Review, 94(4), 837-857.

- Valigura, V., & Ambryk, L. (2016). Financial effects of fiscal decentralization in Ukraine. Svit finansiv, 2(47), 123-135.

- Vasilyeva, T., Sysoyeva, L., & Vysochyna, A. (2016). Formalization of factors that are affecting stability of Ukraine banking system. Risk governance & control: financial markets & institutions, 6(4), 7-11.

- World Bank (2017). World Development Indicators 2017, World Bank.

- Zaman, C., & Drcelic, B. (2009). Macro-Stabilisation Issues in the Serbian Economy: Methodological Evaluation.

- Žigman Ante, & Martina Jergović (2017). The impact of fiscal councils on the budgetary consolidation. Public and Municipal Finance, 6(1), 15-23.

- Żuchowska, D. (2013). Assessment of the Central and Eastern Europe Economies in the Years 2007–2010 Based on the Model of the Macroeconomic Stabilization Pentagon. Equilibrium. Quarterly Journal of Economics and Economic Policy, 8(4), 49-64.

- Yushko, I. (2016). The overall efficiency of the major banks in the global financial instability. Banks and Bank Systems, 11(4).