Impact of audit committees with independent financial experts on accounting quality. An empirical analysis of the German capital market

Published: Feb. 14, 2011

Latest article update: Dec. 7, 2022

Abstract

This paper presents the findings from a study, based on the annual reports’ analysis of German corporations listed in the DAX30, TecDAX, MDAX and SDAX, that investigates whether the implementation of audit committees and independent members with financial expertise leads to higher accounting quality (lower earnings management and accounting errors). The analysis of regressions conducted states a significant negative link between the independence and financial expertise of its members, earnings management and accounting errors. Significant results cannot be achieved if less than 50% of the audit committee members are independent financial experts

Keywords

Corporate governance research, independence, audit committees, financial expertise

Introduction

The implementation of audit committees with independent financial experts is a key aspect of “good” corporate governance with regard to the accounting quality of listed stock corporations. In order to reveal accounting offences and/or earnings management, audit committees intensively deal with the management board’s compliance with the law and usefulness of the accounting policy. Even though the monitoring of accounting activities is part of the supervisory board’s plenum tasks in the German two-tier system. In the regulation draft of 2011, the European Commission (EC) (2011) in opposite to the 8th directive plans to implement audit committees with mainly independent members and at least two financial experts. However, European listed companies will not be forced to implement audit committees if the supervisory board in the two-tier system realizes its tasks.

Earnings management is the intentional and profit oriented decision making of management with regard to the selective application of accounting instruments in order to influence the accounting’s addressees within a legal framework. In cases where earnings management violates the law, e.g., does not comply with the commercial law or International Financial Reporting Standards (IFRS), we talk about accounting errors. Accounting errors are unconscious acts of a company’s management (e.g., unnoticed accounting errors) whereas accounting fraud assumes an intentional violation of existing law. Companies risk a loss of reputation in case accounting offences are not revealed by the audit committee and the annual auditor but by national enforcement authorities enacting the publication of the detected enforcement mistakes. As opposed to other legal systems, so far no empirical results do exist for the German market whether audit committees with independent financial experts have an influence on earnings management and on the occurrence of accounting offences. However, empirical surveys with corresponding research design do exist for the one-tier system (e.g., for Australia Baxter and Cotter, 2009). The present empirical survey is based on Davidson et al. (2005), Koh et al. (2007) and Baxter and Cotter (2009) and addresses a potential influence of newly implemented audit committees and their respective composition of independent financial experts on the dimension of earnings management and the occurrence of accounting offence. It is a contemporary issue because national and European authorities currently seek to improve accounting quality with the implementation of audit committees. From a German perspective, primarily the increase in members of the supervisory board impedes the effective assessment of accounting policies. Other factors are the heterogeneous composition of the supervisory board as well as the level of compliance with co-determination rules. A localization of experts in the audit committee, therefore, is a must.

The remainder of the paper is organized as follows. At the beginning of section 1, we deal with the principal agent-theory, whereby we also explain the main characteristics of the German two-tier system and the structure and functions of the German Corporate Governance Code (GCGC). Thereafter, a review of present empirical corporate governance research results with regard to the influence of audit committees on earnings management and accounting offence as well as hypothesize is part of section 2. Section 3 focuses on the research design, the probability sampling (3.1), the dependent variables (3.2) as well as the independent and the control variables (3.3 and 3.4). Then, emphasis is placed on the empirical results of our study in section 3.5. Regression analysis cannot prove a negative link between the implementation of audit committees, earnings management and the occurrence of accounting offence (hypothesis 1). However, a negative link can be found with regard to the (at least) majority composition of audit committees with independent financial experts and the dimension of earnings management and the occurrence of accounting offence (hypothesis 3). Section 4 focuses on the limitations and implications of the empirical study and on further suggestions for empirical research on our topic on the German capital market. Main results and conclusions are summarized in the final section.

1. Agency theoretical foundation of the German two-tier system

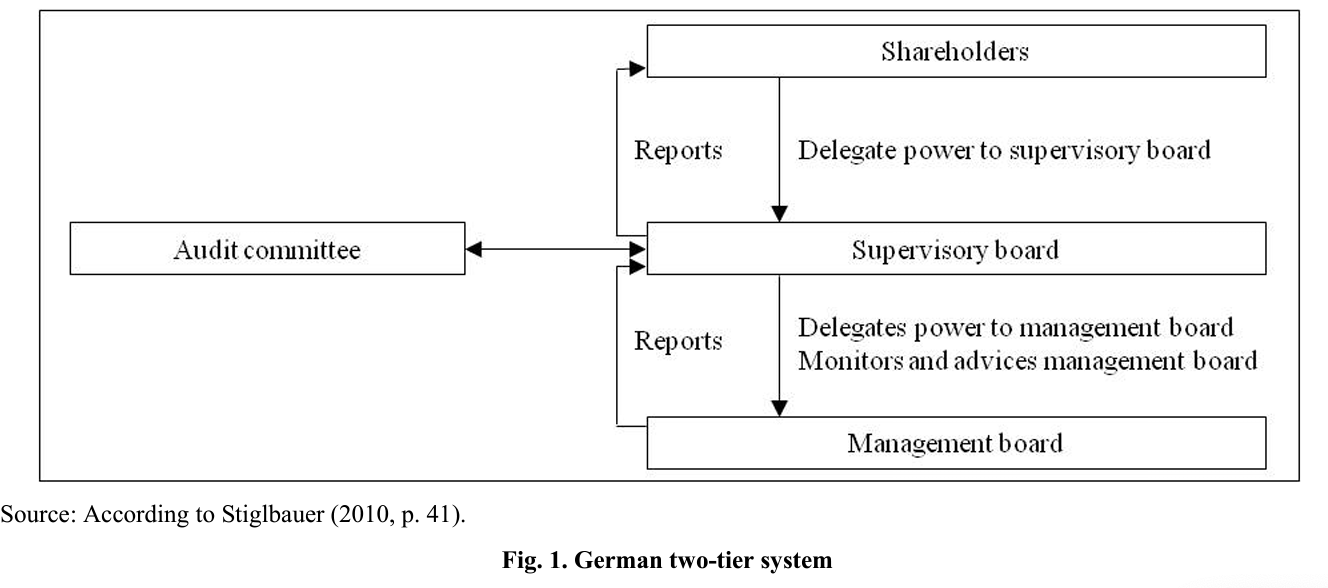

Literature often relates the influence of audit committees on the accounting quality to the double-level principal agent theory of Tirole (1986) (basic model of Ross, 1997; Jensen and Meckling, 1976). In the present analysis of German stock corporations the supervisory board acts as the principal of the management board and at the same time as an agent of the shareholders’ meeting. In contrast to the one- tier system typically for Anglo-Saxon countries, the German Stock Corporation Act (GSCA) has provided two administrative bodies with the management board and the supervisory board. This two-tier system follows the idea of an organizational separation of management and supervision. This principle of separation is represented in the fact that members of the supervisory board may not simultaneously belong to the management board of the company (§105 GSCA). While the management board manages the firm under its own responsibility (§76 GSCA), the supervisory board appoints, monitors and advises the members of the management board and is involved in decisions of fundamental importance to the enterprise (§§84, 111 GSCA). The members of the supervisory board are elected by the shareholders at the general meeting (§101 GSCA) (Figure 1).

In firms with more than 500 or respectively 2,000 employees within Germany, the employees are also represented in the supervisory board. Therefore, one-third of the supervisory board members in enterprises with more than 500 employees and one- half of the members in companies with more than 2.000 employees are representatives elected by the employees (§4 Drittelbeteiligungsgesetz - One-third Participation Act) or respectively §7 Mitbestimmungsgesetz - Co-Determination Act). In firms with more than 2,000 employees, the chairman of the supervisory board has the casting vote in the case of split resolutions (§29 Co-Determination Act). In order to increase its efficiency, the supervisory board has the possibility of appointing committees (§107 GSCA). In this context audit committees among other things deal with the supervision of the tendering of accounts, the effectiveness of the risk management system and the audit (§107 GSCA). The authorities of an audit committee on the German model are more limited in comparison with Anglo-Saxon audit committees though.

The German Corporate Governance Code (GCGC) is a classical representative of a soft law system analogous to many other European countries. Its principles can be divided into three groups: Prescriptions derive from existing law and, therefore, are mandatory for all joint-stock companies. Each listed company is obliged by §161 GSCA to declare in its annual report (with a special compliance statement) whether it does and has complied with the GCGC recommendations or not. Companies are forced to explain the reasons in case of non-compliance since 2009 (“comply or explain”). The third group are suggestions, which the commission has developed the GCGC considers to describe (international) “good” corporate governance standards. They are by no means binding for the companies and not a forced content of the compliance statement but, nevertheless, important since they often represent advances in national as well as international corporate governance best practices. The key functions of the GCGC are to improve German companies’ corporate governance (quality) and to increase transparency of German corporate governance for (foreign) investors. By implementing (international) standards of good corporate governance German companies are expected to guarantee a minimum standard of corporate governance. Increasing transparency should help to describe the German corporate governance system generally and to enforce international standards of good corporate governance via the suggestions of the GCGC. Furthermore, §161 GSCA enables companies to use the standardized instrument “corporate governance statement” to signal their state of corporate governance and thus increase investors’ trust towards them. By this, corporate governance reporting shall lead to more decision useful information for investors.

The principal agent relation between management board, supervisory board, audit committee and shareholders is characterized by information asymmetries and conflicts of interests. Earnings management is a useful instrument to raise the company’s reputation (self-portrayal policy). In particular cases positive self-portrayal goes beyond existing law and results in accounting offence. Hence, the boundary between earnings management and accounting offence is blurred. If the accounting policy activities of the management board (agent) cannot be neutralized by the external financial statement analysis (completely), the basis for decision of the shareholders (principal) is impaired in order to relieve the administrative body. By means of continuous supervision of the management board, audit committees reduce the amount of earnings management as defined by the shareholders. In order to gain realistic insight into companies’ financial situation (true and fair view), the monitoring of accounting policy by the audit committee is of great importance. Since some management board activities are subject to agreement, audit committees influence the accounting policy passively. The overall intention of the measures in question is to reduce information asymmetries between management board, supervisory board and shareholders which result from the principal agent theory. In order to reduce existing conflicts of interest audit committees perform a future-oriented advisory function in addition to the past-oriented supervision of the management board. Consequently, this leads to intense monitoring of strategic corporate policy and accounting policy.

The quality of the accounting policy monitoring is strongly influenced by the professional and personal requirement profile of audit committee members. According to the principal agent theory audit committee member’s independence is an essential prerequisite for adequate accounting quality. Otherwise, the management board brings the audit committee to approve questionable accounting organization, e.g., by means of financial transfer. If the audit committee lacks respective financial expertise the audit committee cannot identify the dimension of accounting policy from the management board’s perspective. The audit committee in the German two-tier system must be composed of members of the supervisory board. The audit committee is the agent. In view of the non committee members of the supervisory board, who preliminary evaluates the financial statements of the management board and offers resolution proposals to the supervisory board. The main economic function of audit committees in the German two-tier system is the supporting role of the board by increasing supervision efficiency. The German legislator demands for at least one independent member with respective financial expertise in the audit committee, respectively the supervisory board of listed corporations. In addition, a cooling-off period of at minimum two years for former management board members to become a member of the supervisory board, respectively audit committee must be strictly adhered. Pursuant to the GCGC recommends the nomination of an appropriate number of independent audit committee members. As already mentioned, in its regulation draft of 2011 the EC plans to increase the job profile of the audit committee members (mainly independence and at least two financial experts) for listed companies in the EU.

Audit committees reveal and decrease accounting offence as well as earnings management. As opposed to unintended accounting mistakes, the management board’s motivation for intentional manipulation of accounting activities (e.g., the illegal capitalization of research expenses according to IFRS) is related positively to the information asymmetries between management board and audit committee. The management board gets financially motivated (e.g., in case of performance-based remuneration) or reasons of publication policy (e.g., positive selfportrayal to achieve good reputation) or individual politic interests (shirking). As an agent of the shareholders, audit committees increase the probability of revealing accounting offence before the publication of the financial statement. Moreover, the continuous supervision of the management board’s activities by the audit committee impedes the occurrence of accounting offence preventative. Again, inevitable precondition for the assessment of truth and fairness of financial statements is the nomination of independent financial experts as audit committee members. Otherwise, probability of coalition between audit committee and management board (lack of independence) increases or truth and fairness of financial statements might not be judged appropriately (lack of financial expertise).

2. Review of the empirical audit committee research and hypotheses

By trend, earnings management is considered negative by a company’s addressees (primarily by the creditors). This holds particularly true for companies in difficult situations (Jones, 1991). According to the principal-agent theory this effect is caused by information asymmetries between management board and investors in case the company’s addressees are not informed correctly about the actual business situation and the self-portrayal of the management is presented too positive. Profit-maximizing accounting policy is a result of a likely fail of analysts’ forecast or the avoidance of disclosed periodic losses. The true and fair view principle which is not specified in the German commercial law is thus not adhered to. Provided that the information deficit in balance sheet and profit and loss account according to Moxter (1984) is not compensated by commenting notes or descriptions in the management report. According to commercial law, accounting principles, in particular the conservative balancing and assessment have priority compared to the true and fair view. Hence, no overriding principle does exist. According to IFRS, the financial statement is not complete and an overriding character of the true and fair view principle has to be negated in spite of the emphasis on the information character of the IFRS financial statement and the subordinate importance of the principle of prudence. Hence, the notes are most relevant for IFRS accounting as well. As described in the detailed commentary regulations in the notes and the possibility to create a - in terms of commercial law comparable management report - management commentary according to IFRS. Legal and correct accounting is at hand with regard to supplementary disclosures in the notes despite of a violation of the true and fair view principle in the balance sheet and profit and loss account. The basis for decisions is rather small since the latitude and the arrangement of balancing and assessment cannot be revealed completely by the shareholders. Since by trend IFRS disclosures in the notes with regard to accounting policy are of minor quality and not easily comparable (empirically Canipa-Valdez, 2010) and in addition primarily contain verbal information, they will not be taken into account. Moreover, the integration into the discretionary accruals is not possible.

The audit committee with the respective financial expertise will not agree to a high degree of earnings management. Thus, the audit committee will recommend to the plenum of the supervisory board to disapprove the questionable accounting policy. Attention needs to be paid to the duty to evaluate the accounting process by the audit committee. At the best, the audit committee’s activities cause a reduction of information asymmetries between management board and shareholders resulting from accounting policy. In addition to a profit-maximized a profit-minimizing accounting policy does also exist. It is often related to “big bath accounting” in case of a change of management. This management strategy was analyzed by Healy (1985). The aim of this strategy is to generate high expenditures within the first or second business year after the change of management. Then, it is communicated to the capital market as a weak performance of the former management. A generous realization of the big bath accounting leads to recoverability of assets in the future. This in turn will be evaluated as the success of the current company’s management by means of development of strategic value drivers within the framework of the performance measurements, leading to positive investor’s reactions. “Big bath accounting” has been verified empirically in terms of the subsequent measurement of the acquired goodwill according to IFRS 3, demanding for an irregular depreciation (impairment only approach) (Chambers, 2006) in contrast to the German commercial law.

As opposed to the profit oriented accounting policy, the aim of the profit minimizing accounting policy is evaluated more positively by the company’s addressees. This is proved by several conservatism research studies (Fuelbier et al., 2008). The principle of prudence accounts for a temporary asymmetric recording of positive and negative profit contributions in terms of accounting. The temporary asymmetry (pre-recording of expenditures and postrecording of revenues) is characterized as newsdependent conservatism or conditional conservatism within the framework of economic research (Beaver and Ryan, 2005). Companies’ addressees expect an appropriate level of conservatism with regard to accounting standard such as IFRS, that do not imply for a system related conservatism principle in contrast to commercial code law (on the basis of common law and code law countries (Ball et al., 2000)). Therefore, the present analysis will deal with profitmaximizing accounting policy only.

In the past, international corporate governance research has dealt with possible correlations between the implementation of audit committees and the quality of companies’ monitoring, though without considering the job specifications of the audit committee members. All of the former studies were based on the one-tier system, hence accounting for a substantial lack of research with regard to the two-tier system in Germany. Because of less expertise in a two-tier system, the empiric results of the one-tier system cannot be applied to the audit committee in the German two-tier system. Within the monistic system, the audit committee is a permanent committee of the board of directors and replaces the missing separate supervision authority in terms of the supervisory board. In contrast to the audit committee in the German two-tier system, unlimited access to information is granted compared to the risk management system. According to the principle of separation in Germany, audit committees cannot take over managerial functions, e.g., the implementation and development of the commercial risk management system that are part of the management board’s responsibilities (Röhrich, 2006). Within the board system the audit committee takes over risk management functions as well as internal audit and controlling tasks. Hence, the audit committee has a direct influence on the auditing process of the internal audit and thus receives the audit reports immediately. Within the German system, the spreading of non-management board information, e.g., interviewing of internal audit members by the audit committee is discussed controversial. In order to reduce information asymmetries, an information organization is created as part of the management board’s rules and regulations. Similar to the board system, this enables audit committees to get access to information on companies’ risk management. A direct influence of the audit committee on the accounting policy strategy of the management board interferes with the leadership role of the management board within the German two-tier system. A certain influence is granted solely with regard to approval requiring transactions of the supervisory board that are recognized by the audit committee preliminary. Insofar, the possibility of the audit committee to influence audit policy within the board system is more likely than within the dualistic system. As a result of these differences the necessity to conduct independent surveys rises.

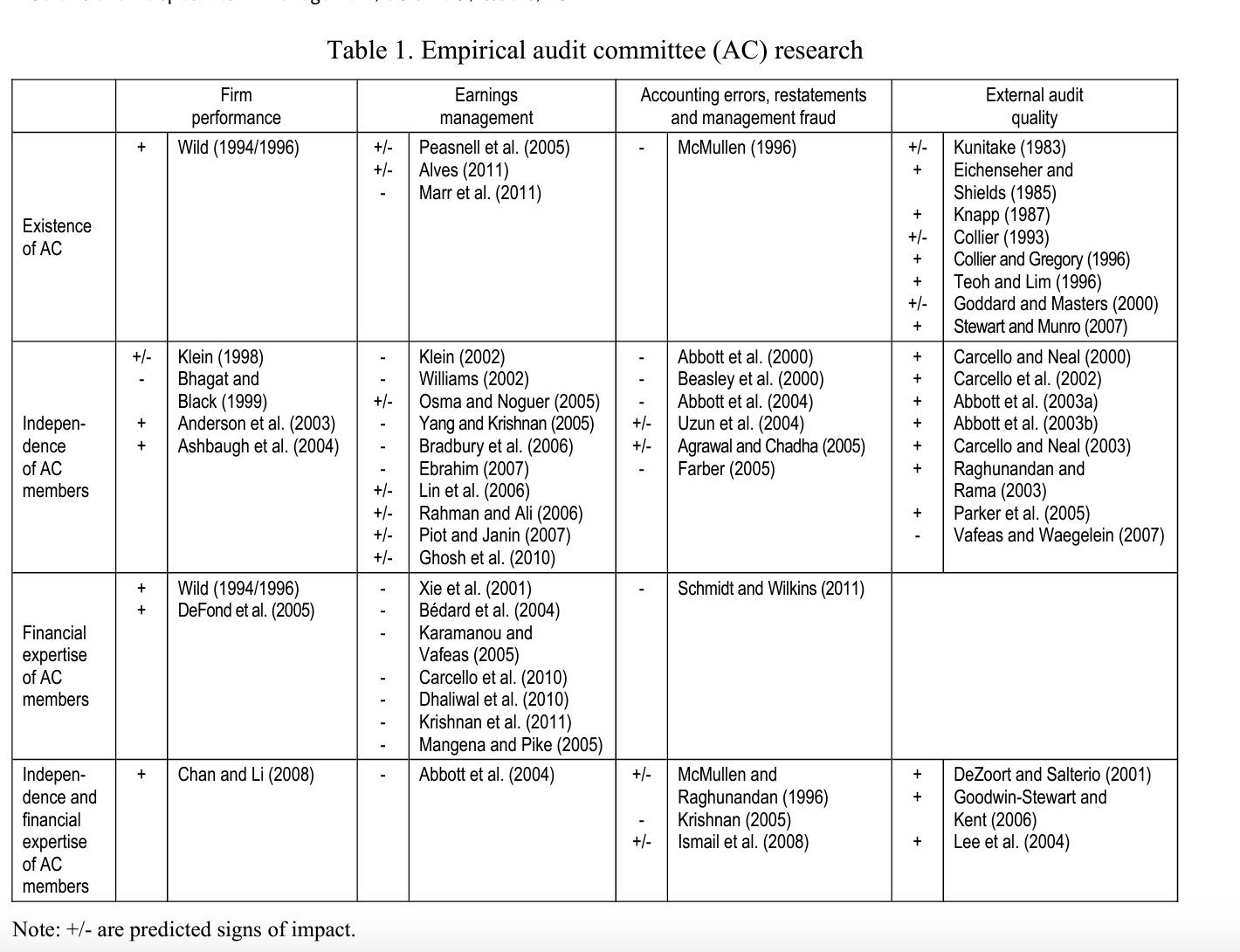

Since no multivariate empirical studies concerning the impact of audit committees on corporate governance quality are available for the German capital market, U.S. studies have primarily been used (see also Veite, 2009; Veite, 2010; Veite, 2011). Table 1 provides an overview of research results. The empirical audit committee research focuses on several variables (capital costs and market reactions, earnings management, accounting errors, restatements and management fraud, external audit quality) to measure the impact of the existence of audit committees with independent financial experts on corporate governance quality. Some studies prove a significant positive link between audit committees with independent financial experts and corporate governance quality, implying lower costs of equity and of debt, increasing firm performance, a reduced amount of earnings management, lower accounting errors, restatements and management fraud and increased external audit quality. There are only few reviews of the world wide audit committee research, yet. Pomeroy and Thornton (2008) conduct a meta-analysis of the link between audit committee independence and financial reporting quality. Examined heterogeneity of the studies has been explained via the use of different measures for financial reporting quality. Furthermore the authors mention that audit committees are more effective at enhancing audit quality (e.g., by averting auditor resignations) than financial statement quality (e.g., by restricting earnings management). Finally, they state that financial statement quality and audit quality are complementary contributors to financial reporting quality.

Peasnell et al. (2005) and Alves (2011) cannot prove a significant relationship between the implementation of the audit committee and the degree of earnings management; whereas Marra et al. (2011) find an increased authority of audit committees in strengthen financial reporting quality after introduction of IFRS. According to McMullen (1996), the implementation of audit committees is correlated negatively to the enforcement activities, representing an increase in balance sheet offences quota. Wild (1994/1996) shows a significantly positive market reaction after an audit committees has been implemented. Several studies also focus on the link between audit committees and external audit by evaluating the amount of audit fees or the relation between audit and non-audit fees. While Kunitake (1983), Collier (1993) and Goddard and Masters (2000) do not state a significant link, Eichenseher and Shields (1985), Knapp (1987), Collier and Gregory (1996), Teoh and Lim (1996) and Stewart and Munro (2007) prove a positive link between audit committee formation and external audit quality. Due to the lack of a supervisory board as a separate supervising unit as conducted in the two-tier system, audit committees close a respective supervising gap in the one-tier system. Though, from a German perspective, it is not clear in how far the sole implementation of an audit committee has a positive impact on the accounting quality. Anyway, the audit committee within the two-tier system is obliged to control financial accounting.

By means of an increasing number of supervisory board members of companies listed in the prime standard, the heterogeneous composition as well as the compliance with rules of co-determination, the economic necessity of the implementation of audit committees within the two-tier system is justified. Audit committees increase accounting quality and disapprove the profit maximizing accounting policy of the management board in case of a violation of expediency. Hence, a trade off occurs between the self-portrayal of the management and the consideration of information interests of the company’s addressees. The audit quality suffers significantly from profit-oriented accounting policy and accounting offence. Hence, the shareholders as the principals of the management board and the supervisory board are not informed sufficiently on the economic situation of the company. The solution statement of the principal-agent theory allows for an audit committee to facilitate the work of the supervisory board and to act as an additional monitoring authority. Usually, supervising activities are of a higher quality when performed by an audit committee than by the supervisory plenum. Supervising activities ought to reduce agency costs resulting from accounting organization. Thus, we formulate hypothesis 1 (Hl):

Hl: The implementation of audit committees has a negative influence on the amount of earnings management and the occurrence of accounting offence.

Recent empirical studies focus on the independence and financial expertise of audit committee members. A positive influence on corporate governance quality is not always concluded. Pursuant to the aforementioned studies, empirical results exist for the one-tier system only. Ashbaugh et al. (2004) and Anderson et al. (2003) find lower costs of equity and of debt when there are independent members in an audit committee. Klein (1998) doesn’t prove a relationship between independence and firm performance and Bhagat and Black (1999) report a negative link. Klein (2002), Williams (2002), Yang and Krishnan (2005), Bradbury et al. (2006) and Ebrahim (2007) state a negative link between audit committee independence and the amount of earnings management, which leads to a higher financial accounting quality. In opposite to this, Osma and Noguer (2005), Lin et al. (2006), Rahman and Ali (2006), Piot and Janin (2007) and Ghosh et al. (2010) cannot prove a significant link between audit committee independence and earnings management. With regard to preventing or decreasing accounting errors, restatements and management fraud, Abbott et al. (2000), Beasley et al. (2000), Abbott et al. (2004) and Farber (2005) find a negative influence of independent members in the audit committee; Uzun et al. (2004) and Agrawal and Chadha (2005) fail to this. With the exception of Vafeas and Wae- gelein (2007), Carcello and Neal (2000), Carcello et al. (2000), Abbott et al. (2003a; 2003b), Carcello and Neal (2003), Raghunandan and Rama (2003) and Parker et al. (2005) prove a positive link between independence and audit quality.

Consistent with the results of international corporate governance research, the independence of audit committee members is indispensable for appropriate accounting quality. It is assumed that independence of audit committee members is related directly to their financial expertise. Ceteris paribus, a demanding job specification of audit committee member accounts for non-approving of dubious accounting activities by the supervisory board. In addition, accounting fraud gets revealed more easily and the supervisory body will not be manipulated throughout decision-making. Hence, the implementation of audit committees as supporting monitoring authority of the supervisory board is strongly influenced by the job specification of its members. Independence and financial expertise of the audit committee members provide a basis for the reduction of information asymmetries between the management board and the audit committee and the respective agency costs. Wild (1994/1996) and DeFond et al. (2005) show a positive influence on market reactions by having financial experts in audit committees. Xie et al. (2001), Bedard et al. (2004), Karamanou and Vafeas (2005), Carcello et al. (2010), Dhaliwal et al. (2010) and Krishnan et al. (2011; related to legal expertise) find a lower amount of earnings management. Man- gena and Pike (2005) prove that the amount of interim reporting increases with the financial expertise in the audit committee. Schmidt and Wilkins (2011) recently state that the financial expertise in the audit committee is connected with shorter duration of a financial statement restatement’s “dark period”, implying increased financial reporting quality.

Recent studies also combine independence and financial expertise of the committee members. Chan and Li (2008) prove a positive link between independent financial experts and firm performance. Abbott et al. (2004) find a lower amount of earnings management by observing both characteristics of the job specification. Krishnan (2005) also finds a positive link between accounting quality and independent financial experts, while McMullen and Raghunandan (1996) and Ismail et al. (2008) do not state any significance. DeZoort and Salterio (2001), Goodwin-Stewart and Kent (2006) and Lee et al. (2004) state a positive link between independent financial experts in the audit committee and audit quality. Though, it is not clear for the German two-tier system whether and in how far compliance with the legal minimum level of independent financial experts or the appointment of a minimum number of independent financial experts has a positive influence on accounting quality. Therefore, hypotheses 2 and 3 (H2, H3) will be tested separately with regard to profit oriented accounting policy and the occurrence of accounting fraud.

H2: Appointing at least one independent audit committee member with financial expertise in equal parts to the composition has a negative influence on the amount of earnings management and the occurrence of accounting fraud.

H3: Appointing independent audit committee members with financial expertise by the majority has a negative influence on the amount of earnings management and the occurrence of accounting fraud.

We have already mentioned the empirical research gap for the German two-tier system. This analysis shall contribute to the discussion in literature and practice about the influence of audit committees, who support the supervisory board’s monitoring of the management board in the two-tier system, on corporate governance quality. We use two measures of financial accounting quality (amount of earnings management and accounting errors).

3. Survey design

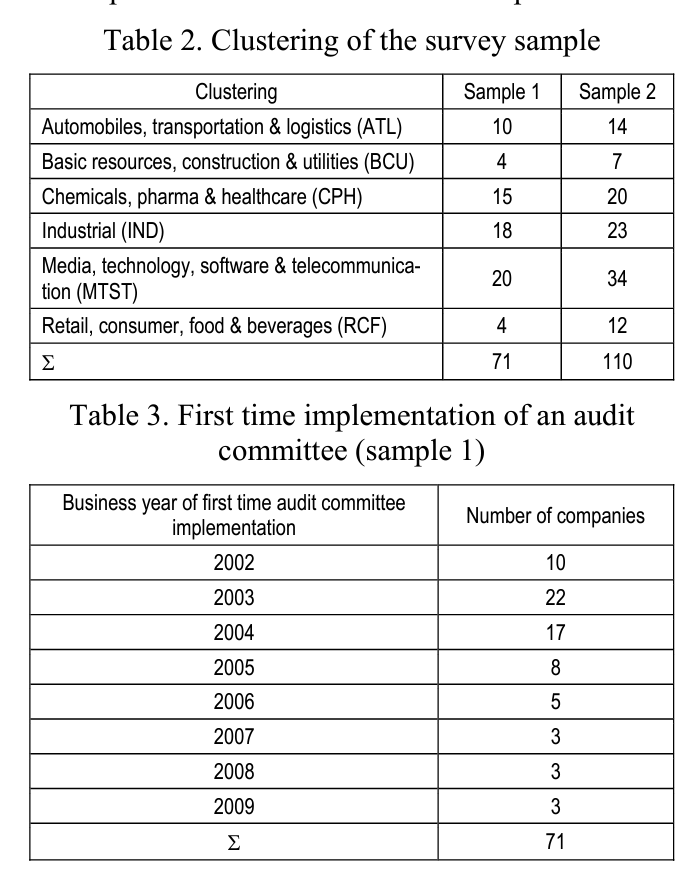

3.1. Sample and data collection. Our sample covers corporations being listed in the indices DAX, Tec- DAX, MDAX and SDAX of Deutsche Börse Group (comprising a total of 160 corporations). These companies underlie the highest standards of transparency & disclosure within the Prime Standard of the Frankfurt Stock Exchange. Researching corporate governance mechanisms of these companies could have a signalling effect for other listed companies in Germany since these companies are covered most intensely by investors. Therefore, analyzing these companies is very valuable from a researcher’s as well as from a practitioner’s perspective. We exclude financial institutions1 (Exemption of financial institutes is due to specific accounting regulations for the industry in comparison with other industries difficult) and research a sample of 71 corporations having an audit committee between 2002 and 2009. In order to test hypothesis 1, dealing with the influence of first-time implementation of audit committees on profit oriented accounting policy and the occurrence of accounting fraud, data has been gathered from the years before and after the implementation on basis of the survey period of 2002-2009. The survey period starts with the publication of the GCGC in the year 2002 already recommending the implementation of audit committees. In order to test hypotheses H2 and H3, assuming a negative influence of the independency and financial expertise on the respective corporate governance variables, only those companies with an audit committee in the business year 2008 were included (110). Table 2 displays the arrangement of all companies according to the industries of the prime standard. Table 3 shows the year of implementation of the audit committee based on the period of2002 until 2009 for sample 1.

Not surprisingly, a considerable increase in implementation of audit committees can be observed in the first years after coming into effect of the GCGC (22 companies in the business year 2003 and 20 companies in the business year 2004). The increase in recent business years is rather negligible. Within this context, attention is drawn to the fact that non- compliance with the recommendation to implement audit committees of the GCGC needs to be disclosed. Non-disclosure may lead to undesirable reactions of the capital market, e.g., investors may ask for an increase in risk premium for providing their capital (basic model of Elliot and Jacobsen, 1994).

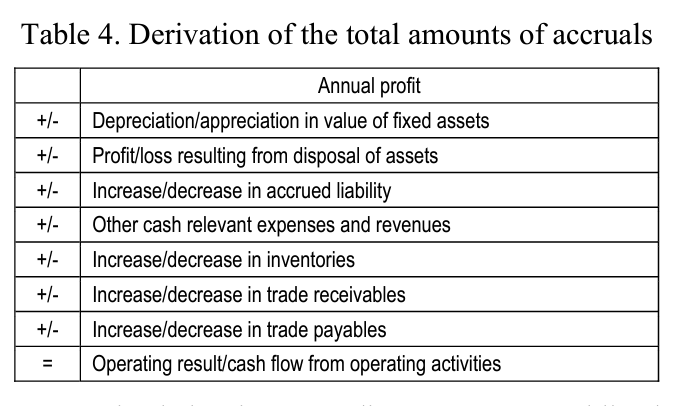

3.2. Dependent variables. According to the empirical accounting research, earnings management in a business period is reflected at least partially in the change of the respective accruals amount (Wagen- hofer and Ewert, 2007). Accruals are composed of the difference between the reported profit and the cash flow of the business activities. Moreover, all cash relevant expenses and revenues are included (Wagenhofer and Ewert, 2007). The total amount of accruals is composed of the change in inventories, receivables and liabilities as well as cash relevant expenses and revenues shown in Table 4. Thus, the accruals adjust the cash flow and add up to value zero throughout the total period of the company as a result of the double edge principle of the preparation of financial statement. Ceteris paribus, profit oriented accounting policy is only achievable temporarily as a result of reverse effects.

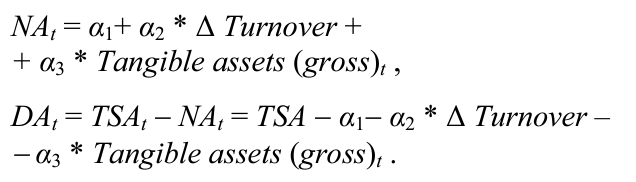

Companies balancing according to IFRS are obliged to prepare a cash flow statement in addition to the balance sheet and profit and loss statement. Pursuant to IAS 7.18 the separate disclosure of the operating result is compulsory, hence facilitating the calculation of accruals. The evaluation of profit maximizing accounting policy (PMAP) divides the total sum of accruals (TSA) into a normal component (NA) and a residual value (discretionary accruals DA) both depending on accounting policy. The basic model of Jones (1991) has attracted interest of international literature (Baxter and Cotter, 2009) although it is referring to the regulation of foreign trade originally. However, the Jones model of measuring accounting policy is applicable to other subjects within the framework of empiric accounting research. The model assumes a positive correlation between the economic development of the company (as measured by turnover) and the normal component (NA). Hence, the discretionary accruals (DA) can be determined in accordance with the basic model as follows:

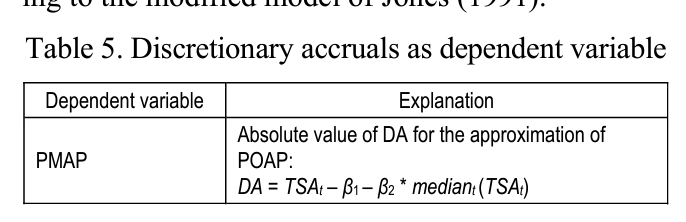

The basic model of Jones (1991) is rather not significant since in practice turnover may be influenced by accounting policy (Jones, 1991). Therefore, the modified version of the Jones (1991) model according to Dechow et al. (1995) classifies all credit sales as a result of profit oriented accounting policy of the company. In addition to the changes in turnover and gross tangible fixed assets a third variable (changes in cash flow) is added to the determination of non- discretionary accruals (Chan et al., 2004). Moreover, Dechow et al. (1995) expand the basic model by an industry related estimation of the DA in order to ameliorate the accuracy regarding the approximation of the PMAP. It is assumed that NA is related proportionally to the median of the industry related TSA. Consequently, the equation shown in Table 5 is to be applied to the determination of DA, accounting for the first dependent variable in the present empirical survey for the test of hypotheses according to the modified model of Jones (1991).

For the present analysis every single component of the TSA for the business years of 2002-2009 has been taken from the respective annual report based on arrangement of companies according to the respective industries shown in Table I2 (Primarily, the data base “Compustat” of Standard & Poor’s has been used, preparing the respective financial statements). The median of TSA for all six industries has been identified for the respective seven business years. Despite of international importance of the modified Jones (1991) model, literature is criticising the lack of objectivity and unclear differentiation of NA and DA (Thoma and Zhang, 2000) partly due to simplifying of reality. Consequent analysis proved an omitted-variables problem for the modified model of Jones. Few variables that are relevant for the specification of NA are neglected, thus accounting for misrepresentation (McNichols, 2000). The inaccuracy of the model is also reflected in the changes in credit sales, measuring the accounting policy by means of discretionary turnover. The respective over-simplifying is often not applicable since changes in credit sales may be due to simple competitive efforts and not only based on pure accounting policy motives. Moreover, the assumption is criticised, demanding for none or only minor accounting policy activities in the years prior to the measurement (Wagenhofer and Ewert, 2007). Despite of the preceding criticism, former alternative concepts of Healy (1985), DeAngelo (1986) and Jones (1991) by trend are inferior to the approach of Dechow et al. (1995) with regard to the measuring of accounting policy.

Restricted and not issued audit certificates as well as the adverse duty to disclose of companies are taken into account in order to estimate the quota of accounting fraud (ACFR) as a second dependent variable. The adverse duty to disclose is regulated by the enforcement institution as part of the enforcement audit after the discovering of accounting fraud. Financial accounting is incorrect only if one or more substantial auditing offences occur. Since the dimension of substantial is interpreted individually by each company, a wide discretion applies. German capital market oriented companies are obliged to announce the determined fraud as well as the respective substantial parts of the declarative statement. Companies may refrain from doing so in case no public interest exists with regard to the announcement or in case - and at the request of the company in question - the publication would harm the legitimate interests of the company. In fact the exceptional rule is to be applied restrictively and should be limited to extraordinary cases, which need to be specified by the legislator in the near future. The accounting fraud quota for the present analysis has been assessed by rating agencies (e.g., Standard & Poor’s). The respective estimation is based on issued and not issued audit certificates; announced accounting fraud and miscellaneous information (e.g., risk profile of the company).

3.3. Independent variables. Pursuant to hypothesis 1, it is to be analysed whether the implementation of an audit committee in the period between the business years of 2002-2009 has an influence on the dimension of profit maximizing accounting policy (PMAP) and accounting fraud (ACFR). Hence, the implementation (IMPL) is the independent variable with regard to sample 1. However, listed stock corporations in Germany are not obliged to implement audit committees. In contrast to other EU member states (e.g., Austria) the German legislator abandoned the option to make the implementation compulsory and decided to comply only with the minimum requirements of the renewed 8th EC Directive. The GCGC recommends the implementation of audit committees since its first publication in 2002. Empirical results show that several companies on the German prime standard comply with this recommendation (Werder and Talaulicar, 2010).

On the basis of sample 2, the influence of the appointment of independent members with the respective financial expertise on the auditing quality is being examined rather than the influence of the implementation of audit committees. Thus, hypotheses 2 and 3 will be tested. The decision to include both, independency and financial expertise in the hypotheses resulted from the measured multi со-linearity of both variables (0,459; 0,001**). Hence, complementary relation between independence and financial expertise of the audit committee members is confirmed. Whether at least the majority (INFIX) of the audit committee members are independent financial experts or not (77V- FI1) is indicated in Table 6. The minimum requirement for INFI} is the existence of one independent financial expert in the audit committee as demanded by the German law. In this context it has to be noticed that IMPL might interact with INFIX or INF 12.

Table 6. Independent variables

Independent variables | Explanation |

IMPL (hypothesis 1) | Implementation of audit committees between 2002 and 2009 |

INFI1 (hypothesis 2) | Appointment of at least one independent financial expert in the audit committee and as a maximum 50% of the members |

INFI2 (hypothesis 3) | Appointment of independent financial experts in the audit committee (> 50%) |

Company’s data with regard to the implementation of audit committee has been collected independently from annual reports or written inquiries to the respective company in case of insufficient specification. Assessment of independence and financial expertise of members is based on the information provided in the curriculum vitae as well as qualification and experience. Since the national legislator does not specify independence and financial expertise within the stock and commercial law, the recommendation of the EU Commission (2005) is taken into account. According to this recommendation, no business, personal or any other kind of relationship is allowed with regard to the respective company, its majority shareholder or management board which might lead to a conflict of interest, influencing the objectivity/judgement of the supervisory board member. Pursuant to the German law, the financial expert needs to deal with accounting or auditing professionally. The regional court pronounced a judgement that a former institutional membership in a different corporate entity (e.g., CFO) with main field of responsibility in accounting or auditing is not mandatory. Hence, also executive staff members in the fields of accounting and controlling as well as accountants, registered auditors or tax consultants are also eligible to act as financial experts.

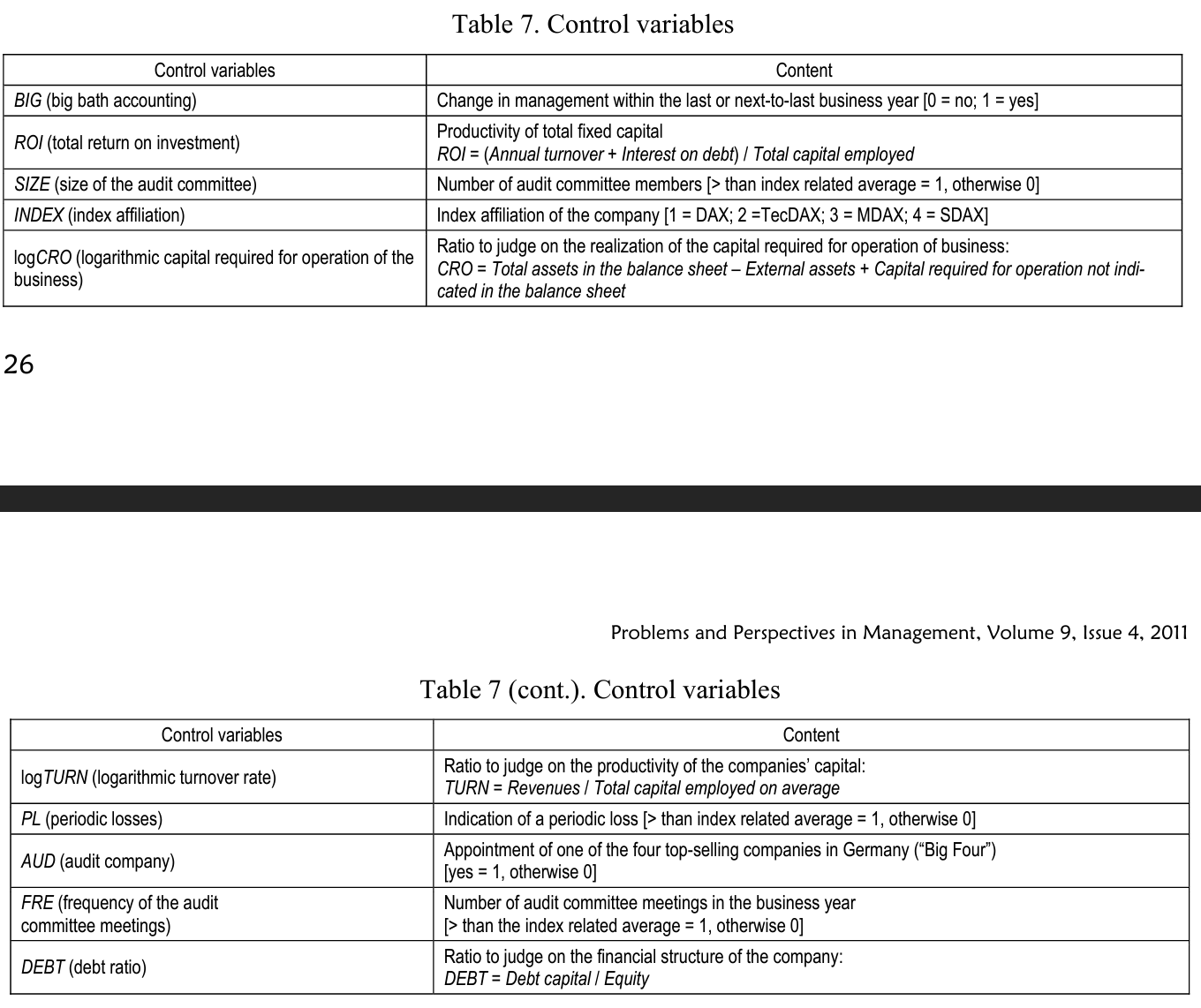

3.4. Control variables. The control variables within our models are frequently used in the empirical audit committee research. Empirical research on the one-tier system provides evidence for the influence of the size of the board of directors, e.g., the audit committee on monitoring quality (Yermack, 1996). Empirical corporate governance research also takes into account the frequency of audit committee meetings (FRE) as a control variable in addition to the size (SIZE) (Baxter and Cotter, 2009). The obvious assumption that an increase in frequency of meetings leads to an increase in activity with regard to the audit of the financial statement cannot prove true in general. The audit committee may decide on simply rearranging the agenda, resulting in several meetings without being more efficient in terms of audit quantity or audit quality. The variables SIZE and FRE are considered in relation to the index related average. Furthermore, the frequency of committee meetings may influence the independent variable IMPL.

The prevailing opinion assumes that the cooperation between audit committee and annual auditor has a positive influence on the accounting quality (Carcello et al., 2002). Within this context, the research of DeAngelo (1981) is of particular interest since it provides evidence for a positive relation between the size of the audit company and their independency. Therefore, the appointment of one of the four top-selling audit companies of Germany (“Big Four”) has been added as another control variable (AUD). The control variable BIG has been defined for a change in the management in order to control a potential big bath accounting. Only, change in the management board before the regular expiry of the contract and non-age related retirement have been taken into account. The remaining control variables are based on the model of Dechow and Dichev (2002). Hereafter, PMAP and ACFR are influenced by the economic situation of the company. With regard to the assessment of the hypotheses, the total return on investment (ROI), the debt-ratio (DEBT), the existence of periodical losses (PL), the logarithmic turnover rate (log- TURN) as well as the logarithmic capital required for operation of the business (logGKO) also are taken into account. The five last mentioned control variables were set into relation according to the respective industry branch. A summary is presented in Table 7. All control variables were recorded for the period of 2001-2010.

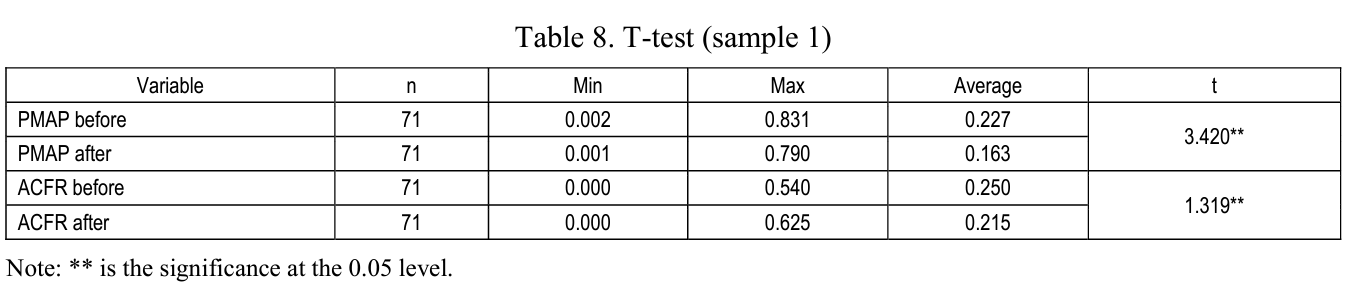

3.5. Empirical findings. In order to verify hypothesis 1 empirically, the data collected needs to decrease significantly in the business year after the implementation of audit committees, since hypothesis 1 is assuming a negative correlation between the first time implementation of the audit committee and the dimension of PMAP and ACFR. The t-test is applied in order to judge on this. The t-test is assessing whether a discrepancy between average values occurs by accident or if there are significant differences between the groups in question before and after the first time implementation of the audit committee between 2002 and 2009. The results of the t-test (with regard to the sample 1) are shown in Table 8.

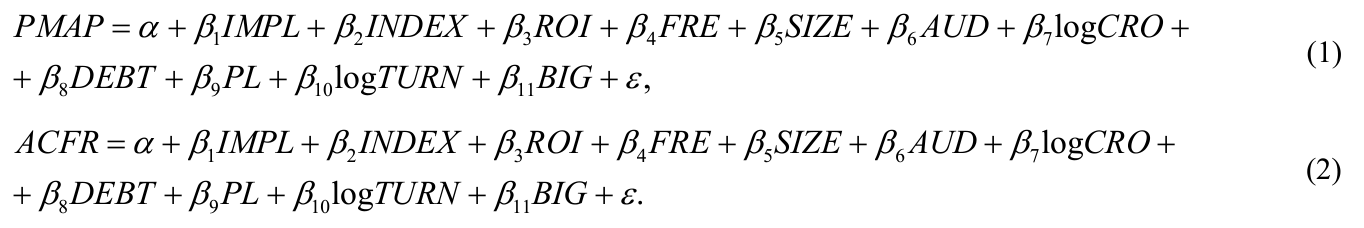

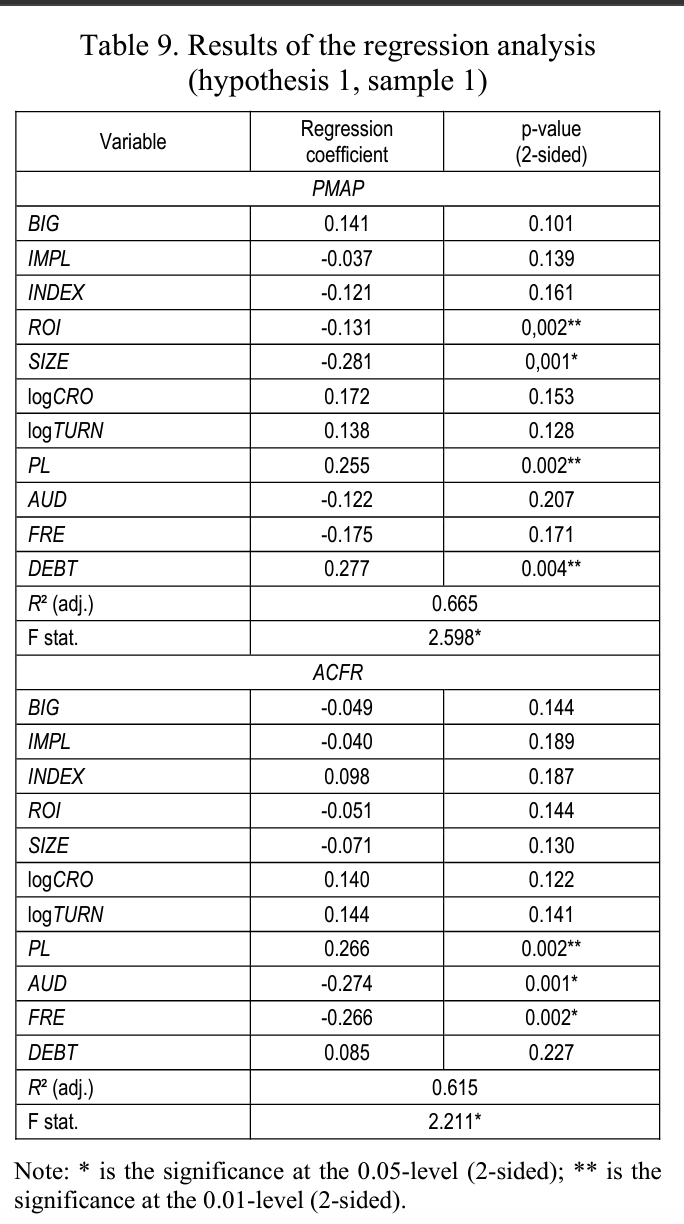

The results indicate that PMAP and ACFR decreased significantly after the implementation of the audit committee. Since the decrease might be caused by other reasons than the implementation of audit committee, all companies (both, with and without audit committees) were included as a control sample. Here, no significant reduction in PMAP and ACFR was found. Hence, the t-test results are robust. The regression analysis verifies potential relations between IMPL, INFIX and INFI! on the one hand and PMAP and ACFR on the other hand. Hypotheses 1-3 is supported, e.g., a negative correlation between audit committee variables as well as PMAP and ACFR exists, in case significances occur for independent variables and the regression coefficient is positive. The results of the multivariable regression analysis (based on sample 1) are summarized in Table 8. The following regression equation is valid for both dependent variables:

The assumptions of regression (linearity, homosce- dasticity of residue, normal distribution of error term, multicollinearity) were tested in accordance with the approach of Hair et al. (1998). To examine the issue of multicollinearity, we calculated variance inflation factors (VIFs) for all variables. All of the VIFs were below the rule of thumb cut-off of

Thus, we can rule out the possibility that some of the control variables do have an interaction effect with the specified independent variables for the test of hypothesis 1. Hypothesis 1 as well as hypotheses 2 and 3 and the models proposed have been tested using IBM SPSS Statistics 15.0 to generate ordinary least squares (OLS) parameter estimates. OLS estimates are considered beneficial especially when targeting important insights into the causal relation of single corporate governance mechanisms (Beiner et al., 2005). The results of the indices in Table 9 indicate that no significances exist between IMPL and However, amongst others, a significant negative correlation between RO I and PMAP, e.g., between SIZE and PMAP could be proved. Hence, PMAP could be reduced by the total return on investment as well as the size of the audit committee, but not by the mere implementation of audit committee.

ROI and SIZE show a negative impact on PMAP whereas PL and DEBT show a positive impact on PMAP. But no significant link exists between the independent variable IMPL and PMAP. Thus, hypothesis 1 cannot be proved. Hence, PMAP could be reduced e.g., by the total return on investment as well as the size of the audit committee, but not by the mere implementation of an audit committee. With regard to ACFR we find a positive impact of PL on ACFR and a negative impact of AUD and FRE on AFR. Again, we do not find a link between IMPL and ACFR as suggested by hypothesis 1 which we have to regret. Considering model validity, the values of the coefficient of determination R2 (adj.) for the PMAP equation (0.665) and for the ACFR equation (0.615) indicate models that fit the data very well.

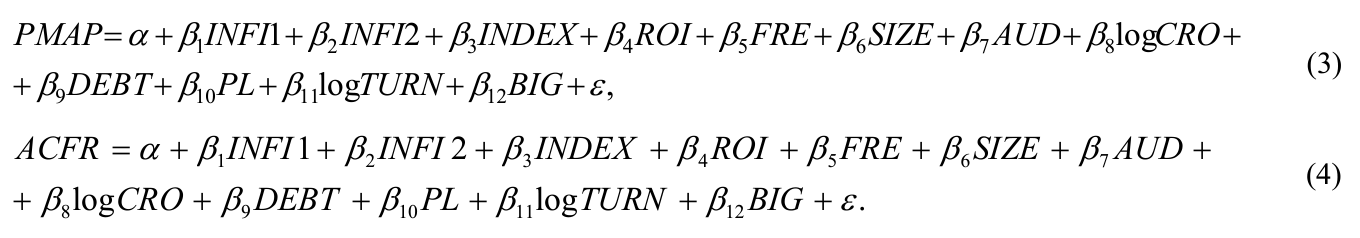

We use sample 2 in order to test whether the majoritarian nomination of independent financial experts as audit committee members has a negative influence on PMAP and A CFR (hypotheses 2 and 3). The assumptions of regression (linearity, homoscedasticity of residue, normal distribution of error term, multicollinearity) in accordance with the approach of Hair et al. (1998) were tested here as well. To examine the issue of multicollinearity, we calculated variance inflation factors (VIFs) for all variables. All of the VIFs were below the rule of thumb cut-off of 10. Accordingly, we can rule out the possibility that some of the control variables do have an interaction effect with the specified independent variables for the tests of hypotheses 2 and 3, too. The results of the multi variable regression analysis (based on sample 2) are shown in Table 9. The following regression equation is valid:

Table 10 indicates significant negative correlations between INFI2, PMAP and A CFR. Hence, supporting hypothesis 3, demanding for an at least majoritarian nomination of independent financial experts as audit committee members. Similar correlations cannot be found for variable INFIX by means of regression analysis. SIZE and FRE show a negative impact on PMAP whereas PL and DEBT show a positive impact on PMAP. Furthermore, we find a negative impact of INFI2 on PMAP but no impact of INFIX on PMAP. Thus, hypotheses 2 cannot be proved, but hypotheses 3 is supported. Hence, audit committees with independent financial experts by majority might limit the amount of earnings management because of a stricter supervision of the management board.

Table 10. Results of the regression analysis (hypotheses 2 and 3, sample 2)

Variable | Regression coefficient | p-value (2-slclecl) |

PMAP | ||

BIG | -0.201 | 0.066 |

INDEX | 0.211 | 0.131 |

ROI | -0.022 | 0.180 |

SIZE | -0.281 | 0.003* |

log CRO | 0.129 | 0.144 |

log TURN | 0.149 | 0.118 |

PL | 0.254 | 0.003* |

AUD | -0.111 | 0.227 |

FRE | -0.271 | 0.002* |

INFI1 | -0.068 | 0.132 |

INFI2 | -0.262 | 0.003** |

DEBT | 0.287 | 0.003* |

R2 (adj.) | 0.672 | |

F stat. | 2.304* | |

ACFR | ||

BIG | -0.144 | 0.169 |

INDEX | 0.198 | 0.121 |

ROI | -0.034 | 0.211 |

SIZE | -0.103 | 0.166 |

log CRO | 0.131 | 0.145 |

log TURN | 0.176 | 0.141 |

PL | 0.291 | 0.002** |

AUD | -0.302 | 0.002** |

FRE | -0.235 | 0.002* |

INFI1 | -0.128 | 0.137 |

INFI2 | -0.275 | 0.002** |

DEBT | 0.156 | 0.201 |

R2 (adj.) | 0.591 | |

F stat. | 2.131* | |

Note: * is the significance on the 0.05 level (2-sided); ** is the significance at the 0.01 level (2-sided).

With regard to ACFR we find a positive impact of PL on ACFR and a negative impact of AUD and FRE on ACFR. Similar to the PMAP equation the ACFR equation proves a negative impact of INFI2 on ACFR as asumed by hypothesis 3. Again, no impact on ACFR can be proved for INFI1. Thus, hypothesis 2 has to be rejected. Summarizing, audit committees with independent financial experts by majority might limit the occurrence of accounting fraud by the management board. Considering model validity, the values of the coefficient of determination R2 (adj.) for the PMAP equation (0.672) and for the ACFR equation (0.591) again indicate models that fit the data very well.

4.Limitations, implications and a note for further empirical research

In this section, we describe some limitations of the empirical audit committee studies in Table 1 and our study. First, beneath different models for estimation, different periods of observation, samples and states with different corporate governance systems are used. In our study we concentrate on the business years of 2002-2009 and on DAX, MDAX, TecDAX and SDAX corporations. Thus, we assume a sample selection bias when comparing the empirical studies above “that results from using non-randomly selected samples to estimate behavioral relationships as an ordinary specification bias that arises because of a missing data problem” (Heckman, 1979, p. 153). Furthermore, non-consideration of changes of listing within selection indices, often connected with index effects does make single studies which are similar on the first sight hardly comparable. Second, we don’t test for endogeneity and reverse causation between corporate governance and performance in order to have highest possible comparability with former studies and in order to use insights of former studies concerning model specification. The hypotheses and the equations proposed generate ordinary least squares parameter estimates which yield models that fitted the data very well (Table 9 and Table 10). Thus, there was no indication for misspecification of our models. This point is strongly connected with missing exogenous variables (omitted variables) which are a general problem in empirical corporate governance research (Börsch-Supan and Köke, 2002), which therefore doesn’t seem to be problem for our models. Future research may assess this question of completeness of governance models. Nevertheless, it seems hard to generalize findings for one single measure, e.g., discretional accruals, for evaluating accounting quality. Therefore, we generally propose multi-model studies with different performance measures. Fourth, the quality of corporate governance reporting in Germany is rather low so that relevant aspects of the composition of audit committees are not presented to the investors. Fifth, there are differences between the studies considering the integration of soft law rules like the GCGC and regulations as the Sarbanes Oxley Act in the US. Sixth, literature gives good reason that the GCGC doesn’t fit as well for SMEs as for big companies (Steger and Stigl- bauer, 2011). When developing the GCGC in 2002, the GCGC Commission especially took the corporate governance requirements of big companies as an example and also in the GCGC Commission there was only one member out from an SME. Natural differences in board structure and the development of and need for committees within boards as well as differences in transparency and reporting between SMEs and big companies (must automatically) lead to a higher rate of non-compliance with the GCGC rules among SMEs. This might put a further bias on the empirical results reported above and its comparison in case of different sample selection.

Nevertheless, our study is the first empirical audit committee study, which is focused on the German capital market and on the link between independent financial experts in the audit committee on accounting quality. With regard to the present discussion by the EC to increase the job specification rules of audit committee our results support the reform measures. The existence of only one independent member in the audit committee according the 8th EC Directive doesn’t suffice to increase the accounting quality. Our results are also important for managers and investors, too. On the one hand, investors might honor a volunteer increase of independent financial experts in the audit committee because they expect a higher professionalism of their supervision tasks. On the other hand, the possibilities of “hidden” earnings management, accounting errors and management fraud are reduced by a higher audit quality of the audit committee. The management board in the German two-tier system must make a trade-off between signaling “good” corporate governance quality and further influencing the financial statements.

As already mentioned there is a major empirical research gap for the German two-tier system and for the implications of audit committees on several corporate governance variables. Further research should evaluate, e.g., links between audit committees and firm performance and audit quality. With this respect, also endogeneity and reverse causation might be captured within multi-model studies (e.g., by developing complex equations systems). Reverse causation means that firm performance may also affect audit committees’ work and not the classical way round. This is a highly topical international discussion (e.g., Lehn et al., 2007), which corporate governance research did not often focus empirically, yet (e.g., Demsetz and Villalonga, 2001; Bhagat and Black, 2002), despite the fact that its consideration is supposed to significantly improve econometrics (Börsch- Supan and Köke, 2002). Thus, those innovative studies are called third generation corporate governance studies, which have been already supposed to become state of the art in corporate governance research (Becht et al., 2003). Furthermore, such an approach deserves different regression estimators like Two Stage Least Squares (2SLS) (when isolated estimating every single equation of an equation system; method with limited information) or Three Stage Least Squares (3SLS) (when estimating a whole equation system simultaneously). Those estimates are considered very valuable to find causal relations between corporate governance and firm performance in complex equation systems. They are the most common iteration to estimate equation systems (Wooldridge, 2009). Nevertheless, they are also more vulnerable for misspecifications within equations systems. Thus, we propose to more and more close the above mentioned research gap for the German two-tier system and for the implications of audit committees on several corporate governance variables by first of all doing much more exploratory research on this topic to lower the possibility of misspecifications: “Errors in any part of the system are more likely to spread through the entire system of equations” (Blalock, 1971, p. 285). This might also lead to new insights whether there are some moderator effects of the control variables with the specified independent variables presented in this present study.

Summary

The present empirical survey is addressing the influence of audit committees on accounting quality for German stock corporations listed in the DAX, Tec- DAX, MDAX and SDAX. The survey is based on the analysis of respective financial statements. Three hypotheses were tested, differentiated by two samples. As a first step, it has been analyzed whether the implementation of audit committees from 2002-2009 had a negative influence on the profit maximizing accounting policy and the occurrence of accounting fraud (hypothesis 1). In order to estimate on the dimension of profit maximizing accounting policy, the modified Jones (1991) model of Dechow et al. (1995) was taken into account and discretionary accruals have been measured. The occurrence of accounting offence was operationalized on the basis of restricted and not issued audit certificates and the disclosure of mistakes that were found during the enforcement audit as well as rating assessment. Hypotheses 2 and 3 follow, assuming that the (by majority) nomination of independent financial experts in the audit committee has a negative influence on the two corporate governance variables mentioned before.

Within the framework of regression analysis, the influence of audit committee on corporate governance variables was tested. Although the t-test (based on sample 1) proved a significant decrease in values after the implementation of audit committees, no corresponding significances could be proved within the framework of regression analysis. Hypotheses 1 and 2 cannot be supported. The (by majority) nomination of independent financial experts in the audit committee rather proves a significant negative correlation with regard to the dimension on profit maximizing accounting policy and the occurrence of accounting offence. Taken together, the intensity of the proven correlations is rather weak. In addition, the restricted significance of estimated variables with regard to the quality assessment of the audit committee only allow for a by trend conclusion. However, the minimum requirement of one independent financial expert according of the German commercial law in order to increase accounting quality seems to be insufficient. The results of the regression analysis rather suggest a more demanding job specification of audit committee members. Within this context, from a regulatory point of view the possibility is in existence, corresponding to the present regulation draft of the EC, to request for an at least majority nomination of independent members and more than one financial expert in the audit committee. The results also provide useful information for investors evaluating the impact of audit committee composition on accounting quality on the German capital market.

References

- Abbott, L.J., Y. Park, S. Parker (2000). The effects of audit committee activity and independence on corporate fraud, Managerial Finance, 26, pp. 55-67.

- Abbott, L.J., S. Parker, G.F. Peters (2004). Audit committee characteristics and restatements, Auditing, 23, pp. 69-87.

- Abbott, L.J., S. Parker, G.F. Peters, K. Raghunandan (2003a). The association between audit committee characteristics and audit fees, Auditing, 22, pp. 17-32.

- Abbott, L.J., S. Parker, G.F. (2003b). Peters, K. Raghunandan. An empirical investigation of audit fees, nonaudit fees, and audit committees, Contemporary Accounting Research, 20, pp. 215-234.

- Agrawal, A., S. Chadha (2005). Corporate governance and accounting scandals, Journal of Law and Economics, 48, pp. 371-406.

- Anderson, R.C., S.A. Mansi, D.M. Reeb (2003). Board characteristics, accounting report integrity, and the cost of debts, Working Paper, Washington DC.

- Ashbaugh, EL, D.W. Collins, R. LaFond (2004). Corporate governance and the cost of equity capital, Working Paper, Madison.

- Ball, R., S.P. Kothari, A. Robin (2000). The effect of international institutional factors on properties of accounting earnings, Journal of Accounting and Economics, 29, pp. 1-51.

- Baxter, P., J. Cotter (2009). Audit committees and earnings quality, Accounting and Finance, 49, pp. 267-290.

- Beasley, M.S., J.V. Carcello, D R. Hermanson, P.D. Lapides (2000). Fraudulent financial reporting, Accounting Horizons, 14, pp. 441-454.

- Beaver, W., S. Ryan (2000). Biases and lags in book-value and their effects on the ability of the book-to-market ratio to predict book return on equity, Journal of Accounting Research, 38, pp. 127-148.

- Bedard, J., S.M. Chtourou, L. Courteau (2004). The effect of audit committee expertise, independence and activity on aggressive earnings management, Auditing, 23, pp. 13-35.

- Becht, M., P. Bolton, A. Röell (2003). Corporate governance and control, In Constantinides, G.M., M. Harris, R.M. Stulz (Eds.), Handbook of the economics of finance, Amsterdam, pp. 1-109.

- Beiner, S., W. Drobetz, M. Schmid, H. Zimmermann (2005). Corporate Governance, Untemehmensbewertung und Wettbewerb, In Franz, W., H.J. Ramser, M. Stadler (Eds.), Funktionsfähigkeit und Stabilität von Finanzmärkten, Tübingen, pp. 27-53.

- Bhagat, S., B. Black (1999). The uncertain relationship between board composition and firm performance, Business Lawyer, 54, pp. 921-963.

- Blalock, H.M. jr. (1971). Causal model in the social sciences,

- Börsch-Supan, A., J. Koke (2002). An applied econometricians’ view of empirical corporate governance studies, German Economic Review, 3, pp. 295-326.

- Bradbury, M.E., Y.T. Mak, S.M. Tan (2006). Board characteristics, audit committee characteristics and abnormal accruals, Pacific Accounting Review, 18, pp. 47-68.

- Canipa-Valdez, M. (2000). Weiterentwicklung der Rechnungslegungsregulierung in der Europäischen Union, Hamburg.

- Carcello, J., T. Neal (2000). Audit committee composition and auditor reporting, The Accounting Review, 75, pp. 453-467.

- Carcello, J., T. Neal (2003). Audit committee characteristics and auditor dismissals following “new” going concern reports, The Accounting Review, 78, pp. 95-117.

- Carcello, J., D. Hermanson, T. Neal (2000). Disclosures in audit committee charters and reports, Accounting Horizons, 16, pp. 291-304.

- Carcello, J., Hollingsworth, C.W., Klein, A., Neal, T.L. (2010). The Role of Audit Committee Financial Experts in the Post-Sox Era, Working Paper, Tennessee.

- Chambers, D. (2006). Is goodwill impairment accounting under SEAS 142 an improvement over systematic amortization of goodwill? Working Paper, Kentucky.

- Chan, K., N. Jegadeesh, T. Sougianni (2004). The accrual effect of future earnings, Review of Quantitative Finance and Accounting, 22, pp. 97-121.

- Collier, P. (1993). Factors affecting the formation of audit committees in major UK listed companies, Accounting and Business Research, 23, pp. 421-430.

- Collier, P., A. Gregory (1996). Audit committee effectiveness and the audit fee, European Accounting Review, 5, pp. 177-198.

- Davidson, R., J. Goodwin-Stewart, P. Kent (2005). Internal governance structures and earnings management, Accounting and Finance, 45, pp. 241-268.

- DeAngelo, L. (1981). Size aa&itqaaiity, Journal of Accounting and Economics,?),^. 183-199.

- DeAngelo, L. (1986). Accounting numbers as market valuation substitutes, Accounting Review, 59, pp. 400-420.

- Dechow, P., I. Dichev (2002). The quality of accruals and earnings, Accounting Review, 77, pp. 35-59.

- Dechow, P., R. Sloan, A. Sweeney (1995). Detecting earnings management, Accounting Review, 70, pp. 193-225.

- DeFond, M.L., R.N. Hann, Hu, X. (2005). Does the market value financial expertise on audit committees of boards of directors? Journal of Accounting Research, 43, pp. 153-193.

- Demsetz, H., B. Villalonga (2001). Ownership structure and corporate performance, Journal of Corporate Finance, 209-233.

- DeZoort, F.T., S.E. Salterio (2001). The effects of corporate governance experience and financial reporting and audit knowledge on audit committee members’ judgments, Auditing, 20, pp. 31-47.

- Dhaliwal, D.S., V. Naiker, F. Navissi (2010). The association between accruals quality and the characteristics of accounting experts and mix of expertise on audit committees, Contemporary Accounting Research, 27, pp. 787-827.

- Ebrahim, A. (2007). Earnings management and board activity, Review of Accounting and Finance, 6, pp. 42-58.

- Eichenseher, J.W, D. Shields (1985). Corporate director liability and monitoring preferences, Journal of Accounting and Public Policy, 4, pp. 13-31.

- Elliot, R., P. Jacobsen (1994). Costs and benefits of business information disclosure, Accounting Horizons, 8, pp. 80-96.

- European Commission. Empfehlung der Kommission vom 15. Februar 2005 zu den Aufgaben von nicht geschäftsführenden Direktoren/Aufsichtsratsmitgliedem/ börsennotierter Gesellschaften sowie zu den Ausschüssen des Verwaltungs-ZAufsichtsrats (2005/162/EWG). In Amtsblatt der Europäischen Gemeinschaften L 52 vom 25.02.2005, pp. 51-63.

- European Commission. Vorschlag für eine Richtlinie des Europäischen Parlaments und des Rates zur Änderung der Richtlinie 2006/43/EG über Abschlussprüfungen von Jahresabschlüssen und konsolidierten Abschlüssen (KOM(2011) 778/2, http://ec.europa.eu/intemal_market/auditing/reform/index_de.htm, Brussels, 2011.

- Farber, D.B. (2005). Restoring trust after fraud, Accounting Review, 80, pp. 539-561.

- Fuelbier, R., J. Gassen, T. Sellhor (2008). Vorsichtige Rechnungslegung, Zeitschrift für Betriebswirtschaft, 78, pp. 1317-1342.

- German Corporate Governance Code. Elektronischer Bundesanzeiger 2.7.2010, pp. 1-10.

- Geraldes Alves, S.M. (2011). The effect of the board structure on earnings management. Evidence from Portugal, Journal of Financial Reporting & Accounting, 9, pp. 141-160.

- Ghosh, A., A. Marra, D. Moon (2010). Corporate boards, audit committees, and earnings management, Journal of Business Finance & Accounting, 37, pp. 1145-1176.

- Goddard, A.R., C. Masters, C. (2000). Audit committees, Cadbury Code and audit fees, Managerial Auditing Journal, 15, pp. 358-371.

- Goodwin-Stewart, J., P. Kent, P. (2006). Relation between external audit fees, audit committee characteristics and internal audit, Accounting and Finance, 46, pp. 387-404.

- Hair, J., R. Anderson, R. Tatham, B. Black (1998). Multivariate data analysis, Upper Saddle River.

- Healy, P. (1985). The effect of bonus schemes on accounting decisions, Journal of Accounting & Economics, 7, pp. 85-107.

- Heckman, J.J. (1979). Sample selection bias as a specification error, Econometrica, 47, pp. 153-161.

- Ismail, H., T.M. Iskandar, M.M. Rahma (2008). Corporate reporting quality, audit committee and quality of audit, Malaysian Accounting Review, 1, pp. 21-42.

- Jensen, M., W. Meckling (1976). Theory of the firm, Journal of Financial Economics, 3, pp. 305-360.

- Jones, J. (1991). Earnings management during import relief investigations, Journal of Accounting Research, 29, pp. 193-228.

- Karamanou, I., N. Vafeas (2005). The association between corporate boards, audit committees, and management earnings forecasts, Journal of Accounting Research, 43, pp. 453-486.

- Klein, A. (1998). Firm performance and board committee structure, Journal of Law and Economics, 41, pp. 275-303.

- Klein, A. (2002). Audit committee, board of director characteristics and earnings management, Journal of Accounting and Economics, 33, pp. 375-400.

- Knapp, M.C. (1987). An empirical study of audit committee support for auditors involved in technical disputes with client Management, Accounting Review, 62, pp. 578-588.

- Koh, ?., S. Laplante, Y. Tong (2007). Accountability and value enhancement roles of corporate governance, Accounting and Finance, 47, pp. 305-333.

- Krishnan, J. (2005). Audit committee quality and internal control, Accounting Review, 80, pp. 649-675.

- Krishnan, J., Q. Wen, W. Zhao (2011). Legal expertise on corporate audit committees and financial reporting quality, The Accounting Review, 6, pp. 2099-2130.

- Kunitake, W. (1983). Auditor changes by audit committees and outside directors, Akron Business and Economic Review, 6, pp. 48-52.

- Lee, H.Y., V. Mande, R. Ortman (2004). The effect of audit committee and board of director independence on auditor resignation, Auditing, 23, pp. 131-146.

- Lehn, K, S. Fatro, M. Zhao (2007). Governance indexes and valuation, Journal of Corporate Finance, 13, pp. 907-928.

- Lin, J., J. Li, J. Yang (2006). The effect of audit committee performance on earnings quality, Managerial Auditing Journal, 21, pp. 921-933.

- Mangena, M., R. Pike (2005). The effect of audit committee shareholding, financial expertise and size on interim financial disclosure, Accounting and Business Research, 35, pp. 327-349.

- Marra, A., P. Mazzola, A. Prencipe (2011). Board monitoring and earnings management pre- and post-IFRS, The International Journal of Accounting, 46, pp. 205-230.

- McMullen, D. (1996). Audit committee performance, Auditing, 15, pp. 87-103.

- McMullen, D.A., K. Raghunandan (1996). Enhancing audit committee effectiveness, Journal of Accountancy, 179, pp. 79-81.

- McNichols, M. (2000). Research design issues in earnings management studies, Journal of Accounting and Public Policy, 19, pp. 313-345.

- Moxter, A. (1984). Bilanzlehre,

- Osma, B.G., B.G. Nouger (2005). Corporate governance and earnings management in Spain, Working Paper, Annual Congress of the European Accounting Association, Gothenburg.

- Parker, S., G. Peters, H. Turetsky (2005). Corporate governance factors and auditor going concern assessments, Review of Accounting and Finance, 4, pp. 5-29.

- Peasnell, K., Pope, P., Young, S. (2005). Board Monitoring and Earnings Management, Journal of Business Finance & Accounting, 32, pp. 1311-1346.

- Piot, C., R. Janin (2007). External auditors, audit committees and earnings management in France, European Accounting Review, 16, pp. 429-454.

- Pomeroy, B., D.B. Thornton (2008). Meta-analysis and the accounting literature. The case of audit committee independence and financial reporting quality, European Accounting Review, 17, pp. 305-330.

- Raghunandan, K., D. Rama (2003). Audit committee composition and shareholder actions, Auditing, 22, pp. 253-263.

- Rahman, R., F. Ali (2006). Board, audit committee, culture and earnings management, Managerial Auditing Journal, 21, pp. 783-804.

- Röhrich, R. (2006). Pruefungsausschuss und Audit Committee, Journal of Corporate Governance, 1, pp. 148-152.

- Ross, S. (1973). The economic theory of agency, The American Economic Review, 63, pp. 134-139.

- Schmidt, J., M. Wilkins (2011). Bringing darkness to light. The influence of auditor quality and audit committee expertise on the timeliness of financial statement restatement disclosures, Working Paper, Texas.

- Steger, T., M. Stiglbauer (2011). The German Corporate Governance Code and its adoption by listed SMEs: Just another ‘Procrustes Bed’?, Working Paper, University of Regensburg, University of Erlangen-Nuremberg.

- Stewart, J., L. Munro (2007). The impact of audit committee existence and audit committee meeting frequency on the external audit, International Journal of Auditing, 11, pp. 51-69.

- Stiglbauer, M. (2010). Corporate Governance Berichterstattung und Untemehmenseriblg, Gabler-Verlag, Wiesbaden.

- Teoh, H.Y., C.C. Lim (1996). An empirical study of the effects of audit committees, disclosure of nonaudit fees and other issues on audit independence, Journal of International Accounting, Auditing & Taxation, 5, pp. 231-248.

- Thomas, J., X. Zhang (2000). Identifying unexpected accruals, Journal of Accounting and Public Policy, 19, pp. 347-376.

- Tirole, J. (1986). Hierarchies and bureaucracies, Journal of Law, Economics and Organization, 2, pp. 181-214.

- Uzun, H., S. H. Szewczyk, R. Varma (2004). Board composition and corporate fraud, Financial Analysts Journal, 60, pp. 33-43.

- Vafeas, N., J.F. Waegelein (2007). The association between audit committees, compensation incentives and corporate audit fees, Review of Quantitative Finance and Accounting, 28, pp. 241-255.

- Veite, P. (2009). Die Implementierung von Prüfungsausschüssen, Audit Committees des Aufsichtsrats, Board of Directors mit unabhängigen und finanzkompetenten Mitgliedern, Zeischriftfür Betriebswirtschaft, 59, pp. 123-174.

- Veite, P. (2010). Der deutsche Prüfungsausschuss nach dem BilMoG und Vorst AG, Zeitschrift für kapitalmarktorientierte und internationale Rechnungslegung, 10, pp. 463-468.

- Veite, P. (2011). The link between audit committees and corporate governance quality, Corporate Ownership & Control, 8, pp. 5-13.

- Wagenhofer, A., R. Ewert (2007). Externe Unternehmensrechnung, New York.

- Werder, A., T. Talaulicar (2010). Kodex Report 2010, Der Betrieb, 63, pp. 853-861.

- Wild, J.J. (1994). Managerial accountability to shareholder, British Accounting Review, 26, pp. 353-374.

- Wild, J.J. (1996). The audit committee and earnings quality, Journal of Accounting, Auditing & Finance, 11, pp. 247-276.

- Williams, S. (2002). Association between earnings management and properties of independent audit committee members, Working Paper, Singapore.

- Wooldridge, J.M. (2009). Introductory econometrics, Mason/OH.

- Xie, B., W. Davidson, P. DaDalt (2001). Earnings management and corporate governance, Working Paper, Illinois.

- Yang, J.S., J. Krishnan (2005). Audit committees and quarterly earnings management, International Journal of Auditing, 9, pp. 201-219.

- Yermack, D. (1996). Higher market valuation of companies with a small board of directors, Journal of Financial Economics, 40, pp. 185-211.