Impact of foreign direct investment on economic growth in Africa

Published: June 13, 2016

Latest article update: Dec. 9, 2022

Abstract

Several studies have been conducted to examine the influence of foreign direct investment (FDI) inflow on economic growth. Indeed, the overall evidence is best characterized as mixed. This paper investigates the effect of FDI on economic growth in some randomly selected African economies from 1980 to 2013, using a modified growth model by Agrawal and Khan (2011). This model consists of Gross Domestic Product, Human Capital, International Technology Transfer, Labor Force, FDI and Gross Capital Formation (GCF). Ordinary least squares and generalized method of moments were used as the estimation techniques. Of all the results, only Gross Capital Formation, Human Capital, and International Technology Transfer in the Central African Republic were found not to have any statistically significant influence on economic growth. In general, the impact of FDI on economic growth in African countries is limited or negligible. Consequently, this study observes that a 1% increase in FDI would result in a 0.12% increase in GDP for South Africa, a 0.05% increase in Egypt, a 0.03% increase in Nigeria, a 0.02% increase in Kenya, and a 1% increase in GDP in the Central African Republic. The findings also reveal that South Africa’s growth is more affected by FDI than the other four countries. The study also provides possible reasons behind South Africa’s great show of FDI and the lessons other African countries could learn from South Africa better utilization of FDI. This study integrates the related drivers of the effectiveness and success of FDI

Keywords

Foreign direct investment, economic growth, OLS, growth model, GMM, Africa, FDI inflow

Introduction

Today, the impact of globalization can never be overemphasized. The tremendous growth in foreign direct investment (FDI) is one of the important influences of globalization (Whalley & Xin, 2009; Mohamed & Sidiropoulos, 2010). Although, African countries are not major beneficiaries of FDI flows in the world; that notwithstanding, FDI inflows have experienced a dramatic upsurge in many countries in Africa over the past two decades (Agrawal and Khan, 2011; Ozturk, 2007). In addition to inward FDI from developed and ‘emerging economies’, the last two decades have also seen a marked increase in the FDI activities of African firms - especially within the region (UNCTAD, 2015). Indigenous companies in South Africa, Nigeria, Togo, and Kenya have operations in more than two countries in the region (Anyanwu and Yameogo, 2015; UNCTAD, 2015). This unique upsurge in the cross-border activities of African firms presented a unique opportunity to investigate the patterns and outcomes of FDI in these countries (Agrawal and Khan, 2011; Aregbesola, 2014; UNCTAD, 2013). In addition, these unprecedented levels of competition for inward FDI in the region are on the premise that inward FDI, whether in the form of portfolio or direct investments, also presents a unique opportunity for African economies to achieve improved economic growth (Asiedu, 2002; Johnson, 2006). As a result, most African countries are now competing more vigorously for FDI inflows in their quest for rapid economic growth (Anyanwu, 2012; Lee, 2005; Li & Liu, 2004).

Furthermore, the increasing competition for FDI in the past two decades in most developing and developed countries is also stimulating the extended and controversial debate about the cost and/or benefits of FDI (Agrawal and Khan, 2011; Wijeweera, Villano & Dollery, 2010). While many scholars concur about the positive influence of FDI on economic growth, given various incentives and appropriate policies, others highlight the potential drawbacks to include the negative impact on both balance of payments and competition in the host country (Johnson, 2006; Ozturk, 2007). Durham (2004) and Agrawal and Khan (2011) also observed the efficacy of exploiting FDI by nations with superior financial market regulations (Ozturk, 2007; Lee, 2005; Li & Liu, 2004). Although various studies have examined the influence of FDI inflow on economic growth, with most reporting mixed results, there seem to be few empirical analyzes on this phenomenon (Durham, 2004). Moreover, many of the previous studies often utilized GDP per capita as a substitute for economic growth, despite the fact that FDI can only moderate the reward for labor (Agrawal and Khan, 2011). In addition, Saggi (2002) also suggests the need for a survey of relationships between inward FDI and economic growth, given its influence on economic development.

The above considered, the main objective of this study was to investigate the effect of FDI inflows on economic growth in some selected African economies from 1980 to 2013. The analytical focus was premised on developing countries, due to the submission of Wyk and Lal (2008). This paper, therefore, argues that the practice of pooling developed and developing economies together in analyzing the impact of FDI on growth is inappropriate. This is on the premise that while developed economies have substantial amounts of two-way FDI flows, developing economies, on the other hand, are almost exclusively recipients of FDI flows (Wyk & Lal, 2008; El-Wassal, 2012). Section two of this paper is the literature review. Section three details the adopted methodology. Section four includes the analysis of the various data collected, results and discussion of findings. Section five presents the conclusion, and the recommendations and implications of the study.

1. Review of related literature

FDI can be in the form of joint venture, Greenfield investment, mergers and acquisitions, management knowhow, portfolio investment and transfer of technology from one country to another (Johnson, 2006; Madsen, 2007). The neoclassical models of growth and endogenous growth models support most of the empirical work on the FDI-growth relationship (Ozturk, 2007; Solow, 1956). According to the neoclassical growth theory, economic growth generally comes from two sources: factor accumulation and total factor productivity (TFP) growth (Felipe, 1997). These are often dependent on the host country’s bargaining power (assets that it is able to provide to investors) in attracting FDI, such as its market size, human capital, geographical location, and infrastructure (Fedderke and Romm, 2005). In other words, Fedderke and Romm (2005, p. 758) summarized that FDI inflow is strongly influenced by the risk profile and net rate of return of FDI liabilities.

Generally, most empirical literature focuses more on the growth of factor inputs. This may not be unconnected with the fact that factor growth is easier to analyze and quantify, while difficulties abound in the measurement of TFP growth due to the unavailability of appropriate data and lack of appropriate econometric modeling techniques (Johnson, 2006; Madsen, 2007). Given the limited contributions of the neoclassical growth theory, the endogenous growth literature posits that FDI not only contributes to economic growth through technology transfers and capital formation (Lucas, 1988; Merican, 2009; Blomstrom et al., 1996), but also through the augmentation of the level of knowledge via skill acquisition and labor training (De-Mello, 1999; Solow, 1956).

Consequently, the framework of endogenous growth models identified three main channels through which FDI can affect economic growth. First, FDI may increase capital accumulation in the host nation through the introduction of new inputs and technologies (Dunning, 1993). Second, FDI can raise the level of skills and knowledge in the host country through training (De-Mello, 1999). Third, FDI can increase the level of competition in the host country through reduction in entry barriers and the market power of existing firms (Johnson, 2006). Consequently, the findings of David Ricardo (comparative advantage), Heckscher-Ohlin’s (factor proportions), and Porter’s competitive advantage clearly establish the practical inevitability of foreign direct investment, as the foundation upon which a nation’s economic growth and prosperity can be built (Aregbesola, 2014).

1.1. FDI and economic growth. A number of interesting studies on the role of FDI in stimulating economic growth have appeared in the past three decades. Bhagwati (1978) was the first to present a theory on the dynamic effect of trade policy regime on FDI, trade and growth in a given host country. This theory was presented as an extension to his theory of immiserizing growth, which was further developed by Bhagwati (1994) and Brecher and Findlay (1983). Also, referred to as the “Bhagwati hypothesis”, the theory postulates that FDI inflows in a restrictive, import-substitution (IS) regime often retard, rather than promote economic growth. This is based on the fact that with the low comparative advantage of the host developing country, FDI often becomes an avenue for multinational companies to maintain and even increase their profitability, market share and the economic rent created by the highly protected domestic market in an IS regime (Aitken, Hanson & Harrison, 1997; Brecher and Findlay, 1983).

In addition to the above two postulations, many theoretical and empirical studies also acknowledge several channels by which FDI may negatively or positively influence economic growth. Apart from improved capital accumulation and efficiency via contract and demonstration effects in the host economy, technological change, competition, improved exports and human capital augmentation are other channels (Mohamed & Sidiropoulos, 2010; Blomstrom and Кокко, 1998). FDI also accelerates growth by generating employment in the host country, and through sharing of knowledge and management skills through forward and backward integration in host countries (Brecher and Findlay, 1983). Investment in learning and innovations by local firms may also generate productivity spillovers for the host economy (Whalley & Xin, 2009).

As a byproduct of technology transfer, technology diffusion is also a channel for improving economic growth (Grossman and Helpman, 1990). This was corroborated by Romer (1990), who highlighted the importance of international trade in technology diffusion, as an impetus to economic growth. Apart from Romer (1990) and Grossman and Helpman (1990), the importance of technological diffusion in enhancing economic growth in developing economies was posited by other endogenous growth theorists (Eaton and Kortüm, 1999; Young, 1991). Other pro-FDI liberalization studies like Love and Chandra (2004) and Chakraborty and Basu (2002) also supported the importance of FDI in enhancing economic growth. Consequently, Love and Chandra (2004) concluded that FDI should be encouraged if the objective of accelerating economic growth in developed economies is to be realized. That notwithstanding, Durham (2004) warned that although FDI may promote economic growth in most developing countries, the extent of the benefits depends on labor-force skills, trade policies and the absorptive capabilities of local firms (Felipe, 1997; Durham, 2004).

However, in a deviation from the above positive sentiments, many past studies on the impact of FDI on economic growth have produced mixed results. Singh (2003), Chakraborty and Basu (2002) and Young and Lan (1996) are not so positive about the influence of FDI on economic growth. Specifically, Singh (2003) and Young and Lan (1996) observed the influence of FDI on economic growth to be industry biased, and the level of development in the home nation also distorts the gains from FDI. It may even depend on the social and economic climate in the host nation (Young and Lan, 1996). This negative sentiment was also echoed by Chakraborty and Basu (2002) about the influence of FDI and trade in the diffusion of technology on economic growth. In addition, FDI may negatively influence the economic growth of the host nation due to significant reverse flows by the multinational companies (Akinlo, 2004). According to Akinlo (2004), these reverse flows could be in the form of dividends, large concessions and remittances of profits. Many empirical studies also provided evidence of significant “crowd in” on other investments at the macro level (Mohamed & Sidiropoulos, 2010; Durham, 2004). Some empirical studies also observed insignificant influence of FDI on economic growth and that FDI is no more productive than domestic investments (Love and Chandra, 2004).

2. Methodology

This research employed time series data of the selected African countries, from 1980 to 2013. For representativeness and ease of generalization (Singh, 2003), the following countries were randomly selected from each of the regions in Africa: Nigeria (West Africa), Egypt (North Africa), Kenya (East Africa), South Africa (Southern Africa), and Central African Republic (Central Africa). The ordinary least squares regression (OLS) and the generalized method of moments (GMM) were the two estimation techniques used. Firstly, we performed an OLS with time fixed effects. However, due to a probable endogeneity bias and serial correlation of the error term, one serious defect of OLS might be unstable and inconsistent parameter estimates (Ozturk, 2007). To deal with this probable problem, the GMM technique was used as compliment to provide consistent estimates (Singh, 2003).

The data set was collected from the following sources: UNCTAD (United Nations Conference on Trade and Development), World Bank Databank, United Nations Commodity Trade Statistics (UNCTS) Database, Matrade Database and World Trade Organization (WTO) Statistics Database, the International Monetary Fund (IMF), the United Nations Statistics Database (UNdata), and publications of national central banks and other agencies of the governments of the selected countries.

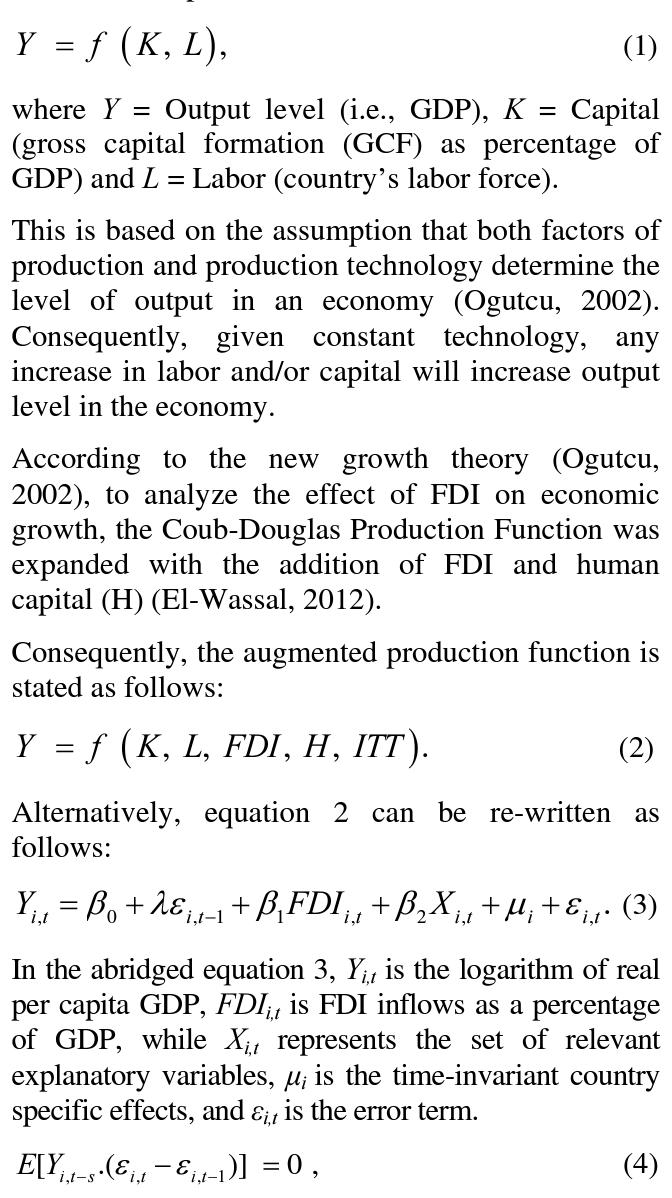

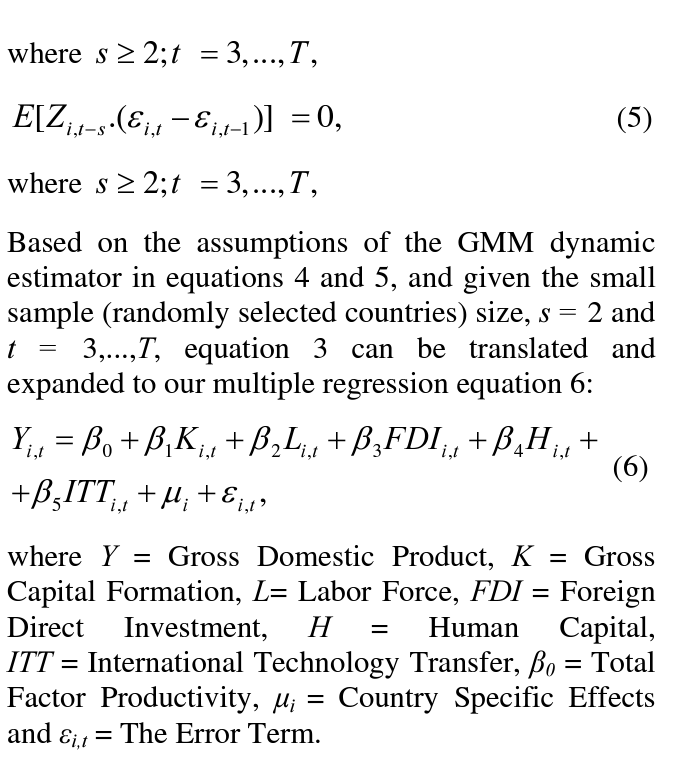

2.1. Multiple regression analysis: OLS and GMM. Based on a modified growth model by Agrawal and Khan (2011), the proposed model was constructed from the basic production function below:

GDP (PPP) was measured in current international US Dollars in millions, and FDI inflow was measured as a percentage of GDP. Gross Capital Formation was also measured as percentage of GDP, as a proxy for capital; while Labor Force was proxied by the Human Development Index (HDI). The importance of education to economic growth was reflected via human capital; accordingly, human capital was proxied by the ratio of secondary and tertiary institution enrolment in the population (El-Wassal, 2012). In addition, the import of machinery was used as a proxy for International Technology Transfers. Total Factor Productivity (TFP) was factored in to explain output growth, and was not accounted for by the other explanatory variables. However, log values of the variables were used to facilitate the use of the ordinary least square method (Agrawal and Khan, 2011).

3. Results and discussion of findings

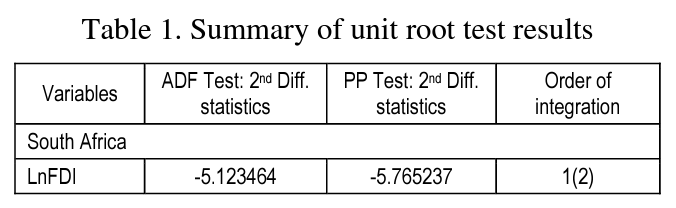

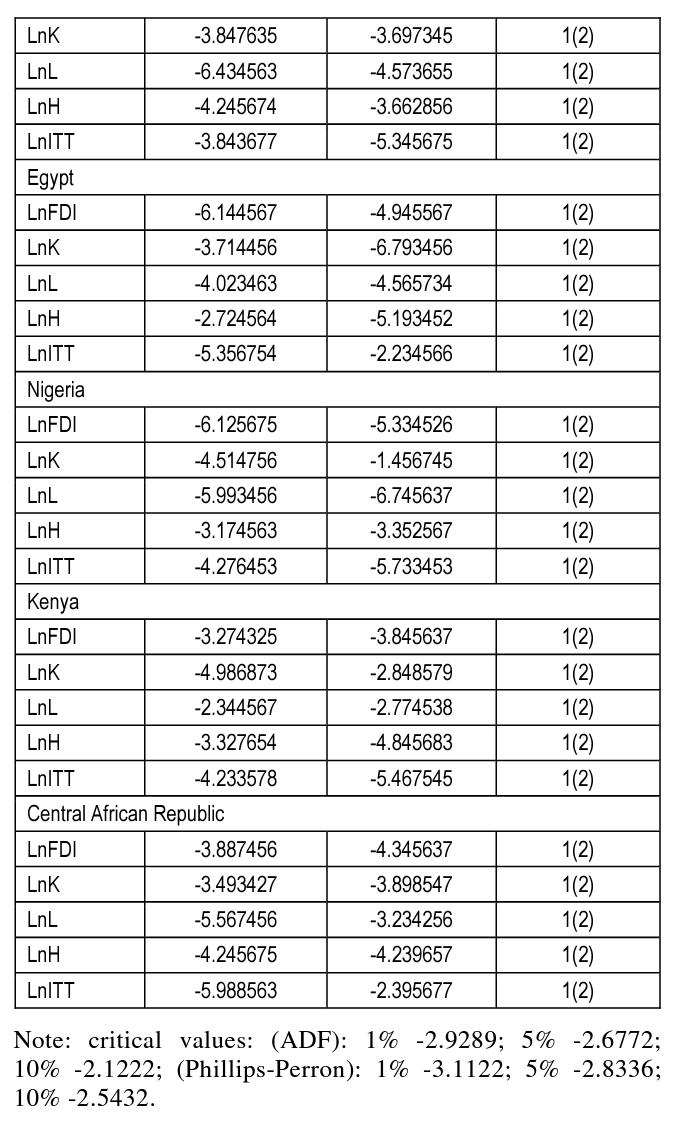

3.1. Unit root test. A formal test for identifying non-stationarity (presence of unit roots) was carried out. A standard augmented Dickey-Fuller (ADF) test (to eliminate autocorrelation and whiten noise) and Phillips Perron (PP) test (given the imperative of uncorrelated error terms) were conducted at the level, first difference and second difference series (Hair et al., 1998; Ozturk, 2007). The results of the unit root tests are presented in Table 1 (below).

The result of the unit root test assumed stationarity of the series for all the variables by the rejection of the null hypothesis for second difference at all the critical values (maximum lag of one). Therefore, the models follow an integrating order of 1(2) process and are a stationary process (Ozturk, 2007).

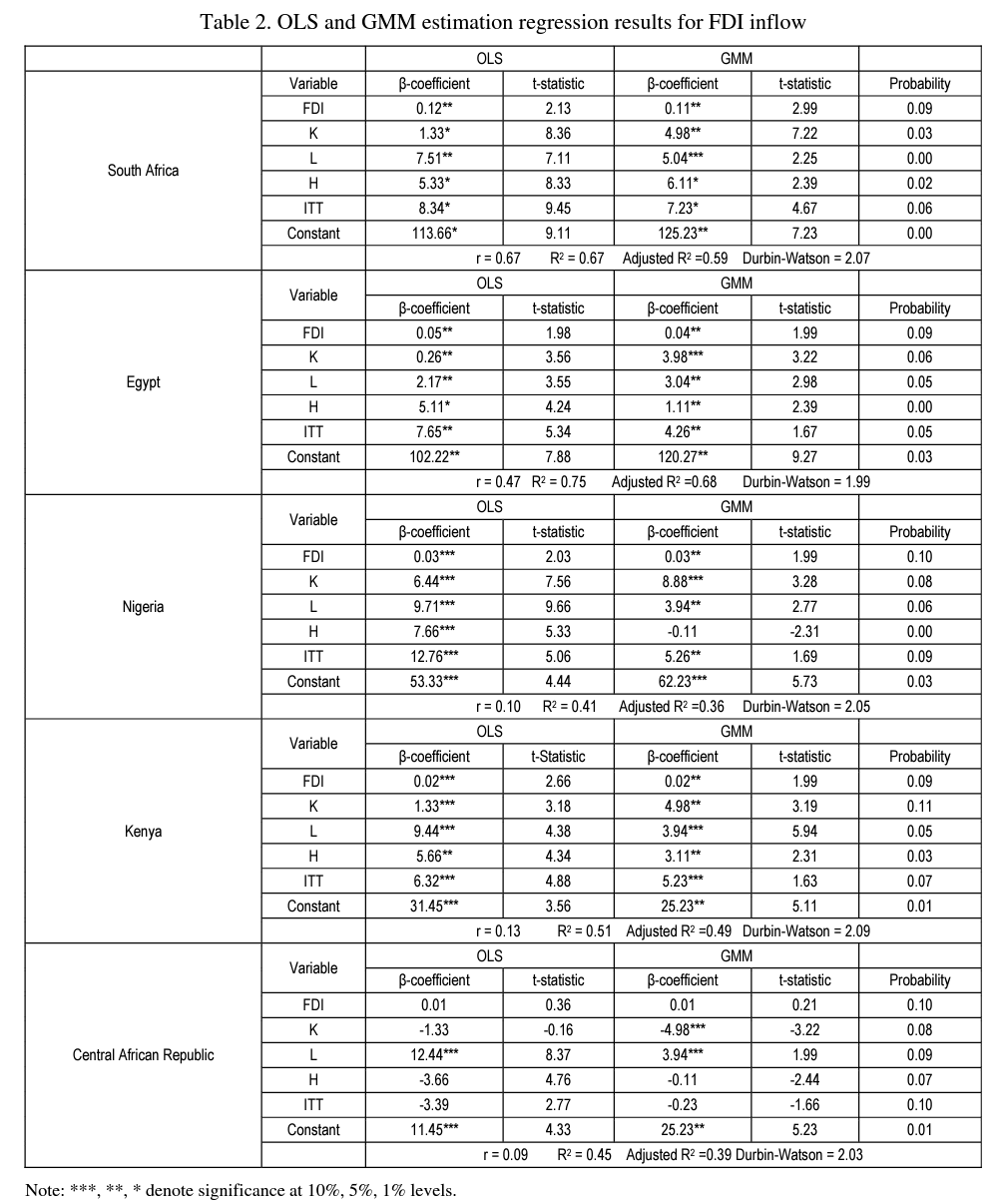

3.2. Estimated regression results. The estimated regression results for all countries are shown in Table 2 (below). In the model of South Africa, the entire variables were positive and significant for both OLS and GMM. The correlation coefficient (r) was 0.67 for South Africa. This implies a positive relationship between economic growth and all the explanatory variables in the model. The adjusted R2 was 0.59, which implies that about 59% variations in economic growth could only be explained by FDI and other explanatory variables, while the remaining 41% were due to other variables outside the regression model and which also affect growth. The assumption of independent errors was tested with the Durbin- Watson statistics, which monitors for serial correlations between errors (Akinlo, 2004).

A value of 1.99 complies with the assumption of no independent errors, since a value less than 1 or greater than 3 are definitely cause for concern (Singh, 2003). It also shows that there is no problem of autocorrelation (Keller, 2002). The estimate of FDI was positive and significant, although limited, for both OLS and GMM, which indicates that FDI inflows contributed minimally in explaining the level of economic growth in South Africa during the study period. Specifically, a coefficient of 0.12 implies that a 1% increase in FDI would result in a 0.12% increase in GDP for South Africa.

The results from the model of Egypt also showed that all variables were positive and significant for both OLS and GMM results. The coefficient of FDI was 0.05, which implies that a 1% increase in FDI would result in 0.05% increase in GDP for Egypt. However, the results from the model of Nigeria were not as impressive as those of South Africa and Egypt. For instance, the estimate for Human Capital was positive and significant for OLS. This indicates that a previous level of Human Capital contributed positively in explaining the level of economic growth in Nigeria. However, the second lag was not significant at the GMM and had a negative sign. This shows that Nigeria’s human capital deteriorated with time (Usman & Ibrahim, 2012). That notwithstanding, other explanatory variables were significant at 10% level of significance, both at OLS and GMM (Ozturk, 2007). The coefficient of FDI was 0.03 - which implies that a 1% increase in FDI would result in a 0.03% increase in GDP for Nigeria.

The results from the model of Kenya were also not as impressive as those of South Africa and Egypt. Although all the variables were positive and significant for both OLS and GMM, only Human Capital (H) was significant at 5%, while FDI and the other explanatory variables were only significant at 10% level of significance (Usman & Ibrahim, 2012; Ogutcu, 2002). The coefficient of FDI was 0.02, which implies that a 1% increase in FDI would result in a 0.02% increase in GDP for Kenya. Lastly, the Central African Republic recorded negative indicators based on the results from the model. Only Labor Force (L) was significant at 10%. FDI and the other explanatory variables were not significant. The correlation coefficient (r) was also very low at 0.09. Although the estimates of FDI were positive, they were not significant for both OLS and GMM. This indicates that FDI inflows failed to explain the level of economic growth in Central African Republic during the study period. That notwithstanding, a coefficient of 0.01 implied that a 1% increase in FDI would result in a 0.01% increase in GDP for the Central African Republic during the study period.

3.3. Discussion of findings. The OLS and GMM results suggest that FDI inflows to the selected African countries over the past three decades have had a limited impact on economic growth. This is not surprising, given similar results from previous studies (Fedderke & Romm, 2005; Cleeve, 2008). For instance, Fedderke and Romm (2005, p. 738) reported a direct positive relationship between FDI and economic growth in South Africa. However, a comparative analysis of results for all the countries showed that both South Africa and Egypt were able to utilize their FDI inflows to enhance economic growth more efficiently than Nigeria, Kenya and the Central African Republic. This might not be unrelated to the availability of government incentives, government reforms, easy accessibility to the export market, developed infrastructure, and a superior macroeconomic climate in both South Africa and Egypt during the study period (Agrawal and Khan, 2011; UNCTAD, 2015). Regional economic cooperation (REC) initiatives also assisted FDI inflows, with the South African Development Community (SADC) facilitating investments and technology transfers in neighboring countries by South Africa companies (Anyanwu, 2012; Hailu, 2010). The high investments in telecommunications, mining and retail over the years also improved economic growth in South Africa via employment generation and improvement in the stock of human capital (Reiter et al., 2010; Hailu, 2010).

Notwithstanding the current decline in FDI inflows (Anyanwu & Yameogo, 2015; UNCTAD, 2015) and the attendant negative impact on economic growth (due to insecurity and declining commodity prices), our study also observed a moderate positive relationship between FDI and economic growth in Egypt. This might not be unconnected, among other variables, with the influence of incentives. According to the Organization for Economic Cooperation and Development report, all Middle East and North African countries offered generous incentives to boost growth and employment, and to improve their competitive position (OECD, 2007, p. 3). This is on the premise that incentives (such as tax incentives) have a very strong influence on attracting FDI in countries with similar fundamentals (Aregbesola, 2014; UNCTAD, 2015). However, due to their less impressive utilization of FDI inflows, Asiedu (2002) maintained that the high level of poverty in Nigeria (70%) and Central African Republic (66%) adversely affected domestic investments, Human Capital development and Technology Transfers. In addition, declining growth in Nigeria, Kenya, and the Central African Republic was attributed to a host of factors impeding FDI inflows. These factors are: corruption, bureaucracy and the high cost of doing business, poor infrastructures and human capital, political and economic risks, and policy inconsistency (Akinlo, 2004; Anyanwu, 2012; Aregbesola, 2014).

Conclusions

This paper investigates the effect of FDI on economic growth in some randomly selected African economies from 1980 to 2013, using a modified growth model. Specifically, except for Central African Republic, the estimate of FDI was positive and significant for both OLS and GMM in all the selected countries. However, despite the significant and positive coefficients of FDI, yet the most important feature of the coefficients is the extremely small magnitude. In econometrics, these results imply a minimal or negligible impact of FDI on economic growth. For instance, the study found that a 1% increase in FDI would result in a 0.12% increase in GDP for South Africa, a 0.05% increase in GDP for Egypt, a 0.03% increase in GDP for Nigeria, a 0.02% increase in GDP for Kenya, and a 1% increase in GDP for the Central African Republic. That notwithstanding, this study provides possible reasons for South Africa’s better use of FDI and the lessons other African countries could learn from South Africa and Egypt so that they can make better utilization of EDI. In general, this study revealed that South Africa’s growth is more affected by EDI than the other four countries. Therefore, this paper posits that South Africa, and, indeed, other African economies, has great potential to improve its inflow of FDI and the growth benefits accruing from FDI (Anyanwu & Yameogo, 2015; UNCTAD, 2015).

Theoretical and managerial implications of the study

This paper contributes to the existing literature in four ways. First, unlike previous studies which largely consider either developed and developing economies, or a group of both developed and developing economies, our study focuses solely on African countries. Second, the analytical focus was premised on developing countries, due to Wyk and Lal (2008) submission. This paper, therefore, argues that the practice of pooling developed and developing economies together in analyzing the impact of FDI on growth is inappropriate (Wyk & Lal, 2008; El-Wassal, 2012). Third, the study adds to the growing literature by examining a range of variables that seem to play an important role in shaping the relationship between FDI and economic growth. Lastly, the study also integrates the related drivers of the effectiveness and success of FDI, by confirming the significant relationship between FDI and economic growth in the selected countries (Anyanwu, 2012; Aregbesola, 2014). In summary, this study posits that FDI tends to have a significant effect on economic growth through multiple channels like gross capital formation, human capital enhancement, labor force, and technology transfer and spillover (Fedderke and Romm, 2005). It is also imperative for policy makers in Africa to understand the role of incentives. To achieve economic and social objectives, incentives can compensate for market failures (OECD, 2007, p. 3). It is also important for developing countries to know that, contrary to expectations, FDI may not automatically lead to economic growth, as is insinuated by many policy makers in the region (Akinlo, 2004). Rather, African countries should focus on the impact of policies on technological change, as well as the diffusion of knowledge through FDI from developed countries (UNCTAD, 2013; Anyanwu, 2012; Aregbesola, 2014). In addition, policy makers in both Nigeria and the Central African Republic should prioritize the expansion of existing human capital and improve the educational system to raise the stock of Human Capital.

However, care must be taken in using the output of this study, due to some inherent limitations. Similar to most empirical literature on the FDI-growth relationships using cross-country evidences, the study suffers from two major econometric weaknesses. First is the problem of endogenity, since most explanatory variables are likely to be jointly endogenous with economic growth (Anyanwu, 2012; Hailu, 2010). The second weakness relates with the presence of periods and country-specific omitted characteristics or variables affecting both inflows of FDI and economic growth (El-Wassal, 2012). That notwithstanding, generalized method of moments (GMM) approach was adopted in this paper to address the potential endogeneity of the regressors (El-Wassal, 2012). That notwithstanding, future studies might consider the inclusion of omitted variables, due to data limitation (Anyanwu & Yameogo, 2015).

References

- Agarwal, G. and Khan, M.A. (2011). Impact of FDI on GDP: A Comparative Study of China and India, International Journal of Business and Management, 6 (10), pp. 71-79.

- Aitken, B.J., Hanson, G.H. and Harrison, A.E. (1997). Spillovers, foreign investment, and export Behavior, Journal of International Economics, 43 (3), pp. 103-132.

- Akinlo, A. E. (2004). Foreign direct investment and growth in Nigeria An empirical Investigation, Journal of Policy Modeling, 26, pp. 627-639.

- Anyanwu, J.C. (2012). Why Does Foreign Direct Investment Go Where It Goes?: New Evidence From African Countries, Annals of Economics and Finance, 13 (2), pp. 433-470.

- Anyanwu, J.C. and Yameogo, N.D. (2015). What Drives Foreign Direct Investments into West Africa? An Empirical Investigation, African Development Review, 27 (3), pp. 199-215.

- Aregbesola, A.R. (2014). Foreign direct investment and institutional adequacy: New Granger causality evidence from African countries, South African Journal of Economic and Management Sciences, 17 (5), pp. 557-568.

- Asiedu, E. (2002). On the determinant of foreign direct investment to developing countries: Is Africa different? World Development, 30 (1), pp. 107-119.

- Bhagwati, J.N. (1978). Anatomy and Consequences of Exchange Control Regimes. New York: Balinger Publishing. 9. Bhagwati, J.N. (1994). Free trade: Old and new challenges, Economic Journal, 104, pp. 231-246

- Blomstrom, M. and Кокко A. (1998). Multinational Corporations and Spillovers, Journal of Economic Surveys, 12, pp. 247-277.

- Blomstrom, M., Lipsey, R.E and Zejan, M. (1996). Is Fixed Investment the Key to Economic Growth, Quarterly Journal of Economics, 111 (3), pp. 269-276.

- Brecher, R.A. and Findlay, R. (1983). Tariff, foreign capital and national welfare with sector specific factors, Journal of International Economics, 14, pp. 277-288.

- Chakraborty, C. and Basu, P. (2002). Foreign direct investment and growth in India: A cointegration approach, Applied Economics, 34, pp. 1061-1073.

- Chen, E.K.Y. (1992). Changing Pattem of Financial Flows in the Asia-Pacific Region and Policy Responses, Asian Development Review, 10 (2), pp. 46-85.

- Cleeve, E. (2008). How effective are fiscal incentives to attract FDI to sub-Saharan Africa, The Journal of Developing Areas, 42 (1), pp. 135-153.

- De Mello, L.R. (1999). Foreign direct investment-led growth: Evidence from time series and panel data, Oxford Economic Papers, 51 (2), pp. 133-151.

- Dunning, J.H. (1993). Multinational enterprises and the global economy. Reading, U.K.: Addisson-Wesley Publishing Company.

- Durham, B. (2004). Absorptive Capacity and the Effects of Foreign Direct Investment and Equity Foreign Portfolio Investment on Economic Growth, European Economic Review, 48 (2), pp. 285-306.

- Eaton, J. and Kortüm, S. (1999). International Technology Diffusion: Theory and Measurement, International Economic Review, 40 (3), pp. 537-570.

- El-Wassal, K.A. (2012). Foreign direct investment and economic growth in Arab Countries (1970-2008): an inquiry into determinants of growth benefits, Journal of Economic Development, 37 (4), pp. 79-100.

- Fedderke, Land Romm, A.T. (2005). Growth impact and determinants of foreign direct investment into South Africa, 1956-2003, Economic Modelling, 23 (2), pp. 738-760.

- Felipe, J. (1997). Total Factor Productivity Growth in East Asia: A Critical Survey, Economics and Development Research Center Report Series No. 65, Asian Development Bank, pp. 233-235.

- Grossman, G.M. and Helpman, E. (1990). Trade, Innovation, and Growth, The American Economic Review, 80 (2), pp. 86-91.

- Hailu, Z.A. (2010). Demand Side Factors Affecting the Inflow of Foreign Direct Investment to African Countries: Does Capital Market Matter? International Journal of Business and Management, 5 (5), pp. 104-116.

- Hair, J.F., Anderson, R.E., Tatham, R.L. and Black, W.C. (1998). Multivariate Analysis, 5th ed. Englewood Cliffs, NJ: Prentice-Hall.

- Johnson, A. (2006). The Effects of FDI Inflows on Host country Economic growth. Available at: http://www.infra.kth.se/cesis/documents/WP58.pdf. Accessed 31 May 2008.

- Keller, W. (2002). Trade and the transmission of technology, Journal of Economic Growth, 7, 5-21.

- Kransdorff, M. (2010). Tax incentives and foreign direct investment in South Africa, Consilience: The Journal of Sustainable Development, 3 (1), pp. 68-84.

- Lee, L.H. (2005). Foreign Direct Investment and Regional Trade Liberalization: A Viable Answer for Economic Development? Journal of World Trade, 39 (4), pp. 701-717.

- Li, H. and Liu, F. (2004). Foreign Direct Investment and Economic Growth: An Increasingly Endogenous Relationship, World Development, 33, pp. 393-407.

- Love, J. and Chandra, R. (2004). Testing Export-Led Growth in India, Pakistan, and Sri Lanka Using a Multivariate Framework, The Manchester School, 74 (4), pp. 483-496.

- Lucas, R. (1988). On the mechanics of economic development, Journal of Monetary Economics, 22 (3), pp. 3-42.

- Madsen, J.B. (2007). Technology spillover through trade and TFP convergence: 135 years of evidence for the OECD countries, Journal of International Economics, 72, pp. 464-480.

- Merican, Y. (2009). Foreign Direct Investment and Growth in ASEAN-4 Nations, International Journal of Business and Management, 4 (6), pp. 122-134.

- Mohamed, S.E. and Sidiropoulos, M.G. (2010). Another Look at the Determinants of Foreign Direct Investment in MENA Countries: An Empirical Investigation, Journal of Economic Development, 35 (2), pp. 75-96.

- OECD, (2007). Organization for Economic Cooperation and Development: Tax incentives for investment - A global perspective: experiences in MENA and non-MENA countries. Available at: http://www.oecd.org/mena/investment/38758855.pdf. Accessed 2012-07-04.

- Ogutcu, M. (2002). Foreign Direct Investment and Regional Development: Sharing experiences from Brazil, China, Russia and Turkey. OECD Paper,

- Ozturk, I. (2007). Foreign Direct Investment-Growth Nexus: A Review of the recent Literature, International Journal of Applied Econometrics and Quantitative Studies, 4 (2), pp. 79-98.

- Reiter, S.L., Newton, H. and Hanson, J. (2010). Human Development and Foreign Direct Investment in Developing Countries: The Influence of FDI Policy and Corruption, World Development, 38 (12), pp. 1678-1691.

- Romer, P. (1990). Endogenous Technological Change, Journal of Political Economy, 98 (5), pp. 71-102.

- Saggi, K. (2002). Trade, Foreign Direct Investment and International technology transfer: A Survey, The World bank Research Observer, 17 (2), pp. 191-235.

- Singh, T. (2003). Effects of Exports on Productivity and Growth in India: An Industry Based Analysis, Applied Economics, 35, pp. 741-749.

- Solow, R.M. (1956). A Contribution to the Theory of Economic Growth, Quarterly Journal of Economics, 70, pp. 65-94.

- (2013). World investment report: Global value chains: Investment and trade for development. New York and Geneva: The United Nations Conference and Trade and Development, New York: United Nations.

- (2015). World Investment Report. New York: United Nations.

- Usman, A. and Ibrahim, W. (2012). Foreign Direct Investment and Monetary Union in ECOWAS Sub-Region: Lessons from Abroad, Journal of Applied Finance & Banking, 2 (4), pp. 185-192.

- Whalley, J. and Xin, X. (2009). China’s EDI and Non-FDI Economies and the Sustainability of Future High Chinese Growth, China Economic Review, 41 (3), pp. 143-158.

- Wijeweera, A., Villano, R. and Dollery, B. (2010). Economic Growth and FDI Inflows: A Stochastic Frontier Analysis, The Journal of Developing Areas, 43, pp. 143-158.

- Wyk, J.V. and Lal, A.K. (2008). Risk and FDI Flows to Developing Countries, South African Journal of Economic and Management Sciences, 11 (4), pp. 511-528.

- Young, A. (1991). Learning by Doing and the Dynamic Effects of International Trade, The Quarterly Journal of Economics, 106 (2), pp. 369-405.

- Young, S. and Lan, P. (1996). Technology Transfer to China through Foreign Direct Investment, Regional Studies, 31 (7), pp. 669-679.