The impact of foreign direct investment on economic growth: case of post communism transition economies

Published: Feb. 20, 2014

Latest article update: Dec. 5, 2022

Abstract

The study investigates the impact of foreign direct investing on economic development of post Comecon transition economy countries. Neoclassical growth theory model is used to analyze the effects of FDI on economic growth. The results show significant FDI influence on economic growth of host countries. The paper concludes with explaining the results and suggesting some policy recommendations

Keywords

National economies, foreign direct investment, financial and infrastructure reforms, economic growth

Introduction

For developing countries foreign direct investment (FDI) is considered to be a way to transfer technology and capital from other developing and especially developed countries. A reason in theoretical literature is as following: when FDI comes to a domestic country (in specific business) that firm receives competitive advantage due to the usage of new knowledge, experience, ways of production and management. Current successful economic growth of developing countries is explained by “catch up effect” in technological development with developed countries. According to Yu et al. (2011) FDI is considered to be one of the major channels of technological transfer.

However, some other studies (e.g. Schoors et al., 2002) suggest that FDI can have negative impact on domestic economies. Repatriation of profit and “market stealing effect” are good examples discussed in this study. Mahutga et al. (2008) found that foreign investment also has a robust positive effect on income inequality; effect was observable over the short term, no matter how FDI was measured. FDI are different in its structure and as Eller et al. (2006) suggest the level and quality of foreign investment influences the financial sectors’ contribution to growth in emerging markets.

Post communistic countries form the subset in the set of developing countries. However, because of communistic past, many domestic firms have “old” organizational structure and are operated by “old” style managers, who received an education in communistic times. For example, only countries that became part of EU adopted International Financial Reporting Standards, while others did not. This increases transactional costs of investing in existing companies. “New” style of management sometimes can be incompatible with the “old” corporative culture that middle managers, workers and clerks are trained for. There is anecdotal evidence that this incompatibility revealed major conflicts resulting in several companies decreasing output, job places or being “sold by parts”. For instance, Arcelor Mittal Kryvyi Rih (steel producer) decreased the number of jobs by 40.5% (from 52000 to 37000 jobs) while Lühanskteplovoz (locomotives and multiple unit trains producer) sold major capacities. However, the big picture of FDI effects on post communistic countries is unclear.

The main question of the study is: Did foreign direct investment contribute to economic growth in post Comecon countries that moved from communism? Comecon was a Council for Mutual Economic Assistance, an organization of several communistic countries in the middle and end of XX century under the leadership of the Soviet Union. As of 1990, it included countries that are now known as Bulgaria, Slovak Republic and Czech Republic, Hungary, Macedonia, Bosnia and Herzegovina, Slovenia, Poland, Romania, Mongolia, Estonia, Kazakhstan, Latvia, Lithuania, Georgia, Armenia, Belarus, Ukraine, Kyrgyz Republic, the Russian Federation, Serbia and Montenegro (including Kosovo according to UNSCR 1244), Uzbekistan, Azerbaijan, Moldova, Cuba, Vietnam and German Democratic Republic. Comecon was an Eastern Bloc counterpart of the European Union. In early 90s, most of these countries dropped communistic governments, moved to a period of transition to capitalism and adopted western standards of democracy. Today, Cuba and Vietnam are still under communistic governments. Therefore, they are excluded from this analysis. German Democratic Republic became a part of the Federal Republic of Germany and is also excluded due to lack of data. Similarly, due to data problems Serbia and Montenegro are excluded from the analysis as well.

Economic growth is an important issue for the sample of countries mentioned above. It is for this reason that they use different techniques and policies to ensure its stimulation. As far as transition and developing economies are concerned, they often suffer from shortage of capital and the FDI inflows may be a good source for economy modernization. According to Navaretti and Venables 2004), expected benefits of FDI inflows are the modernization of national economy and promotion of economic development. However, in empirical studies the evidence is not often supported. Usually there are specific factors that determine whether or not the recipient country will benefit from FDI. Transition economies could be a good case to test FDI influence. Firstly, transition economies have “proper human capital”. Secondly, transition economies possess different levels of business environment and institutions, which enable the use of threshold analysis.

This paper is structured in three parts: a theoretical analysis of FDI influence on economic growth; an analysis of empirical studies on the issue; and a description of the data, model and results for the selected sample of countries.

1. Theoretical analysis of FDI influence on economic growth

FDI depends on business environment. The latter depends on regulations. The law system of post Comecon countries differ from English law systems used in Commonwealth, the USA and the Republic of Ireland. English law constitutional principle of “Everything which is not forbidden is allowed” is almost opposite to the law practices of post Comecon countries. Only Georgia has plans of implementing the English law in the city of Lazika, but it is still not done as of March 2013. Therefore, governments’ actions are one of the factors that influence FDI. Foreign Development Investors are mostly invited by transition and developing countries in a hope that through this international activity, the positive experience from developed countries will come to domestic countries (Silvio, 2009). The positive side for investors is that investing in developing countries may bring higher gain and profits. There is a widespread belief among policymakers that FDI generates positive productivity effects (externalities) for the host countries. According to this main mechanisms for these externalities are the adoption of innovations through licensing, staff training, introduction of new processes, and products by foreign firms. New ways of motivation, corporate culture and management are especially different from old ways for Comecon countries.

Capital accumulation and augmentation of human capital through education, trainings, and new managements are also prescribed to FDI inflows (Buckley, 2002). Also more productive foreign firms stimulate industry competition, which is often useful for domestic firms. Thus as suggested by Blomstrom et al. (1998) domestic firms with foreign investment have high-quality output, which requires markets to comply with this quality, driving up production standards in other competitive domestic firms and supplement business.

FDI are mostly done through multinational firms (Silvio, 2009), where the motherboard company invests to increase its production, sales, and services abroad. FDI are sound when the multinational firm technology is superior to the domestic one and allows them to be more productive and profitable. In other words, FDI contributes to greater technological growth and hence, faster economic development.

In neoclassical growth models FDI promotes creation of capital stock and more means for productions, which eventually contributes to economic growth. In this situation the efficiency of foreign capital is considered to be the same as domestic with little spillover effect. The other bulk of literature argues that efficiency of FDI flows is higher than the domestic due to the much superior technologies. That is FDI effect is represented not only by short run but also long run effects (Roman, 2012).

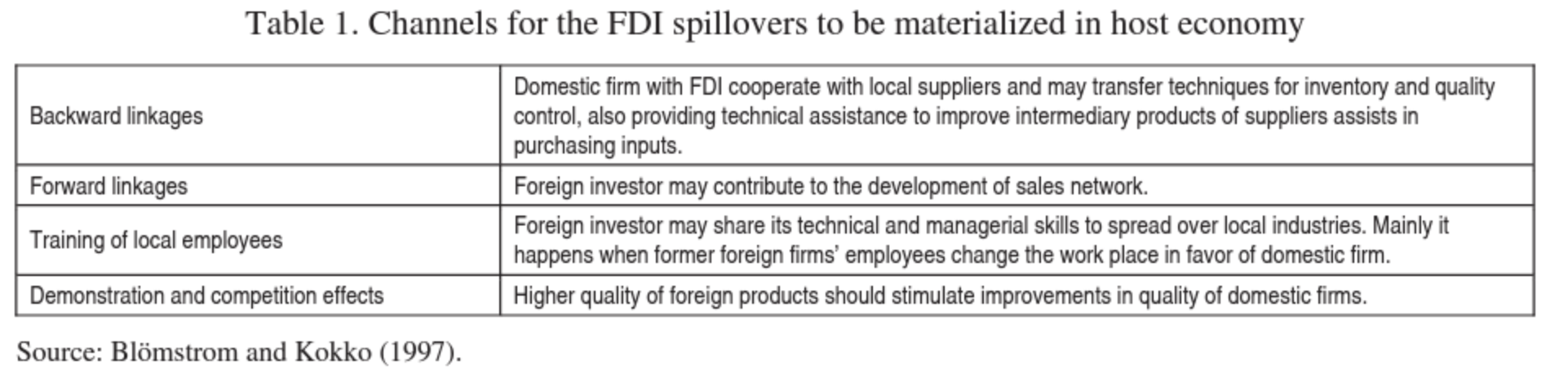

In general, positive influence of FDI is explained by “technological diffusion” originating from firms accepting foreign capital and spreading to related companies in a form of technical support of suppliers (customers) and business environment. Technological diffusion is associated with positive external effect of FDI. Literature reveals several channels for the FDI spillovers (Table 1).

Even though FDI is not the only way of technology enhancement, capital acquisition, management practices or competition improvements, it is still scope of the study, because of following reasons. First of all business in developing countries have limited access to credit market. Two digits interest rates, sometimes higher that 20% per annum are caused by high country risk rankings. Hence, allowing new investors to come into business is the only relatively cheap way. In addition, foreign investors that became shareholder can be guarantees of the loans from credit market, making loan cheaper. In addition, FDI necessarily mean at least one of above on micro level and hence it is simple, but powerful indicator on macro level.

2. Negative consequences for the domestic country from FDI

In some cases investments aimed at other countries might be harmful for domestic economy decreasing rates of economic growth. The FDI recipient country may fear foreign ownership of domestic firms. According to Schoors et al. (2002) at early stages of the development and/or transition to the market economies, FDI may have a negative impact. Additional inflows of FDI in firms may push out of the market other firms without FDI. This fact is referred to as a “market stealing” effect, when domestic firms are not so productive compared to the foreign ones. Thus, when business with less than average market productivity leave the market, then the industry benefits due to increases in productivity. However, when the most productive firms leave the market, in such cases FDI inflows are harmful for the recipient country. This is because the FDI negative influence weakens the competitive position of local producers and results in structural unemployment.

An important issue of FDI is where research and development is held. If FDI comes with R&D it has greater spillover effect, but if the R&D stays in some other countries, FDI can reduce job places for highly qualified researches consequently may cause brain drain.

Among other factors of negative influence are dependence from foreign investors and repatriation of profits. When the foreign capital leaves the market domestic firms will not be able to fulfill that gap in a short run.

Thus, the danger of FDI should be considered by private, state and public organizations at all stages of attracting foreign capital.

3. Empirical analysis of FDI influence on economic growth

According to the analysis performed by (Jyun-Yi, 2008) for 62 countries over the 1975-2000 period, it was found that FDI did not accelerate growth in all sample countries. Author used the LS approach for panel data estimations. Moreover, using the GMM method (controlling for endogeneity and non- spherical errors), it was found that FDI did not have any positive effect on growth. The results of the threshold regression controlled for the amount of GDP, initial human capital, some social and institutional parameters do represent positive influence of FDI on economic growth. It was stated that recipient countries can learn and as a result benefit from foreign investors.

Analyzing Eastern European transition countries (Stanisic, 2008) did not find any positive correlation between FDI inflows and economic growth rate. However, it provided an assumption that this particular region is in the middle of the transitional process and FDI influence is not definite.

According to Roman (2012), the research done for Romania found that FDI and capital endowments are positively correlated with GDP, but what was not expected was the fact that the human capital was negatively correlated with GDP evolution. As the author states the last fact is explained by the reduction of Romanian population in 1995-2004. Another paper by Pelinescu et al. (2009) found that direct FDI influence is still at a low level, but the indirect influence, through the increase in productivity and competitiveness is more valuable for Romania.

In Latvia the research conducted by Titarenko (2006) supports the idea of crowding out effect of domestic investments by FDI. Also the analysis showed that positive influence of FDI is not greater than Latvian investment.

The influence of FDI on economy depends on which sector (manufacturing, agriculture etc.) FDI flows are directed. It was found by Alfaro (2003) for 47 countries during 1981-1999 that FDI inflows into the primary sector tend to have a negative effect on growth. On the contrary the FDI inflows in manufacturing sector do bring positive effect. The same results were in Aitken and Harrison (1999), who found a negative influence of FDI on productivity of domestic firms in manufacturing industry in Venezuela. Evidence from the foreign investments in service sector is ambiguous. Agriculture and mining sectors do have tittle spillover potential for economy and as a result FDI inflows are of tittle efficiency.

Different researches show different results of causeconsequence effects. That is some researchers argue that high GDP levels causes FDI inflows, on the contrary other papers state the FDI itself causes economic growth.

Campos (2002) has analyzed the influence of FDI on transition economies and found that the effect of FDI does not depend on any threshold level of human capital for transition economies do possess already necessary quality of labor force. Independently FDI has no significant effect in MENA countries (Mustapha, 2008). Also the level of FDI was not dependent on the trade openness and initial levels of GDP. What is important is that both FDI and GDP growth depend on macroeconomic stability, specifically on CPI level.

Thus Lyroudi et al. (2004) analyzed a sample of transition economies in 1995-1998: Albania, Azerbaijan, Belarus, Bosnia, Georgia, Kazakhstan, Kyrgyz Republic, Latvia, Lithuania, Moldova, Mongolia, Romania, Russia, Slovenia, Tajikistan, Turkmenistan, and Uzbekistan. The analysis was performed with two variables: independent FDI as a percentage share of GDP and dependent percentage growth. The results suggested that FDI did not have any significant influence on economies in transition. The same conclusions were obtained after splitting the sample into two groups (low and high income). The data before 1998 was not included due to low quality, poor institutions and structural change caused by the 1997-1998 financial crisis. Alfaro (2004) suggests that the more developed local financial markets, the easier it is for credit constrained entrepreneurs to start their own businesses. The increase in number of varieties of intermediate goods leads to positive spillovers to the final goods sector produced by domestic company with FDI inflows. As a result, financial markets allow the backward linkages between foreign and domestic firms to turn into FDI spillovers. Actually we use the same sample of transition countries and some developing one, however the analyzed period covers 1998-2010 years. The analysis of foreign direct investment starts with investigating the aggregate data on foreign direct inflows into transition economies over the transition period. In our sample FDI inflows are shown in Figure 1 (see Appendix).

4. The theoretical model

The endogenous growth theory development has stimulated research of the long-run impact of FDI on growth. The contemporary economic literature derives the estimating equations for regression analysis from a basic augmented production function, with FDI as one of the explanatory variables (1).

where Y is the output (gross domestic product in real terms); A is the exogenous state of technology; К is the physical capital (domestic capital stock); L is the labor input; F is the foreign capital (foreign direct investment); P is a vector of ancillary (including policy) variables.

Actually first neoclassical models of such type (1) were previously described by Romer (1990), extended and introduced to transition economies by Borensztein et al. (1998) and Aleksynska (2003). According to Alfaro (2004), Xu (2000), Bevan et al. (2004), the inclusion of human capital measures, domestic financial development, institutional quality, lagged values of FDI and other growth factors also shows robust results.

Assuming that the augmented production function is linear in logarithms, taking logarithms and time derivatives of an augmented Cobb-Douglas approximation of (1) yields the following as an expression for the growth rate of GDP:

gyit is the logarithmic value of GDP growth rate in country у at period t; Y0it is the logarithmic value of the GDP per capita in year before are taken; Hit is the human capital, depending on the specification of regression we use logarithmic value of population growth rate, logarithmic value of years of schooling, logarithmic value of tertiary education; К is the physical capital (due to the shortage of the information we use its proxy - logarithmic value of infrastructure achievements); FDI - foreign capital (foreign direct investment), we use logarithmic value of FDI growth rate; P is a vector of policy and infrastructure variables (enterprise restructuring, price liberalization, Trade&Forex system, competition policy).

Coefficients e1, a2, a3, a4, a5, denote the output elasticity with respect to physical capital, labor, FDI and other variables frequently included as additional determinants of growth.

Also it should be admitted that model 2 could suffer multicollinearity problem since policy and infrastructure variables are correlated with foreign direct investment. Bevan et al. (2004) found what some formal institutions like private ownership of business, banking sector reform, foreign exchange and trade liberalization, and legal development do to influence FDI. In order to correct for multicollinearity some instruments have to be used. Running regressions without correcting for multicollinearity means that the effect of FDI on economic growth would be underestimated since some positive effect would be captured by policy and infrastructure variables.

The initial level of GDP per capita (Y0it) is included consistently in endogenous growth theory, to capture the possibility of a convergence effect. It is expected that higher initial per capita income will lead to a slower economic growth which means the sign of its coefficient (a1) is theoretically expected to be negative.

5. Data description and results

The data on macroeconomic variables for the economies in transition is obtained from international statistics, primarily from the European Bank of Reconstruction and Development (EBRD). This choice was not arbitrary; as the data coming from a single international source makes it possible to overcome the problems associated with methods and approaches to compelling data bases.

The data on policy indices is obtained from EBRD Transition Report, which includes scores on a 5- point for Transition Indicators measuring progress towards market economy status. Among the main transition indicators are: price liberalization, trade & foreign exchange system, competition policy. The EBRD Transition Report captures indicators annually, the analysis covers the period between 1998 and 2010.

Also some indicators on human capital are taken from NationMaster data portal, which has a compilation of data from such sources as the CIA World Factbook, UN and OECD.

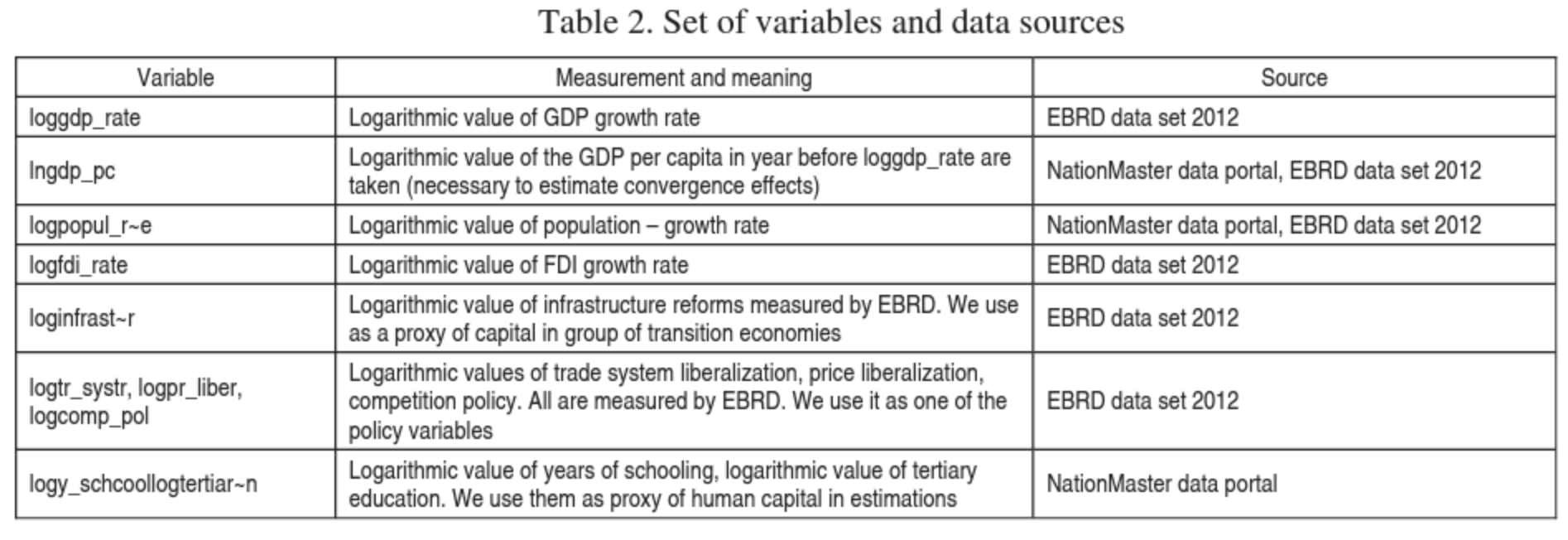

Panel data on 26 economies in the transition over a period of 13 years was also used. Due to the data limitations, the data for some countries contains a period of 12 years. The main variables and data sources are presented in Table 2.

Conventionally, economies in transition are divided into three sub-groups: the countries of Central Europe (Albania, Bulgaria, Croatia, Hungary, Macedonia, Bosnia and Herzegovina, Slovak Republic, Slovenia, Romania, Poland), the countries of the Commonwealth of Independent States or CIS (Armenia, Azerbaijan, Belarus, Moldova, Ukraine, Russia, Georgia, Kazakhstan, Kyrgyz Republic, Tajikistan, Turkmenistan, Uzbekistan), and the Baltic states (Latvia, Lithuania, Estonia).

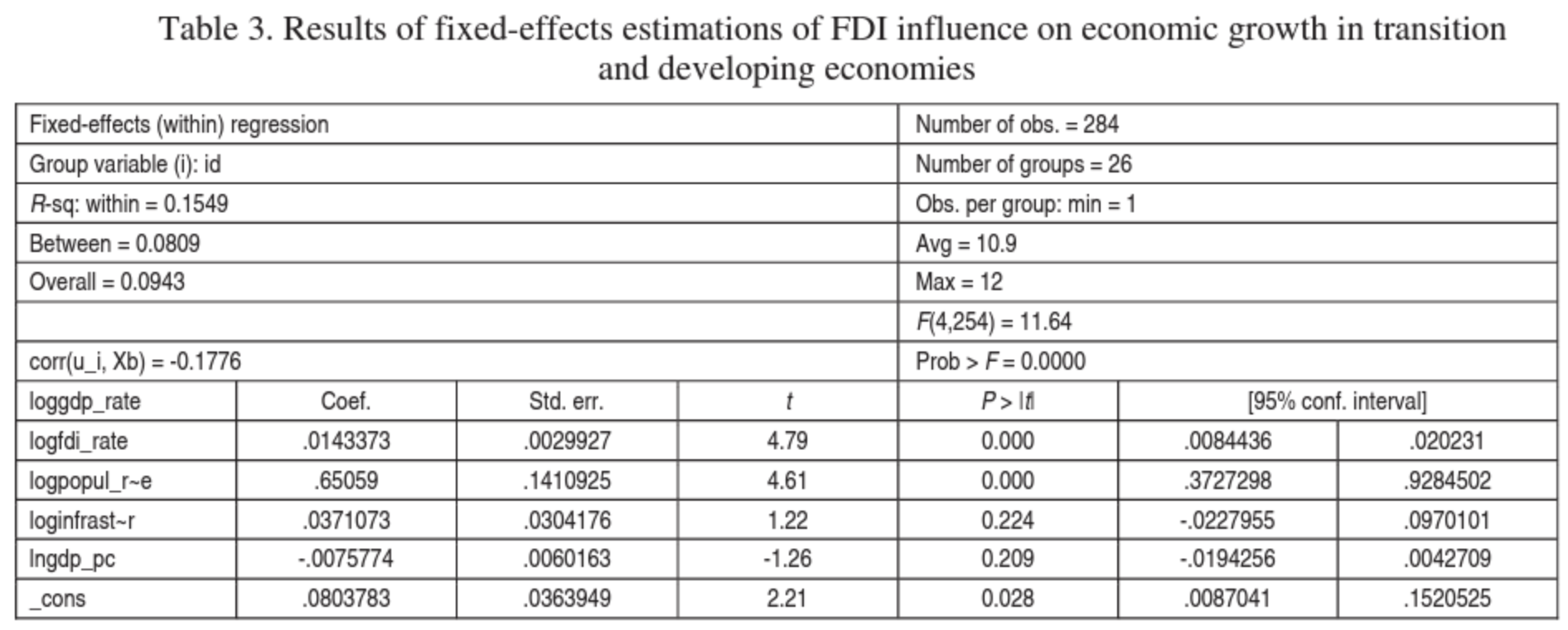

To determine the appropriate method of panel data estimation, the Hausman specification test was used. The Hausman specification test showed that it was appropriate to use the fixed effect rather than random effect. The regression results are presented in Table 3.

As a dependent variable the logarithmic value of GDP growth ratein group of 26 developing and transition countries was used. Unfortunately there are several potential problems associated with this variable. First, GDP growth rate is not a perfect measure of economic growth. It does not capture environmental change (Sotnyk et al., 2012; Sauer et al., 2012), change in human capital and institutions. Second, non-tradable goods and services is a large part of economy in transition countries. These shortcomings are common for research in the field. Third, most of countries in our sample have large share of shadow economy. Hence, growth in official GDP can be partially driven by legalization of informal sector. However, legalization of informal sector is consistent with economic development. Therefore this problem is of limited importance to the research of economic development. Forth, governments of countries of our sample have political incentives and institutional tools to manipulate GDP measurements. If to compare GDP of countries in the sample made by United Nations, World Bank, IMF and CIA they differ. Please refer to Jerven (2009) for discussion about poor numbers in Africa. Similar problems but of smaller magnitude seem to be in our sample. However, fixed effects used in the study mitigate this problem. Overall, potential problems related to GDP measure have limited effect on our results, because of theoretical model and econometric methodology. The study proceeds with a description of the results of the standard regression specification, in which logarithmic value of FDI is a major explanatory variable.

The above table shows that influence of FDI as predicted is positive and significant at 1% level of significance. The results of the “log-log” model should be treated as elasticity - one percentage change in independent variable leads to Д percentage change in the dependent variable. In this case, an increase in FDI growth rate by 1% is related to 0.014% increase in a specific region’s growth rate, which means that FDI positively influence economic growth in transition economies. These results are consistent with Pelinescu et al. (2009).

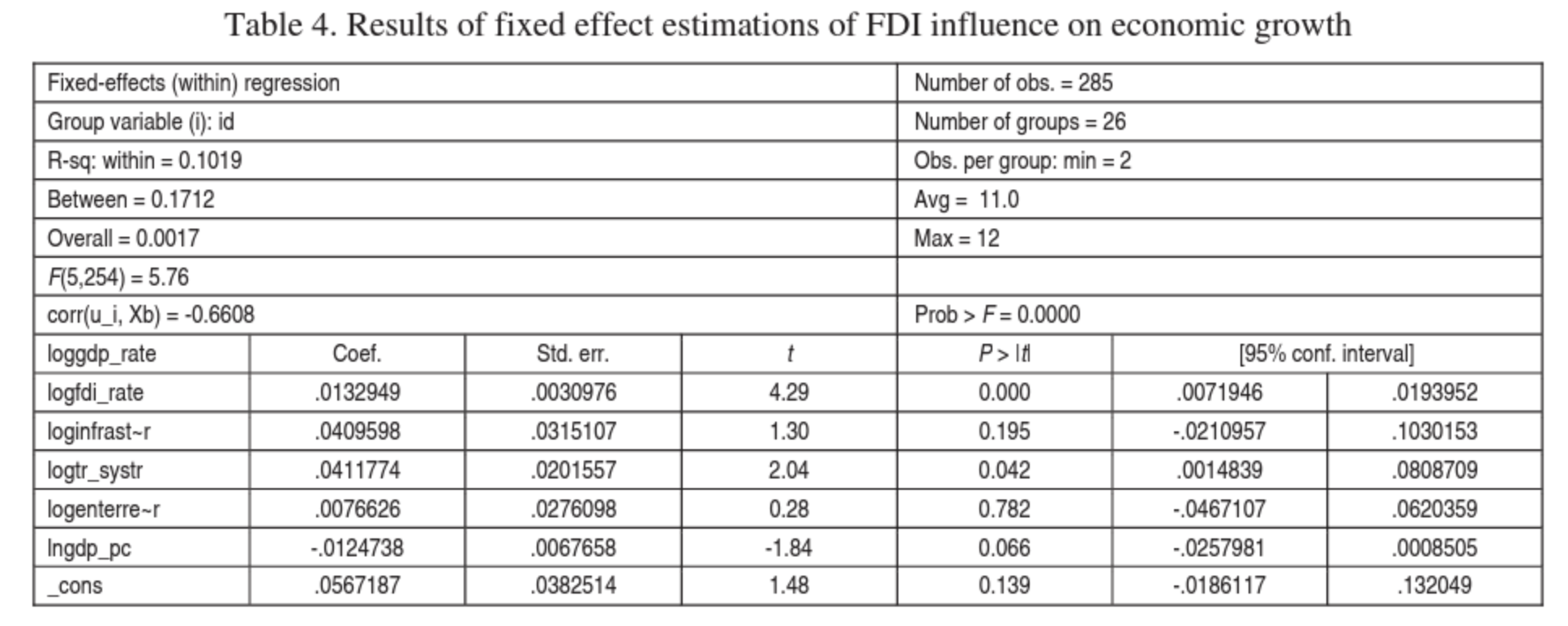

Furthermore, infrastructure reforms, trade system reform are also positively correlated with economic growth. The impact of trade policy is positive and significant at 10% level of significance (Table 4).

The convergence effects were tested in the sample of transition and developing economies and it was found that logarithmic lagged GDP per capita values are negative and significant (Tables 2, 3). The concept of economic convergence according to Matkowski and Prochanik (2004) should be addressed in two aspects. First, a tendency towards leveling per capita incomes and growth rates among counties (regions). Second, a tendency toward economic cycle convergence (that is ups and downs of economic cycles ideally should conform). The negative lag value of GDP per capita (lngdp_pc = -0.0075, Table 2, and lngdp_pc = = -0.0125, Table 3) means the presence of economics convergence in estimated sample of countries. That is initially poor countries (estimated as per capita values in 1998) do catch up with initially rich regions.

The discussions in this paper should be taken with caution because the problem of endogeneity was not addressed due to lack of appropriate instrumental variables. However, it is safe to say that FDI is positively correlated with GDP growth in Comecon countries.

Conclusions

Foreign direct investments in former Comecon transitional and developing economies do influence economic growth positively. An increase in FDI is positively correlated with an increase in a specific region’s growth rate. Well-developed financial and institutional sectors are the important sources of GDP growth and FDI inflows. Host countries do develop their economies faster with higher indicators of infrastructure, bank reforms and institutional police. Therefore, transition and developing economies should pay more attention to the business climate and positive institutional changes. It was found the presence of economic convergence in selected sample of transition and developing countries. That is with passage of time poor regions converge with rich ones.

References

- Aitken, B.J., Harrison, A.E. (1999). Do Domestic Firms Benefit from Foreign Direct Investment? Evidence from Venezuela, The American Economic Review, 605-618.

- Aleksynska Mariya (2003). Foreign direct investment and economic growth in economies in transition, EERC, 77 p.

- Alfaro Laura (2003). Foreign Direct Investment and Growth: Does the Sector Matter? Harvard Business School, 32

- Alfaro, L., Chanda, A., Kalemli-Ozcan, S., Sayek, S. (2004). FDI and economic growth: The role of local financial markets, Journal of International Economics, 64 (I), pp. 89-112.

- Barba Navaretti, G. and A. Venables (2004). Multinational Firms in the World Economy, Princeton: Princeton University Press.

- Bevan, A., Estrin, S., Meyer, K. (2004). Foreign investment location and institutional development in transition economies, International Business Review, 13 (I), pp. 43-64.

- Borensztein E., de Gregorio J. and Lee J. (1998). How Does Foreign Direct Investment Affect Economic Growth? Journal of International Economics, 45, pp. 115-135.

- Blomstrom M., Кокко A. (1998). Multinational Corporations and Spillovers, Journal of Economic Surveys, 12, pp. 247-277.

- Blömstrom, M., Кокко, A. (1997). How Foreign Investment Affect Foreign Countries, The World Bank Policy Research Working Paper,

- Buckley P., Clegg J., Wang C. and Cross A. (2002). FDI, Regional Differences and Economic Growth: Panel Data Evidence from China, Transnational Corporations, 11 (I), pp. 1-28.

- Campos N. (2002). Foreign Direct Investment as Technology Transferred: Some Evidence from the Transition Economies, The Manchester School Paper, 70 (3), pp. 398-412.

- Eller M., Haiss P., Steiner K. (2006). Foreign direct investment in the financial sector and economic growth in Central and Eastern Europe: The crucial role of the efficiency channel, Emerging Markets Review, 7, pp. 300-319.

- Findlay R. (1978). Relative backwardness, direct foreign investment and the transfer of technology: A simple dynamic model, Quarterly Journal of Economics, 92, pp. 1-16.

- Lyroudi K., Papanastasiou J., Vamvakidis A. (2004). Foreign Direct Investment and Economic Growth in Transition Economies, South Eastern Europe Journal of Economics, 1, pp. 97-110.

- Matkowski Z., Prochanik M. (2004). Real Economic convergence in the EU accession countries, International Journal of Applied Econometrics and Quantitative Studies, 1, pp. 5-38.

- Mustapha Sadni Jallab, Monnet Benoit Patrick Gbakou, Rene Sandretto (2008). Foreign Direct Investment, Macroeconomic Instability and Economic Growth in MENA Countries.

- Mahutga, M.C., Bandelj, N. (2008). Foreign investment and income inequality: The natural experiment of Central and Eastern Europe, International Journal of Comparative Sociology, 49 (6), pp. 429-454.

- Morven Jerven (2013). Poor numbers: How we are misled by African statistics and What to do about it? Cornell University Press; 1 edition (February 19, 2013).

- Pelinescu Elena, Dulescu Magdalena (2009). The impact of foreign direct investment on the economic growth and countries’ export potential, Romanian Journal of Economic Forecasting, 4, pp. 153-169.

- Roman Mihai Daniel, Padureanu Andrei (2012). Models of Foreign Direct Investments Influence on Economic Growth. Evidence from Romania, International Journal of Trade, Economics and Finance, 3 (I).

- Sauer, Petr et al. (2012). Assessment of Environmental Policy Implementation: Two Case Studies from the Czech Republic, Polish Journal of Environmental Studies [elektronickyzdroj], 21 (5), pp. 1383-1391.

- Schoors, Koen, van der Tol, Bartoldus (2002). The Productivity Effect of Foreign Ownership on Domestic Firms in Hungary, EEA Venice Conference Paper.

- Silvio Contessi and Ariel Weinberger (2009). Foreign Direct Investment, Productivity, and Country Growth: An Overview, Federal Reserve Bank of St. Louis Review, 91 (2), pp. 61-78.

- Sotnyk, I.M. Tendetsii i problemy upravlinnia dematerializatsieiu vyrobnytstva i spozhivannia [Trends and problems in management of production and consumption dematerialization]. Actual Problems of Economics, 2012, 8, pp. 62-67.

- Stanisic Nenad (2008). Do foreign direct investments increase the economic growth of Southeastern European transition economies? South-Eastern Europe Journal of Economics, 1, pp. 29-38.

- Titarenko D. (2006). The influence of foreign direct investment on domestic investment processes in Latvia, Transport and Telecommunication, 7 (I), pp. 76-83.

- Jyun-Yi, Wu and Hsu Chih-Chiang (2008). Does Foreign Direct Investment Promote Economic Growth? Evidence from a Threshold Regression Analysis, Economics Bulletin, 15 (12), pp. 1-10.

- Xu, B. (2000). Multinational Enterprises, Technology Diffusion, and Host Country Productivity Growth, Journal of Development Economics, 62, pp. 477-493.

- Yu, Ning, Tu, Yonghong and Tan, Xiao (2011). Technology Spillovers from FDI: The Case of ASEAN (December 8, 2011). Available at SSRN: http://ssm.com/abstraet-19700I5 or http://dx.doi.org/10.2139/ssm.1970015.