The role of age and business size on small business performance in the South African small enterprise sector

Published: Oct. 21, 2014

Latest article update: Dec. 8, 2022

Abstract

This study examines the effect that age and business size have on business performance. A structured research instrument was used to collect data from 500 SMEs in retail industry through interviewer administrated and selfadministrated survey and 93% of questionnaires were returned. The results show that there is no statistical significant difference between the means of business size and business performance. There is no significant difference between the age categories; under one year and 20 years and more and business performance. Age is no longer a significant factor in a company’s performance after twenty years. Life cycle approach of the company or industry could be an appropriate basis for analysis. Effective use of employees will increase business performance. It is important that employees are well trained to use the necessary technology and understand the importance of technology in the business

Keywords

Business performance, business age, business size

Introduction

There is much debate about the continued emphasis on demographies in management research. Although some scholars have questioned the utility of demographies on business performance, others have argued that demographies are useful predictors of business outcome. Within the entrepreneurship domain, failure to identify a set of demographic characteristics for profiling an entrepreneur has led some scholars to shift their attention to entrepreneurial behaviors (Poon, Ainuddin and Junit, 2006).

Throughout the world, entrepreneurship is seen as the driving force in economic development. Some authors argued that entrepreneurship is the fundamental value driven activity. Morris, Schinde- hutte and Lesser (2002) argued that personal values seemed to have important implications not only for the decision to pursue entrepreneurship but the way in which the entrepreneur approaches a venture. It is very important to explore how much influence a common set of values has on entrepreneurial development. Scholars in entrepreneurship have been searching for constructs of individual characteristics that are unique to entrepreneurs. The current researchers will therefore investigate if values like age and business size have impact on business performance for an entrepreneur to operate a business.

A lot of attention has been devoted to the role of values in successful entrepreneurial endeavors. Morris et al. (2002) argued that values reflect the entrepreneur’s conscious view of himself or herself. Some studies in Africa conclude that psychological variables and race and ethnicity are important predictors of entrepreneurial activity. McClelland (1961) and Urban (2004) discovered that self-belief that one has about himself or herself directly shapes movement toward action.

Other studies by Mitchell, Smith, Mörsern, Seawrignht, Perdo and McKenzie (2002) focused on entrepreneurial motives, values, beliefs and cognitions to examine relationship between national culture and entrepreneurial characteristics and traits. A better understanding of the motivations for business ownership can help policymakers design policies that encourage and promote the creation of businesses.

Being an entrepreneur, offers a personal challenge that many individuals prefer over being an employee. The entrepreneurs accept the personal financial risks of owning a business but also benefit from potential success of the business. The high failure rate of small businesses makes it necessary to further examine if demographic factors such as age and business size influence start-ups to succeed in business. The role of age and business size will be investigated to find out if these factors have any impact on business performance.

The study aims to find, what effects do age of business and business size impact on business performance in the South African small business sector.

The study is structured in the following manner. In the introduction the research problem is presented. Section 1 presents the literature review which elaborates the constructs used in this study and proposes hypotheses for each construct to measure the impact of each demographic variable to the business performance. Then, section 2 presents the research methodology of the study. Section 3 presents the analysis and findings of the study regarding the hypotheses proposed for each construct. The final section concludes the paper with a discussion and recommendations.

1. Literature review

The literature will look at how the business age and business size impact on business performance of SMEs.

1.1. Business performance and demographic variables (business age, business size). The importance of business age and business size and their influence on firm performance have been highlighted in both theoretical discussion and empirical research. At empirical level, past studies have shown positive relationships between business size and firm performance (Wiklund and Shepherd, 2005). Small businesses tend to perform very well but up to a certain size where they become sluggish. These businesses if they are entrepreneurial tend to perform well and if not, they are more likely to fail than older businesses who are more experienced and better resourced endowed (Urban, 2004). A longitudinal study found that entrepreneurial orientation has positive long-term effects on the growth and financial performance of small firms.

Entrepreneurship scholars have attempted to explain performance by investigating the relationship between entrepreneurial orientation and firm performance (Lumpkin and Dess, 2001). Businesses with entrepreneurial orientation have the capability to discover and exploit new market opportunities (Wiklund and Shepherd, 2003). Other research has employed a variety of financial measures like cash flow, return on assets and return on equity to assess firm performance. Some studies suggest a combination of financial and non-financial measures to offer more comprehensive evaluation on firm performance (Li, Huang and Tsai, 2009). Subjective non-financial measures include indicators such as perceived market share, perceived sales growth, customer satisfaction, loyalty and brand equity (Li et al., 2009). Murphy, Trailer and Hill (1996) examined 51 published entrepreneurial studies using performance as the dependent variable and found that the most commonly considered dimensions of performance were related to efficiency, growth and profit. Efficiency comprises some financial measures like return on investment and return on equity; growth focuses on increase in sales, employees or market share; and profit includes return on sales and net profit margin.

Studies by Cliff (1998), comparing the performance of male and female owned firms have consistently shown that businesses by women tend to be smaller than those headed by men, whether size is measured by gross revenues, number of employees or profit level. Older firms tend to build good network business partners and customers, and have good relationship with financial institutions. Older firms have already built a good reputation in the market. Firm age represents the experience of firms in the industry which is the influential factor for firm success (Takalashi, 2009; GEM, 2010).

Alasadi and Abdelrahim (2007) pointed in then- study where business performance was measured in terms of size (number of employees) and sales growth, indicated that when size of firm is used as performance measure, accounting, technology and purchasing were proved significant influential factors. Their study concluded that older firms have poor performance when compared with younger firms. But, Takahashi (2009) pointed that bigger businesses can enjoy economies of scale as they are able to exploit available resources better than smaller business. Achieving economies of scale means bigger businesses can produce a larger quantity of outputs with low costs because they have the capacity to access critical resources like business finance. This leads to competitive advantage and better performance (Takahashi, 2009).

The size of the organization is related to both the resources it has access to as well as the costs associated with the operations of a firm of a particular size. Firm size can be measured by number of employees.

Most scholars argue that small firms should enjoy the greatest performance in environments characterized by local institutions that do not unduly favor large firms at their expense.

Small firms lack the tangible or intangible resources necessary to effectively construct or gain access to these informal networks; they rely primarily on the publicly available markets that result in higher than average transaction costs (LiPuma, Newbert and Doh, 2011). Empirical evidence suggests that small firms in emerging economies have historically suffered due to lack of managerial and technical skills that constrains their performance and that small firms that receive both monetary and managerial resources are more likely to survive, grow and to compete.

Research has shown that market entry is often exceedingly difficult for new firms in emerging economies due to institutional deficiencies in the form of restricted access to capital markets and burdensome regulatory constraints (LiPuma, Scott and Newbert, 2011). The primary characteristic that distinguishes new firm from small firms is their lack of legitimacy. Primary factor that motivates external factors such as institutions, to provide access to the resources that control is their belief that firm is legitimate. In other words, in order for a firm to convince resource gatekeepers to engage in resource exchange with it, a firm must create an impression of viability and legitimacy. Unfortunately for new firms, due to their lack of a proven “track record”, they are generally perceived as less credible, less trustworthy and less predictable than established firms. Therefore the risk associated with the investment of human, financial and social capital in new firms is unknown. Because institutions dedicated to providing financial resources, for example, tend to view legitimacy as a prerequisite for exchange, new firms often find it exceedingly difficult to gain access to the resources controlled by public or private institutions that they so desperately require to survive and grow. Where the institutions are weak, new firms are more likely to be exploited via the expectation of bribes and onerous intervention (LiPuma, Scott and Newbert, 2011).

Takahashi (2009) further examined the relationship between human resources and performance. He points out that performance is the objective of the business and thus it is treated as the dependent variable. The independent variables are human resources variables at the beginning of the business (including education, business development services and training on starting a business), human resources development after starting the business (that is, training for entrepreneurs) and the previous experience of entrepreneurs. Human resources involve the productive services people provide to the business in the form of their skills, knowledge, expertise and decision-making capability for business. Then, the study therefore suggests that: H01 and H02: There is no statistical significant difference between business performance and mean values of business size (H01) and business age (H02).

2. Methodology

An ex post facto and cross sectional design was used in this study. The study assumes causality and statistical inferences about how the whole population will be made based on a representative sample.

The population of the study is SMEs (small and medium enterprises) in the retail sector of the Gauteng province of South Africa. The researcher uses the brabys.com populations of SMEs in Gauteng. This organization is a reliable and leading registry of SMEs in the country. The population size ofbrabys.com is 10000 SMEs in the retail industry. The study population was therefore based on 10000 SMEs.

According to Cooper and Schindler (2008, p. 409), the sample size that is acceptable is 5% of the total population. Given this study’s estimate of a population of 10000, it means that the targeted sample was 500 respondents (that is, 10000 entrepreneurs * 0.05 = 500 respondents).

Probability sampling was used to ensure that each member of SME population is given a known nonzero chance of selection. Simple random sampling was utilized to identify the respondents. This increased accuracy and precision of the sample in representing the characteristics of the population of SMEs in retail industry in that province.

A structured research instrument (a questionnaire) was used to collect data through self-administration interview.

2.1. Control variables. Businesses of different size and age may exhibit different organizational and environmental characteristics, which in turn may influence performance. The same is true for firms in different industries. These variables were therefore included as controls. Respondents were asked to indicate the number of years the business being in operation. The respondents were also asked how many individuals worked in the firm at the present time to control for firm size.

The questionnaire was designed to encompass the two sections: business size and business age.

The investigative questions concerned the following variables.

2.2. Business size. A single question concerning the business size was asked. A question was formulated to establish whether there was a significant difference between the business size and the variable business performance.

The questions were aimed to find the extent to which the size of business affects the business performance. Business size was measured through the following categories: 1-5 employees; 6-50 employees; 51-100 employees; 101-200 employees and 200 and more employees. The assumption was that there is a significant difference between size of business and performance of a business. The researcher therefore wanted to find out if there is any impact and to what extent. The Mann-Whitney test was performed to test the hypothesis.

2.3. Business age. A single question concerning the business age was asked. A question was formulated to establish whether there was a significant difference between the business age and the variable business performance. The questions were aimed at finding the extent to which number of years the business in operation can affect the performance of business. Business age was measured through the following categories: less than 1 year; 1-4 years; 5-10 years; 11-20 years and 20 years and more. The assumption was that there is a significant difference between business age and performance of a business. The researcher therefore wanted to find out if there is any impact and to what extent.

2.4. Business performance. Murphy, Trailer and Hill (1996) examined 51 published entrepreneurial studies using performance as the dependent variable and found that the most commonly considered dimensions of performance were related to efficiency, growth and profit. Efficiency comprises some financial measures like return on investment and return on equity; growth focuses on increase in sales, employees or market share; and profit includes return on sales and net profit margin.

The respondents were required to state how their businesses performed in the past five years. The questions were aimed at finding out the extent to which businesses had performed in the following areas: income, profit, market share, return on investment, number of employees and product line. The business performance construct was measured through 6 questions covering each of the above areas and a five-point Likert scale (decreased significantly, decreased a bit, no change, increased a bit and increased significantly) was used for each of the six questions that were asked.

The assumption was that demographic variables age and business size would have an impact on performance of business as intimated in literature. The researcher therefore wanted to see if this was true and to find out which variable affected business performance and to what extent.

3. Results and discussion

The analysis of variance (ANOVA) is the statistical method for testing the null hypothesis so that the means of several populations are equal. Since there will be two independent variables to be tested, the ANOVA was used. The ANOVA is used to test the main and the interaction effects of categorical variables on a continuous dependent variable, controlling for the effects of selected continuous variables which covary with the dependent (Tustin, Ligthelm, Martins and Van Wyk, 2005).

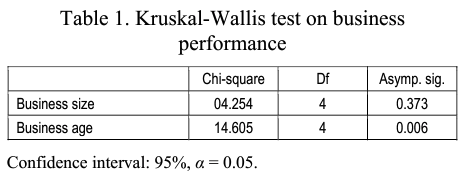

The non-parametric Wilcoxon test (Kruskall-Wallis) was used on the following variables: business size and business age. The results are shown in Table 1.

3.1. Business performance and business size. Null hypothesis H01: There is no statistical significance difference between the mean values of business size and the variables business performance.

The results show that there is no statistical significant difference between the means of business size and business performance (H01) p-value of 0.373, > a = 0.05 at 95% confidence level.

Applying the p-value rule that one should accept the proposition if the p-value is bigger than the alpha, hypothesis, business performance and business size (H01) is accepted. Hypothesis (H01) is accepted since there is no significant difference between the means of the two variables.

The results show that a significant difference does not exist between the business size and the variable, business performance. This implies that the variable business size measured by “number of employees” does not impact the performance of a business. What this means is that whether the business started is small, micro, medium or big the identified entrepreneurial variables will apply equally to these businesses.

3.2. Business performance and business age. The question was formulated to establish whether there was a significant difference between the age of the business and the variable, business performance.

The null hypothesis H02: stated that there is no statistical significance difference between the means of business age (period business is in operation) and the variable business performance. The Kruskal- Wallis test was performed to test this hypothesis.

The results show that there is a statistical significant difference between the mean of business age and business performance (H02) with p-value 0.006, < a = 0.05. Applying the p-value rule that one should accept the proposition if the p-value is bigger than the alpha, hypothesis (H02) is rejected.

A significant statistical difference does exist between business age and business performance. According to the life-cycle approach, firm performance improves with age of business, e.g. due to learning experience. It further states that the performance increases up to a certain age of the firm after which it declines. Decline in the life-cycle occurs if the business does not constantly develop new and innovative ideas to prevent the entrepreneur from becoming complacent as the business becomes successful (Smith, Cronje, Brevis and Vrba, 2007). Takahashi (2009) argued that business age has no impact on performance.

A further analysis will be carried out to find out the ages that have an effect on performance.

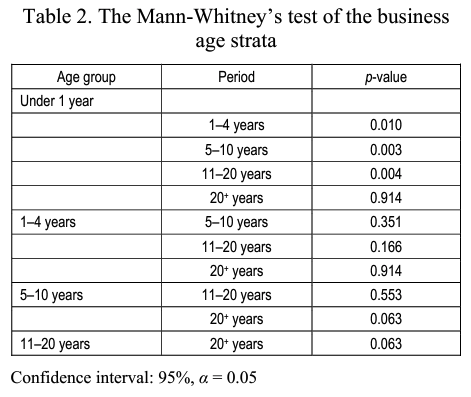

3.3. Further tests. Further tests were performed to find the reasons for rejection of the hypothesis.

3.3.1. Age of business and business performance. Null hypothesis N02: there is a statistical significant difference between business performance and the age of the business under one year (H02:-a); one to four years (H02:-b); five to 10 years (H02:-c); 11 to 20 years (H02:-d); and 20+ years (H02:-e).

The results show that there is a significant difference between the age category under one and one to four years (p-value of 0.010, < 0.05), five to 10 years (p-value of 0.003, < 0.05) and 11 to 20 years (p-value of 0.004, < 0.05), except for 20+ years which is not significant. Applying the p-value rule that one should accept the proposition if the p- value is bigger than the alpha, the hypotheses N02: -a; H02:-b; H02:-c; H02:-d are accepted. What the results mean is that during these periods, the age of existence has a significant effect on a company’s performance.

There is no significant difference between the age category under one year and 20 years+ (p-value of 0.914, > 0.05). The hypothesis (H02:-e) is rejected. This means that after 20 years of existence, age is no longer a significant factor in a company’s performance. The life cycle approach of the company or industry could be an appropriate basis for analysis. The 20 years of business operation might be the maturity stage of the business. This stage is mostly characterized by a strong organizational learning effect and lack of competitiveness. At this stage, competition becomes stronger and problems begin to surface. Only a few businesses with good managerial skills survive during this period. Only businesses which develop new and innovative ideas can be sustained in the business environment.

The findings are that a statistically significant variation does exist between the different business age strata as shown in table 2 above. Therefore, the original hypothesis (H02:-e) was appropriately rejected because the above results proved that a significant difference does exist.

Conclusion and recommendation

The study sought to determine if the demographic variables: business size and age of business influence the dependent variable business performance. Hypotheses were designed to find out how the demographic variables: business size and business age affect business performance.

The results show that a significant difference does not exist between the business size and the variable, business performance. This implies that the variable business size measured by “number of employees” does not impact the performance of a business.

It is also found that there is no significant difference between the age categories; under one year and 20 years and more and business performance. This means that after 20 years of existence, age is no longer a significant factor in a company’s performance. The life cycle approach of the company or industry could be an appropriate basis for analysis. The 20 years of business operation might be the maturity stage of the business.

The following is recommended to improve business performance: business owners should ensure that their employees are involved in the decision-making process and have the capacity and confidence to implement and deliver on strategy as supported by Takahashi (2009). Effective use of employees will increase business performance. It is important that employees are well trained to use the necessary technology and understand the importance of technology in the business. Alasadi and Abdelrahim (2007) pointed that training and development practices can promote entrepreneurial behavior to the extent that they are applicable to a broad range of job situations and encourage high employee participation. Better education brings about better performance (GEM, 2012)

References

- Alasadi, R. and Abedelrahim, A. (2007). Critical analysis and modeling of small business performance (case study: Syria), Journal of Asia Entrepreneurship and sustainability, 3 (2), pp. 320-355.

- Cliff, J. (1998). Does one size fit all? Exploring the relationship between attitudes towards growth, gender and business size, Journal of Business Venturing, 13, pp. 523-542.

- Cooper, D R. and Schindler, P.S. (2008). Business research methods, 10th edition, Boston: McGraw-Hill Irwin.

- Global Entrepreneurship Monitor (2010). 2010 Report on Higher Expectation Entrepreneurship, from: gemconsortium.org (accessed on 1 June 2011).

- Global Entrepreneurship Monitor (2012). 2012 Report on Higher Expectation Entrepreneurship, from: gemconsortium.org (accessed on 4 June 2013).

- LiPuma, J.A., Newbert, S.L. and Doh, J.P. (2011). The effect of institutional quality on firm export performance in emerging economies: a contingency model of firm age and size, Small Business Economics, 40, pp. 817-841.

- Li, Y.H., Huang, J.W. and Tsai, M.T. (2009). Entrepreneurial orientation and company performance: The role of knowledge creation process, Industrial Marketing Management, 38 (209), pp. 440-449.

- Lumpkin, G.T. and Dess, G.G. (2001). Linking two dimensions of entrepreneurial orientation to business performance: The moderating role of environment and industry life cycl e, Journal of Business Venturing, 16, pp. 429-451.

- Urban, B. (2004). Understanding the moderating effect of culture and self-efficacy on entrepreneurial intentions, Doctoral thesis submitted at the University of Pretoria in April 2004.

- McClelland, D C. (1961). The achieving society, Princeton, NJ: Van Norstrand.

- Mitchell, R., Smith, J.B., Mörsern, E.A., Seawrignht, K., Perdo, A.M and McKenzie, B. (2002). Are entrepreneurial cognitions universal? Assessing entrepreneurial cognitions across cultures, Entrepreneurship Theory and Practice, 26 (4), pp. 9-32.

- Morris, M., Schindehutte, M. and Lesser, J. (2002). Ethnic entrepreneur ship. Do values matters? New England Journal of Entrepreneur ship, 5 (2), pp. 35-46.

- Murphy, G.B., Trailer, J.W. and Hill, R. (1996). Measuring performance in entrepreneurship research, Journal of Business Research, 36 (1), pp. 15-23.

- Poon, J.M.L., Ainuddin, R.A. and Junit, S.H. (2006). Effects of self-concept traits and entrepreneurial orientation on firm performance, International Small Business Journal, 24 (1), pp. 61-82.

- Rauch, A., Wiklund, J., Lumpkin, G.T. and Frese, M. (2009). Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future, Entrepreneurship Theory and Practice, 33 (3), pp. 761-787.

- Smith, P.J., Cronje, G.J. de J., Brevis, T. and Vrba, M.J. (2007). Management principles: A contemporary edition for Africa, 4th edition, Lansdowne: Juta.

- Takahashi, S.I.Y. (2009). Entrepreneurs as decisive human resources and business. Performance for the Lao SMEs, Chinese Business Review, 8 (7), pp. 29-47.

- Tustin, D.H., Ligthelm, A.A., Martins, J.H. and Van Wyk, H. de J. (2005). Marketing research in practice, Pretoria: Unisa Press.

- Wiklund, J. and Shepherd, D. (2003). Knowledge-based resources, entrepreneurial orientation and performance of small and medium businesses, Strategic Management Journal, 24, pp. 1307-1314.

- Wiklund, J. and Shepherd, D. (2005). Entrepreneurial orientation and small business performance: A configurational approach, Journal of Business Venturing, 20, pp. 71-91.