The vital role of business processes for a business model: the case of a startup company

Published: Oct. 19, 2014

Latest article update: Dec. 8, 2022

Abstract

The present study highlights the importance of alignment between a business model (BM) and business processes. The authors employ a case study method and analyze a young company focused on R&D in high technology. In order to explicate the observations, the researchers invoke the newly developed ‘VIP framework’ (Solaimani and Bouwman, 2012). The research reveals that the business processes (BP) carried out in the company must fit the stated business model. The case study demonstrates how some of the processes are not optimal and efficient, and that the two main requirements for achieving a higher level coherence and consistency between BM and BP are an enhancement in human resource management and information systems. This research fills a research gap in understanding the connection between BM and BP and contributes to the illumination of their significance. Besides, a newly developed BM/BP alignment framework is empirically applied for the first time

Keywords

Alignment, VIP framework, business processes, business model

Introduction

Only about half of all startup businesses survive beyond 5 years. These failure rates are stable over time (Lader and Leatherman, 2011; Headd, 2003). In particular, ГГ-producing companies have high mortality rates. Only about 40% of these firms survive beyond 5 years (Lader and Leatherman, 2011; Knaup, 2005). Previous studies have revealed that business survival depends on a diversity of factors such as industry, location, regional and national economic conditions, and various environmental factors (Lader and Leatherman, 2011; Luo and Mann, 2011). In addition, the ability to create suitable processes and control systems has a substantial impact on the performance of new ventures (LeBrasseur and Zinger, 2005). In order to succeed, it might not be enough for a startup to state what the current strategy and business model are. Instead, it appears to be beneficial to create alignment between the strategic ‘what to do’ with an operational ‘how to do it’ (Solaimani and Bouwman, 2012).

However, the alignment between the business model and the business processes has received very little attention; many researchers and consultants do not even elaborate on the role of business processes for a business model (Solaimani and Bouwman, 2012). The definitions of business model differ across studies. They vary from e-businesses with an ГГ perspective, to strategic issues such as value creation and competitive advantage, and innovation and technology management (Shafer et al., 2005; Zott et al., 2011). For the purpose of this article, we refer to the business model concept of Zott and Amit, i.e., “the content, structure and governance of transactions designed so as to create value through the exploitation of business opportunities” (Amit and Zott, 2001, p. 511) and “a system of interdependent activities that transcends the focal firm and spans its boundaries” (Zott and Amit, 2010, p. 216). The extant literature agrees that a business model is foremost the responsibility of senior management, next to, and as a pendant to strategy. Yet, its implementation should be carried out at operational levels. Thereby, business processes materialize the business model. Unfortunately, this area of business models has been largely disregarded. Some business process definitions limit themselves to describing inputs and outputs of a company. We will use a definition that also highlights the order of activities within a company. We follow Davenport (1993, p. 5) who describes business processes as“[...] a specific ordering of work activities across time and place, with a beginning, an end, and clearly identified inputs and outputs: a structure for action”.

Our study aims at better understanding the relationship between business models and business processes. We pose the research question: “How can a company ensure its development through the alignment of its top-level business model and its operational business processes?”

In order to address this question, we intend to find out which interactive factors link the business models with their underlying business processes. Furthermore, we use a case study methodology since the extent of control we have over actual behavioral events in a company is limited (Yin, 2009). We chose a startup company from the process-intensive high-tech industry. Just like all newly established businesses, the company ‘ABC’ has to manage various tensions and find the right fit between creation of its planned business model and implemented processes. Evaluating alignment, we discover that an intended business model needs to be effectively linked to the realized processes. In our case, these include e.g., customer identification and acquisition, or internal communication. Consequently, we identified two main requirements for alignment: suitable human resource management and contemporary information systems. The improvements in these two areas are a prerequisite for designing and executing such business processes. These help achieve consistency of the intended business model with the realized business processes.

The remainder of this article is organized as follows: section 1 elaborates on the theoretical foundations of the business model and business process alignment. Section 2 explains our case study methodology. The case company and the findings are presented in section 3. The final section discusses the contributions and limitations of this study, as well as research recommendations.

1. Theoretical background of alignment

In this section, we elaborate on the dimensions that align business models with business processes. Solaimani and Bouwman (2012) investigate contemporary alignment approaches (Bergholtz et al., 2003; Geerts and McCarthy, 1999; Gordijn et al., 2000a, b; McCarthy, 1982; Osterwalder, 2004). The authors find that these approaches are incomepre- hensive and depend on specific tools instead of general frameworks. Thus, Solaimani and Bouwman (2012) develop a VIP framework (value, information, and processes) to overcome the limitations. This framework is the primary foundation for our further investigation.

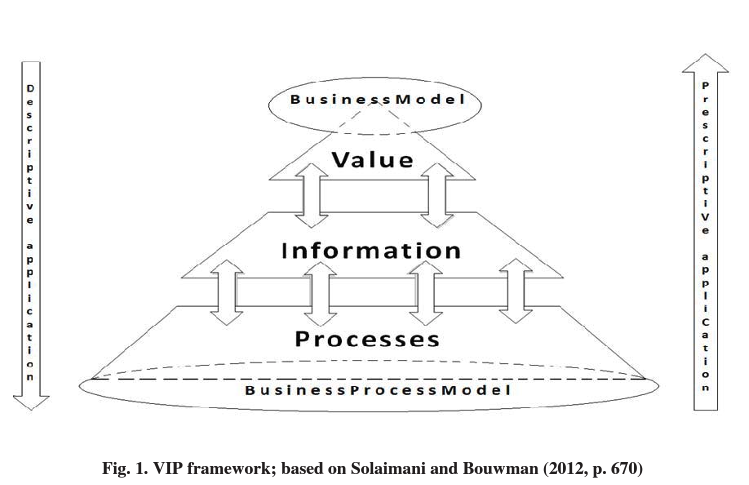

The VIP framework consists of three domains: value exchange, information exchange, and primary business processes, which “are derived from and build upon each other” (Solaimani and Bouwman, 2012, p. 669). Solaimani and Bouwman (2012) use the term actor to include all managers, actors and stakeholders that have an impact on the link between the business model and the business processes. All interactions between actors are divided into this set of three generic domains, with each domain having sub-elements. Sub-elements are the essentials which constitute a domain. These subelements are integrated in a generic way, rather than focusing on one specific field of business. A description of each domain and its constitutive elements is presented briefly below. Figure 1 depicts how the domains link the business models to business processes.

1.1. Value domain. In this framework, value means that actors have diverse objectives. Actors interact with each other to increase tangible or intangible benefits. Therefore, “[...] the focus here is on the exchange of values between actors.” (Solaimani and Bouwman, 2012, p. 664). The value domain is represented by the elements actors, value objects, value activities, value goals and value dependencies. It answers the question what is offered by whom to whom? And what is expected in return? (Solaimani and Bouwman, 2012, p. 665).

1.2. Information domain. The essential aspect in the information exchange domain is the information flow between actors. Moreover, the viability of the business model is strongly dependent on access to information, e.g., information about customers, products, or markets. If the access is obtainable and the flow is smooth, the company is able to capture and exploit the key information. The information domain can be detailed into data, information and knowledge. Data and information are seen as tangible resources. Knowledge is considered an intangible resource. Information flow, information

authorization, and trust dependency have to be considered as further sub-elements.

1.3. Processes domain. The process domain describes “how the activities are carried out and how they are related to each other” (Solaimani and Bouwman, 2012, p. 668). Since companies involve a wide range of different processes representing various internal and external activities, some level of abstraction and classification is introduced. The process domain is characterized by the elements: primary processes, process behavior, process unit boundaries, and process dependencies. Primary processes are those processes which involve first tier actors. These processes are crucial for the creation and delivery of services and products. Processes also have a specific behavior like a sequence flow and conditions. Moreover, processes have a scope, i.e., boundaries. Finally, there are also process dependencies, e.g., if one process must be finished before another one can be finalized.

1.4. Prescriptive and descriptive applications. As shown in Fig. 1, the model can be used in a descriptive or a prescriptive way. The prescriptive business model is the one that the top management intends to implement, based on planning, and it helps evaluate the level of alignment of processes (Lueg and Nprreklit, 2012). For instance, it identifies whether some processes are not in line with the overall business model. The descriptive business model is the one that is actually realized (i.e., ‘emergent’); it starts with an analysis of the high-level business model and then sets the strategic or operational requirements in order to design business processes.

Since this is a new model in its conceptual stage, the authors invite other researchers to test their framework empirically. We use both applications in our study to identify possible misalignment. Thereby, our research tests the applicability of the model (theoretical contribution) and elaborates on its practical relevance (practical contribution).

2.Research design

Due to the nature of the research problem and the question asked, we chose an explanatory single case study (Yin, 2009). As a subject of our study, we have selected a small, relatively young startup that we name ‘ABC’. The case study reties on multiple sources of evidence, namely direct observations, documents, physical artifacts and archival records. The main sources are two semi-structured interviews conducted at the end of April 2013 with the CEO and one of the interns in the company.

The focus of our study enables us to investigate the alignment of business processes and the business model in a real-life context (Bums and Scapens, 2000; Scapens, 1990). We argue that our case study is timely and can be transferred to similar situations experience.

In order to reach a transferable conclusion, we apply a deductive logical reasoning by using the theories of Amit and Zott (2001) and Zott and Amit (2010) for the business models and Solaimani and Bouwman (2012) in order to interpret the findings.

3. Findings

3.1. Presentation of the company. ABC is a European startup company founded in 2007. Including the CEO, 7 actors work in the company office. Additionally, there are freelancing actors working from home on projects closely related to the company. The company is wholly owned by the CEO and is strictly centralized. He makes the decisions, contacts potential clients, and takes care of human resources. The mission of ABC is to make actors more creative with the help of a 3-dimensional printing technology they intend to offer at a relatively low price compared to their current competitors. In order to do that, ABC develops a 3-D prototype that will be patented by the end of 2013. Moreover, it develops its own service for easy control of the final product: 3-D printer. In this sense, ABC is an R&D- intense company. Currently, the company faces two problems. First, it cannot find a manufacturing company that is willing to enter into serial production of the prototype and then sell it to end-users. Second, because of the lack of cash inflow, ABC’s expenses are very limited. When we gathered the data for that study, ABC operated from the CEO’s house to cut expenses.

3.2. Alignment between the business model and the business processes. 2.1. Prescriptive application. We present our findings using the VIP framework, starting with the prescriptive (bottom-up) application. As we will highlight again in the discussion, the domains do not have strict boundaries but are interdependent. Thus, some evidence can reflect multiple domains.

3.3. The value domain concerns the exchange of values among actors. Currently, ABC aims for a business model where it exchanges values with suppliers, manufacturers, distributors and endusers. It starts by ABC exchanging the product prototype, service, knowledge, and legal rights for money with a big manufacturer. The manufacturer then produces the printer and exchanges this for money at a distributor. The distributor sells the product to the end-users. The end-users could be households or small and medium companies. The CEO told us that he was contemplating over an alternative business model in case this first one would

not lead to a break-even in the near future. In this alternative business model, ABC would be the link between the manufacturer and the suppliers. In this set up, ABC receives patented materials (plastic) from a supplier and sells this to the manufacturers; the suppliers get a commission on the sale. However, this alternative business model depends on ABC finding such a patented-plastic supplier. Until then, ABC will attempt to realize its original business model.

The value domain links directly to the intended business model. However, ABC’s interns are involved in a lot of the strategically relevant processes, e.g., risk analysis, or developing the surveys for determining target customers. Those outcomes have very direct implications for the business model (Borisov and Lueg, 2012; Lueg and Borisov, 2014). Yet, the CEO is unaware of the validity and reliability of what the interns have done, or at which stage they are currently working at any given time. As the CEO stated when we asked him about risk analysis: “[...] basically we are creating this product. And then, we are trying to understand the risks...to be honest I haven’t double checked this one. ”

Likewise, interns were uncertain about the status of implementing the business models. As one of them stated in a meeting: “[...] at the moment, I don’t know if you [refers to the CEO] said that we are at step 3, and we are currently looking for people to talk to.”

3.4. Since ABC is a relatively young company, it does not have its own information database which would allow it to store the data objects. During the observations and the interview, we have identified that the actors mainly use Dropbox and Skype as communication tools. However, these tools are subject to several limitations in this context. For example, they contain many old documents written by interns who are not in the company anymore. As the CEO states: “Sometimes it’s a bit hard to keep track of who did what. We have all files, all documents in Dropbox. But I am not sure who did what, or whom to talk to. Everyone has been writing on the same document.”

The reason why the information flow among actors has become difficult to handle is that there are a lot of interns and freelancers who work from home. The CEO explains: “There is a lot of fluctuation, and it is irregular. For the last three months, we have been approximately 14 people. That was a lot. It was really hard to keep track.” Using Dropbox is an easy, reliable, and inexpensive way of sharing information between actors. But for ABC, the exchange of information should be controlled better, so an overload of old or unverified documents can be prevented. Using interns is certainly not expensive, and a lot of startups with unstable cash inflows usually need interns. However, the disparity between regularly employed actors to actors on an internship and freelancing actors creates chaos and dysfunctional behavior. In addition, the interns are still learning and they cannot take responsibility for crucial elements of the business model. Thus, the process of hiring and training interns should be planned better in order to avoid further negative impheations. The CEO himself is aware of this disparity, and he intends to find better matches. Specifically, he would like to hire staff with knowhow so that he does not have to train them. As he says: “I’m looking for people who can help on the business side. So I am trying to find someone who will fit perfectly.”

However, it will be difficult to attract actors with experience due to the poor financial condition of the company. Moreover, the access to knowledge is limited. The only one who receives the knowledge from the different seminars, conferences and events was the CEO. When it came to training and skills, the CEO always spoke in singular: “Yesterday, I was at an event about how to raise money from investors.”

So, knowledge in ABC is limited to one person. Such a knowledge concentration should be avoided for two reasons: first, it is risky to have only one strong personality in the company who makes the decisions and decides over future developments, even if this person is the CEO. Second, actors should also benefit from such seminars as they will help them implement the company’s business model with actual processes.

З.2.1.З. Processes. Since the company is still relatively young, one of the primary business processes is identifying potential customers (Mahnmose et al., 2014). We identify the two main techniques at ABC. Target customers are identified through brainstorming and the social network LinkedIn. To begin with, actors gather and start naming the companies they know. The process of brainstorming has some well-documented weaknesses (Isaksen and Caulin, 2005; Pauhus et al., 1993). In this case, ABC only includes the companies the actors are familiar with. There is no innovative impulse, and other options become excluded. Of course, brainstorming can be a suitable process to start with; however, it should be supplemented with additional information resources. As Isaksen and Caulin, (2005, p. 323) note: “While there is an appropriate time for brainstorming, there is also a need for other complementary thinking processes and tools for analysis, judgment and development of ideas.” Various databases containing company information and B2B search engines would enable gathering of more in-depth information about potential customers. A more quantitative and qualitative list would be obtained. One drawback is the additional expenses ABC would have to incur.

The other tool to identify potential customers is to contact them on LinkedIn. From the brainstorming list of potential companies, ABC identifies actors in marketing, technical actors, and other relevant professionals working in relevant manufacturing companies. Using the social network, ABC then tries to get in touch with those professionals. Again, there are several drawbacks that impair the business model to be implemented: similarly to brainstorming, only limited information is obtained. Skeels and Grudin (2009) note that it is still the prevailing attitude among older professionals that LinkedIn only attracts job seekers, not entrepreneurs. Moreover, ABC’s CEO acknowledges: “[...] so far it has been successful especially with American companies, because everybody is on LinkedIn. It was easy to connect. With the Japanese companies, it is quite hard, because nobody is on LinkedIn.” Thus, only a limited number of professionals can be contacted. And since this process is time-consuming, the tradeoff between the cost (i.e. the time and effort of ABC) and the result is questionable.

ABC sees a possible manufacturer of its printer as its main customer. Nevertheless, ABC also interacts with end-consumers. Operating as an R&D center, ABC should try to better understand the preferences of the end-consumer. This way, ABC can convince the manufacturer of the value of its printer prototype. Currently, ABC does not sufficiently explore these processes related to the end-consumer. It should interact more with its end-users to improve its knowledge about their needs, requirements, or preferences. So far, ABC has only conducted one survey for this purpose. The questionnaire was posted on the internet and was open for anyone. However, the actors employed at ABC felt that the methodology of this survey was weak: the potential customers had not been addressed directly, and the questions posed were quite broad. Currently, ABC uses the preliminary insights from the survey to initiate improved market research. For instance, a new communication intern now has the task of making improvements on the methodology and searching for ways to intensify the communication with end-consumers.

Connected to that, we can identify a number of business processes dependencies. First, knowledge about the end-consumers must be collected. Only then, can it be used to convince a manufacturer to produce the printer. Second, the current and the only relationships with suppliers stem from an EU- financed project which has set its goal on creating a new type of plastic. Currently, ABC tries to strengthen and expand the relationships with the suppliers beyond this specific project. The possibility exists to earn on the consumable plastic. ABC could procure the plastic for the end-consumers of 3-D printers. However, this arrangement depends on the technical aspects and patent issues. The CEO of ABC hypothesizes: “What we are looking for right now are solutions. A technical solution of how to control how you are using the right plastic. And if you are not using the plastic of our supplier, you cannot print.” According to the interview, the agreement to work on other projects with the current plastics supplier depends on the other processes. These are technical plastic development and patenting. To begin with, the plastic development process needs to be patented. Then, ABC can offer a settlement to the suppliers to obtain some rights on the plastic. This way, ABC would earn a commission from the end-consumers of 3-D printing. If one of the processes fails (e.g. to develop superior plastic), it can ruin the business model. Thus, process dependencies are significant.

To sum up, the prescriptive application of the VIP framework suggests misalignment between the intended business model and the current business processes. Yet, ABC initiates business processes that help implement the intended business model. However, some of the processes - such as customer identification and acquisition, internal communication, and risk analysis - are not effective. These processes need to be improved to match the intended business model.

3.2.2. Descriptive application. Following the descriptive (top-down) application, we now disclose the prerequisite in order to design business processes that reduce this misalignment. Our evidence shows that the mismatch between the intended Business Model and the way the company carries out the processes comes from two poor process building blocks: human resources and information systems. Here, improvements are necessary in order to achieve coherence between the processes and the business model.

3.2.2.1. Human resources management. According to the resource-based view, actors can be a source of competitive advantage. This is especially true in a startup company. Enhancement in human resource management can bring new human skills and competences to the company (Barney, 1997; Lueg et al., 2013b).

Currently, it is mainly the ABC-intems that run crucial processes instead of qualified permanent staff. The CEO acknowledges his situation, but financial restrictions prevent him from improving it. “7 would like to hire people - basically there are some people that are very good that I would like to hire. But before I can do that, we need to have a plan that ensures that these employees will get paid." Under the given circumstances, the CEO needs to select the interns more cautiously. Because we already identified the high staff turnover as a problem, this entails finding interns who stay for longer periods of time. In addition, future human resource management needs to be considered more critically. Recent research has revealed that a firmspecific human capital might have a significant impact on learning and firm performance. Human capital selection and development through training significantly improve learning by doing, which in turn improves performance (Hatch and Dyer, 2004). Better actor selection means that selection and training are critical aspects which need to get much more attention from the CEO.

3.2.2.2. Information systems management. Relevant and reliable information forms the basis for effective business processes. Therefore, a quality information system can facilitate process execution and bring advantages. In the case of ABC, information system improvement would enhance access to more diverse information as well as enrich internal communication. This would include defining process owners in data management who update documents regularly.

First, access to diverse information is crucial for successful business processes and for developing a business model (Ross et al., 2001). Especially, high quality information is essential in the ABC’s primary process: customer identification. We follow Nelson, Todd and Wixom (2005) that high quality information needs to be accurate, complete, timely, and understandable. Identifying customers through brainstorming does not yield any information that conforms to these requirements. ABC needs to employ information sources beyond brainstorming. An adequate information system would provide wider access to the most critical data, e.g., data about potential customers.

Besides, information systems are relevant for internal communication. They can help eliminate the misunderstandings of who did what, and knowledge sharing becomes more efficient. Specifically, information needs to be timely as timeliness poses a major challenge to ABC’s efficient operations.

To sum up, human resource management and information systems play a crucial role in the alignment of business processes with the business model. Information systems ensure that the initial plans (values) of the business model conform to the actually realized processes, and employing capable actors fosters deep implementations in routines to enact the business model in the business processes.

4. Discussion

This article responds to the recent call for research on the alignment of a company’s business model with its business processes (Morris et al., 2005; Solaimani and Bouwman, 2012). We contribute to the literature by showing that the alignment of business processes determines whether an intended business model actually can be realized.

4.1. Contributions to the practice of business models. Our study contributes to practice in three ways. First, while most preceding business model studies focus (directly or indirectly) on the effects of culture and the structure of strategy as factors for effective business model implementation, we provide evidence that the alignment of business processes is another key success factor for business model implementation. As a second take-away for practitioners, we demonstrate that changes in the business processes - such as a new way of procuring plastic for ABC - can determine a change in the business model. Thus, the interaction between Business Models and business processes is bilateral. Third, our study offers the first empirical evidence on the importance of this alignment topic. We contribute to the literature by providing an in-depth understanding on the vital role of business processes as a part of successful business model implementation.

4.2. Contributions to the theory of business models. As to theoretical contributions, we first show that the newly established framework of Solaimani and Bouwman (2012) is indeed well-applicable when it comes to explaining the alignment of business models and business processes in the field. This is due to the fact that the VIP framework has coherent domains that are linked in a comprehensive and logical manner. Also, we show that it is not only suitable for establised companies as conjectured by Solaimani and Bouwman (2012) but also for a startup company. In addition, the prescriptive and descriptive analyses of the VIP framework make it relevant in a longitudinal manner.

Second, we have detected some issues with the VIP framework that warrant further consideration. The transition between its domains might leave too much room for interpretation. The distinction between the domains can sometimes be difficult to detect, and some issues seem to belong to more than one domain. For example, ABC’s customer identification can be treated as a primary process and analyzed at the process domain. Likewise, it could also be analyzed

in the information domain, e.g., to evaluate the access to information on potential customers. Some researchers might encounter settings in which they find more than one ‘correct’ way of applying this framework, just as we did. To ensure the validity of future research on this topic, conceptual researchers should further clarify the boundaries of the VIP framework.

4.3. Our analyses are subject to several limitations. First, the literature review could include more academic literature on startup companies. Yet, the business model alignment topic is new and has not been widely researched. Future research could consider the relevance of linking a business model to business processes in more detail (e.g., Larsen et al., 2014). Popular definitions of business models do not emphasize this process dimension (Zott et al., 2011). For instance, the business model canvass of Osterwalder & Pigneur (2010) only considers key activities, but not yet focuses on the comprehensive set of processess that have to be optimized in a company. Likewise, Magretta’s (2002) popular definition emphasizes financial profits and storytelling, but not the concrete implementation in business processes. Our work can help to extend these notions of business models in the future.

Second, our results from a single company case study might not be generalizable. Thus, we only suggest that our empirical test of the VIP model is a preliminary step toward a better understanding of the alignment between business models and business processes (Flyvbjerg, 2006). Thus, we do not generalize for all startup companies, but provide exemplary knowledge about the issues startups might face when aligning their business processes with their business models.

4.4. Future research agenda. The limitations of our work provide avenues for future research. First, we advise conducting comparative case studies in order to test the validity of the VIP framework. These could be conducted across companies (possibly in different industries or life-cycle stages), but also across the division or function-specific business models within one company (e.g., Lueg et al., 2013a). In the latter setting, the VIP framework would be specifically beneficial when it comes to understanding process dependencies and information flows across departments. This could help along understanding of how the same business processes support different business models.

Second, future studies may use a longitudinal design to explain how a change in business processes in fact triggers measurable changes in a business model (e.g., Lueg and Pedersen, 2014). We can only hypothesize about this effect.

Conclusion

Many startup companies fail before reaching their 5th year of existence due to the lack of a business model that is aligned with the actual business processes of this company (Solaimani and Bouwman, 2012). Based on a case study, we analyze the alignment of a business model with business processes in a startup company across the three domains of the VIP framework (Solaimani and Bouwman, 2012). We identify several problems of misalignment, such as the lack of knowing target customers or the value the startup should provide for them. The root causes of these alignment problems are a lack of qualified human resources and insufficient information systems. Our findings are relevant for academics who aim to understand business model implementations and how they link to business processes. This link is currently underexplored in popular business model definitions (Magretta, 2002; Osterwalder and Pigneur, 2010; Zott et al., 2011). Additionally, our findings are useful for practitioners attempting to identify misalignment in their own businesses.

References

- Amit, R., C. Zott (2001). Value creation in e-business, Strategic Management Journal, 22, pp. 493-520.

- Barney, J.B. (1997). Gaining and sustaining competitive advantage, Addison-Wesley Reading.

- Bergholtz, M., P. Jayaweera, P. Johannesson, P. Wohed (2003). Process models and business models - a unified framework, Advanced Conceptual Modeling Techniques, 364-377.

- Borisov, B.G., R. Lueg (2012). Are you sure about what you mean by ‘uncertainty’? The actor’s perspective vs. the institutional perspective, Proceedings of Pragmatic Constructivism, 2, pp. 51-58.

- Bums, J., R.W. Scapens (2000). Conceptualizing management accounting change: an institutional framework, Management Accounting Research, 11, pp. 3-25.

- Cader, H.A., J.C. Leatherman (2011). Small business survival and sample selection bias, Small Business Economics, 37, pp. 155-165.

- Davenport, Т.Н. (1993). Process innovation: reengineering work through information technology, Harvard Business Press.

- Flyvbjerg, B. (2006). Five misunderstanding about case-study research, Qualitative Inquiry, 12 (2), pp. 219-245.

- Geerts, G.L., W.E. McCarthy (1999). Use of an accounting object infrastructure for knowledge-based enterprise models [J], AAAI Technical Report.

- Gordijn, J., H. Akkermans, H. Van Vliet (2000a). Business modelling is not process modelling, Conceptual modeling for e-business and the web, 40-51.

- Gordijn, J., H. Akkermans, H. Van Vliet (2000b). What’s in an electronic business model? Knowledge Engineering and Knowledge Management Methods, Models, and Tools, 257-273.

- Hatch, N.W., J.H. Dyer (2004). Human capital and learning as a source of sustainable competitive advantage, Strategic Management Journal, 25, pp. 1155-1178.

- Headd, B. (2003). Redefining business success: Distinguishing between closure and failure, Small Business Economics, 21, pp. 51-61.

- Isaksen, S.G., J.P. Gaulin (2005). A reexamination of brainstorming research: Implications for research and practice, Gifted Child Quarterly, 49, pp. 315-329.

- Knaup, A.E. (2005). Survival and longevity in the Business Employment Dynamics data, Monthly Labor Review, 128, p. 50.

- Larsen, M.K., R. Lueg, J.L. Nissen, C. Schmaltz, J.R. (2014). Thorhauge. Can the business model of Handelsbanken be an archetype for small and medium sized banks? A comparative case study, Journal of Applied Business Research, 30, pp. 869-882.

- LeBrasseur, R., J.T. Zinger (2005). Start-up survival and management capability: A longitudinal study of microenterprises, Journal of Small Business & Entrepreneur ship, 18, pp. 409-422.

- Lueg, R., B.G. Borisov (2014). Archival or perceived measures of environmental uncertainty? Conceptualization and new empirical evidence, European Management Journal, 32, pp. 658-671.

- Lueg, R., S.N. Clemmensen, M.M. Pedersen (2013a). The role of corporate sustainability in a low-cost business model - A case study in the Scandinavian fashion industry, Business Strategy and the Environment (forthcoming).

- Lueg, R., L. Nedergaard, S. Svendgaard (2013b). The use of intellectual capital as a competitive tool: a Danish case study, International Journal of Management, 30, pp. 217-231.

- Lueg, R., H. Nprreklit (2012). Performance measurement systems - Beyond generic strategic actions. In: Mitchell, F., Nprreklit, H., Jakobsen, M. (Eds.). The Routledge Companion to Cost Management, Routledge, New York, NY, pp. 342-359.

- Lueg, R., L.D. Pedersen. How do controls and trust interact? The case of failed alliance negotiations in the financial services industry // International Journal of Business Research, 2014. forthcoming.

- Luo, T., A. Mann (2011). High-Tech Business Survivorship: An Analysis By Organization Type, Journal of Business & Economics Research (JBER), 9, pp. 1-16.

- Magretta, J. (2002). Why business models matter, Harvard Business Review, 80, pp. 86-92.

- Mahnmose, M., R. Lueg, S. Khusainova, P.S. Iversen, S.B. Panti (2014). Charging customers or making profit? Business model change in the software industry, Journal of Business Models, 2, pp. 19-32.

- McCarthy, W.E. (1982). The REA accounting model: A generalized framework for accounting systems in a shared data environment, Accounting Review, 554-578.

- Morris, M., M. Schindehutte, J. Allen (2005). The entrepreneur’s business model: toward a unified perspective, Journal of Business Research, 58, pp. 726-735.

- Nelson, R.R., P.A. Todd, B.H. Wixom (2005). Antecedents of information and system quality: an empirical examination within the context of data warehousing, Journal of Management Information Systems, 21, pp. 199-235.

- Osterwalder, A. (2004). The business model ontology: A proposition in a design science approach, Institut d’Informatique et Organisation, Lausanne, Switzerland, University of Lausanne, Ecole des Hautes Etudes Commerciales НЕС, Vol. 173.

- Osterwalder, A., Y. Pigneur (2010). Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers, John Wiley & Sons, New York, NY.

- Pauhus, P.B., M.T. Dzindolet, G. Poletes, L.M. Camacho (1993). Perception of performance in group brainstorming: The illusion of group productivity, Personality and Social Psychology Bulletin, 19, pp. 78-89.

- Ross, J., M. Vitale, P. Weill (2001). From place to space: Migrating to profitable electronic commerce business models.

- Scapens, R.W. (1990). Researching management accounting practice: the role of case study methods, The British Accounting Review, 22, pp. 259-281.

- Shafer, S.M., H.J. Smith, J.C. Linder (2005). The power of business models, Business Horizons, 48, pp. 199-207.

- Skeels, M.M., J. Grudin (2009). When social networks cross boundaries: a case study of workplace use of facebook and linkedin, Proceedings of the ACM 2009 international conference on Supporting group work, ACM, pp. 95-104.

- Solaimani, S., H. Bouwman (2012). A framework for the alignment of business model and business processes: A generic model for trans-sector innovation, Business Process Management Journal, 18, pp. 655-679.

- Yin, R.K. (2009). Case Study Research: Design and Methods (4th ed.), Sage, Thousand Oaks, CA.

- Zott, C., R. Amit (2010). Business model design: an activity system perspective, Long Range Planning, 43, pp. 216-226.

- Zott, C., R. Amit, L. Massa (2011). The business model: recent developments and future research, Journal of Management, 37, pp. 1019-1042.