Activity based costing (ABC) in the public sector: benefits and challenges

Published: Dec. 16, 2014

Latest article update: Dec. 6, 2022

Abstract

Peter Drucker (1986), in “Management: Tasks, responsibilities, and practices” states that business enterprises and public-service institutions, are organs of society which do not exist for their own sake, but to fulfil a specific social purpose and to satisfy need of society, community, or individual. To achieve the above objectives, managers of these institutions must plan, control and make decisions about the resources entrusted to their care. A key element of efficient organizational decision making is to use reliable information, both operational and managerial accounting data for analysis and decision support. This can be achieved by using activity-based costing (ABC) method. The underlying premise of ABC is that resources are consumed by activities to produce outputs or products and services (US General Services Administration, 2006). It focuses on the allocation of indirect costs to products and services, which was traditionally done on arbitrary basis. ABC is useful in two situations: areas with large and growing indirect and support costs (Krumwiede, 1998a; Becker, Bergener and Räckers, 2010), and areas with a large variety in products, customers and processes (Cooper, 1988a, 1988b; Groot, 1999). The unique characteristic of public sector organizations as overhead-intensive service entities, therefore, is amenable to the use of ABC methodology (Becker, Bergener, and Räckers, 2009). Buttross and Schmelzle (2003) re-emphasize ABC adoption in the public sector and suggest that it can provide information on the cost of providing government services for strategic decisions. Despite its popularity in the literature, relatively little is known about the adoption of ABC, especially in South Africa’s public sector. The purpose of this study was to review the literature about the use of the ABC methodology to overcome shortcomings in traditional approaches to allocating costs to products and services in the public sector so as to promote effective financial management and concomitantly, efficient service delivery in the South Africa’s public sector

Keywords

South Africa, challenges, public sector, activity based costing, benefits

Introduction

In recent times, South Africa has experienced a phenomenal increase in service delivery protests. This has been attributed partly to inefficient management of public funds by municipalities. According to the Auditor General’s 2010/2011 financial year local government audit outcomes report, only 13 of the 283 (6 metropolitan, 46 district and 231 local) municipalities in South Africa achieved clean audits (Auditor General, Consolidated general report on the local government audit outcomes 2010-11). Inadequate human capacity was identified as one of the root causes of the poor audit results in local government. Similarly, the AG’s findings in the 2010/11 audit outcomes revealed that: 1) municipalities failed to account for more than R10 billion in the year, with much of it potentially lost through fraud and corruption, 2) widespread failure to comply with public finance legislation and regulations, and 3) 89% of municipalities did not comply with legislation on service delivery performance reporting and 24% of municipalities did not report at all (Auditor General, Consolidated general report on the local government audit outcomes 2009-10).

The AG’s findings support ACCA’s (2010) study which has demonstrated that the general public is more likely to have a greater trust in public sector organizations (PSO) if there is a strong financial stewardship, accountability and transparency in the use of public funds. The study further pointed out that strong financial management is vital for PSO because it impacts on four broad areas, namely: 1) aggregate financial management - fiscal sustainability, resource mobilization and allocation; 2) operational management - performance, value- for-money and budget management; 3) governance - transparency and accountability; and 4) fiduciary risk management - controls, compliance and oversight. It is quite clear from the AG’s reports that South Africa’s public sector, especially, municipalities are faced with teething financial management problems which impacts adversely on efficient service delivery. This study argues that the problems facing PSO in South Africa can be addressed by using ABC methodology instead of the traditional cost accounting.

While traditional cost accounting (TCA) was developed to comply with external financial reporting requirements, it falls short in providing public sector organizations with the strategic information needed in today’s environment. A major problem with TCA is that large amounts of indirect expenses tend to be allocated to products or services using allocation bases that are typically unrelated to what causes costs to be incurred. Since overheads do not just occur, but are caused by activities which ‘drive’ the costs, the consumption of resources needs to be traced and assigned as costs based on cause-and-effect relationships. This can only be done by activity-based costing (ABC) methodology. Buttross and Schmelzle (2003) reemphasize ABC adoption in the public sector and suggest that it can provide useful information on the cost of providing government services for strategic decisions. As pointed out by Brimson (1991), and Maiga and Jacobs (2006), ABC has the potential to provide management with the resources to streamline business activities, identify fundamental problems, eliminate waste, design cost out of activities, improve efficiencies, and link corporate strategy to operational decision making. In their study, Using Activity-Based Costing To Manage More Effectively, Granof, Platt and Vaysman (2000), argue that universities, government agencies, and other non-profit and public sector organizations can improve their financial management by adopting activity-based cost accounting systems that measure not only their ‘inputs’ but also their ‘outputs’.

1. Problem statement

Previous studies have shown that ABC is useful in two situations: (1) organizations with large and growing expenses in indirect and support costs (Krumwiede, 1998a), and (2) organizations with a large variety in products, customers and processes (Cooper, 1988a, 1988b; Groot, 1999). The unique characteristic of public sector organizations as overhead-intensive service entities, therefore, is amenable to the use of ABC as a useful tool for evaluating public administration (Becker, Bergener, and Rackers, 2009). Despite its popularity in the literature, relatively little is known about the adoption of ABC in South Africa’s public sector, especially municipalities, which are at the grassroots for service delivery to the public. This raises many unanswered questions relating to how to go about implementing ABC, the possible uses, and the costs and benefits. This study attempts to address the above questions by presenting the conceptual/ theoretical underpinnings and details of ABC, contrasting ABC with traditional costing systems, and concludes by recommending the adoption of ABC in South Africa’s public sector.

2. Objectives of the study

The objectives of the study are: (1) to discuss the theoretical frameworks of traditional and activity based costing systems; (2) to review the empirical literature on the benefits and challenges of ABC adoption; (3) to recommend ABC as a management tool that assures efficient service delivery in South Africa’s public sector.

3. Theoretical frameworks for traditional versus activity based costing

3.1. Traditional costing accounting (TCA). Traditional cost accounting (also known as absorption costing), which was developed to comply with external financial reporting, can be traced to the emergence of large enterprises like textile mills, railroads, steel companies and retail companies in the USA (Taylor, 2000). Johnson and Kaplan (1987) argue that by 1925, virtually all of the traditional cost accounting practices prevalent today (e.g. cost accounts for labor, material, and overhead; budgets for cash, income, and capital; flexible budgets, sales forecasts, standard costs, variance analysis, transfer prices, and divisional performance measures), had been developed. TCA is based on the assumption that cost objects (products or services) consume resources (e.g raw materials, labor, supplies, etc.). Fundamentally, traditional costing systems try to assign cost directly to products, rather than to activities first and then from the activities to product units. According to Baker (1998), the traditional costing systems are often designed as either job costing or process costing systems which divide costs into product (direct) and period (indirect) costs. The former include direct materials, labor and factory overhead costs and the latter include selling, general and administrative costs which are charged against income in the period incurred. TCA allocates the indirect costs to products or services arbitrarily using one cost driver (direct labor or machine hours). This approach therefore, suffers from several defects that result in distorted costs for decision making. For example, the TCA allocates the costs of idle capacity to products or services, thereby, charging such products or services for resources that they did not use. Therefore, the typical cost report gives information on what is spent, but not why it is spent. This can lead to inaccurate determination of product or service costs.

3.2. Activity based costing (ABC). The underlying assumption of activity based costing is entirely different from that of conventional costing systems. While the conventional costing system assumes that products cause costs, activity based costing systems have activities as the fundamental cost objects. Cooper and Kaplan (1987) are widely credited with developing the ABC methodology. They define ABC as an approach to solve the problems of traditional cost management systems; that is the TCA systems are often unable to identify correctly the true costs of processes. CIMA official terminology (2005) defines ABC as an approach to the costing and monitoring of activities which involves tracing resource consumption and costing final output. Resources are assigned to activities, and activities to cost objects based on consumption estimates. The latter utilizes cost drivers to attach activity costs to cost outputs. Thus, ABC recognizes the causal relationships of cost drivers to activities (Holst and Savage, 1999).

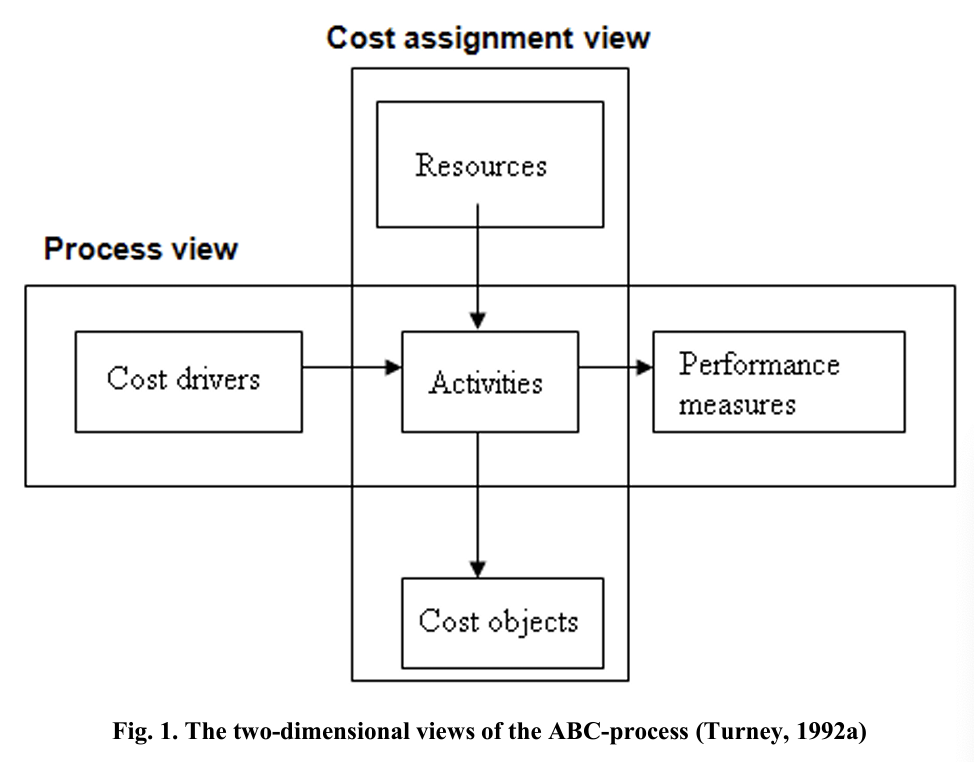

ABC is a two dimensional model with cost assignment view (CAV) and the process view (Figure 1). The CAV generally occurs in two stages - from resources to activities (stage 1) and then from activities to cost objects (stage 2). Resources are an economic element that is used or applied in the performance of activities. Examples include salaries and supplies. Activities are aggregation of actions performed within an organization that is useful for the purposes of activity-based costing. Finally, cost objects are products or services for which a separate cost measurement is desired. The main purpose of this process is to find out the costs of the activities and the cost objects. The second view of ABC - process view, provides a report of either what has happened or what is happening. The definition of activity remains the same as in the CAV. Cost drivers are any factor that causes a change in the cost of an activity. An activity may have multiple cist drivers associated with it. Performance measures (financial or non-financial) are indicators of the work performed and the results achieved in an acidity, process or organizational unit. While the cost view can be seen as the phase of building the model, the process view can be seen as the phase of using the model built in the first phase. The steps of this view consist of finding out the cost drivers of the activities and using the information for performance measurement.

Cokins (1993), summarizes the ABC development process into five interrelated activities: (1) identifying resources (i.e. what is used to do work); (2) identifying resource drivers (i.e. what is assigning the cost of the resources to activities based on effort expended); (3) identifying activities (i.e. work); (4) identifying activity drivers (assigning the cost of the activities to products based on unique consumption patterns); and (5) identifying the objects of work (to what or for whom work is done).

The basic difference between ABC and TCA is illustrated in Figure 2. It is obvious from the diagram that TCA methodology provides a simplified view of the relationship between products and resources and uses volume-related bases such as direct labor or machine-hours to allocate indirect (overhead) costs to products. On the contrary, the ABC approach gives a more comprehensive view of the relationship between resources, activities and products; and uses multiple cost drivers to assign indirect (overhead) costs to these activities.

4. Methodology

The purpose of this study was to review the literature about the use of the ABC methodology to overcome shortcomings in traditional approaches to allocating costs to products and services in the public sector so as to promote effective financial management and concomitantly, efficient service delivery in the South Africa’s public sector. To achieve this purpose, the study reviewed national and international literature about implementation, challenges and benefits of ABC adoption in practice. Sources include refered research articles, unpublished postgraduate dissertations, empirical reports, and articles from professional journals. The literature is discussed in section 5, literature review.

5. Literature review

5.1. Benefits of ABC. ABC has emerged as a modem cost accounting and management innovation that can be used to link an organization’s operational performance and actual financial performance (Paduano, 2001; Cagwin and Bouw- man, 2000). Canby (1995) argues that ABC systems can reveal how an organization’s activities align with its strategic goals and objectives. Using the theories of innovation (Kwon and Zmud, 1987), transactions cost economics (Roberts and Sylvester, 1996), and information technology (Dixon, 1996), researchers have demonstrated that organizations tend to adopt innovations such as ABC to obtain benefits that directly or indirectly impact financial performance measures. For example, Cagwin and Bouwman (2000) analyzed the impact of ABC on 205 large companies in the USA and found a significant and positive relationship between ABC and financial performance as measured by 3 and 5- year return on investment. In South Africa, Watt Communications (2007) reported that the implementation of Activity Based Costing at the Buffalo City Municipality enabled the municipality to efficiently compare the costs of services to the tariffs set out for the public. This allows tariffs to be brought in line with service costs and to be set more accurately, thereby providing transparency to ratepayers. In addition, the present researcher, in an earlier study, investigated the impact and possible concomitant improvement in financial performance consequent upon the use of activity based costing (ABC) and the conditions under which such improvement is achievable in the South African public sector. The case study method was employed to collect and analyze data relating to improvement in financial performance, perception and success of ABC in the Buffalo City Municipality in the Eastern Cape Province of South Africa. The study revealed that ABC provides significantly more accurate and useful information than traditional cost accounting. The results indicated further that management strongly agree that ABC utilization improves insight into causes of cost; provides better cost control and cost management; provide better understanding of cost reduction opportunities; improves managerial decision making; and provides more accurate information for product or service costing and pricing. Management also agrees that ABC use improves financial performance. The study is significant because it highlighted the important role that ABC plays in improving financial management in the public sector. ABC use can be recommended for public sector organizations to provide decision makers (e.g. legislators, public officials and administrators) with valuable information and cost data. The cost data can be significant because they will give decision makers the opportunity to make optimal choices about how to allocate limited resources. Finally, ABC data will enable decision makers to streamline and restructure public entity operations and processes to ensure effectiveness and efficiency.

King (1995) carried out studies on hospitals in the UK and concluded that the UK National Health Service can benefit from the implementation of ABC. Vazakidis, Karagiannis and Tsialta (2010) investigated the relevance of ABC in the Greek public sector. Their findings revealed that when combined with new technologies and new methods of management, ABC can resolve all the deficiencies of the public sector and help produce services at minimal cost. Argyroupolis Municipality (2005) in Greece claims on its website that it has implemented ABC since 2005 to better monitor and control various elements of costs. USAID (2003) examined the application of ABC to calculate unit costs for a healthcare organization in Peru. The results show that applying ABC to healthcare services in a developing country is feasible and potentially useful. The study observes further that applying ABC to healthcare services will reveal where an organization is spending money, the difference between production costs and support costs and potential targets for efficiency improvement.

Buttross and Schmelzle (2003) re-emphasize ABC adoption in the public sector and suggest that it can provide useful information on the cost of providing government services for strategic decisions. As pointed out by Brimson (1991), and Maiga & Jacobs (2006), ABC has the potential to provide management with the resources to streamline business activities, identify fundamental problems, eliminate waste, design cost out of activities, improve efficiencies, and link corporate strategy to operational decision making. In their study, Using Activity-Based Costing To Manage More Effectively, Granof, Platt and Vaysman (2000), argue that universities, government agencies, and other non-profit and public sector organizations can improve their financial management by adopting activity-based cost accounting systems that measure not only their ‘inputs’ but also their ‘outputs’. Finally, Brimson and Antos (1994) mentioned examples of US Public Sector where ABC succeeded - telecommunications, parcel post companies, hospitals, electricity and gas companies. The authors noted that ABC helped these companies control their costs.

5.2. Challenges of ABC. Sartorius, Eitzen, and Kamala (2007) used a survey-case study methodology to identify reasons for implementation/ non-implementation, problems and critical success factors relating to ABC implementation. The results show that the extent of ABC implementation in South Africa is lower than that found in developed countries, but the evidence is inconclusive. The results further suggest that the issues facing ABC implemented in South Africa are similar to those faced in many other countries. The authors concluded that the findings provide South African companies with a comparative framework of important variables to be considered in implementing ABC.

Wessels and Magdalena (2000) examined the extent and nature of organizational problems that are encountered in South Africa in respect of activity based costing implementation compared with difficulties experienced by companies in the British Isles, the United States of America and Australia. The investigation comprised a literature survey as well as an empirical study of the companies listed in South Africa. The results suggest that, contrary to the findings of overseas studies, South African companies experience less difficulty in respect of support from senior management and consider the employee resources allocated to the ABC projects to be adequate and satisfactory. The study further found that ABC objectives are aligned with organizational goals, culture and company strategy. However, whilst implemented are adequately trained, the insufficient training of users and managers was perceived to be a hindrance to success and in the majority of companies other priorities take precedence to the ABC project.

Taba (2005) measured employees’ perceptions of ABC implementation, the benefits of ABC implementation and the conditions that affect the potential benefits of ABC implementation at the South African Post Office. He found that technical factors such as training, high costs of implementation, lack of software packages, the lack of data requirements and co-operation between departments were hindrances to the successful implementation of ABC. In another study, Naidoo (2010) examined the costing systems of 45 private higher education (PHI) institutions in South Africa from 1990 to 2005. The study found that although PHI’s were using traditional costing systems, a large number (70%) were in the process of adopting modem cost systems, to include Activity Based Cost systems and balanced scorecards. However, the study revealed that in terms of the PHI’s size based on student numbers, the costs far exceed the benefits of introducing modem cost systems. The authors conclude that the findings are not only important to the national education department, public higher education institutions, students, sponsors and shareholders but more important to prospective overseas countries like the United States, England and Australia, that wish to invest in South African higher education.

Using questionnaires to collect data, Rundora and Selesho (2014) examined the determinants of and barriers to ABC adoption by small manufacturing firms in the Emfuleni municipality in South Africa. The barriers examined are high cost of implementing ABC, resistance to change, ABC involves a great deal of work, ABC is time consuming, lack of top management support, lack of cooperation and commitment among departments, lack of knowledge concerning ABC, problems in defining cost drivers, problems in identifying activities, high cost of consultations, and a higher priority of other changes or projects. The authors reported a significant difference in the perception of ABC users and nonusers, even though the results revealed that four of the eleven barriers of implementing ABC are rated significantly higher by the non-users. The highest ranking barrier among non-users was a lack of knowledge concerning ABC. Other non-users raised the challenge in defining cost drivers as well as identifying activities.

Shields (1995) found that success of ABC is influenced by behavioral and organizational variables, as opposed to technical variables. These variables comprise top management support, linkage of the ABC system to competitive strategies, linkage of the ABC system to performance evaluation and compensation, sufficient internal resources, training in designing and implementing ABC and nonaccounting ownership, which is the commitment of non-accountants to use ABC information. Towson (2005) investigated the effect of ABC on the efficiency in the UK health system. He found that several factors influence the successful implementation of ABC. These are top management support; corporate strategy; resources, the presence of a champion for ABC; external consultants; team size and heterogeneity; a competitive environment; and training and interaction with existing systems.

5.3. Adoption of ABC in municipalities. The Municipal Finance Management Act (Act No. 56 of 2003) (MFMA) aims to modernize budget and financial management practices in municipalities in order to maximize the capacity of the municipalities to deliver services to all their residents, customers and users. It also gives effect to the principle of transparency as required by sections 215 and 216 of the Constitution. The MFMA provides the overall financial framework in which a municipality must manage its budget and establish its tariffs and other revenue. This implies that municipalities need to have a sound understanding of all the costs of then- services and a “realistic” estimate of revenue that they are likely to receive from service charges. The MFMA requires measurable objectives to be set for each vote in the budget in line with the Integrated Development Plan (IDP). This means that any expenditure to be incurred has to be linked to some measurable outcome, such as particular level of service to be provided. In this way there is a formal link between expenditure, income (and tariffs) and municipal performance. Thus tariff setting should not be seen in isolation from the operational targets set for solid waste services in the MP. An effective and efficient way of achieving the objectives of the MFMA is to employ ABC. Yet, not many municipalities have implemented ABC.

Conclusion and recommendation

The main conclusion of this study is that there are several challenges inherent in ABC adoption. These are high cost of implementing ABC, resistance to change, lack of top management support, lack of cooperation and commitment among departments, lack of knowledge concerning ABC, problems in defining cost drivers, problems in identifying activities, high cost of consultations, and a higher priority of other changes or projects, and lack of software packages. Despite these limitations, the empirical literature shows that, in the long-term, the benefits to be derived from implementing an ABC system far outweigh the costs. The key benefits relate to heightened awareness of activities, the costs they create, and improved decision making. ABC also provides a strong link between organization’s operational performance and actual financial performance; can reveal how an organization’s activities align with its strategic goals and objectives; enhances financial management; improves insight into causes of cost; provides better cost control and cost management; provide better understanding of cost reduction opportunities; improves managerial decision making; and provides more accurate information for product or service costing and pricing.

The study reviewed the literature about the use of the ABC methodology to overcome shortcomings in traditional approaches to allocating costs to products and services in the public sector so as to promote effective financial management and concomitantly, efficient service delivery in the south Africa’s public sector. The study found that not many municipalities have implemented ABC. The study therefore sets an important benchmark for further research in this area.

References

- Association of Chartered Certified Accountants (ACCA) (2010). Improving public sector financial management in developing countries and emerging economies. Accessed at: accaglobal.com/accountants_business.

- Auditor General (2009). Consolidated general report on the local government audit outcomes,10.

- Auditor General (2010). Consolidated general report on the local government audit outcomes, 11.

- Baker, J.J. (1998). Activity-based Costing and Activity-based Management for Health Care, Jones & Bartlett Learning.

- Bagur, L., Boned, J.L. and Tayles, M. (2006). Cost System Design and Cost Management in the Spanish Public Sector, Paper in progress.

- Becker, J., Bergener, P. and Räckers, M. (2009). Process-based governance in public administrations using activitybased costing.A. Wimmer et al. (Eds.): EGOV 2009, LNCS 5693, Springer-Verlag Berlin Heidelberg, pp. 176-187.

- Becker J., Bergener, P. and Räckers, M. (2010). Activity-Based Costing in Public Administrations: A Business Process Modeling Approach, International Journal of E-Services and Mobile Applications, 2 (4), pp. 1-10.

- Bekker, H.J. (2009). Public Sector Governance -Accountability in the State. Paper for CIS Corporate Governance Conference, 10-11 September 2009.

- Brimson, J.A. and Antos, J. (1994). Activity-Based Management for Service Industries, Government Entities and Non-Profit Organizations, 1st Edition, John Wiley and Sons, Inc. New York.

- Brown, R.E., Myring, M.J. and Gard, C.G. (1998). Activity-Based Costing in Government: Possibilities and Pitfalls, Public Budgeting & Finance, 19 (2), pp. 3-21.

- Buttross, T. & Schmelzle, G. (2003). Activity-Based Costing in the Public Sector, Encyclopaedia of Public Administration and Public Policy

- Cagwin, D. & Bouwman, M.J. (2000). The association between activity based costing and improvement in financial performance.

- Canby, J. (1995). Applying activity-based costing to healthcare settings, Healthcare Financial Management Association.

- Chartered Institute of Management Accountants (CIMA) (2005). Official Terminology.

- Chartered Institute of Management Accountants (CIMA) (2001). Technical Briefing: Developing and Promoting Strategy, April 2001.

- Cokins, G. (1993). An ABC Manager ’s Primer: Straight Talk on Activity-Based Costing, McGraw-Hill Trade.

- Cooper, R., Kaplan, R.S. (1988a). Measure costs right: Make the right decisions, Harvard Business Review, 65 (5), pp. 96-103.

- Cooper, R., Kaplan, R.S. (1988b). How cost accounting distorts product cost, Management Accounting,

- Cooper, R. and Kaplan, R. (1991). Profit Priorities from Activity-Based Costing, Harvard Business Review, May- June, p. 130.

- Drucker, F.P. (1986). Management: Tasks, Responsibilities, Practices, Truman Talley Books/EP Dutton, New York.

- Drury, C. (2004). Management and Cost Accounting, 5th edition, Thomson Publishing, London.

- Drury, C. and Tayles, M. (2000). Cost systems design and profitability analysis in UK Companies, London, Chartered Institute of Management Accountants.

- Evans, P. and Bellamy, S. (1995). Performance evaluation in the Australian public sector: the role of management and cost accounting control systems, International Journal of Public Sector Management, 8, pp. 30-38.

- Fourier, D. (2006). Good Corporate Governance in Ensuring Sound Public Financial Management, School of Public Management and Administration, University of Pretoria, South Africa.

- Groot, T.L. C.M. (1999). Activity-based costing in U.S. and Dutch food companies, Advances in Management Accounting, 7, pp. 47-63.

- Gunasekaran, A., Marri, H.B. and Yusuf, Y.Y. (1999). Application of activity-based costing: some case experiences, Managerial Auditing Journal, 14 (6), pp. 286-293.

- Holst, R. and Savage, R. (1999). Tools and techniques for implementing ABM. In: Player St, Lacerda, R. (eds). Arthur Anderson ’s global lesions in ABM, New York.

- Johnson, H.T., Kaplan, R.S. (1987). Relevance lost: the rise andfall of management accounting, Harvard Business School Press, Boston.

- Krumwiede, K.R. (1998). The implementation stages of activity-based costing and the impact of contextual and organizational factors, Journal of Management Accounting Research, 10, pp. 239-277.

- Kwon, T.H. and Zmud, R.W. (1987). Unifying the fragmented Models of Information Systems and Implementation. In: Critical Issues in Information Systems Research, edited by R.J. Boland and R. Hirscheim, New York, John Wiley & Sons.

- Maiga, A.S. and Jacobs, F.A. (2003). Balanced Scorecard, Activity-Based Costing And Company Performance: An Empirical Analysis, Journal of Managerial Issues, 15 (3), p. 283.

- Melese, F., Blandin, J. & O’Keele, S. (2004). A New Management Model for Government: Integrating Activity Based Costing, the Balanced Scorecard and Total Quality Management with the Planning, Programming and Budgeting System, International Public Management Review, 5 (2), pp. 103-131.

- Municipality of Argyroupolis (2005). Activity based costing. Municipal Development Company of Argyroupolis. Accessed at: http://deada.gr/index.php?option=com_content&task=view&idItemid=74.New.

- South Africa Treasury (2004). Normative Measures for Financial Management (Phase I: Perfecting the Basics).

- Olsen, R. (1998). Activity-Based Costing: A Decision-Making Tool, The Manufacturing Report 1998 by Lionheart Publishing, Inc.

- Oseifuah, E.K. (2013). Activity based costing approach to financial management in the public sector: the South Africa experience, European Scientific Journal, 9 (1).

- Sprow, E. (1992). The new ABCs of cost justification, Manufacturing Engineering, 106, pp. 30-31.

- Taba, L.M. (2005). Measuring the successful implementation of Activity Based costing (ABC) in the South African Post Office, Unpublished Masters Thesis, University of South Africa.

- Taylor, T.C. (2000). Current developments in cost accounting and the dynamics of economic calculation, The Quarterly Journal of Austrian Economics, 3 (2), pp. 3-19.

- Tumey, B.B.P. (1996). Activity Based Costing The Performance Breakthrough, CEA, London.

- Tumey, B.B.P. and Stratton, A.J. (1992). Using ABC to support continuous improvement, Management Accounting, September, pp. 46-50.

- UNDP (2006). The Buffalo Municipality. Review of the Duncan Village Waste Management and Recycling Project and its Relationship with the Integrated Development Plan (IDP).

- Vazakidis, A., Karagiannis, I. and Tsialta, A. (2010). Activity-Based Costing in the Public Sector, Journal of Social Sciences, 6 (3), pp. 376-382.

- Mail & Guardian Online by Laura Grant Research shows sharp increase in service delivery protests. 12 Feb 2014. Available at: http://mg.co.za/article/2014-02-12-research-shows-sharp-increase-in-service-delivery-protests (accessed on 24 April 2014).