Linking CSR and financial performance: an empirical validation

Published: July 5, 2012

Latest article update: Dec. 6, 2022

Abstract

The escalating demand of stakeholders’ interests in social performance has put pressure on corporations to embark on social responsibility reporting and practices in order to gratify the demands and to gain public support. Some organizations have already responded well to this perspective, either by publishing a separate report regarding their social activities, or by providing such information in their annual report or on their web site. The aim of this study is to better understand the relationship between CSR and financial performance in Indian context. Previous research on the relationship between corporate social responsibility and financial performance has largely been based on international data. CSR indexes (www.karamyog.org) and financial performance (annual reports) measures were taken to allow the estimation of regression analysis conducted to examine the relationship between CSR and financial performance. Our preliminary results revealed statistically significant relationship between corporate social responsibility (CSR) and financial performance (CFP) as measured by sales revenue and profits of five hundred Indian companies i.e. it concluded that, there is a marked financial benefit for companies that are innovative to invest in CSR

Keywords

Corporate social responsibility, corporate financial performance, regression, correlation, profits before taxes

Introduction

Corporate social responsibility (CSR) may be defined as “the commitment of business to contribute to sustainable economic development, working with employees, their families, the local community and society at large to improve their quality of life” (World Business Council for Sustainable Development, 2004). There has been increasing pressure on business from the social and government organizations to take up social welfare projects. Corporations have been investing in CSR projects in an attempt to improve their reputation in society and compete with global corporations. Companies are boosting about their CSR expenditure in their annual reports to attract investors and satisfy various stakeholders like employees, customers, suppliers, government, regulators, distributors etc. Companies are increasingly using CSR as a marketing tool and to establish good rapport with the public. Current corporate performance measures involve the corporate social performance. This measure has critical importance to corporate sustainability and reputation management.

It is also used as a prevention strategy by the companies to protect them from corporate scandals, unpredicted risks, possible ecological accidents, governmental rules and regulations, protect noticeable profits, brand differentiation, and better relationship with employees based on volunteerism terms. Most corporations are much cognizant to publish their CSR activities on their websites, sustainability reports and their advertising campaigns. CSR is also practiced because customers as well as governments today are demanding more ethical behaviors from

© Namita Rajput, Geetanjali Batra, Ruchira Pathak, 2012. organizations. In response, corporations are volunteering themselves to incorporate CSR as part of their business policies, mission proclamation and values in multiple areas, respecting labor and environmental laws, while taking care of the differing interest of various stakeholders (Kashyap et al., 2006).

The study is organized as follows. Section 1 gives details relating to school of thoughts on CSR and business. Section 2 gives extensive Review of Literature, Section 3 gives details about Research Methodology, Section 4 states the objectives of the study. Analysis and interpretations of results are discussed in Section 5, followed by summary and conclusion in the final Section.

1. Schools of thoughts on CSR and business

From the vast literature available on the subject of Corporate Social Responsibility (CSR), some of which was reviewed as part of this research work, three different themes or schools of thoughts emerge, which have been designated as ‘Sceptic’, ‘Idealistic’ and ‘Pragmatist’. These are explained further in the following sections.

1.1. Sceptic view. The sceptics are highly critical of CSR. They believe that in a free society, the only responsibility of corporate officials is to make as much money for their stakeholders as they can. According to this view, the corporates do not have any responsibility other than increasing sales and earning profits. The idea of CSR is contrary to the basic purpose of business which is to create wealth. The proponents of this view see giving money away for CSR as a self-imposed tax. They extremely counter any idea for expenses other than related to business operations and growth. According to the proponents of this view, managers who have been put in charge of a business have no right to give away the money of the owners. Managers are employed to generate wealth for the shareholders and not give it away for charitable purposes.

1.2. Idealistic view. The idealistic view of CSR reflects the idea that companies have a prior duty to anyone touched by their activity, their stakeholders rather than their stockholders. Companies are especially liable towards the vulnerable, which may be exploited by the company’s operation. Some holding this set of views are of the opinion that companies such as those manufacturing weapons or growing tobacco can never be considered responsible by virtue of the harmful effects of their products. Companies should not be silent witnesses to illegal and immoral activities in the society. Business does not have an unquestioned right to operate in society. Those managing business should recognize that they depend on society. Business relies on inputs from society and on socially created institutions. There is a social contract between business and society involving mutual obligations. Society and business must identify that they have to fulfil these mutual obligations for each other’s existence and success.

1.3. Pragmatist view. The pragmatist view is widely followed and practiced. As per pragmatist view, CSR is not about investing funds and expertise in solving social problems. CSR is about the veracity with which a company governs itself, fulfils its objectives, lives by its values, and engages with its stakeholders. It is the honesty with which the business measures its impacts on society and how it reports about its activities.

Pragmatist view promotes ethical decision making in company affairs and transparency of decisions and policies. The main theme of this view is compliance to rules and regulations and following them in letter and spirit. This view also promotes persistent assurance by business to behave ethically and contribute to economic development by improving the quality of life of the workforce and their families as well as that of the local community and society at large. A company, being a good citizen in the community should manage its business process to produce an overall positive impact on society. It is duty bound to conduct business in an ethical way and in the interests of the wider community, respond positively to emerging societal priorities and expectations, be willing to act ahead of regulatory confrontation, and balance shareholder interests against the interests of the wider community. There are four dimensions of corporate responsibility as per this view:

- Financial - responsibility to earn profits for shareholders.

- Legal - responsibility to comply with the law.

- Ethical - not acting just for profit but doing what is right, just and fair.

- Philanthropic - promoting human welfare and goodwill.

The proponents of this view consider responsibility to earn profits as one of the many responsibilities of business.

2. Review of literature

In this section we review the literature on Corporate Social Responsibility (CSR) and present the findings reported by various authors about how the CSR impacts the profitability of an organization, employee morale and loyalty and whether it has a bearing on customer satisfaction.

Broadly, the literature on CSR indicates three different schools of thoughts or groups. Each of these groups has taken statistically significant samples from different industries and organizations to validate their point. The main theme of these three group’s findings and observations is as mentioned below. One group supports CSR and claims that it results in improved corporate image, stable stock prices, improved sales and positive impact on customer loyalty. Second group opposes CSR and shows that CSR has a negative impact on profit and only adds to expenses. It leads to loss of business focus which can be better utilized in running the business profitably. Third group is neutral to CSR and shows that CSR is a good charitable social act with no impact whatsoever on profitability. This section is accordingly organized in three parts, with each part covering the findings from the three groups mentioned above.

2.1. Literature of CSR having positive impact on profitability. Louis W. Fry, Gerald D. Keim, Roger E. Meiners (1982) have revealed that firms spending on CSR have to spend less on advertising. This helps in reducing costs and creating a corporate identity or building the reputation of the firm. Sue Annis Hammond and John W. Slocum (1996) have concluded that CSR can improve corporate reputation and lower the financial risk, which implies such organizations are less likely to go bankrupt as compared to those which do not engage in CSR. Klassen, Robert D, McLaughlin and Curtis P. (1996), have proposed a theoretical model that strong environmental management to improved future financial performance. A. Waddock and Samuel B. Graves (1998) have shown that Corporate Social Performance (CSP) is positively associated with prior financial performance. Paterson (2000) have found that financial incentives are not the key to attract

and retain quality staff. They reported that as high as 82% of UK professionals would turn down a lucrative job offer if the company failed to accord with their own personal values. Bennett Daviss (1999) have concluded that companies will grow their profits only by embracing their new role as the engine of positive social and environmental change. Lord Tim Clement (2002) is of the view that CSR has bottom line relevance and the way it is communicated and reported is important. CSR helps an organization in building loyalty with customers, counteracting allegations of corporate greed, avoiding expensive class action suits, helps in attracting, motivating and retaining a talented workforce and lowering company’s equity risk premium. Wilks (2002) has linked the idea of corporate social responsibility with the idea of the triple bottom line, whereby business success should be judged on not just financial terms but also on social and environmental grounds. Boutin-Dufresne and Savaria (2004) have shown that socially responsible companies show less diversifiable risk in their stock behavior than non-socially responsible companies. Crawford and Scaletta (2005) have suggested use of Balanced Score Card to make CSR reporting more effective. Falck and Heblich (2007) opined that shareholders react favorably towards the stock prices of companies’ strategically practicing corporate social responsibility (CSR). Younghwan, Jungwoo and Taeyong developed a corporate transparency index and accessed transparency of 237 Korean companies. They concluded that financial, corporate, operational, and social transparencies play an important role in firm’s profitability. Dr Boorman (2011) has shown that a healthy and happy work force can improve a company’s bottom line.

2.3. Literature for CSR having negative impact on profitability. Henderson (2001) has given a case against social responsibility. According to him, the concept of CSR is severely damaged. Adoption of CSR increases the possibility of cost escalations and impaired performance. He highlights that managers will get loaded by wide ranging goals, involvement in time consuming process of discussion with outside consultants, need of new accounting, auditing and monitoring systems if they practice CSR. All this may offset any gains from CSR. Friedman (2007) is of opinion that a business is responsible only to increase profits and not responsible to society. Reich (2008) argues that the firms practicing CSR have to sacrifice freedom of profits to attain social goods. Promotion of corporate social responsibility by companies misleads the public to believe that more is being done by the private sector for the well-being of society than is in fact the case. Robert remarks negatively about CSR saying that it is an expense that is only to mislead public opinion.

2.4. Literature for CSR having no impact on profitability (neutral). O’Neill, Saunders and Derwinski McCarthy (1989) investigated the relationship between corporate social responsiveness and profitability in a sample of corporate directors. Their findings show no relationship between the level of director social responsibility and corporate profitability. Kenneth L. Kraft and Jerald Hage (1990) correlate community service goals from 82 business firms with various organizational characteristics, including goals, niches, structure, context, and performance. Their results demonstrate that communityservice goals were not related to profit goals, low- price niche, and multiplicity of outputs, workflow continuity, qualifications, or centralization. Griffin and Mahon (1997) examined the relationship between corporate social performance and corporate financial performance, with particular emphasis on methodological inconsistencies. They focused on chemical industry and used multiple sources of data both perceptual based (KLD Index and Fortune reputation survey), and performance based (TRI database and corporate philanthropy). They used the five most commonly applied accounting measures in the corporate social performance and corporate financial performance (CSP/CFP) literature to assess corporate financial performance. They concluded that priori use of measures may predetermine the CSP/CFP relationship outcome. Their results show that Fortune and KLD indices very closely track one another, whereas TRI and corporate philanthropy differentiate between high and low social performers and do not correlate to the firm’s financial performance. Balabanis, Phillips and Lyall (1998) concluded that CSR disclosure positively affected firm’s CSR performance and its concurrent financial performance. Involvement in environmental protection activities had negative correlation with subsequent financial performance. Policies of a firm regarding women’s positions resulted in positive capital market performance in the subsequent period. Donations to the Conservative Party were not to be related to companies past, concurrent or subsequent financial performance. McWilliams and Siegel (2000) conclude that CSR has a neutral impact on financial performance. Quazi and O’Brien (2000) conclude that corporate social responsibility is two-dimensional and universal in nature. Differences in cultural and market settings in which managers operate have very less impact on the ethical perceptions of corporate managers. Their study did not find any significant effect of CSR on the profitability. McWilliams and Siegel (2001) outlined a supply and demand model of corporate social responsibility (CSR). On the basis of this framework, they hypothesized that a firm’s level of CSR depends on its size, level of diversification, research and development, advertising, government sales, consumer income, labor market conditions, and stage in the industry life cycle. From these hypotheses, they concluded that there exists an “ideal” level of CSR, which managers can determine by doing costbenefit analysis. They established a neutral relationship between CSR and financial performance. Husted and Allen (2007) conclude that although CEOs and government leaders insist in public that CSR projects create value for the firm, privately they admit that they do not know if CSR pays off. Mackey, Mackey and Barney (2011) debate about whether firms should involve in socially responsible behavior. They have proposed a theoretical model in which the supply and demand of socially responsible investment opportunities determines whether these activities improve, reduce, or have no impact on a firm’s market value. Their theory shows that managers in publicly traded firms might fund socially responsible activities that do not maximize the present value of their firm’s future cash flows however maximize the market value of the firm.

3. Research methodology

For the purpose of analysis, sales and profit figures of largest 500 Indian companies was taken for two years 2008-09 and 2009-10. The CSR rating for these years 2009 and 2010 was taken from Kara- myog (www.karamyog.org). Ordinary Least Squares Regression analysis and correlation analysis is performed on the data using SPSS tool. The data of top companies with the largest market share and revenue across multiple industry segments is analyzed to see the impact of CSR on financial performance of the company if there exists a relationship between CSR activities and financial performance. Also, spread across industry segments ensures more robustness and gives more unbiased results and will catch the real essence of relationship between financial and social performance. Кагату og provides CSR rating for Indian companies. Karamyog is a platform for the Indian non-profit sector providing research on CSR activities of Indian companies. It rates the Indian Companies based on their CSR activities. The companies were rated on 0 to 5 scale based on criteria like products & services, reach of CSR activities, expenditure on CSR, harmful processes etc.

4. Objectives of the study

The main objective of the present study is to investigate if there is some relationship between CSR expenditure made by an organization and its financial performance as reflected in Sales Revenue and Net Profit figures. This relationship is required to determine if expenditure on CSR activities affects the financial performance and also if companies with good financial performance spend more on CSR.

4.1. Testable hypothesis. CSR initiatives as measured by CSR rating is a forecaster as well as a consequence of firm’s financial performance as measured by firm’s sales revenue and profits (Waddock and Graves, 1997). To achieve the objective of the paper, four hypotheses have been framed. They have been stated in null form.

Hp There is no significant relationship between Corporate Social Responsibility (CSR) in the current year and profits in the following year. The above hypothesis is based on the rationale that companies which invest in CSR activities have a better image in public, get positive media coverage besides having an improved ability to attract capital and skilled employees. These factors may lead to increased profits in the next year.

H2: There is no significant relationship between profits in the current year and CSR in the following year. This hypothesis is based on the reasoning that companies which are financially strong have available resources to invest in rural development, environment and other social causes.

H3: There is no significant relationship between CSR in the current year and sales revenue in the subsequent year.

H4: There is no significant relationship between sales revenue of current year and CSR of the next year.

There may be a time lag in implementation of corporate social activities and consequently improved financial performance in the form of increased sales revenue and profits (Blackbum, Doran and Shrader, 1994). Also, there may be a time lag between firms generating more sales revenue and earning greater profits taking up corporate’s social initiatives (Waddock and Graves, 1997). As in studies performed by Callan and Thomas (2009), Waddock and Graves (1997), Hart and Ahuja (1996), Russo and Fonts (1997), this study assumes a one year lag between the CSR and CFP impact. The independent variable has been lagged by one year.

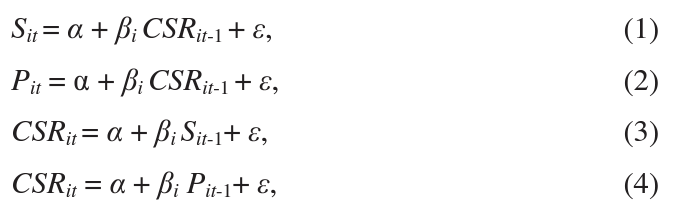

4.2. Model specification. The models are as follows.

where S is the sales, CSR is the expenditure on CSR, a is the regression intercept, [> is the regression coefficient, and e is the error term.

This research studies four models - two with CSR rating as independent variable and sales revenue and profits as dependent variables respectively and two with CSR rating as dependent variable and sales revenue and profits as independent variables respectively.

In equation (1), the dependent variable, S, refers to sales revenue in the year 2010 and CSR rating of 2009 has been taken as independent variable ß is the coefficient of the independent variables; e represents the error term; i and t are firm and time identifiers.

In equation (2), the dependent variable, P, refers to profit for the year 2010 and CSR rating of 2009 is taken as the independent variable.

In equations (3) and (4), CSR rating of the year 2010 has been taken as dependent variable and with sales revenue and profits for the year 2009 as independent variables respectively.

5. Analysis and interpretation of results

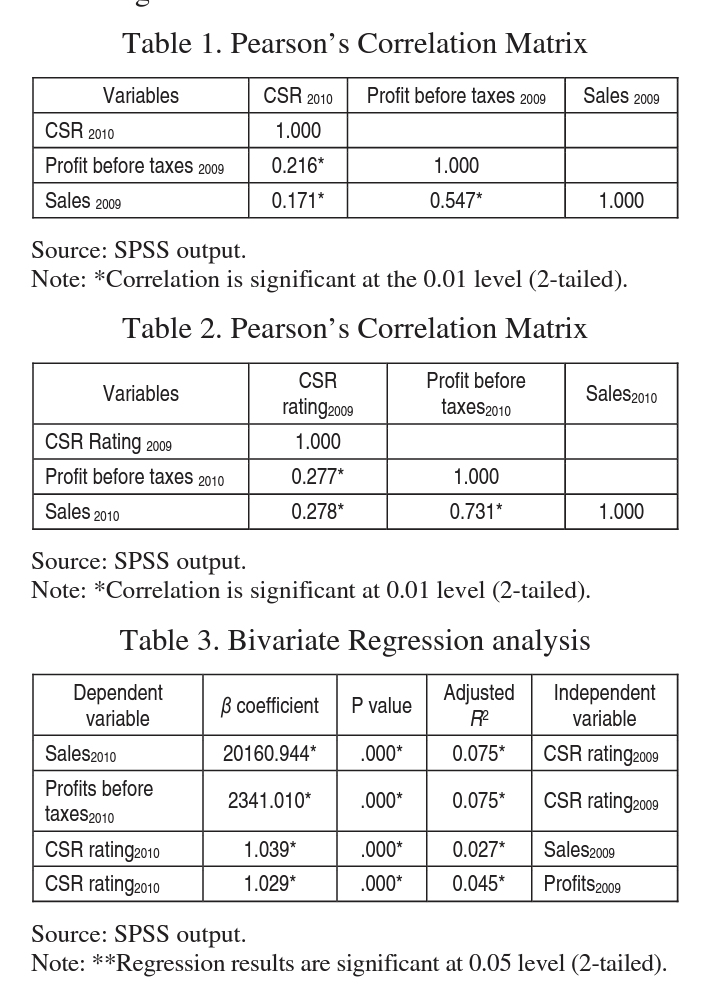

The results of the analysis have been reported in the following tables.

5.1. Correlation results. Correlation tables show moderate degree of positive correlation between the variables.

5.2. Regression results. The adjusted R2 measures the regression’s explanatory power. An adjusted R2 of 1 indicates that the independent variables explain all of the variations in the dependent variable. A value of 0 indicates that very little variation is explained by the independent variables.

The beta coefficients indicate the strength of relationship.

The P-value indicates at what level the results are statistically significant. Typically, a P-value of 5 percent or less shows that the results are significant. In the above table, a P-value of 0 shows that the results are significant.

Thus, in all the four cases, we reject the hypothesis and the model revealed that expenditure on CSR in previous year results in increase in average profits in the next year also, the firms having greater average sales and average profits spend more on CSR activities.

Summary and conclusions

The purpose of this study was to examine the relationship between the corporate social responsibility (CSR) of an organization and the financial performance of the organization. CSR rating of the organization has been taken as an indicator of CSR and profits and sales have been taken as indicators of financial performance. Four hypotheses were made. In order to test Hb regression analysis was done taking sales as the dependent variable and CSR rating as independent variable. In H2 profits were taken as dependent variable and CSR rating as independent variable. H3 has been built taking CSR rating as dependent variable and sales as independent variable. H4 takes CSR rating and dependent variable and profits as independent variable. By checking bidirectional casualty of data from 2009 to 2010, the results of the study show that CSR expenditure by the firm results in improved financial performance and also the firms having more sales and profits spend more on CSR activities. Most of the literature reviewed also concludes with positive relationship between CSR rating and financial performance. The results of our analysis clearly establish the relationship between CSR and financial performance. The relationship between CSR and financial performance has been empirically examined by many studies and there have been many theoretical debates and discussions concerning the positive relationship between corporate social performance and firm financial performance.

References

- Ali, L, Rehman, KU., Yilmaz, A.K., Nazir, S., J.F. Ali. Effects of corporate social responsibility on consumer retention in cellular industry of Pakistan I I African Journal of Business Management, - №4 (4). - pp. 475-485.

- Aras, G., Aydars, A., O. Kudu. Managing corporate performance: Investigating the relationship between corporate social responsibility and financial performance in emerging markets // International Journal of Productivity and Performance Management, - №59 (3). - pp. 229-254.

- Aupperle, K.L., Carroll, A.B., J.B. Hatfield. An Empirical Examination of the Relationship between Corporate Social Responsibility and Profitability // The Academy of Management Journal, - №28 (2). - pp. 446-463.

- Balabanis, G., Phillips, H.C., J. Lyall. Corporate social responsibility and economic performance in the top British companies: are they linked? II European Business Review, - №98 (1). - pp. 25-44.

- Barnett M.L. Stakeholder Influence Capacity and the Variability of Financial Returns to Corporate Social Responsibility // The Academy of Management Review, - №32 (3). - pp. 794-816.

- Baron, D.P. Corporate Social Responsibility and Social Entrepreneurship // Journal of Economics & Management Strategy, - №16 (3). - pp. 683-717.

- Baron, D.P. Private Politics, Corporate Social Responsibility, and Integrated Strategy // Journal of Economics & Management Strategy, - №10 (1). - pp. 7-45.

- Blackbum, V.L., Doran, M., C.B. Shrader. Investigating the dimensions of Social Responsibility and the consequences for Corporate Financial Performance // Journal of Managerial Issues, - №6 (2). - pp. 195-212.

- Boorman, S. Healthy profits: Workers’ wellbeing is directly linked to the bottom line // Western Daily Press [Bristol (UK)] July 5, 2011. - p. 1.

- Borgonovi, V., Meier, S., Manjari Sharda, M., L. Vaidyanathan. Creating Shared Value in India: How Indian Corporations Are Contributing to Inclusive Growth While Strengthening Their Competitive Advantage // FSG, 2011.

- Burke, L., J.M. Logsdon. How corporate social responsibility pays off // Long Range Planning, - №29 (4). - pp. 495-502.

- Callan, S.J. and J.M. Thomas. Corporate financial performance and corporate social performance: An update and reinvestigation// Corporate Social-Responsibility and Environmental Management, 2009. - №16 (2). - pp. 61-81.

- Clement, L.T. Corporate social responsibility - bottom-line issue or public relations exercise? // Financial Times, February 18, 2002. - №1. - pp. 5-13.

- Crawford D., T. Scaletta. The Balanced Scorecard and Corporate Social Responsibility: Aligning values for profit // The Management Accounting Magazine, CMA Management, - №79 (6). - pp. 20-27.

- Daviss B. Profits from Principle // The Futurist, - №33 (3). - pp. 28-33.

- Dolnicar S., A. Pomering. Consumer response to corporate social responsibility initiatives: An investigation of two necessary awareness states // ANZMAC Conference CD Proceedings, Dunedin, New Zealand, 2007. - №1. - pp. 3-6.

- Dufresne, F.B., P. Savaria. Corporate Social Responsibility and Financial Risk // The Journal of Investing, - №13 (1). - pp. 57-66.

- Falck, O., S. Heblich. Corporate social responsibility: Doing well by doing good // Business Horizons, - №50 (3). - pp. 247-254.

- Friedman M. The Social Responsibility of Business Is to Increase Its Profits // Corporate Ethics and Corporate Governance, - №4. - pp. 173-178.

- Fryxell, G.E. and Jia. The Fortune corporate ‘reputation’ index: Reputation for what? // Journal of Management, - №20 (1). - pp. 1-14.

- Fry, L.W., Keim, G.D., R.E. Meiners. Corporate Contributions: Altruistic or For-Profit? // The Academy of Management Journal, - №25 (1). - pp. 94-106.

- Griffin, J.J, J.F. Mahon. The Corporate Social Performance and Corporate Financial Performance Debate // Business and Society, - №36 (1). - pp. 5-31.

- Hallinan, E. Objectives: Profitability Isn’t the Only One // Reeves Journal, - №86 (4). - pp. 18, 20.

- Hammond, S.A., J.W. Slocum. The impact of prior firm financial performance on subsequent corporate reputation // Journal of Business Ethics, - №15 (2). - pp. 159-165.

- Hart, S., G. Ahuja. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance // Business Strategy and the Environment, - №5 (1). - pp. 30-37.

- Henderson, D. The Case Against Corporate Social Responsibility // Policy, - №17 (2). - pp. 28-32.

- Husted, B.W., D.B. Allen. Strategic Corporate Social Responsibility and Value Creation among Large Firms: Lessons from the Spanish Experience // Long Range Planning, - №40 (6). - pp. 531-642.

- Ivana B., Ivona S., Influence of Ethics Education on Management and Entrepreneurship Students Attitude toward Ethical Behavior: Case of Croatia H The Business Review, Cambridge, 2011. - №17 (2). - pp. 197-204.

- Jenkins, H. A ‘business opportunity’ model of corporate social responsibility for small- and medium-sized enterprises // Business Ethics: A European Review, - №18 (1). - pp. 21-36.

- Jones, MT. The Institutional Determinants of Social Responsibility I I Journal of Business Ethics, - №20 (2). - pp. 163-179.

- Kamani, A. The Case Against Corporate Social Responsibility // The Wall Street Journal, - №1.

- Kashyap R., Mir R., E. Iyer. Toward a responsive pedagogy: linking social responsibility to firm performance issues in the classroom // Academy Management Learning Education, - №5 (3). - pp. 366-376.

- Klassen, Robert D., P. McLaughlin Curtis. The impact of environmental management on firm performance // Management Science, - №42 (8). - pp. 1199-1215.

- Kraft, K.L., J. Hage. Strategy, social responsibility and implementation // Journal of Business Ethics, - №9 (l).-pp. 11-19.

- Kraft, K.L., A. Singhapakdi. The role of ethics and social responsibility in achieving organizational effectiveness: Students versus managers // Journal of Business Ethics, - №10 (9). - pp. 679-686.

- Light, L. Marketers. Seize The Opportunity To Help Heal Society’s Ills // Advertising Age, - №78 (45). - pp. 34.

- Mackey, A., Mackey, T.B., J.B. Barney. Corporate Social Responsibility and Firm Performance: Investor Preferences and Corporate Strategies // The Academy of Management Review, - №32 (3). - pp. 817-835.

- McWilliams, A., Siegel, D. Corporate social responsibility and financial performance: correlation or misspecification // Strategic Management Journal, - №21 (5). - pp. 603-609.

- McWilliams, A., D. Siegel. Corporate Social Responsibility: A theory of Firm’s Perspective // The Academy of Management Review, - №26 (1). - pp. 117-127.

- Mittal, R.K., Sinha, N. and A. Singh. An analysis of linkage between economic value added and corporate social responsibility // Management Decision, - №46 (9). - pp. 1437-1443.

- Moore, G. Corporate Social and Financial Performance: An Investigation in the U.K. Supermarket Industry // Journal of Business Ethics, - №53 (1-2). - pp. 73-86.

- O’Neill, H.M., Saunders, C.B., A.D. McCarthy. Board members, corporate social responsiveness and profitability: Are trade-offs necessary? // Journal of Business Ethics, - №8 (5). - pp. 353-357.

- Paterson, R. (2000). “High-fliers choose ethics over avarice”, Sunday Herald, Glasgow (UK), 3 Edition, December 31,2000, p. 5.

- Pava, M.L., J. Krausz. The association between corporate social-responsibility and financial performance: The paradox of social cost // Journal of Business Ethics, - №15 (3). - pp. 321-357.

- Quazi, A.M., D O. Brien. An Empirical Test of a Cross-national Model of Corporate Social Responsibility // Journal of Business Ethics, - №25 (1). - pp. 33-51.

- Reich, R.B. The Case Against Corporate Social Responsibility // Goldman School of Public Policy, 2008. Working Paper No. GSPP08-003.

- Russo, M., P. Foots. A resource-based perspective on corporate environmental performance and profitability // Academy of Management Journal, - №40 (3). - pp. 534-559.

- Stanwick, P.A., P.D. Stanwick. The Relationship between Corporate Social Performance, and Organizational Size, Financial Performance, and Environmental Performance: An Empirical Examination // Journal of Business Ethics, - №17 (2). - pp. 195-204.

- Wilks, Neil. Good behaviour is its own reward // Professional Engineering, - №15 (8). - pp. 36-37.

- Waddock, S.A., S.B. Graves. The Corporate Social Performance-Financial Performance Link // Strategic Management Journal, - №18 (4). - pp. 303-319.

- Yang, F.J., C.W. Lin, Y.N. Chang. The linkage between corporate social performance and corporate financial performance // African Journal of Business Management, - №4 (4). - pp. 406-413.

- Younghwan K., Jungwoo L., Y. Taeyong. Corporate Transparency and Firm Performance: Evidence from Korean Ventures // International Council for Small Business (ICSB). World Conference Proceedings, 2010. - pp. 1-35.

Appendix

Table 1. Rating criteria used by Karamyog

Necessary criteria | Explanation | Rating level |

Panel A. Minimum necessary criteria (necessary parameters that make a company eligible for a particular rating level) | ||

If undertaking any CSR activity | Where any kind of social, developmental or community work is done | Level 1 |

If CSR is linked to reducing the negative impacts of company’s own products or processes | CSR activities that aim to improve processes and products of the company | Level 2 |

If CSR initiatives are for the local community | CSR activities that are focused on those who are affected directly by the company | Level 3 |

If CSR is embedded in the business operations | CSR activities form a part of the daily business activities of the company | Level 4 |

If innovative ideas and practices are developed for CSR | CSR activities enable sustainable and replicable solutions to problems faced by society | Level 5 |

Panel B. Sufficient criteria for minimum rating (if the company is doing this, it automatically gets this rating at least) | ||

Sufficient criteria | What this means | Rating level |

Company fulfilling the basic needs of society e.g. manufacture of food | The products and services of the company are useful and benefits society | Level 1 |

Unique CSR activity which would not otherwise happen e.g. developing a mapping and tracking software for adoption in India | The CSR activity being undertaken by the company is not being done by government, NGOs, etc. | Level 1 |

Sufficient criteria | What this means | Rating level |

Company reducing negative impact of others e.g. a company that makes water purification & waste recycling systems | The company’s products or senrices provide solutions to mitigate harm caused by actions of companies, their products, etc. | Level 1 |

Company adopting the GRI framework for CSR reporting | The company is committed to measuring and reporting its CSR initiatives as per a voluntary globally accepted framework. | Level 2 |

Company’s annual expenditure on CSR = 0.2% of sales | The company is committed to a minimum expenditure on CSR annually, and thus considers CSR as an integral part of its business | Level 3 |

Panel C. Negative criteria that usually determine the maximum possible rating (companies in this category will not normally get a higher rating than the one shown) | ||

Negative criteria | Reason | Rating level |

Companies that make liquor, tobacco, genetically modified crops | These products are not needed by society, and cause harm to people and the environment. The CSR to do is to stop making these products. | Level 0 |

Companies that violate laws/rules/regulations | CSR is not limited just to how a company spends its money, but also to how it makes that money in the first place | Level 1 |

Companies engaged in high impact processes | Processes that severely damage the environment require extraordinary efforts by the company to reduce and repair the damage, and require greater contributions to benefit society | Level 1 |