The impact of management board diversity on corporate performance - An empirical analysis for the German two-tier system

Published: Feb. 25, 2014

Latest article update: Dec. 5, 2022

Abstract

For the last two decades, board diversity is increasingly considered as a significant mechanism of good corporate governance. Thus, the question arises whether a heterogeneously or rather a homogenously composed board contributes to the efficiency of a company’s management and monitoring. Especially national and international regulators and standard setters consider board diversity to be associated with an increasing firm performance. Therefore, the economic impact of board diversity aspects needs to be investigated empirically. This study examines the relationship between diversity within management boards and corporate performance for the German two-tier system by presenting a comprehensive literature analysis as well as an empirical analysis based on 149 publicly listed German organizations for the financial years 2009, 2010 and 2011. Hence, management board diversity is characterized by attributes, such as gender, age, nationality and functionality. An analysis comparable to the one at hand including multiple dimensions for German companies has not been performed, yet. We mostly find negative effects of various board diversity characteristics on corporate performance, especially regarding age and national diversity. This may be due to the fact that great internationality on boards can decrease communication between board members and large age differences may alleviate decision-making processes

Keywords

Board of directors, board composition, corporate governance, diversity, firm value

Introduction

Board diversity represents a significant corporate governance (CG)1 (Corporate Governance refers to a system by which corporations are directed and controlled. The governance structure specifies the distribution of rights and responsibilities among different participants in the corporation and specifies the rules and procedures for making decisions in corporate affairs (see OECD Principles of Corporate Governance 2004, p. 1)) mechanism in order to realize efficient management and monitoring within companies (Boone et al., 2007, p. 67). Thereby, the consideration of diversity when selecting the board of directors (one-tier system) or the management board and the supervisory board (two-tier system) is essential. Within the empirical CG research, analyses regarding the economic effects of board diversity play a major role (Loden & Rosener, 1991; Van den Berghe & Levrau, 2004, p. 462). Besides board diversity, board size is also implied when evaluating the performance of business managements. The determination of an optimal board size (Jensen, 1993; Lipton & Lorsch, 1992; Di Pietra et al., 2008) and board diversity constitutes an essential CG mechanism due to possible effects on companies’ performance.

The relevance of the topic results from a normative as well as an empirical respect. The capital market’s confidence in the quality of CG, accounting and external auditing was damaged by the recent financial crisis. In 2010 and 2011 the EU Commission responded to this with three green papers. These papers attach great importance to increase the monitoring quality of the management and supervisory board by reducing conflicts of interests and considering diversity issues.

A large number of empirical CG-studies consider board diversity as an indicator of success for the international corporate practice (e.g. Kiel & Nicholson, 2003; Rose, 2007a; Dahya & McConnell, 2007). This article comprehensively summarizes prior empirical research results regarding different measurement variables and the diverging effect of board diversity on business performance. Therefore, we perform a multiple regression analysis regarding the impact of multi-dimensional management board diversity within the German two-tier system for three financial years.

Our sample consists of 149 German listed firms and the financial years 2009, 2010 and 2011. The variables of management board diversity, which are integrated in our model, are age, gender, nationality and functional diversity. Our research question is, whether a statistical correlation between selected variables of management board diversity and figures of business performance can be found. A comparable analysis including multiple dimensions for German companies has not been performed, yet. We expect new insights about the German corporate governance system and further reform measures to increase corporate governance quality.

The remainder of this paper is structured as follows. The first section comprises a theoretical foundation in accordance with the principal agent-, stewardship-, social psychological-, critical mass-, social cognition and resource dependence-theory. Section two summarizes the results of recent empirical CG research regarding various variables of board diversity (gender, national, educational/functional and age diversity). Based on this literature review, the hypotheses are derived. Section three incorporates the methodology and the empirical evidence on board diversity in the German two-tier system. Lastly, the last section will give the conclusions and an outlook for future research.

1. Theoretical background

In contrast to the one-tier system which is prevalent in Anglo-Saxon countries, the German Stock Corporation Act (GSCA) has provided for two administrative bodies with the management board (“Vorstand”) and the supervisory board (“Aufsichtsrat”). Therefore, the two-tier system follows the idea of an organizational separation of management and supervision. Following this principle of separation, members of the supervisory board are not allowed to belong to the management board of the company simultaneously (§ 105 GSCA). While the management board is leading the organization (§ 76 GSCA), the supervisory board appoints, monitors and advises the members of the management board and is involved in decisions of fundamental importance to the enterprise (§§ 84, 111 GSCA). The members of the supervisory board are elected by the shareholders at the general meeting (§ 101 GSCA). In firms with more than 500 or respectively 2,000 employees within Germany, the employees are also represented in the supervisory board (codetermination). In order to increase its efficiency, the supervisory board has the possibility of appointing committees (§ 107 GSCA). In this context audit committees among other things deal with the supervision of the tendering of accounts, the effectiveness of the risk management system and the external audit (§ 107 GSCA). The authorities of an audit committee on the German model are more limited in comparison with Anglo-Saxon audit committees though.

The principal-agent theory serves as an appropriate approach for board diversity and its effects on business performance in one-tier and two-tier systems (Berle & Means, 1932; Jensen & Meckling, 1976). The board of directors or the management board and supervisory board within listed public companies represent the agents of the shareholders (principals) because they adopt and execute business management and monitoring on behalf of the shareholders (Yermack, 1996; Daily et al., 2003). The major problems of the agency theory are information asymmetries due to hidden characteristics, hidden information, hidden action and hidden transfer. Therefore, the risks of adverse selection and moral hazard increase (Berle & Means, 1932; Jensen & Meckling, 1976). Furthermore, conflicts of interests between the corporate administration and the capital market arise. The corporate administration ideally operates in the investors’ interests by considering the shareholder value-policy. Through monitoring and bonding, which also causes agency costs, hidden actions are supposed to be reduced.

Contrary to the agency theory the stewardship theory (Davis et al., 1997; Donaldson & Davis, 1991) neglects the assumption that board members act opportunistically. Therefore, the board members are supposed to operate in terms of shareholders and the capital market, whereas a trade-off between personal needs and corporate objectives takes place. In order to ensure the stewards’ self-motivation, specific monitoring activities are counterproductive. This is based on the assumption that the management board’s activities correspond with the interests of the shareholder meeting. Furthermore, the management board is aiming to reduce possible information asymmetries. The supervisory board rather functions as a supporting and consulting instance, which creates and expands the optimal framework for the management (Donaldson & Davis, 1991, pp. 51-52; Muth & Donaldson, 1998, p. 6; Ong & Lee, 2000, p. 9).

The resource-dependence theory developed by Pfeffer and Salancik (1978) focuses on the mutual interaction between organizations in order to support the exchange of resources. The long-term prosperity of companies depends on the availability and the controlling possibilities regarding critical resources (Pfeffer & Salancik, 1978, p. 2). Thereby, the members of corporate administration, who distinguish in terms of age, gender, nationality or education, are able to concentrate the diverging resources for the benefit of the company (Hillman et al., 2000). Hereafter, a higher effectiveness of board activities can be justified, for example due to higher information processing or the necessity to discuss within the plenum (Carter et al., 2010, p. 398). Due to the members’ different individual contacts inside and outside the company, a variety of additional resources are generated by a growing board-size.

Apart from the generally accepted theories explained above, the theoretical foundation of board diversity effects can be deduced from behavioral sciences. Appropriate theories in the field of behavioral sciences are e.g. the social psychological theory2 (The social psychological theory (Latane & Wolf, 1981) argues that different characteristics of board members reduce their social cohesion and thus decrease the probability that the minority’s opinion will influence decision-making by the rest of the board), the critical mass theory3 (The critical mass theory indicates that a certain number of persons are required to influence social action (Oliver et al., 1985). With regard to board diversity this theory is basically used to examine the number of female board members needed to significantly influence the decisionmaking process and to evoke fundamental changes in the boardroom) or the social cognition theory4 (The social cognition theory (Miller & Dollard, 1941) states that individuals tend to categorize other persons, e.g. female directors, into certain groups (groupthink). Consequently, individuals treat members of a certain groups with respect to previous experience, knowledge and biases (Ernst & Young, 2009)). This paper’s objective is to analyze the financial and economic impact of board diversity and focuses on the generally accepted principal-agent, stewardship and resource-dependence theory, because these theories appear to be the most relevant economic theories of our research.

Economic factors are based on the assumption that firms which fail to select the most able candidates for the management board decrease their financial performance. Greater board diversity regarding gender, nationality, functionality and age can be connected with a firm’s competitive advantage relative to companies with less diversity. The main arguments, which support this hypothesis, are stated by Robinson and Dechant (1997). Firstly, board diversity promotes a better understanding of the market by matching the diversity of the management to the diversity of potential customers and employees. Secondly, it is argued that board diversity as one of the most important demographic factors is linked with more creativity and innovation. Furthermore, diversity can enhance problem-solving as the range of perspectives that result from a more diverse management implies more alternatives, which are evaluated. Therefore, the board has a better understanding of the complexity of the business environment. These potential advantages of board diversity are not only limited to gender, but also connected with nationality, functionality and age.

There are also risks of board diversity, which could lead to a decreased firm performance. Members of homogeneous boards (with low diversity) are more cooperative and experience fewer emotional discussion. Therefore, decision-making can be more costly in terms of time and less effective. The likelihood of conflict is higher in diverse boards and this can be problematic if a firm is operating in a strong competitive market where the possibility to react quickly to changes is an important task (Wilhams & O’Reilly, 1998). These different arguments encompass both, positive and negative association between management board diversity and firm performance. The following section shows that these diverse results are also stressed by the empirical corporate governance research.

2. Empirical corporate governance research on board diversity effects

2.1. Gender diversity. Hereafter, the results of our literature analysis regarding prior empirical CG research on the effects of different board diversity variables on corporate performance are presented. Gender diversity within boards forms a major focus of empirical CG research regarding the board composition. This research focus has developed from a long-lasting political discussion on gender diversity in management boards. The primarily used figure of firm performance within this field of research is the Tobin’s Q ratio (Lückerath-Rovers, 2013; Fauzi & Locke, 2012; Adams & Ferreira, 2009). The results are characterized by strong heterogeneity resulting in an uncertain interdependency. Besides the US, increased research activity is performed in Scandinavian countries (i.e. Norway) due to the introduction of fixed female quota within boards (see Appendix). Furthermore, investigations for European countries, such as Great Britain and Spain and for Asian and African countries were performed.

In the EU, gender diversity is of interest. The European Commission has published a master plan concerning corporate governance as well as a directive proposal in 2012, which includes the implementation of a fixed female quota of 40 percent within supervisory boards and for non-executive members of the board of directors. The respective EU Commissioner aims to achieve a regulation, in case the self-commitment of the companies regarding a stronger consideration of gender diversity does not lead to the results desired. Besides, a few European countries, such as Norway, already established fixed proportions of female quota in boards.

The under-representation of women within boards is known as the “glass ceiling-problem” (Arfken et al., 2004, p. 180), which is based on a different life and career management, a predominant male business culture, and the two-sided pressure resulting from career as well as family accomplishments (Vinni- combe & Singh, 2003, p. 296; Holst & Busch, 2008, p. 17). Daily et al. (1999) investigated the Fortune 500 companies with the result that women made good progess regarding the board representation but still occupy CEO positions very rarely. The genderspecific unequal distribution was proven for Great Britain, too (Singh & Vinnicombe, 2004; Conyon & Mallin, 1997; Brammer et al., 2007). Within the politically motivated requirement to consider gender diversity, the “old boys network” is mentioned frequently. Hereafter, male board members more often participate in conflicts of interests due to multiple mandates and cross-shareholding between different companies (Carter et al., 2010, p. 399). According to Eagly and Johnson (1990) and Eagly et al. (2003), women tend to a less hierarchical but rather cooperative leadership, which supports the communication and the forming of opinions within boards.

Although the topic receives particular attention, the capital market does not indicate consistent results whether gender diversity has positive or negative effects. Besides positive effects on firm performance (Lückerath-Rovers, 2013; Ujunwa et al., 2012; Ujunwa, 2012; Catalyst, 2004; Carter et al., 2003; Adler, 2001), negative effects (Fauzi & Locke, 2012; Dobbin & Jung, 2011; Adams & Ferreira, 2009; Shrader et al., 1997; Krishnan & Parsons, 2008; Gul et al., 2007) and missing correlations (Jhunjhunwala & Mishra, 2012; Shukeri et al., 2012; Sun et al., 2011; Carter et al., 2010; Farrell & Hersch, 2005; Erhardt et al., 2003) are also determined. This also applies to the Scandinavian area (positive correlation according to Torchia et al., 2011; Nielsen & Huse, 2010, negative effect according to Bphren & Strom, 2010 and missing correlation according to Rose, 2007a; Randoy et al., 2006; Smith et al., 2006; Du Rietz & Henrekson, 2000). In Norway a legal female quota of 40 percent in the management has been introduced in 2006. This standardization counteracts the “tokenism phenomena”, which implies that companies occupy only a few board positions with female board members in order to fulfill the external expectations (Torchia et al., 2011, p. 300).

Referring to Carter et al. (2003), the positive influence results from a larger talent pool, which companies are able to use for recruiting qualified board members despite of gender-specific criteria. Catalyst (2004), a US-American research and consultancy organization, was able to prove a positive influence of gender diversity on financial performance based on the Return on Equity (ROE) and the Total Return to Shareholders (TSR). The positive impact on ROE applies to all industry sectors, while a positive effect on the TSR has been identified for 80 percent of the industry sectors. Additionally, an endogenous effect was observed, which states that financially strong businesses have increased gender diversity (Catalyst, 2004, p. 10). Besides a positive influence of gender diversity on corporate performance, Adams and Ferreira (2009) also determine, that an increasing number of female board members induces a higher meeting attendance rate of the male board members. This assumption is based on the fact, that female board members more frequently take part in meetings. Furthermore, the investigation discovered that gender diversity also increases the proportion of share-based payment. The major research results regarding the effect of gender diversity on corporate performance are summarized in Appendix.

Based on the literature review and prior empirical evidence on gender diversity the following hypothesis was derived.

H1: Gender diversity in management boards increases corporate performance.

2.2 National diversity. As gender diversity is in the center of attention, additional diversity variables (nationality, ethic, education, function and age) are investigated rarely. With regard to the international composition of the board (national diversity), the CG report by Heidrick and Struggles (2009) shows that in Europe the foreign percentage within boards has increased from 11 up to 23 percent within the years from 2007 to 2009. With regard to empirical CG research, it is expected that national diversity will gain importance due to the globalizing tendencies. However, there is an increasing number of empirical research studies for Scandinavian countries (Norway, Sweden and Denmark), e.g. by Oxelheim and Randoy (2003), Randoy et al. (2006) and Rose (2007b), measuring a positive influence of foreign board members on companies’ performance. A positive link was also stated by Ujunwa et al. (2012) and Ujunwa (2012) for Nigerian quoted firms. Oxelheim and Randoy (2003, p. 2370) observe only foreigners, who are originally from the US, Canada or England due to the planned adaption of the Anglo-American CG system. Randoy et al. (2006) use a different concept for the 500 largest Danish, Norwegian and Swedish companies as the foreigners are not bound to specific regions. Prior research results are reviewed in Appendix.

Based on the CG research regarding national diversity within boards the following hypothesis was proposed.

H2: National diversity in management boards increases corporate performance.

2.3. Educational and functional diversity. The heterogeneity within boards regarding educational and functional diversity becomes more relevant as the complexity of the economic framework increases (Mahadeo et al., 2011, p. 378). Professional experience and expertise are primarily expected in the departments of human resources, investment, finance, accounting or marketing (Houle, 1990, p. 35). In comparison to gender diversity, only a few empirical studies analyze the influence of educational and functional diversity on corporate performance.

Cannella et al. (2008) distinguish between intrapersonal functional diversity (within-member breadth of functional experience) and dominant functional diversity (heterogeneity in the functional areas in which each top management team (TMT) member has served the longest). This study finds that intrapersonal functional diversity has a positive impact on firm performance. Environmental uncertainty and TMT co-location are tested to have a strong and positive moderating effect on intrapersonal diversity and its impact on firm performance. The authors also find a positive and significant effect of team member co-location on dominant functional diversity and its effect on firm performance.

Simons et al. (1999) show that educational diversity has a positive but not significant effect on both, change in profitability and sales growth, whereas functional background diversity has a negative impact. Additionally, they find that open discussion among top management members has a moderating effect on (acts as a moderator between) diversity and performance. A culture of open discussion combined with both, educational as well as functional background heterogeneity has a positive impact on firm performance. Camelo et al. (2010) find a positive relationship between educational diversity in top management and innovation performance. Contrarily, they find a negative effect of functional diversity on innovation performance.

Mahadeo et al. (2011) distinguish between the degree of prior professional experience and education. Hereby, on the one hand a significantly positive correlation between board size and educational diversity and on the other hand between educational diversity and gender diversity was derived. In contrast to prior research results, this study tests the hypothesis that higher educational diversity decreases the corporate performance (based on ROE). Possible explanations for the negative correlation are communication and coordination problems due to different professional experiences. The efficiency of the business administration would be impaired by long-lasting discussions in the context of decisionmaking and potential “block construction”.

Professional experience and expertise can also be attributed to prior job positions and employments. Board members, who were appointed internally, have gained more precise firm knowledge than outsiders. Baysinger and Butler (1985) investigate the connection between the proportion of independent directors and ROE. In their results, Baysinger and Butler (1985) summarize that boards with both, insiders and outsiders, create high ROE. The relevant results for this diversity dimension are summarized in Appendix.

Based on the aforementioned literature review and theoretical background we evaluate the following hypothesis.

H3: Functional diversity in management boards increases corporate performance.

2.4. Age diversity. The consideration of a wide range of age within board composition is also expected to affect the company’s performance positively. In prior literature, boards are often distinguished by age and functions. Thereby, the eldest part of the board has the necessary experience, while the middle-aged part assumes the responsibility and the youngest members are prepared for their management position in order to ensure the future of the company (Houle, 1990, p. 34). Surprisingly, age diversity within boards is evaluated rarely. Simons et al. (1999) and Richard and Shelor (2002) identify a negative relation between age diversity and corporate performance. According to Richard and Shelor (2002) age diversity in top management shows a curvilinear impact on sales growth. For low and medium levels of age diversity, the relationship between age diversity and sales growth is positive. For high levels of age diversity there is a negative impact on sales growth. Furthermore, the authors conclude that context plays an important moderating role regarding the impact of age diversity on firm performance. Innovation and environmental complexity have a positive moderating effect on the relationship between age diversity and firm performance.

McIntyre et al. (2007) examine age diversity within boards of S&P500 as well as TSX Compositive Index companies. Hereby, the hypotheses that a low and high level of age diversity decreases the corporate performance are tested. McIntyre et al. (2007) assume that a “moderate” level would increase the performance. A significant positive effect of age diversity was determined on the basis of the Tobin’s Q ratio, but not by using the performance figures Economic Value Added (EVA) and Return on Assets (ROA). Furthermore, the hypothesis that the financial performance increases due to higher average age is rejected (McIntyre et al., 2007, p. 555). This result is not consistent with the investigation by Kang et al. (2007), who analyzed the top 100 Australian companies and value experience and expertise of older board members as more important than dynamics and potential creativity of young professionals. Thereby, a positive relation between age diversity and board size was proven. Bonn (2004) analyzes the board composition and its influence on ROE and Tobin’s Q ratio in Australian companies. This research did not identify any influence of age diversity on company’s performance.

Appendix summarizes the essential results regarding the influence of national, educational, functional as well as age diversity on corporate performance. Based on the literature review and CG research results regarding age diversity the following hypothesis was proposed.

H4: Age diversity in management boards increases corporate performance.

Based on these hypotheses the following section incorporates the methodology and tests the hypotheses on board diversity in the German two-tier system empirically.

3. Empirical study for the German two-tier system

3.1. Methodology. In order to analyze the rela- tionnship between board diversity and corporate performance, we gathered information for the years 2009, 2010 and 2011 on the largest 160 publicly traded German companies, which are listed in the blue-chip indices DAX305 (The DAX30 is often described as the benchmark index for the German equity market. The DAX index measures the share performance of the 30 largest German companies in terms of exchange turnover and market capitalization, and is thus an established indicator for the performance of the German company as a whole (Deutsche Boerse Group, 2012)), MDAX6 (The MDAX includes the 50 largest companies – known as mid-caps – from classic sectors in Prime Standard ranking directly below the DAX30 shares. The index mainly contains shares from the sectors pharmaceuticals, chemistry, machinery, and finance (Deutsche Boerse Group, 2012)), SDAX7 (The SDAX index comprises 50 companies from classic sectors in the Prime Standard segment that rank directly below the MDAX shares in terms of size (Deutsche Boerse Group, 2012)) and TecDAX8 (TecDAX reflects the price development of the 30 largest technology shares in Prime Standard below DAX30 (Deutsche Boerse Group, 2012)). The 160 largest listed companies were chosen due to the availability of data and the fact that these four indices include blue chips, mid caps and small caps of various industries. The information on the board of directors’ diversity attributes and the companies’ performance figures were drawn from the annual financial statements, the companies’ homepages and the Bloomberg databases. The sample had to be reduced from 160 to 149 companies due to missing data and a few companies, which are organized in the one-tier system and therefore, are not comparable to majority of the sample organized in the two-tier system. Thus, a total of 447 financial years was included into the multiple regression model. We chose the period from 2009 to 2011 after the global financial crisis in order to avoid any bias in the sample that may have resulted from including years of the crisis. Furthermore, we do not assess the European debt crisis which began in 2010/2011 significantly influencing our investigation as we concentrate on German companies.

The diversity within the boards of directors was examined by four attributes, which represent the independent variables of our multiple regression model. The ‘female quota’ reflects the proportion of women on the board of directors, while the variable ‘outsiders’ describes the proportion of externally appointed board members as opposed to internally recruited board members. The variable ‘intematio- nality’ represents the number of different nationalities within the boards. Additionally, the age structure of the boards of directors was determined by forming five age groups9 (The board members’ ages were divided into the following five classes: < 40, 40 < 49, 50 < x < 59, 60 < x < 69, > 69). The independent variable ‘age groups’ reflects the number of different age groups, which appear within the boards. Corporate performance is measured by the dependent variable ‘EBITDA- margin’, which expresses the companies’ operating profitability and, as a relative performance figure, provides a better comparability between differently sized businesses. This financial ratio is defined as earnings before interest, tax, depreciation and amortization (EBITDA) divided by total revenue. Additionally, we regressed the variable Tobins’s Q ratio on the independent variables (‘female quota’, ‘outsiders’, ‘intemationality’, and ‘age groups’) but the results presented very low significances and minimal R-squared. Thus, we preferred the EBIT-margin over the Tobin’s Q ratio as the performance figure.

This study uses multiple regression analysis in order to investigate the effect of board diversity on corporate performance. For the years 2009, 2010 and 2011 the dependent variable ‘EBITDA-margin’ is regressed against the four independent diversity variables ‘female quota’, ‘outsiders’, ‘intemationality’, and ‘age groups’.

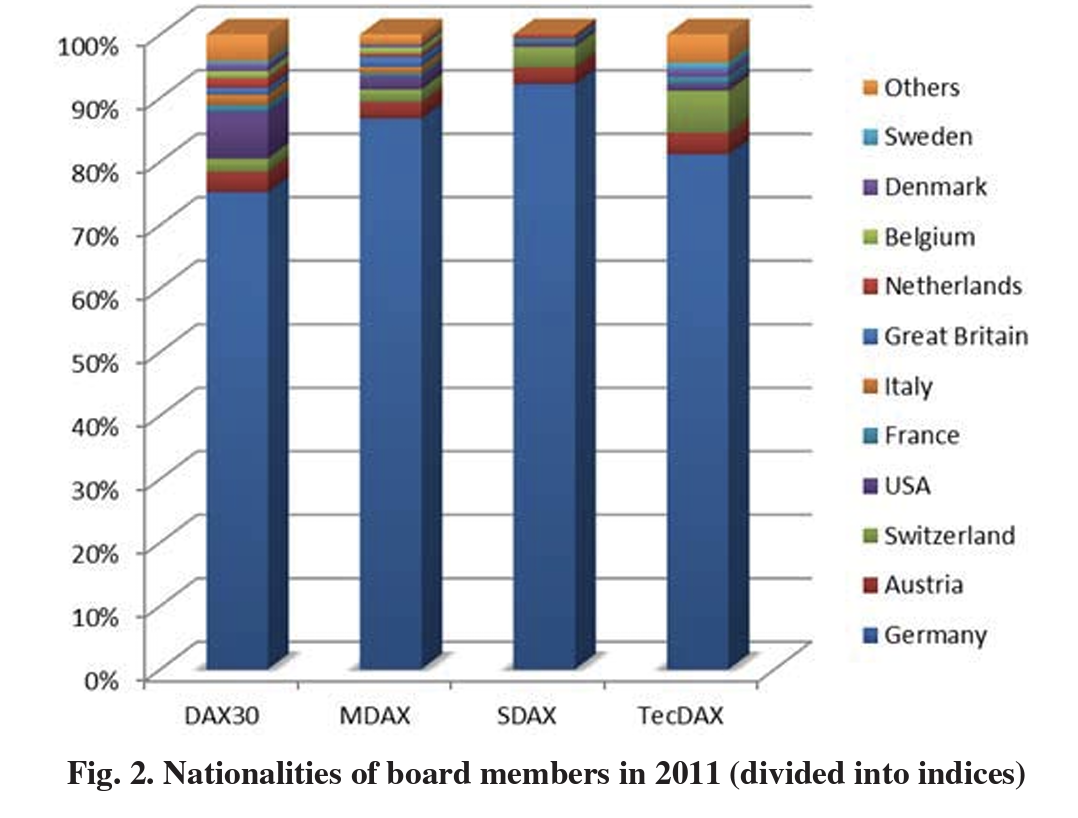

The statistical model of business performance can be expressed as:

where i refers to the company and t refers to the time.

Additionally, we integrated control variables in our multiple regression model. In order to control for firm-specific variables and avoid any firm size bias, we controlled for board size, firm age and firm size which was expressed by the number of employees.

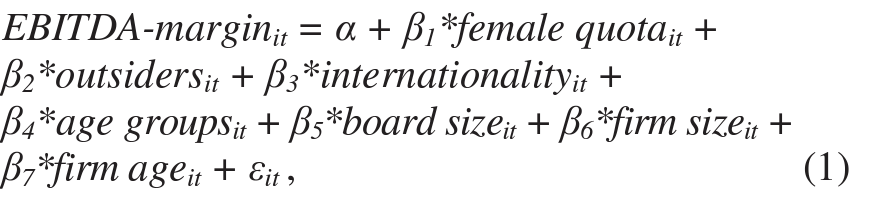

3.2. Descriptive statistics. Based on the data gathered for the years 2009, 2010 and 2011 on the largest 160 publicly traded German stock companies we first determine the boards’ age structures. Figure 1 presents a link between companies’ size and the average age of board members, which illustrates that companies of the DAX30 delegate corporate management to more experienced board members. The boards’ average age in DAX30-companies not only exceeds the total average of 51.3 years of age for 2011, but also clearly surpasses the averages of the SDAX and TecDAX stock indices.

Furthermore, a link between average age and sector affiliation can be identified, as especially companies of communication, media and technology sectors present an average age, which is considerably lower than the total average of all indices. Thus, organizations’ products and business models, which strongly require creativity and innovation ability and aim at achieving a rather young costumer group, seem to employ younger board members in order to pursue their objectives.

Moreover, the collected data demonstrate that German companies prefer board members who same DAX-company before they were appointed into the board of directors. However, the annual comparison indicates a trend towards an increasing proportion of externally appointed board members. appointed internally whereas in 2011 this proportion decreased to 59.42 percent. Increasing globalization as well as the rising Anglo-American impact on the European economy may be reasons for this development.

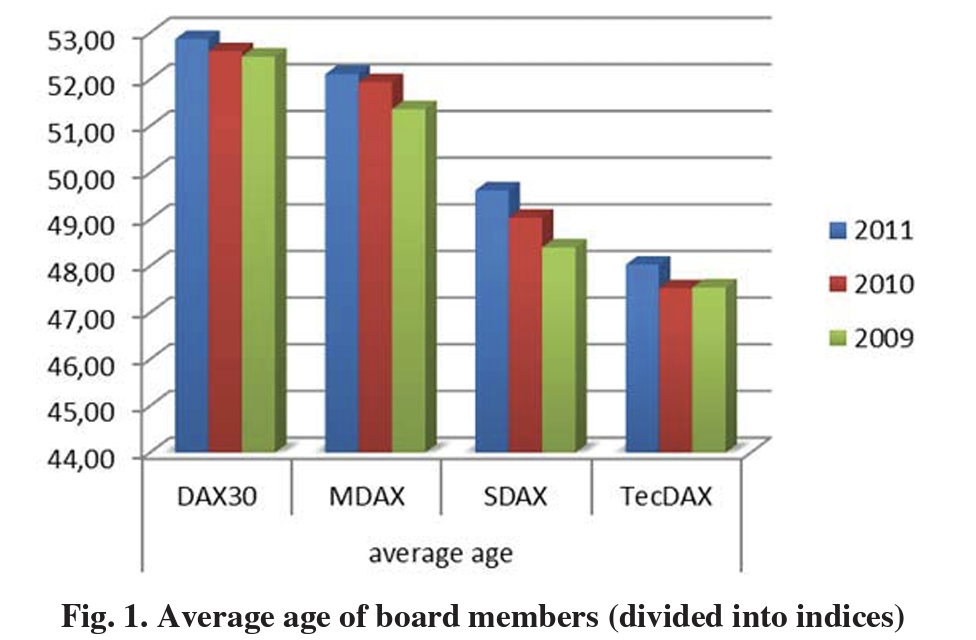

With regard to national diversity within boards, a strong majority of German managers (83.76 percent) is identified on the 160 German DAX-companies. However, considering the proportion of Swiss and Austrian board members on German boards (see DAX30 stock index has an extraordinary position regarding the board members’ nationalities due to the smallest proportion of 75.13 percent German board members and the greatest diversity expressed by 18

3.3. Empirical evidence. The descriptive statistics and correlation results are reported in Appendix, Tables 4, 5 and 6. The mean of the control variable board size shows that the largest 160 publicly traded German companies have about four board members. The mean of firm size, which was measured by the total number of employees, slightly increases within the sample periods from 31,270 to 33,983. The average firm age within our sample is about 70 years. Basically, the correlation results show that our control variable board size correlates with other variables. For all three sample periods board size is correlated with the variable firm size at 1 percent significance level. These results were expected because as firm size increases the necessity for a larger board becomes evident due to the fact that the skillset, knowledge and responsibilities within boards need to be diversified.

When regressing the variable EBITDA-margin on various independent variables (‘female quota’, ‘outsiders’, ‘intemationality’, and ‘age groups’) for the year 2009, the results of the multiple regression analysis present an Я-squared of 0.061. Thus, the Я- squared explains 6.1 percent of the variance in Y, our dependent variable EBITDA-margin. At first sight, the value of the Я-squared may seem low or may not explain a lot of variation in our model. However, as previous literature has already argued, when regressing some kind of performance measure on various diversity characteristics one needs to consider a low value for the Я-squared, since numerous other external and internal factors as well as strategical and operational decisions influence corporate performance (Carter et al., 2003; Erhard! et al., 2003, Smith et al., 2006). Within our four independent variables of concern, we do not find any significance for the variables ‘female quota’, ‘intemationality’, and ‘outsiders’. Nonetheless, the variable ‘age groups’ appears to be significant at however only 15 percent significance level. With a coefficient of -21.554, the results present a strong negative effect on corporate performance if greater age diversity can be identified in an organization. Thus, we reject H4 as we were able to identify a negative influence of age diversity on corporate performance. The /-statistic allows us to measure the relative strength of the prediction and the generalization of findings beyond the sample. Hence, our results show that the /-statistic with a value of 1.525 does not yet provide strong evidence for the fact that higher age diversity decreases firm performance, however, we can certainly identify a trend for 2009.

For our sample in 2010, we find an Я-squared of 0.071. The Я-squared indicates that the multiple regression model used here explains 7.1 percent of the variance in Y, EBITDA-margin. The variable ‘age groups’, implying a high diversification in age within the board of directors, appears to be the only variable with significant results. At the 10 percent significance level, we observe that the coefficient, once again, appears to be highly negative. Consequently, with a coefficient of -19.018, the larger the age diversity within an organization the lower the performance. More precisely, the more age groups are represented in the board of directors, the more the dependent variable EBITDA-margin as a representative of corporate performance will decrease. Thus, we reject H4 as we were able to identify a negative influence of age diversity on corporate performance. We do not find significant results for the remaining independent variables (‘female quota’, ‘intemationality’, and ‘outsiders’). However, our findings are in line with the results for 2009, which lead to a similar conclusion. Thus, we find for 2009 and 2010 a strong negative effect of the variable ‘age groups’ on our performance indicator EBITDA-margin. These findings are in line with the results of Simons et al. (1999) and Richard and Shelor (2002), who identified a negative relation between age diversity and corporate performance.

Table 1. Results of the multiple regression analysis

Independent variable | Dependent variable: EBITDA-margin | ||

2011 | 2010 | 2009 | |

Female quota | -9.847 | -13.046 | -15.851 |

(.517) | (.395) | (.384) | |

Outsiders | 4.930 | 1.530 | 6.252 |

(.291) | (.767) | (.332) | |

Intemationality | -10.437 | -6.574 | -7.145 |

(.036) | (.231) | (.317) | |

Age groups | -10.609 | -19.018 | -21.554 |

(.373) | (.094) | (.130) | |

Control variables | |||

Board size | .592 | -.157 | -.472 |

(.659) | (.896) | (.727) | |

Control variables | 2011 | 201C | 2009 |

Firm size | -2.125E-005 | -1.149E-005 | -2.322E-005 |

(.357) | (.606) | (.382) | |

Firm age | .006 | .006 | -.001 |

(.510) | (.522) | (.950) | |

R-squared | .073 | .071 | .061 |

Significance | .224 | .261 | .386 |

In our model for 2011, utilizing the same dependent and independent variables, we observe a R-squared of 0.073. The same reasoning applies as before thus the multiple regression model explains 7.3 percent of the variance in Y, the dependent variable EBITDA- margin. Here, we want to point out once again, that the fairly conservative value of the Я-squared is no reason to omit the model, as there are numerous factors influencing the dependent variable EBITDA- margin. Interestingly, our results for 2011 appear to be slightly different to the findings for 2009 and 2010 More precisely, we find significant results not for the variable ‘age groups’, but ‘intemationality’ in 2010 With a p-value of 0.036 the variable ‘intemationality’ is significant at the 5 percent significance level. With reference to the coefficient, the effect on the dependent variable is found to be negative. Accordingly, the greater the number of nationalities within the board of directors the lower corporate performance, which implies a decrease in the value for the EBITDA-margin. Thereby, the coefficient amounts to -10.437. Hence, we reject H2 as national diversity is negatively affecting corporate performance. With a /-statistic of 2.118 our results gain generalization beyond our sample. Moreover, we can conclude, considering the high /-statistic, that the variable ‘intemationality’ is a good predictor of the dependent variable EBITDA-margin in our model. The remaining independent variables are found to be insignificant and hence having no influence on our dependent variable.

Conclusion

Prior empirical CG research realizes diverging results regarding the influence of board diversity on corporate performance. In our study, we analyze gender, age, nationality and functional diversity in German management boards and their influence on firm performance. The empirical analysis was conducted by 149 listed firms (DAX, TecDAX, MDAX, SDAX) for the business years 2009, 2010 and 2011. We mostly find negative effects of board diversity characteristics on corporate performance, especially regarding age and national diversity. Explanations for the heterogeneity of the results may be long-term effects, which may be excluded due to short sample periods. The economic effect of board diversity results from an exchange of experiences and expertise between board members, which is based on a long-term interactive process. However, diversity may influence the CG positively or negatively. Our regression results showed a negative effect of age and national diversity on corporate performance measured by the EBITDA- margin. Board diversity can not only result in a competitive advantage but also may reduce communication, complicate decision-making processes, increase the risk of in-groups and out-group and damage cohesiveness (Bassett-Jones, 2005). Consequently, these negative effects can impair management quality and corporate performance.

Empirical studies on board diversity studies imply several restrictions. The comparison of empirical studies is impaired due to varying legal environments, sample periods and variables (Guest, 2009, p. 386; De Andres et al., 2005, p. 209; Grosvold et al., 2007, p. 345). The application of a long sample period as an efficient analysis method (De Andres et al., 2005, p. 209) is just recently considered (Guest, 2009, p. 386; Grosvold et al., 2007, p. 345). Additionally, the endogeneity of correlations (Hermalin & Weisbach, 2003, p. 8; Dahya & McConnell, 2007, p. 536), whereby firm performance influences board diversity, is rarely elaborated (Beiner et al., 2004). Furthermore, board diversity is characterized by several interdependence relationships with other variables, such as the meeting frequency. Measuring the endogeneity requires appropriate statistical methods, which exist only recently (Carter et al., 2003, p. 43; Campbell & Minguez-Vera, 2008, p. 443). Additionally, the majority of current research results observes the one- tier system and is therefore not applicable for national and supranational reforms due to essential differences between the one- and the two-tier system, which is mandatory in some EU-countries, such as Germany and Austria.

The focus of future research on board diversity and its influence on companies should therefore aim on analyzing larger sample periods in order to integrate long-term effects. Consequently, on the basis of this study it is necessary to develop the statistical analysis further. Thereby, a panel regression in order to achieve more reliable results on the connection between the boards’ diversity and the companies’ success as this relationship represents an essential factor for good corporate governance can be considered.

References

- Adams, R.B., D. Ferreira (2009). Women in the boardroom and their impact on governance and performance, Journal of Financial Economics, 94, pp. 291-309.

- Adler, R.D. (2001). Women in the executive suite correlate to high profits, Harvard Business Review, 79 (10), pp. 1-10.

- Arfken, D.E., S.L. Bellar, M.M. Helms (2004). The Ultimate Glass Ceiling Revisted: The Presence of Women in Corporate Boards, Journal of Business Ethics, 50 (2), pp. 177-186.

- Basset-Jones, N. (2005). The Paradox of Diversity Management, Creativity and Innovation, Creativity and Innovation Management, 14 (2), pp. 169-175.

- Baysinger, B.D., H.N. Butler (1985). Corporate governance and the board of directors: Value effects of changes in board composition, Journal of Law, Economics and Organization, 1 (1), pp. 101-124.

- В einer, S., W. Drobetz, F. Schmid, H. Zimmermann (2004). Is Board Size an Independent Corporate Governance Mechanism? Kyklos-Intemational Review for Social Sciences, 57 (3), pp. 327-356.

- Berte, A.A., G.C. Means (1932). The modem corporation and private property, New York: McMillian.

- Bphren, Ö., R.Ö. Strpm (2010). Governance and Politics: Regulating Independence and Diversity in the Board Room, Journal of Business Finance & Accounting, 37 (9-10), pp. 1281-1308.

- Bonn, I. (2004). Board Structure and Firm Performance: Evidence from Australia, Journal of Management & Organization, 10 (1), pp. 14-24.

- Boone, I., L. Casares Field, C.G. Raheja (2007). The determinants of corporate board size and composition: An empirical analysis, Journal of Financial Economics, 85 (1), pp. 66-101.

- Brammer, S., A. Millington, S. Pavelin (2007). Gender and Ethic Diversity among UK Corporate Boards, Corporate Governance -An International Review, 15 (2), pp. 393-403.

- Camelo, С., M. Fernandez-Alles, A.B. Hernandez (2010). Strategic consensus, top management teams, and innovation performance, International Journal of Manpower, 31 (6), pp. 678-695.

- Campbell, K., A. Minguez-Vera (2008). Gender Diversity in the Boardroom and Firm Financial Performance, Journal of Business Ethics, 83 (3), pp. 435-451.

- Cannella, A.A., J.H. Park, H.U. Lee (2008). Top Management Team Functional Background Diversity and Firm Performance: Examining the Roles of Team Member Colocation and Environmental Uncertainty, Academy of Management Journal, 51 (4), pp. 768-784.

- Carter, D.A., B.J. Simkins, W.G. Simpson (2003). Corporate Governance, Board Diversity, and Firm Value, Financial Review, 38 (1), pp. 33-53.

- Carter, D.A., D’Souza, F., B.J. Simkins, W.G. Simpson (2010). The Gender and Ethic Diversity of US Boards and Board Committees and Firm Financial Performance, Corporate Governance - An International Review, 18 (5), pp. 396-414.

- The Bottom Line: Connecting Corporate Performance and Gender Diversity, available at: www.catalystwomen.org.

- Conyon, M.J., C. Mallin (1997). A Review of Compliance with Cadbury, Journal of General Management, 22 (3), pp. 24-37.

- Dahya, J., J.J. McConnell (2007). Board Composition, Corporate Performance and the Cadbury Committee Recommendation, Journal of Financial and Quantitive Analysis, 42 (3), pp. 535-564.

- Daily, C.M., D.R. Dalton, J.L. Johnson, A.E. Ellstrand (1999). Number of Dorectors and Financial Performance: A Meta-Analysis, Academy of Management Journal, 42 (6), pp. 674-686.

- Daily, C.M., D.R. Dalton, A.A. Cannella (2003). Corporate Governance: Decades of Dialogue and Data, Academy of Management Review, 28 (3), pp. 371-382.

- Davis, J.H., F.D. Schoormann, L. Donaldson (1997). Toward a Stewardship Theory of Management, Academy of Management Journal, 22 (1), pp. 20-47.

- De Andres, P., V. Azofra, F. Lopez (2005). Corporate Boards in OECED Countries: size, composition, functioning and effectiveness, Corporate Governance -An International Review, 13 (2), pp. 197-210.

- Deutsche Boerse Group. The DAX Index World, available at: http://www.dax-indices.com/EN/MediaLibrary/ Document/120611_DeutscheBoerse_E_WEB.pdf.

- Di Pietra, R., C.A. Grambovas, I. Raonic, A. Riccaboni (2008). The effects of board size and ‘busy’ directors on the market value of Italian companies, Journal of Management & Governance, 12 (1), pp. 79-91.

- Dobbin, F., J. Jung (2011). Corporate Board Gender Diversity and Stock Performance: The Competence Gap or Institutional Investor Bias? North Carolina Law Review, 89 (3), pp. 809-838.

- Donaldson, L., J.H. Davis (1991). Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns, Australian Journal of Management, 16 (1), pp. 49-64.

- Du Rietz, A., M. Henrekson, M. (2000). Testing the Female Underperformance Hypothesis, Small Business Economics, 14 (1), pp. 1-10.

- Eagly, A.H., B.T. Johnson (1990). Gender and leadership style: A meta- analysis, Psychological Bulletin, 108 (2), pp. 233-256.

- Eagly, A.H., M.C. Johannesen-Schmidt, M.L. van Engen (2003). Transformational, transactional, and laissez-faire leadership styles: A meta-analysis comparing women and men, Psychological Bulletin, 129 (4), pp. 569-591.

- Erhardt, N.L., J.D. Werbel, C.B. Shrader (2003). Board of Director Diversity and Firm Financial Performance, Corporate Governance - An International Review, 11 (2), pp. 102-111.

- Ernst and Young (2009). Groundbreakers: Using the strength of women to rebuild the world economy, New Jersey.

- EU-Commission. Proposal for a directive of the European Parliament and of the Council amending Council Directives 78/660/EEC and 83/349/EEC as regards disclosure of nonfinancial and diversity information by certain large companies and groups (COM (2013) 207 final), http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2013:0207:FIN:EN:PDF23.05.2013)

- Farrell, K.A., P.L. Hersch (2005). Additions to corporate boards: the effect of gender, Journal of Corporate Finance, 11 (1-2), pp. 85-106.

- Fauzi, F., S. Locke (2012). Board structure, ownership structure and firm performance. A study of New Zealand listed-firms, Asian Academy of Management Journal of Accounting & Finance, 8 (2), pp. 43-67.

- Grosvold, J., S. Brammer, S., B. Rayton (2007). Board diversity in the United Kingdom and Norway: an exploratory analysis, Business Ethics- A European Review, 16 (4), pp. 344-357.

- Guest, P.M. (2009). The impact of board size on firm performance: evidence from the UK, The European Journal of Finance, 15 (4), pp. 385-404.

- Gul, F.A., B. Srinidhi, J. Tsui (2007). Do female directors enhance corporate board monitoring? Some evidence from earnings quality, Hong Kong.

- Heidrick and Struggles (2009). Corporate Governance Report 2009 - Boards in turbulent times. Available at: http://www.heidrick.com/PublicationsReports/PublicationsReports/CorpGovEurope2009.pdf.

- Hermalin, B.E., M.S. Weisbach (2003). Boards of Directors as an Endogenously Determined Institution: A Survey of the Economic Literature, Economic Policy Review, 9(1), pp. 7-26.

- Hillman, A., A. Cannella, R. Paetzold (2000). The resource dependence role of corporate directors: Strategic adaptation of board composition in response to environmental change, Journal of Management Studies, 37 (2), pp. 235-256.

- Holst, E., A. Busch (2008). Verdienstdifferenzen zwischen Frauen und Männern nur teilweise durch Strukturmerkmale zu erklären, DIW-Wochenbericht, 75 (15), pp. 184-190.

- Houle, C.O. (1990). Who Should Be on Your Board? Nonprofit World, 8 (1), pp. 33-35.

- Jensen, M.C. (1993). The Modem Industrial Revolution, Exit, and the Failure of Internal Control Systems, The Journal of Finance, 48 (3), pp. 831-880.

- Jensen, M.C., W.H. Meckling (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure, Journal of Financial Economics, 3 (4), pp. 305-360.

- Jhunjhunwala, S., R.K. Mishra (2012). Board Diversity and Corporate Performance. The Indian Evidence, IUP Journal of Corporate Governance, 11 (3), pp. 71-79.

- Kang, H., M. Cheng, S.J. Gray (2007). Corporate Governance and Board Composition: diversity and independence of Australian boards, Corporate Governance -An International Review, 15 (2), pp. 194-207.

- Kiel, G.C., G.J. Nicholson (2003). Board Composition and Corporate Performance: how the Australian experience informs contrasting theories of corporate governance, Corporate Governance - An International Review, 11 (3), pp. 189-205.

- Krishnan, G.V., L.M. Parsons (2008). Getting to the Bottom Line: An Exploration of Gender and Earnings Quality, Journal of Business Ethics, 78 (1), pp. 65-76.

- Latane, B., S. Wolf (1981). The social impact of majorities and minorities, Psychological Review, 88 (5), pp. 438-453.

- Lipton, M., J.W. Lorsch (1992). A modest Proposal for Improved Corporate Governance, Business Lawyer, 48 (1), pp. 59-77.

- Loden, M., J.B. Rosener (1991). Workforce America! Managing Employee Diversity as a Vital Ressource, New York.

- Lückerath-Rovers, M. (2013). Women on boards and firm performance, Journal of Management & Governance, 17 (2), pp. 491-509.

- Mahadeoa, J.D., T. Soobaroyen, V. Oogarah-Hanumana (2011). Changes in social and environmental reporting practices in an emerging economy (2004-2007): Exploring the relevance of stakeholder and legitimacy theories, Accounting Forum, 35 (3), pp. 158-175.

- McIntyre, M.L., S.A. Murphy, P. Mitchell (2007). The top team: examining board composition and firm performance, Corporate Governance-An International Review, 7 (5), pp. 547-561.

- Miller, N.E., J. Dollard (1941). Social learning and imitation, New Haven.

- Muth, M.M., L. Donaldson (1998). Stewardship theory and board structure: A contingency approach, Corporate Governance -An International Review, 6 (1), pp. 5-29.

- Nielsen, S., M. Huse (2010). The Contribution of Women on Boards of Directors: Going beyond the Surface, Corporate Governance - An International Review, 18 (2), pp. 136-148.

- OECD (2004). OECD Principles of Corporate Governance,

- Oliver, P., G. Marwell, R. Teixeira (1985). A theory of the critical mass, American Journal of Sociology, 91 (7), pp. 522-556.

- Ong, C.H., S.H. Lee (2000). Board Functions and Firm Performance: A Review and Directions for Future Research, Journal of Comparative International Management, 3 (1), pp. 3-24.

- Oxelheim, L., T. Randoy (2003). The impact of foreign board membership on firm value, Journal of Banking & Finance, 27 (12), pp. 2369-2392.

- Pfeffer, J., G.R. Salancik (1978). A Social Information Processing Approach to Job Attiudes and Task Design, Administrative Science Quarterly, 23 (2), pp. 224-253.

- Randoy, T., L. Oxelheim, S. Thomsen (2006). A Nordic Perspective on Corporate Board Diversity,

- Richard, O.C., R.M. Shelor (2002). Linking top management team age heterogeneity to firm performance: juxtaposing two mid-range theories, The International Journal of Human Resource Management, 13 (6), pp. 958-974.

- Robinson, G., K. Dechant (1997). Building a Business Case for Diversity, Academy of Management Executive, 11 (1), pp. 21-30.

- Rose, P. (2007a). The Corporate Governance Industry, Journal of Corporation Law, 32 (4), pp. 887-926.

- Rose, J.M. (2007b). Corporate Directors and Social Responsibility: Ethics versus Shareholder Value, Journal of Business Ethnics, 73 (4), pp. 319-331.

- Shukeri, S.N., W.S. Ong, M.S. Shaari (2012). Does Board of Director’s Characteristics affect firm performance? Evidence from Malaysian Public Listed Companies, International Business Research, 5 (9), pp. 120-127.

- Shrader, C.B., V.B. Blackbum, P. Iles (1997). Women in Management And Firm Financial Performance: An Exploratory Study, Journal of Managerial Issues, 4 (3), pp. 355-372.

- Simons, T., L.H. Pelled, K.A. Smith (1999). Making use of Difference: Diversity, Debate, and Decision Comprehensive in Top Management Teams, Academy of Management Journal, 42 (6), pp. 662-673.

- Singh, V., S. Vinnicombe (2004). Why So Few Women Directors in Top UK Boardrooms? Evidence and Theoretical Explanations, Corporate Governance -An International Review, 12 (4), pp. 479-488.

- Smith, N., S. Smith, M. Verner (2006). Do women in top management affect firm performance? A panel study of 2,500 Danish firms, International Journal of Productivity and Performance Management, 55 (7), pp. 569-593.

- Sun, J., G. Liu, G. Lan (2011). Does female Directorship on Independent Audit Committees Constrain Earnings Management? Journal of Business Ethics, 99 (4), pp. 369-382.

- Torchia, M., A. Calabro, M. Huse (2011). Women Directors on Corporate Boards: From Tokenism to Critical Mass, Journal of Business Ethics, 102 (4), pp. 299-317.

- Ujunwa, A. (2012). Board characteristics and the financial performance of Nigerian quoted firms, Corporate Governance - The International Journal of Effective Board Performance, 12 (5), pp. 656-674.

- Ujunwa, A., C. Okoyeuzu, I. Nwakoby (2012). Corporate Board Diversity and Firm Performance. Evidence from Nigeria, Review of International Comparative Management, 13 (4), pp. 605-620.

- Van den Berghe, L.A.A., A. Levrau (2004). Evaluating Boards of Directors: what constitutes a good corporate board? Corporate Governance -An International Review, 12 (4), pp. 461-478.

- Vinnicombe, S., V. Singh (2003). The 2002 female FTSE index and women directors, Women in Management Review, 18 (7), pp. 349-358.

- Williams, К., C. O’Reilly (1998). Forty Years of Diversity Research. A Review, in: Staw, B.M. and Cummings, L.L. (eds.), Research in Organizational Behavior, Greenwich, pp. 77-140.

- Yermack, D. (1996). Higher market valuation of companies with a small board of directors, Journal of Financial Economics, 40 (2), pp. 185-211.